GDPR meets VAT: what e‑commerce sellers need to know about data and compliance

Spis treści

For many sellers, the first challenge is understanding the General Data Protection Regulation, better known as GDPR. This law was introduced to make sure that personal data, such as a customer’s name, address, or payment details, is handled carefully, transparently, and only when necessary. It forces businesses to think not only about what data they collect but also about why they collect it and how long they store it.

The second challenge is Value Added Tax, or VAT. Anyone selling goods or services in the EU has to comply with VAT obligations, which means issuing invoices, applying the right VAT rates depending on the customer’s location, and keeping transaction records for years. VAT is not just about paying the right amount of tax—it’s also about proving that every sale has been accounted for.

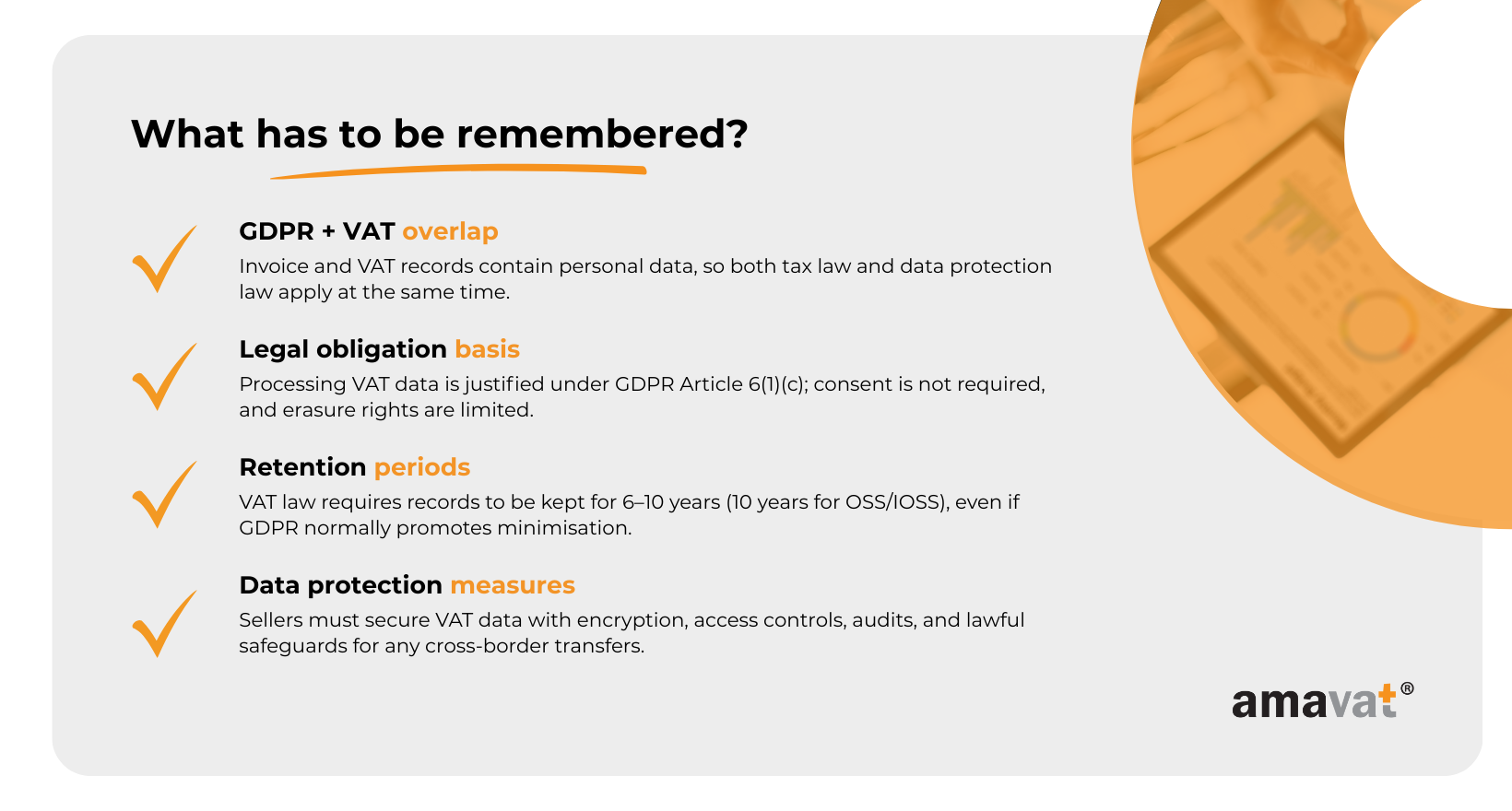

These two systems—GDPR and VAT—might seem unrelated at first. One deals with privacy, the other with tax. But in practice they are deeply connected. The very data that sellers are obliged to keep for VAT purposes is also personal data, which means it automatically falls under GDPR. A customer’s name, address, and purchase history are required for VAT compliance, yet at the same time must be collected and stored in line with strict data protection principles.

This overlap is where many small businesses run into difficulties. It is easy to think that if you are fulfilling tax obligations, you are automatically on the safe side. But in reality, failing to respect GDPR when processing VAT-related data can lead to penalties from both sides—tax authorities and data protection regulators. For a growing e-commerce business, the consequences can be costly and damaging.

The key takeaway is simple: GDPR and VAT obligations intersect, and e-commerce sellers must learn to manage both at the same time. By understanding how these rules connect, you can create systems that protect customer data while also satisfying tax authorities. Far from being a bureaucratic burden, this alignment can build trust with customers and give your business a stronger foundation for growth.

The legal interplay between GDPR and VAT

When you run an online store, it can feel like you are constantly navigating a maze of rules and regulations. Two of the most important frameworks in the European Union are the General Data Protection Regulation (GDPR) and the VAT Directive. At first glance they might look like they belong to completely different worlds—one is about protecting personal data, the other about paying taxes. But for e-commerce sellers, the two meet more often than you might expect, and understanding their connection is essential to staying compliant.

GDPR in the e-commerce context

The General Data Protection Regulation, known as GDPR, applies to anyone who processes the personal data of people living in the European Union. For online sellers, this means practically every interaction with a customer. Each time someone places an order, registers an account, or subscribes to a newsletter, their personal details are collected and stored.

GDPR sets out strict principles for how this data must be handled. It requires that businesses only collect what is necessary, that they have a lawful reason for every processing activity, and that the information is stored securely. It also gives customers clear rights: they can ask what data a company holds about them, request corrections, or even demand deletion when there is no legal reason to keep their details any longer.

In short, GDPR is there to make sure businesses don’t treat personal information as just another resource to exploit. Instead, it forces transparency, responsibility, and respect for the individual.

VAT Directive and its requirements

On the other side of the spectrum stands the VAT Directive, the backbone of the EU’s Value Added Tax system. It lays down the rules for how VAT must be applied, collected, and reported across all Member States. For e-commerce sellers, the Directive touches almost every transaction.

To comply with VAT rules, businesses must issue proper invoices, keep detailed transaction records, and apply the correct VAT rate depending on where the customer is based. This becomes especially complex with cross-border sales within the EU, where special systems like the One-Stop Shop (OSS) or Import One-Stop Shop (IOSS) come into play. These frameworks are meant to simplify VAT reporting, but they also require sellers to collect and store large amounts of transaction data.

That means holding onto customer identification details, proof of where a buyer is located, and precise records of what was sold, when, and for how much. These records must often be kept for 10 years (this is the minimum period required for OSS/IOSS transactions under EU rules, though some Member States may require longer storage under local VAT law).

Where GDPR and VAT meet

Here’s where the two frameworks collide: the very data you are required to keep for VAT compliance is also personal data under GDPR. A customer’s name, address, and purchase history are not just numbers in your accounting system—they are pieces of information that identify a real person. That means they fall under the scope of GDPR.

This overlap creates a delicate balance. On the one hand, VAT law tells you that you must collect and retain certain information for years. On the other hand, GDPR tells you to minimise data, store it only as long as necessary, and protect it carefully. For a small business owner, this can feel like being pulled in two directions at once.

The truth is that both sets of obligations must be respected at the same time. You cannot use VAT requirements as an excuse to ignore GDPR principles, nor can you delete records early in the name of data minimisation if tax law says you must keep them. If you fail on either side, the risks are serious. Tax authorities can issue financial penalties for missing or incomplete records, while data protection regulators can fine you for mishandling customer data.

This double risk of non-compliance makes it essential for e-commerce sellers to understand how GDPR and VAT obligations overlap. The good news is that once you grasp the logic of both frameworks, you can set up systems that satisfy tax authorities and data protection regulators at the same time. Doing so not only avoids penalties but also builds credibility with customers, who increasingly expect transparency and professionalism from the businesses they buy from.

What data must be collected and retained for VAT compliance

Every online sale in the EU generates more than just revenue for your shop. It also produces a trail of information that you are legally required to keep. This information forms the foundation of VAT compliance, since it allows tax authorities to verify whether you applied the right VAT rate and whether your reporting is correct. But because most of this information can identify your customers, it automatically becomes personal data under GDPR. For sellers, the task is not only about keeping invoices and records for tax reasons but also about ensuring that this personal data is handled in line with strict privacy rules.

Customer identification data

The first category of data you are required to collect is information about who your customer actually is. For consumer sales, invoices must show the buyer’s full name and billing address, so that the transaction can be linked to a specific individual if an audit takes place. For business-to-business sales, the requirements go further. Invoices need to include the company’s legal name, its VAT identification number when available, and its registered business address. Even though this looks like standard order information, under GDPR these details are clearly personal data. A name combined with an address can easily identify someone, which means you have to treat this information with the same care as any other personal data you hold.

Transaction details

The second category relates to the transaction itself. VAT law requires invoices to contain detailed information about what was sold and under which conditions. This includes the date of supply, the description of the product or service, the quantity, the price per unit, the VAT rate, and the total VAT amount. From the perspective of the tax authority, this is essential because it allows them to confirm that your VAT return reflects the actual sale. From a privacy perspective, this information is also significant. A purchase history is more than just a receipt; it can reveal personal habits, interests, or financial behaviour, all of which GDPR recognises as sensitive information that must be carefully protected.

Proof of intra-EU supply

When sales cross borders inside the European Union, the rules tighten even further. The EU created the One-Stop Shop and the Import One-Stop Shop to make reporting simpler, but in practice these systems require sellers to collect additional evidence to prove where the customer is based. This is crucial because the customer’s location determines which VAT rate applies and to which country the tax should be paid. To meet this obligation, sellers must hold at least two non-contradictory pieces of information about the buyer’s location. These can include billing and shipping addresses, bank account details, or even technical data such as IP addresses. While this may feel like routine administration, under GDPR all of these details are classified as personal data, meaning you must handle them with the same restrictions and safeguards as any other customer information.

Retention periods under VAT law and GDPR

One of the most difficult issues for small businesses is understanding how long this data must be kept. Under the VAT Directive, the general rule is that invoices and supporting documentation must be stored for at least ten years when dealing with cross-border sales through OSS or IOSS. For domestic sales the period is usually between six and ten years, depending on the national law of the Member State. Some countries go even further and require records to be held for longer.

At the same time, GDPR is built on the principle that personal data should not be stored for longer than necessary. At first sight this looks like a direct contradiction. How can you minimise storage when tax authorities demand that you keep records for a decade? The answer lies in the principle of purpose limitation. GDPR allows personal data to be stored as long as there is a valid legal ground, and in this case that ground is the obligation under VAT law. This means you are required to keep invoices for the statutory retention period, but you are not allowed to use the same data for other purposes, such as marketing, unless you obtain a separate legal basis. Once the retention period expires, you must securely delete or anonymise the records.

Practical implications for e-commerce sellers

The key for online shops is to design systems that keep VAT compliance data clearly separated from data used for other parts of the business. Storing VAT records in a secure archive, limiting access only to those who genuinely need it, and planning for secure deletion at the end of the retention period are all practical ways to achieve this balance. By treating VAT data as a dedicated compliance archive, you satisfy the requirements of both tax authorities and data protection regulators, while also showing your customers that you take their privacy seriously.

Lawful basis for processing VAT data under GDPR

Whenever you handle personal data, GDPR requires you to have a lawful basis for doing so. This is the legal ground that justifies why you are allowed to collect and use information about your customers. For many activities in e-commerce, such as marketing campaigns or running loyalty programs, businesses rely on consent. For tasks like fulfilling an order or processing payments, the lawful basis is usually the performance of a contract. But when you process customer data in order to meet your VAT obligations, the lawful basis is different. In this case, it is the legal obligation created by tax law.

Legal obligation as the foundation

Article 6(1)(c) of the GDPR states that personal data may be processed if it is necessary for compliance with a legal obligation to which the controller is subject. For e-commerce businesses, this obligation comes from EU and national VAT rules. The EU VAT Directive requires taxable persons to keep proper accounts and to store invoices, while the implementing rules of special schemes such as the OSS and IOSS demand that traders retain detailed records for at least ten years. Member States define the exact retention periods, which are usually between six and ten years for domestic transactions and at least ten years for cross-border sales.

This legal duty is why you do not need to ask for customer consent to keep invoice data. A buyer also cannot force you to erase their information during the statutory retention period, because the right to erasure under Article 17 GDPR does not apply when processing is necessary to comply with a legal obligation. Similarly, the GDPR right to object is irrelevant in this context, since it does not apply to processing based on Article 6(1)(c).

At the same time, the scope of this lawful basis is limited. You can only rely on Article 6(1)(c) to process the data that tax law actually requires. If you decide to reuse invoice data for other purposes, such as targeted advertising or customer profiling, you must identify a separate lawful basis. Legal obligation covers VAT compliance only—it does not give you a free hand to use the same records for business growth or analytics.

Documenting processing activities

Having a lawful basis is not enough on its own. GDPR also requires that businesses maintain proper documentation of how data is processed. This is done through a Record of Processing Activities, known as a RoPA, which is required under Article 30 GDPR. Although there is a limited exemption for very small organisations, it does not apply if the processing is routine, poses risks to individuals, or involves special categories of data. Because VAT invoicing and archiving are continuous and systematic, most e-commerce sellers—even small shops—are expected to maintain a RoPA for their VAT processing.

In practice, your RoPA should make clear that the lawful basis is Article 6(1)(c), that the data categories include customer identification, transaction details, and location proofs, and that the recipients include tax authorities or auditors. It should also set out the statutory retention periods that apply. Maintaining such a record not only fulfils a GDPR duty but also helps you demonstrate accountability if a regulator asks how you handle invoice data.

Informing customers through privacy notices

Even when the lawful basis is a statutory obligation, transparency remains essential. Articles 13 and 14 of GDPR require you to inform customers, at the time of data collection, why you are processing their information, what the lawful basis is, how long you will keep it, and who may receive it. You also have to explain whether providing this data is a legal requirement and what the consequences are if a customer refuses—for example, that you cannot issue a valid VAT invoice without their details.

For an e-commerce shop, the most practical way to meet this obligation is through a privacy notice available at checkout or when a customer creates an account. The notice should explain in simple terms that some personal data is collected and stored because tax law obliges you to do so, that it cannot be erased before the end of the statutory period, and that it is not used for unrelated purposes. Making this clear from the start avoids confusion, reduces complaints, and builds trust with your buyers, who will see that you respect both the law and their privacy.

Applying data minimisation and purpose limitation

Two of the most important principles in GDPR are data minimisation and purpose limitation, set out in Articles 5(1)(c) and 5(1)(b). For an online store these rules are very practical. They tell you what customer information you are allowed to collect, how much of it you should keep, and what you are permitted to do with it. This is particularly important when dealing with VAT records, where the temptation can be to collect more data than necessary or to reuse it for business purposes that have nothing to do with tax compliance.

Collecting only what is necessary

The principle of data minimisation means you should collect only the information that is strictly required to meet your obligations. For VAT, this typically includes customer identification details such as the name and billing address, or the company name and VAT identification number in B2B transactions. It also covers the invoice number, a description of the goods or services, the value of the transaction, and the applicable VAT rate.

Anything beyond this—such as a customer’s date of birth, a personal identification number, or other demographic details—should not be collected unless a specific provision in national tax law makes it compulsory. Some Member States impose special invoice requirements for certain sectors, but unless you fall under one of those rules, additional personal data has no place in your VAT records.

A practical example makes this clear. If a customer buys a pair of shoes from your store, you need their name, their billing address, and the transaction details for the invoice. You do not need their date of birth, and collecting it “just in case” would violate the principle of minimisation. The discipline lies in resisting the urge to gather unnecessary data and sticking strictly to what tax law requires.

Limiting use to the intended purpose

Purpose limitation is closely connected to minimisation. It means that once you collect personal data for one lawful reason, you cannot simply decide to use it for something else. In the VAT context, the purpose of collecting customer data is very clear: to issue valid invoices, apply the correct VAT rate, and keep records for possible audits. That is the scope of the lawful basis under Article 6(1)(c).

This purpose does not extend to marketing, profiling, or analytics. If you want to use customer details in that way, you must establish a separate lawful basis, such as consent or, in certain cases, legitimate interest. Without it, reusing invoice records for commercial gain would breach GDPR. More importantly, it would also undermine customer trust, because buyers expect their invoice information given for compliance reasons to remain in that narrow context, not to reappear in promotional campaigns.

Why these principles matter in practice

For small e-commerce businesses, minimisation and purpose limitation are not just formalities. They are safeguards that reduce risk and simplify operations. The more data you collect or repurpose, the more you expose yourself to potential data breaches, complaints from customers, or audits by regulators. By contrast, if you only collect what is required and use it strictly for VAT compliance, you reduce liability, make your data management more straightforward, and show that you respect your customers’ privacy.

From the customer’s point of view, this is a strong signal of professionalism. Many buyers today are aware of privacy issues and look for reassurance that their data is being used fairly. When your business communicates clearly that invoice details are collected only because the law demands it, and not for hidden purposes, you comply with GDPR while also strengthening trust and loyalty.

Safeguarding VAT data: security and access controls

Collecting and storing VAT records is only half of the compliance story. Under GDPR, once you hold personal data you become responsible for protecting it with appropriate technical and organisational measures. This duty is set out in Articles 32 to 34, which make clear that businesses must secure personal data against unauthorised access, accidental loss, or unlawful disclosure. For an online seller this means that VAT records cannot be treated as simple paperwork. They are sensitive personal information, and must be safeguarded as such.

Encryption, backups, and access management

One of the most effective ways to protect VAT records is to ensure that, even if they fall into the wrong hands, they cannot be easily read. Encryption, explicitly mentioned in Article 32 as an example of an appropriate safeguard, is a powerful tool in this regard. Encrypting invoices and transaction archives means that the data is meaningless without the right decryption key, which significantly reduces the damage a breach can cause.

Backups are another vital safeguard. VAT records must be retained for long statutory periods—typically six to ten years for domestic transactions, and ten years for OSS and IOSS cross-border supplies. Losing these records through technical failure or human error could leave you in breach of tax law. Secure backups, stored separately from your main systems, ensure that the data can be restored when needed and that your compliance obligations are not compromised.

Equally important is controlling who inside your business has access to VAT information. GDPR requires that personal data be processed only by authorised persons. Implementing role-based access means that only those with a genuine business need, such as accountants or tax managers, can open and use VAT records. The fewer people with access, the lower the risk of mistakes or deliberate misuse.

Ongoing audits and monitoring

Security is not something that can be handled once and forgotten. GDPR expects companies to review and update their measures regularly, taking into account the risks that arise as systems evolve. For an e-commerce business this might mean checking on a regular basis who still has access rights to VAT data, testing whether backup and recovery systems actually work, and monitoring access logs to detect unusual or unauthorised activity. Running vulnerability scans on the systems that store invoices is another way to identify weak points before they are exploited.

These kinds of checks not only help you improve your security in practice, they also create a documented record of accountability. If regulators or tax authorities ever ask how you manage VAT data, being able to demonstrate that you monitor, audit, and update your security measures regularly provides strong evidence that you take your obligations seriously.

Responding to data breaches

Even with the best safeguards, no business is immune to incidents. GDPR therefore sets out strict rules on how to handle a breach when it happens. If VAT records containing personal data such as names, addresses, or transaction histories are compromised, you must notify the relevant supervisory authority within seventy-two hours unless the incident is unlikely to pose a risk to individuals. When the risk is considered high—for example, if the breach could expose customers to fraud or identity theft—you must also inform the customers themselves.

For an e-commerce seller, this means having a clear plan in place before a breach occurs. You need to know who in your organisation is responsible for investigating incidents, how risks will be assessed, which authority must be contacted, and how affected customers will be informed. A prepared response can make the difference between an incident that is handled quickly and a crisis that damages both your reputation and your legal standing.

Cross-border data transfers in VAT compliance

E-commerce is naturally cross-border, not only in terms of customers but also in the way business systems operate. Many small online shops use cloud services, payment processors, or invoicing platforms that may host data on servers outside the European Union. This setup can be convenient, but it also raises specific challenges under GDPR. Because VAT records contain personal data, any time they are transferred outside the EU or EEA, they fall under the strict rules of Chapter V of GDPR, Articles 44 to 49.

Risks of storing VAT data outside the EU

When VAT invoices or transaction records are processed in countries such as the United States or elsewhere outside the EU, GDPR treats this as a restricted transfer. The problem is that many of these jurisdictions do not provide data protection standards that match EU law. This creates several risks. Personal details in VAT records—such as customer names, addresses, and purchase histories—may be exposed to unauthorised access by foreign authorities, subject to surveillance programs that do not respect GDPR safeguards, or misused by service providers. The Court of Justice of the European Union highlighted these dangers in the Schrems II ruling, which struck down the EU–U.S. Privacy Shield framework precisely because U.S. surveillance laws conflicted with EU privacy rights.

For small businesses, these risks often arise invisibly. An invoicing plugin, a cloud storage account, or a payment processor might automatically transfer data to servers outside the EU without you being fully aware. Even if the process is hidden from your view, GDPR makes it clear that as the controller you are responsible for ensuring that the transfer is lawful.

Standard Contractual Clauses and adequacy decisions

GDPR provides two main mechanisms to make such transfers lawful. One option is an adequacy decision under Article 45, where the European Commission has recognised a country as offering an essentially equivalent level of data protection. Transfers to those countries—such as the UK, Switzerland, Japan, or under the current EU–U.S. Data Privacy Framework—do not require further authorisation.

Where no adequacy decision exists, businesses must rely on Standard Contractual Clauses approved by the European Commission. These clauses impose EU-style protections on the non-EU recipient through binding contractual terms. However, since Schrems II, signing SCCs is not enough on its own. You are also required to carry out a Transfer Impact Assessment to evaluate whether the legal system of the recipient country allows those clauses to function in practice. If the assessment reveals risks, you may need to apply additional safeguards such as strong encryption or pseudonymisation before transferring VAT records abroad. Many large cloud providers now build SCCs into their standard contracts, but GDPR ultimately places responsibility on you, the seller, to make sure the protection is effective.

Limiting processing to VAT purposes

Even when a transfer is lawful under an adequacy decision or SCCs, the GDPR principle of purpose limitation in Article 5(1)(b) still applies. Data collected for VAT compliance may only be processed for that purpose, whether stored inside or outside the EU. That means invoices and transaction records can be used for invoicing, reporting, or statutory archiving, but not for profiling, targeted advertising, or unrelated analytics.

It is your responsibility as the controller to make sure contracts with service providers explicitly restrict VAT data to compliance functions. Privacy notices must also clearly explain to customers that this information is retained because of legal obligations, often for six to ten years in domestic transactions and ten years for OSS and IOSS cross-border records. On top of that, you need to ensure that technical and organisational measures such as encryption and access controls are consistently applied, regardless of where the data is stored.

Key implications for e-commerce sellers

The important point is that using international platforms is not forbidden under GDPR. What matters is that you understand where your VAT data is being stored and processed, and that you take the steps required by law to protect it. This means knowing whether your provider relies on an adequacy decision or SCCs, carrying out a Transfer Impact Assessment when necessary, and putting in place safeguards like encryption and strict access controls. By limiting the use of VAT records to compliance purposes only and making sure your contracts reflect this, you can enjoy the benefits of global services without compromising either tax law or GDPR.

Practical steps for e-commerce sellers

Understanding the rules is one thing, but applying them in daily business is another. For a small e-commerce company, it can feel overwhelming to juggle tax obligations with strict data protection duties. The good news is that compliance does not have to mean heavy bureaucracy. With the right tools and routines in place, you can build VAT and GDPR requirements into your everyday processes. This not only keeps you on the safe side legally but also helps you run a more professional and trustworthy business.

VAT-compliant invoicing modules

One of the most effective ways to stay compliant is to make sure that your invoicing system is built for VAT from the ground up. Many e-commerce platforms, from WooCommerce to Shopify or Allegro, offer modules that automatically generate invoices with the required fields. These systems can apply the correct VAT rate based on the customer’s location, include the right identification details, and archive the documents for the legally required retention period. Automating this process reduces the risk of mistakes and ensures that the information you store is limited to what tax law actually requires, which aligns with the GDPR principle of data minimisation.

GDPR-compliant privacy notices at checkout

While invoicing systems help with the technical side of compliance, transparency with your customers is equally important. A privacy notice shown at checkout or account creation should clearly explain why certain personal data is being collected and stored. It should mention that VAT law obliges you to issue invoices and retain them for a period of years, and that this data cannot be erased before the statutory deadline. Presenting this information up front reduces confusion and shows that you are committed to fair and lawful processing. Customers are more likely to trust a store that is honest about its obligations and careful with personal information.

Automated retention and secure archiving

Another area where technology can help is in managing retention periods. Since VAT records must be stored for six to ten years domestically and ten years under OSS and IOSS, it is easy to lose track of which data can be deleted and when. Automated retention policies built into your invoicing or document management system can solve this problem. They ensure that records are archived securely while they are legally required, and that they are deleted or anonymised once the retention period ends. Keeping VAT data in a secure archive, separate from marketing or customer service databases, adds another layer of protection and reduces the risk of accidental misuse.

DPIAs for large-scale transaction data

For some online shops, especially those growing quickly or processing large volumes of customer orders, a Data Protection Impact Assessment may be required. GDPR makes DPIAs mandatory when data processing is likely to create a high risk for individuals. Large-scale handling of transaction data could fall into this category, particularly when combined with cross-border transfers or complex storage systems. A DPIA helps you identify the risks in advance and document the safeguards you have put in place. For a regulator, this is a sign of accountability; for you, it is a way to anticipate problems before they escalate.

Staff training for secure handling

Finally, no system is stronger than the people who use it. Even the most advanced invoicing module or encryption method can fail if employees do not understand their responsibilities. Training staff to recognise what counts as personal data, to handle invoices securely, and to follow access control rules is an essential step in GDPR compliance. In a small e-commerce business this might mean just a few people, but the impact is the same: fewer mistakes, quicker recognition of potential issues, and a culture where privacy and compliance are taken seriously.

Conclusion

For anyone running an online shop, VAT obligations and GDPR duties may at first seem like two separate worlds. One is about paying taxes and keeping invoices, the other about protecting customer privacy. But as we have seen, they are inseparable. Every invoice contains personal data, and every record you keep for tax purposes must therefore also meet the strict requirements of data protection law.

The key lesson is that VAT data is both a tax obligation and a privacy obligation. You cannot prioritise one over the other without running into risks. If you keep invoices without considering GDPR, you expose yourself to fines and reputational damage. If you delete data too early in the name of privacy, you risk sanctions from tax authorities. The only sustainable approach is to recognise that both regimes apply at the same time and to design your processes so that they complement each other.

This is not just about avoiding penalties. Aligning GDPR and VAT compliance is the foundation of trust in cross-border e-commerce. Customers want to know that their information is handled carefully, and authorities expect businesses to take their responsibilities seriously. By showing that you can respect privacy while also fulfilling tax duties, you demonstrate professionalism and create a business that can grow across markets without fear of compliance problems.

The final thought is simple: alignment of GDPR and VAT compliance is not optional. It is a basic requirement for operating in today’s European digital economy. For young e-commerce sellers, mastering this balance early is not a burden but an investment. It gives you the confidence to expand across borders, to build customer trust, and to develop your shop on a secure and sustainable foundation.