EPR System in Switzerland

Spis treści

That holiday is ending.

The Swiss government has decided to catch up fast, and the tool for that is the new Packaging Ordinance, known as the VerpV. This reform will completely change how packaging is handled across the country. For Swiss businesses and for EU-based e-commerce sellers sending parcels across the border, this is a big moment. The new system is designed to align Switzerland with the EU’s sustainability goals, reduce waste, increase recycling and finally introduce something that looks like real, modern EPR. If you already comply with packaging rules in Germany, France or Austria, the general logic will feel familiar. But Switzerland has its own style, and it’s taking a phased approach that gives businesses a runway—but not a long one.

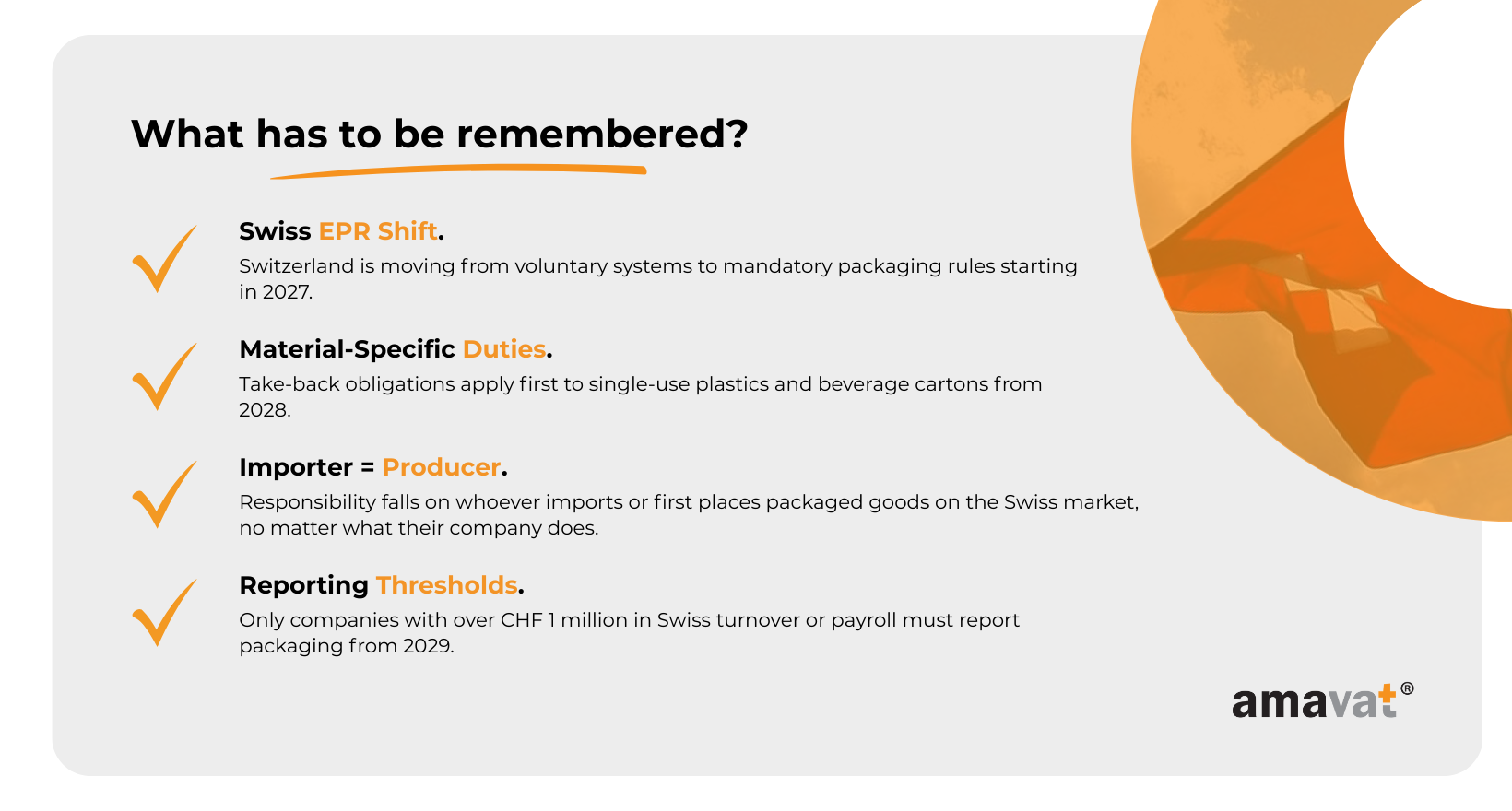

The first step happened in June 2025, when the Federal Council launched a public consultation on the draft VerpV. That consultation runs until October 2025. After that, everything accelerates. The ordinance will enter into force on January 1, 2027. One year later, in January 2028, take-back obligations begin. Another year after that, in January 2029, reporting obligations kick in. Three years, three steps, one complete transformation of how packaging is managed in the country.

For e-commerce sellers aged 25 to 35—especially small business owners juggling marketing, fulfillment and EU compliance—this is the kind of regulatory shift that’s easy to miss until it becomes urgent. Switzerland isn’t in the EU, so its rules don’t show up on the standard “EPR rules in Europe” checklists. But the country is a wealthy market with high online shopping rates and loyal customers who expect smooth delivery, especially from EU brands. Understanding how the VerpV will work is not just about avoiding trouble later. It’s about staying competitive, keeping customers happy and planning early enough to avoid headaches when the new rules arrive.

Over the next sections, this article dives into why Switzerland stayed without mandatory packaging EPR for so long, why the government is making a dramatic shift now and what the next few years will look like as the new system rolls out. The goal is simple: if you run an online store that ships into Switzerland, you’ll know exactly what’s coming, how it affects your packaging choices and how to prepare without stress.

The Current Situation (Before 2027)

When you look at Switzerland from the outside, especially if you’re used to shipping into tightly regulated markets like Germany or France, it’s easy to assume the country must have an equally strict system for packaging. After all, Switzerland has a reputation for being obsessively organised and environmentally conscious. But when it comes to packaging rules, the current framework is much lighter than what most EU online sellers would expect. Until 2027, Switzerland is still operating with a mix of voluntary systems, industry initiatives and a small set of legally regulated exceptions — mainly in the beverage sector.

This means that, for now, e-commerce sellers aren’t juggling EPR IDs, registering packaging volumes or dealing with detailed reporting structures. The gap between Switzerland and the EU is big, and understanding that gap is essential if you want to prepare for the new Packaging Ordinance that’s coming.

No Mandatory Packaging EPR Yet

At the moment, Switzerland doesn’t have a comprehensive, all-packaging EPR system. There’s no national registration platform, no central authority checking the kilos of packaging you place on the market, and no requirement to license your shipping boxes or fillers with a Producer Responsibility Organization. For most online sellers in the EU, this makes Switzerland feel unusually “light-touch” — especially compared to countries that send you quarterly packaging statements and invoices.

But there is one important exception: beverage packaging. Producers of PET bottles, cans and glass containers are already subject to specific rules. They must either finance an approved sector recycling system or organise their own take-back solution, and they must meet minimum recycling rates set out in existing legislation. Glass bottles, for example, include a prepaid disposal fee that’s legally required. PET bottles are financed through contributions embedded in the product price. These systems are established and well known in Switzerland, but they apply only to beverages, not to the cardboard boxes and plastic mailers used in everyday e-commerce shipping.

For an EU-based e-commerce seller sending parcels into Switzerland, this means that — so far — your typical packaging (mailers, cardboard, fillers, bubble wrap) does not trigger the kind of reporting or payments that you deal with in EU countries. That’s about to change, but for the moment, the rules remain surprisingly permissive.

Existing Voluntary Systems

Even without a mandatory packaging EPR, Switzerland hasn’t been ignoring recycling altogether. What exists today is a patchwork of voluntary or semi-voluntary systems that work well in some areas and less well in others. The strongest example is PET beverage bottles, where high recycling rates are achieved through a mix of industry-led schemes and legal targets. Consumers know PET bottles go into specific collection points, and the system is very visible in daily life.

Glass and aluminium beverage packaging is also supported by established structures. Cardboard and paper collections are organised at the municipal level and are widely used. Large retailers have created return points for certain plastic packaging types, and some regions have expanded mixed-plastic collection through the RecyPac initiative, which is gradually building a more unified approach to plastic packaging and beverage carton collection across the country. But none of these systems cover all packaging materials, and participation isn’t standardised nationwide.

For electronics, the situation is much more structured. Organisations like SWICO and SENS operate well-developed take-back systems, funded through advance recycling fees built into the purchase price. These cover IT devices, appliances, batteries and similar products. But again, these mechanisms don’t apply to general packaging — only to the electronic products themselves.

The common thread across these voluntary systems is that they depend heavily on consumer behaviour. Swiss residents are famously diligent about sorting their waste, and this cultural habit has allowed voluntary schemes to function without strong state enforcement. But as the volume of packaging continues to grow — especially due to e-commerce — voluntary participation is no longer enough.

Challenges and Environmental Impact

Here’s where the picture becomes more complicated. Switzerland consumes roughly one million tonnes of plastics each year, and around 350,000 tonnes of that is used specifically for packaging. About 790,000 tonnes of plastic waste are generated annually, and nearly half comes from short-lived items like packaging and single-use products. The problem is that almost none of this plastic packaging gets recycled unless it’s PET. For non-PET packaging, the recycling rate is only about three percent, which is extremely low by European standards.

Since Switzerland bans landfilling of combustible waste, nearly everything that isn’t recycled is incinerated. While the country has efficient waste-to-energy facilities, incineration still represents a loss of material resources and contributes to emissions. For a country that prides itself on sustainability, this imbalance has become increasingly hard to justify. Several Swiss reports have warned that environmental externalities — from waste, emissions and resource loss — amount to billions of francs per year across the wider economy.

The key takeaway is that Switzerland’s voluntary approach is no longer keeping up with the scale of the problem. The plastic statistics alone tell a clear story: despite strong public environmental awareness, the system wasn’t designed for the explosion of packaging brought on by modern e-commerce. This mismatch is one of the main reasons the government decided to move toward a full packaging ordinance aligned with EPR principles.

Understanding this current landscape makes the upcoming reforms easier to digest. Switzerland isn’t jumping from “nothing” to strict EPR overnight. It’s moving from a patchy, partly voluntary system to a more unified approach, finally bringing packaging rules in line with the country’s environmental ambitions — and with the expectations of its trading partners.

The Game-Changer: Switzerland’s New Packaging Ordinance (VerpV)

For a long time, Switzerland’s packaging rules were fairly lightweight and fragmented. Voluntary systems handled most materials, beverage packaging was regulated through a separate ordinance, and the rest of the market operated on trust and good intentions. With the new Packaging Ordinance (VerpV), that era is ending. The country is moving toward a modern, EU-inspired framework that covers all packaging types, but in a typically Swiss way: lean, focused and phased in over several years so businesses have time to adjust.

The VerpV is a complete overhaul of the existing beverage-container rules and expands the legal framework to all packaging. While not every obligation applies equally to every company, the new rules will significantly reshape how most businesses — including many EU sellers sending goods into Switzerland — design, finance, collect and report their packaging.

Understanding what happens when is key, so let’s walk through the timeline and what it means in practice.

Implementation Timeline

The Swiss government chose a gradual rollout, giving companies time to prepare their packaging systems, choose the right take-back scheme and set up reporting processes. The dates are already fixed in the draft:

On 1 January 2027, the ordinance enters into force. From this moment, the general design requirements apply: packaging should use only as much material as necessary, be recyclable within existing systems and contain as much recycled content as technically and economically feasible. Even if many companies won’t feel this immediately, it marks the formal start of the new regime.

On 1 January 2028, take-back obligations begin — but only for certain types of packaging. Specifically, companies placing single-use plastic packaging or beverage cartons on the Swiss market must either participate in an approved industry scheme or organise take-back and recycling themselves. For e-commerce sellers, especially smaller ones, joining a collective organisation will be the only realistic option. Existing rules for PET, aluminium and metal beverage packaging continue under updated structures.

On 1 January 2029, reporting obligations start. Most mid-size and larger companies (typically those above CHF 1 million in annual Swiss turnover or payroll) will need to submit detailed reports on the amounts and types of single-use packaging they place on the market. For plastics, this includes reporting by polymer type. Smaller companies remain exempt, but anyone shipping significant volumes into Switzerland should expect administrative duties from this point onward.

There is roughly a two-year gap between the law’s entry into force and the first take-back duties, and about three years until reporting kicks in. For businesses that want to avoid being caught off guard, these transition years matter.

Scope Expansion

One of the biggest shifts under the VerpV is that packaging is no longer limited to beverage bottles and cans. The ordinance now covers all packaging used to contain, protect, transport or present goods. This includes the everyday items used by online sellers: shipping boxes, padded envelopes, mailing bags, inner protective packaging, branded cartons, service packaging and more.

The ordinance doesn’t name “e-commerce parcels” explicitly, but the functional definition clearly includes them. If your packaging accompanies a product into the Swiss market — whether you’re an EU seller shipping directly or working through a Swiss partner — it falls within the ordinance’s scope.

This expansion doesn’t mean that every packaging type suddenly gets its own full EPR scheme with fees and quotas. But it does mean that design rules, reporting obligations and — for some materials — new collection and recycling requirements will now apply across the entire packaging ecosystem.

Core Requirements for Producers and Distributors

Once the VerpV is active, companies placing packaged goods on the Swiss market will be expected to follow several new responsibilities. The level of obligation depends on the company size, the material stream and whether they are the ones “first placing” the goods on the market. In cross-border commerce, this usually means the importer or the seller who ships directly to Swiss consumers.

A central requirement is sustainable packaging design. Packaging must be reduced to the minimum necessary volume or weight, it should not cause avoidable problems in the recycling process and it is expected to contain a high share of recycled content whenever technically and economically feasible. This doesn’t introduce fixed percentages but it sets a strong direction for packaging development.

Another major pillar is participation in a take-back system. From 2028, businesses placing single-use plastic packaging or beverage cartons on the Swiss market must join an approved take-back scheme or take responsibility for collecting and recycling their packaging themselves. For almost all small and mid-size e-commerce sellers, the practical path will be joining a collective industry system.

The ordinance also introduces recycling targets for the materials subject to mandatory take-back. The targets are ambitious: 55 percent recycling for single-use plastic packaging and 70 percent for beverage cartons. These align with EU benchmarks and signal Switzerland’s shift toward a high-performance circular economy.

To support these systems financially, the VerpV extends the prepaid disposal fee currently used for beverage glass to other glass packaging categories, such as jars and cosmetic containers. It also allows for advance disposal fees or deposit systems to be introduced for single-use plastic packaging and beverage cartons if recycling quotas aren’t met. This creates a financial backbone for the new system and ensures that producers contribute to the cost of recovery and recycling.

Finally, the ordinance introduces structured documentation and reporting duties. From 2029, eligible companies must report how much single-use packaging they’ve placed on the market, broken down by material type. This gives Swiss authorities the insights they’ve historically lacked and allows them to monitor progress toward recycling targets.

Specific Design and Operational Rules

The VerpV doesn’t just outline general principles — it also includes specific rules that shape how packaging must be designed and managed in everyday business operations.

One major rule is the push toward using recycled content. The ordinance doesn’t fix minimum percentages, but it requires companies to use as much recycled material as is realistically achievable. For companies already moving toward recycled or mono-material packaging to meet EU requirements, this will feel familiar.

Another important requirement is the need to avoid recycling obstacles. Packaging that combines incompatible materials, uses problematic inks or adhesives, or would significantly complicate collection or recycling may not comply with the ordinance. Simple, mono-material packaging will become increasingly attractive for sellers who want to meet Swiss expectations with minimal risk.

The ordinance also formalises the system of mandatory deposits for reusable beverage packaging. Producers must charge at least 30 Rappen as a deposit and ensure that the container can be returned and reused. This is mainly relevant for beverage brands, but it signals a broader move toward reuse models in Switzerland.

Retailers also take on greater responsibility. For the materials subject to take-back, retailers must provide take-back points where consumers can return used packaging. This applies particularly to beverage packaging streams and, from 2028 onward, to single-use plastic packaging and beverage cartons. For consumers, it makes recycling more convenient. For businesses, it creates a more predictable and consistent countrywide system.

All of these elements — design rules, recycled content requirements, mandatory take-back for specific materials, clearer financing and structured reporting — make the VerpV a genuine game-changer. It shifts Switzerland away from voluntary participation and toward a coordinated national system, while still giving businesses a practical and phased way to adapt.

How Switzerland’s EPR Differs from the EU’s PPWR

When you compare the Swiss Packaging Ordinance (VerpV) to the EU’s PPWR, it’s tempting to assume Switzerland is simply copying the European model. In reality, the two systems share the same goals but approach them very differently. The EU builds highly detailed, binding rules with hundreds of pages of technical requirements. Switzerland takes the opposite route: a short, principles-based ordinance that’s lean, structured and rolled out slowly — but still ambitious in terms of environmental outcomes.

For e-commerce sellers used to EU compliance, this mix of alignment and independence is important to understand. It means that some of the knowledge you already have will transfer naturally, but you shouldn’t expect the Swiss version to behave like a trimmed-down PPWR. It’s its own system, with its own logic.

Similarities

Even though VerpV is much shorter, its philosophy is almost identical to the PPWR. Both approach packaging through the full life cycle, from design all the way to disposal and recycling. In both cases, producers are expected to take responsibility not just for what happens after a package becomes waste, but for how it’s built in the first place.

Design expectations are also aligned. Switzerland puts strong emphasis on sustainable, recyclable packaging, pushing businesses to minimise material use, avoid components that slow down recycling and incorporate recycled content wherever it is technically and economically feasible. These principles echo the eco-design direction of the PPWR, even if Switzerland phrases them more simply.

And when it comes to recycling targets, the overlap is clear. The Swiss targets for single-use plastic packaging (55 percent) and beverage cartons (70 percent) match the performance level the EU wants to reach. This is intentional. Switzerland is building a system that fits comfortably alongside the EU’s circular-economy trajectory, so cross-border businesses aren’t operating in two completely different worlds.

Key Differences

But as close as the goals are, the systems themselves differ quite a bit. The first and most obvious difference is the format: the Swiss VerpV is a compact, 12-page ordinance, not a full regulatory ecosystem like the PPWR. Instead of long, prescriptive annexes and detailed technical requirements, the VerpV sets principles and leaves a lot of practical implementation to industry organisations and future specifications. It is simpler to read — not necessarily lighter to comply with, but certainly less bureaucratic on paper.

Another major difference is the absence of marketplace liability. In the EU, marketplaces have become gatekeepers for EPR compliance: if a seller can’t prove they’re registered, the platform becomes responsible. Switzerland has chosen not to include this model. Marketplaces are not treated as producers, they don’t have verification duties and they are not pulled into compliance enforcement. Whether that changes later is still open, but for now Switzerland keeps online platforms at a distance.

A further distinction is the lack of a central packaging register. There is no Swiss equivalent of Germany’s LUCID or France’s SYDEREP. Reporting will begin in 2029, but it won’t be a universal register of every producer. Instead, reporting goes directly to the Federal Office for the Environment (BAFU) and only applies to producers of single-use packaging above certain thresholds — typically companies with more than CHF 1 million in Swiss turnover or payroll. Smaller businesses are effectively exempt.

And finally, the implementation rhythm is very different. While the EU tends to roll out big reforms all at once, Switzerland has chosen a three-step timeline: the ordinance enters into force in 2027, take-back obligations for beverage cartons and single-use plastics begin in 2028, and reporting obligations for larger companies start in 2029. This slow ramp-up gives businesses more time to adapt — but it also means the Swiss system becomes fully operational over several years, not overnight.

Why Switzerland Is Aligning with the EU

Switzerland is not joining the EU, yet the VerpV intentionally moves in the same direction as the PPWR. The motivation is practical rather than political. Switzerland is a heavily export-oriented economy, and many domestic manufacturers already meet EU packaging rules because their products circulate inside the Single Market. If Swiss law remained much weaker than EU law, companies would end up with stricter obligations abroad than at home — something the government explicitly wants to avoid.

There’s also a strong need for harmonization. Packaging supply chains are international, recycling requires scale and consumers increasingly expect sustainability rules to be consistent across borders. Staying too far out of sync with the EU would create friction for traders, increase compliance complexity and risk Switzerland falling behind on environmental performance.

On top of that, there is competitive pressure. If Swiss producers are required to meet high EU standards but foreign competitors entering the Swiss market are not, domestic businesses are disadvantaged. Aligning with EU principles helps level the playing field and keeps Swiss industry competitive.

The result is a system that shares the EU’s objectives and ambitions but expresses them in a more compact and Swiss-style regulatory structure. For e-commerce sellers, this means the Swiss rules will feel familiar in spirit, without turning into another PPWR-style compliance marathon. There is work to do — especially around plastics, cartons and glass — but the path is clearer, the timeline is slower and the architecture is simpler.

What E-commerce Sellers Need to Know

For EU-based online sellers shipping to Switzerland, the new Packaging Ordinance reshapes what compliance looks like over the next few years. The transition is gradual, but the responsibilities become clearer — and stricter — as we move toward 2027, 2028 and 2029. If you already deal with EU EPR rules, you’ll recognise a lot of the logic. What changes is who carries the responsibility and how Switzerland structures its version of take-back and reporting.

Who Is Affected

A natural question for every e-commerce seller is: does this law apply to me? The short answer is that it applies to most businesses whose products enter Switzerland packaged in any form, but the long answer depends on who is legally “placing” the goods on the Swiss market.

Under the draft VerpV, a producer is anyone who manufactures or imports packaged products for commercial distribution. This means the obligations fall on whoever brings the goods into Switzerland — which can be you, your logistics partner or your Swiss distributor, depending on your setup.

If you’re a cross-border seller shipping under common incoterms like DAP or DDP, you or your business partner will often be treated as the importer and therefore as the producer. But if a Swiss customer personally imports a product — a less common scenario in standard e-commerce — then the foreign seller may not be the producer. In most practical online retail situations, though, the seller or their Swiss partner ends up with the responsibility.

If you work with a Swiss distributor or importer, they usually take on the role of producer because they’re the ones first placing the packaged goods on the Swiss market. This mirrors how Switzerland handles many other product compliance rules.

When it comes to fulfilment operators, their responsibility depends entirely on the contractual setup. A fulfilment centre alone isn’t automatically the producer — only if it acts as the importer of record. Some fulfilment partners do this, others don’t, so it’s crucial to clarify before the new rules kick in.

For marketplace sellers, Switzerland currently takes a hands-off approach. Marketplaces are not liable for EPR compliance, they’re not treated as producers and they have no legal duty to verify seller compliance. The only time a marketplace becomes a producer is when it imports the goods itself — not because it’s a marketplace, but because it plays the importer role. For most sellers, this means you still need to handle your own packaging responsibilities.

Three Main Obligations (2027–2029)

The new system rolls out in phases, and each year adds a new layer of responsibility. For most businesses, obligations cluster around three core areas: design rules, participation in take-back systems and, for larger companies, reporting.

From 2027, the design rules apply. These rules cover all packaging types, not just single-use packaging. They require businesses to keep packaging to the minimum necessary, avoid designs that create recycling problems and use as much recycled content as is technically and economically feasible. Switzerland doesn’t specify percentages, but it clearly expects packaging to align with circular-economy principles. If your packaging is already evolving for EU markets, you’ll likely be in good shape here.

From 2028, the first operational requirements appear: take-back obligations for single-use plastic packaging and beverage cartons. If you place either of these on the Swiss market, you must join an approved take-back organisation or manage your own collection and recycling. In practice, almost no small or mid-size e-commerce seller will set up their own system — joining a collective scheme will be the standard route. Note that these obligations don’t apply to every material type; they target streams with the highest environmental impact and lowest recycling rates.

From 2029, larger companies must begin tracking and reporting their single-use packaging. This reporting goes directly to the Federal Office for the Environment (BAFU), not into a public register. And it only applies to companies with more than CHF 1 million in annual Swiss turnover or payroll across two consecutive years, provided they’re not already subject to the glass fee system. Reporting is relatively detailed — plastics must be broken down by polymer type (PET, PE, PP, etc.) — so this is one area where early preparation will help businesses avoid headaches later.

These three obligations — design, take-back and reporting — form the backbone of the VerpV. How much they affect you depends on your company size, your packaging materials and how your goods enter Switzerland.

Marketplace Sellers

Marketplace sellers will notice one very clear difference between Switzerland and the EU: Switzerland does not hold marketplaces responsible for verifying or enforcing EPR compliance. There are no “deemed supplier” rules, no EPR ID checks and no marketplace-level fines for non-compliance. The responsibility always stays with the party that imports or first places the goods on the Swiss market.

This doesn’t mean marketplaces will stay hands-off forever. As take-back systems mature, major platforms may introduce voluntary compliance checks simply to avoid risk and friction. Large marketplaces don’t like uncertainty, and they often require documentation even before the law forces them to.

It’s also worth noting that if a marketplace imports goods for resale — similar to an “Amazon Global Store” model — it becomes the producer, but only because it is acting as the importer. Marketplace status itself never triggers producer responsibilities in Switzerland.

For now, the message for marketplace sellers is straightforward: you cannot rely on a platform to manage Swiss packaging compliance for you. At least under the current rules, it remains your responsibility (or the responsibility of your Swiss importer or fulfilment partner) to meet the design requirements, join the appropriate take-back system if needed and keep packaging documentation ready in case a platform or partner requests it.

Current EPR Obligations That Already Apply (Non-Packaging)

Before the new packaging rules arrive, it’s worth remembering that Switzerland isn’t starting from scratch. The country already has long-standing, well-organised EPR systems in several product categories, especially electronics, appliances, batteries and beverage containers. These systems have been operating for decades and are often cited as examples of how producer responsibility can work smoothly when industry, government and retailers collaborate.

The new Packaging Ordinance essentially extends this familiar logic to packaging for the first time — but the principles behind it have been part of the Swiss system for years.

WEEE Obligations Through SWICO and SENS

Switzerland’s approach to electronic waste is older than most of the EU’s WEEE legislation. The country introduced mandatory take-back and recycling for electrical and electronic equipment in the late 1990s, and the system has been operating ever since under two major organisations: SWICO and SENS.

SWICO covers IT devices, office equipment, small consumer electronics, telecom devices and similar categories. SENS handles a wide range of appliances, lighting equipment, tools, toys, garden machinery, medical devices and more. Both systems rely on an advance recycling fee that is added to the price of a new product. This fee finances the collection network, transport and treatment of devices at end of life.

For consumers, returning electronics is easy — they simply drop them off at one of the many take-back points. For businesses, the key is understanding who is responsible for paying into the system. In e-commerce, the responsible party is usually the importer of record. If you ship electronics directly into Switzerland under terms where your business becomes the importer, you’re generally treated as the “producer” and must ensure the fees are handled correctly.

If, however, a Swiss distributor or marketplace imports the goods before selling them domestically, they take on the responsibility. The obligation always follows the first party placing the product on the Swiss market.

Battery Take-Back Requirements

Batteries — whether sold separately or built into products — have their own producer responsibility rules in Switzerland. These obligations focus on safe recycling, preventing environmental harm and ensuring convenient collection for consumers. Retailers must take back used batteries free of charge, and producers or importers must finance the system that collects and recycles them.

As with electronics, the responsible party in cross-border e-commerce is usually whoever imports the batteries (or battery-containing products) into Switzerland. If that’s you, you are expected to contribute to the relevant collection scheme. If a Swiss distributor handles the import, they take on the duty. The system is well established, consumer-friendly and widely understood in the Swiss market.

Existing Beverage Packaging Rules Under the 2000 VGV

Although Switzerland hasn’t had a comprehensive packaging EPR system, it has had strict rules for beverage containers for more than two decades. These come from the Beverage Containers Ordinance (VGV) of 2000, which remains in force today and will stay active until it is replaced by the new Packaging Ordinance on 1 January 2027.

Under the VGV, producers and importers of beverage containers must meet minimum recycling quotas — at least 75% for PET bottles, aluminium cans and glass bottles. The system works because it combines clearly defined targets with industry-run collection networks and a long-standing culture of returning beverage packaging.

Glass beverage bottles carry a mandatory prepaid disposal fee, which finances the collection and recycling system. PET beverage bottles and aluminium cans are supported by well-organised take-back structures, resulting in some of the highest beverage-container recycling rates in Europe.

These rules apply today only to beverage packaging. In the packaging world, they have always been the exception — the one area where Switzerland has a fully regulated producer-responsibility regime. With the arrival of the VerpV, this model expands. Beverage cartons and single-use plastic packaging will be brought under structured take-back and recycling requirements, and larger companies will eventually need to report all single-use packaging they place on the Swiss market.

For e-commerce sellers, the takeaway is simple:

If you sell beverages in Switzerland, you already have legal obligations today under the VGV.

If you don’t, the VGV may never have applied to you — but the new VerpV certainly will.

Strategic Recommendations for E-commerce Businesses

If you sell into Switzerland — whether occasionally or as part of your main market mix — the new Packaging Ordinance will gradually reshape your responsibilities. The transition is long enough to plan properly, but short enough that you don’t want to wait until the last minute. The smartest approach is to treat this as a three-phase journey: what you can do now, what needs to happen before the law enters into force, and what you’ll need to manage once the new system becomes operational.

Short-Term (2025–2026)

The next one to two years are all about understanding where you stand. Even though the VerpV doesn’t start applying until 2027, the smartest brands are already preparing. This period is ideal for running internal checks, mapping your packaging footprint and making sure your supply chain is aligned with the direction Switzerland is heading in.

A good starting point is a packaging audit. This doesn’t have to be complicated. You simply look at every type of packaging you currently use for Swiss orders — shipping boxes, padded envelopes, protective inserts, product packaging, labels, fillers — and gather basic details such as weight, material and whether the components are mono-material or mixed. Most companies are surprised by how quickly these details add up and how many different materials are involved.

From there, you can move into material mapping. This is where you categorise your packaging materials more clearly: which ones are plastics, which are paper or cardboard, which use adhesives or coatings, which might be hard to recycle and which already align with eco-design principles. If you sell a wide range of products, this step helps you understand where your biggest challenges will be under the new law.

It’s also a good moment to look at the voluntary systems currently operating in Switzerland. PET bottles, glass and cardboard already have strong networks. Even though voluntary systems won’t replace the legal obligations coming in 2027 and beyond, understanding what works today gives you a sense of how the future take-back organisations may operate. If you sell beverages, you might already be part of such a system without realising it.

Finally, assess your alignment with EU packaging obligations. Many EU sellers already comply with strict EPR rules in countries like Germany, France or Spain. If your packaging strategy is already evolving for the PPWR, you’re halfway prepared for Switzerland. The philosophy is similar, even if the mechanics differ. Anything you improve for EU compliance — like shifting to mono-material packaging — will benefit your Swiss compliance later.

Medium-Term (2026–2027)

By the time 2026 arrives, you’ll want to move from planning to decision-making. The new design rules apply from 2027, so this is the period where your operational setup starts to matter.

One of the most important decisions is choosing the take-back scheme you’ll join. For beverage cartons and single-use plastic packaging, you must either join an approved collective organisation or operate your own take-back system. Realistically, almost all e-commerce sellers will join a collective scheme. This is also the moment to clarify who in your supply chain counts as the importer: you, your fulfilment provider or your Swiss distributor. Whoever imports is typically the one who must join the scheme.

Next, you’ll want to build cost forecasts. Even though Switzerland doesn’t copy the EU’s detailed fee-per-kilogram model, there will be costs associated with joining take-back organisations, contributing to recycling networks and, in some cases, paying advance disposal fees. Forecasting these costs helps avoid surprises later and allows you to adjust your pricing if necessary.

This period is also perfect for starting packaging redesign processes. If your audit from the earlier phase revealed heavy or mixed packaging, this is the time to update it. Switching to recyclable mono-material packaging, reducing unnecessary weight and increasing recycled content where feasible will all align you with the new design rules. Redesigning packaging always takes longer than expected — especially when you factor in procurement cycles — so don’t push this step too late.

As you get closer to 2027, it’s worth setting up data systems that will eventually support reporting. Even if you’re a small seller who may never meet the reporting threshold, collecting basic packaging data is still useful. If your business grows, you’ll already be prepared. If you’re above the CHF 1 million threshold, these systems will eventually become essential. You don’t need fancy software — even a structured spreadsheet can be effective at this stage.

Long-Term (2028 Onward)

Once we hit 2028, the new system becomes real. This is when take-back obligations begin for beverage cartons and single-use plastic packaging, and companies large enough to fall under the reporting rules need to be ready to provide data the following year.

The biggest ongoing responsibility will be full compliance and reporting. If you meet the threshold for reporting, you’ll need to track your annual packaging volumes by material type — and for plastics, by polymer. Once 2029 begins, these reports will be submitted to the Swiss Federal Office for the Environment. Maintaining accurate internal data will make your yearly reporting routine rather than stressful.

You’ll also want to stay on top of regulatory updates, because Switzerland tends to legislate in phases. Once the core system is established, authorities may refine details, adjust targets or extend obligations to additional materials. Switzerland hasn’t ruled out a central register, marketplace liability or expanded take-back duties in the future — so keeping an eye on developments will protect you against unpleasant surprises.

Finally, consider using sustainable packaging as part of your marketing and brand positioning. Swiss consumers tend to be environmentally conscious, and the new rules will only reinforce this. If you’re investing in more sustainable packaging anyway, it can become a selling point: lighter materials, fully recyclable shipping boxes, plastic-free product packaging, compostable fillers — these improvements speak directly to customer values and can differentiate your brand in a competitive market.

Conclusion

Switzerland’s move from a mostly voluntary patchwork of recycling initiatives to a structured, mandatory EPR system is one of the biggest regulatory shifts the country has seen in years. For decades, packaging was the missing piece in an otherwise well-developed Swiss recycling landscape. With the new Packaging Ordinance, that gap finally closes. What was once limited to beverage containers will now extend across single-use plastics, beverage cartons and, eventually, all single-use packaging for larger producers.

For e-commerce sellers, especially those based in the EU, this evolution shouldn’t come as a surprise. The entire European market is moving toward tougher sustainability standards, clearer producer responsibilities and more transparent reporting. Switzerland is simply entering that same conversation, but in its own typically Swiss way: step by step, principle-based, predictable and aligned with broader circular-economy goals.

The smartest thing sellers can do is act early. The transition may look far away on paper — 2027 for design rules, 2028 for take-back obligations, 2029 for reporting — but packaging changes, cost planning, system selection and data setup all take time. The businesses that start preparing now will feel almost no friction when the rules officially apply. Those who wait until the last moment may find themselves scrambling to redesign packaging, identify the importer of record or gather data they never tracked in the first place.

And beyond compliance, there’s a bigger opportunity here. Sustainable packaging is becoming a competitive advantage in cross-border trade. Customers in Switzerland, just like in the EU, are paying more attention to waste, recycling and the environmental footprint of the brands they buy from. What once felt like a regulatory headache can easily become a part of your value proposition: lighter packaging, recycled materials, fewer plastics, more transparency. Every improvement you make for compliance also strengthens your brand story.

Switzerland’s new rules mark the beginning of a more consistent, more circular and more environmentally responsible packaging system. For e-commerce sellers willing to prepare early, this transition doesn’t have to be a burden — it can be a chance to modernise, simplify and stand out in a market that increasingly rewards sustainability.