EPR System in Hungary

Spis treści

Before you start shipping orders, though, it’s important to understand one key legal requirement: Hungary’s EPR system – Extended Producer Responsibility.

EPR might sound like bureaucratic jargon, but in practice it’s straightforward. It’s a system that holds businesses accountable for what happens to the packaging and products they introduce to the market. In Hungary, this responsibility is formalised through mandatory registration, regular reporting, and the payment of environmental fees based on the quantity and type of packaging materials used.

What makes this especially important for international sellers is that EPR applies to all business-to-consumer sales, even if your company has no local presence in Hungary. From the very first parcel you send, you’re considered part of the system and must comply with its rules.

Ignoring these requirements can lead to financial penalties and complications that could easily disrupt your operations. But with proper preparation, compliance becomes a routine part of doing business — another process to manage, not a hurdle to growth.

This article serves as a practical guide to the Hungarian EPR framework. You’ll learn what the system is, who it applies to, how registration works, what fees to expect, and how to stay compliant without unnecessary stress.

Whether you’re a small brand exploring new EU markets or an established e-commerce company expanding your cross-border sales, understanding Hungary’s EPR system is essential for operating smoothly and sustainably.

What Is the EPR System in Hungary

Definition of the Hungarian EPR System

Hungary operates under the Extended Producer Responsibility (EPR) framework — in Hungarian, kiterjesztett gyártói felelősség. The concept places the financial and operational responsibility for managing packaging waste on the companies that first place products or their packaging on the Hungarian market.

In practical terms, this means that businesses must register in the national EPR system, report regularly on the quantities of goods and packaging they introduce, and pay environmental fees based on this data. These payments are used to finance Hungary’s waste collection, recycling, and disposal infrastructure, ensuring that waste management costs are borne by the producers and importers rather than by the state or consumers.

Invoices for these environmental fees are issued by MOHU, the official concessionaire appointed by the Hungarian government to manage the EPR system. MOHU uses the data submitted in quarterly reports to calculate the fees due from each business, and the collected funds support nationwide recycling and waste-handling programmes.

The Role of MOHU and OKIR

Hungary’s EPR system is built on two central institutions. The first is MOHU (MOL Hulladékgazdálkodási Zrt.), the exclusive concession holder responsible for organising, operating, and financially managing the country’s EPR framework. Businesses must register with MOHU to gain access to the partner portal where their environmental obligations are tracked and settled.

The second key element is OKIR, the National Environmental Information System, maintained by the Hungarian authorities. Companies submit their quarterly EPR reports via OKIR, and this data forms the basis for the invoices issued by MOHU. Together, these two systems create a centralised and transparent structure that applies uniformly to all companies operating on the Hungarian market, regardless of their size or country of origin.

Who Is Covered by the Hungarian EPR System

EPR obligations in Hungary are determined by the concept of the “first placer on the market.” This isn’t limited to manufacturers. It includes any business that first introduces a product or its packaging into the Hungarian market — whether through local production, import, or direct sales to consumers.

That means a foreign e-commerce company shipping directly to Hungarian customers is treated the same as a local manufacturer or distributor. Even if you don’t have a Hungarian office or warehouse, you’re still considered a first placer and must comply with registration, reporting, and fee payment requirements.

The only businesses not directly affected are retailers who sell goods that have already been introduced to the market by another registered entity.

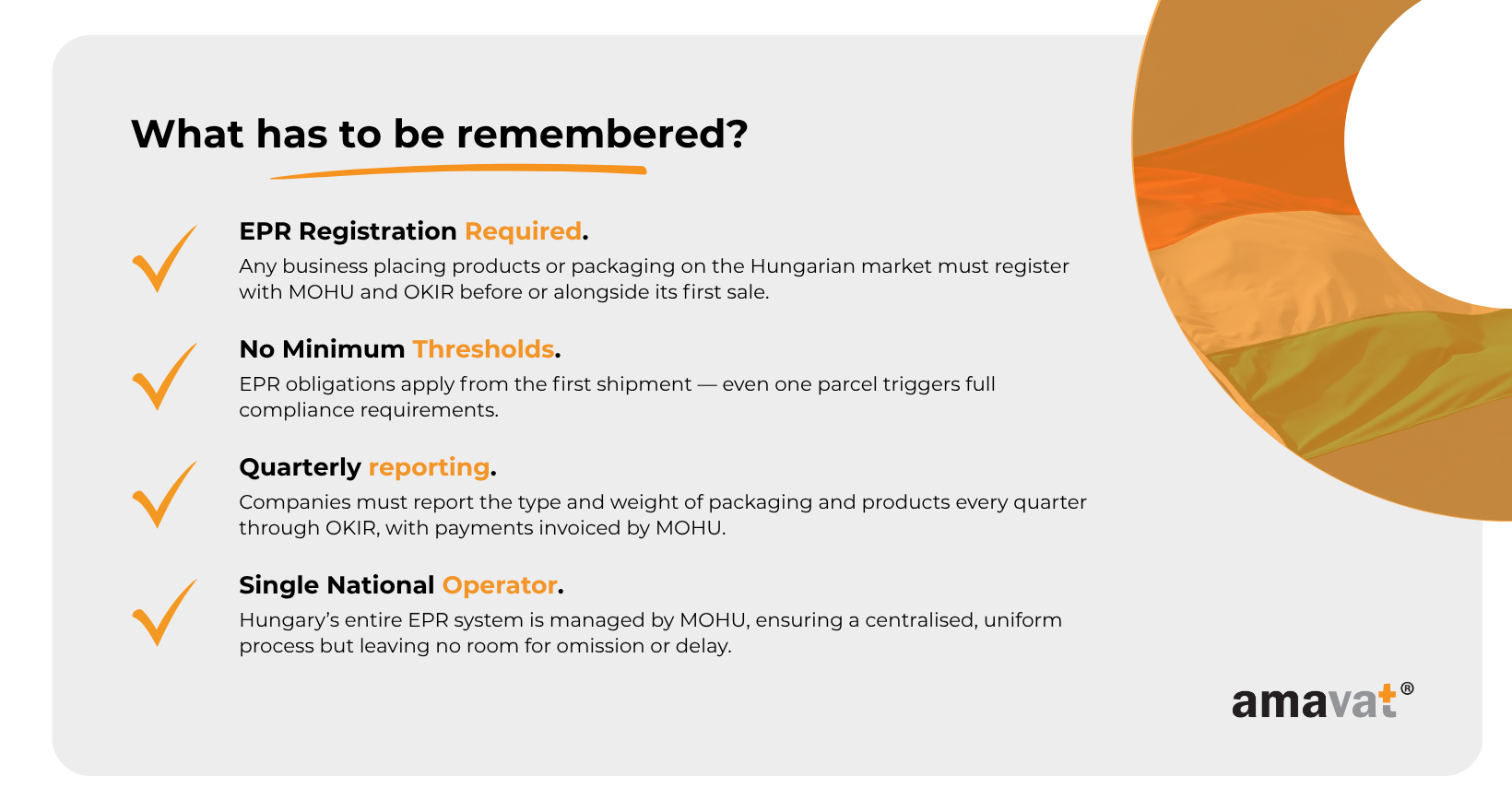

Obligation from the First Delivery

One of the defining features of the Hungarian EPR system is its lack of minimum thresholds or exemptions. The obligation to register and report begins with the very first shipment sent to a Hungarian customer. Whether you handle a handful of orders a year or thousands of deliveries each month, you fall under the same legal framework.

This ensures a consistent approach: every company contributing to the flow of goods into Hungary participates in financing the country’s recycling and waste management system. For sellers expanding internationally, this means EPR compliance should be part of your launch checklist — not an afterthought.

Key Obligations Under the Hungarian EPR System

Registration with MOHU and OKIR

The first and most essential step in complying with Hungary’s EPR rules is registration. Companies introducing products or packaging into the Hungarian market must register with both MOHU, the licensed operator responsible for managing the EPR system, and OKIR, the national environmental registry. Without completing these registrations, you cannot legally sell to Hungarian consumers.

The registration process requires providing detailed company data and information about the products and packaging you plan to place on the market. Once registered, all reporting and invoicing are handled through the MOHU and OKIR systems. The procedure can take time, as it involves assigning correct product codes and submitting verified business documentation. For non-Hungarian companies, it is common — and often advisable — to work with a local authorised representative who can facilitate registration and communication with the authorities.

No Minimum Thresholds

Hungary’s EPR framework applies from the very first product shipment. There are no volume thresholds or exemptions for small businesses. Whether you send one parcel a year or thousands per month, you are subject to the same obligations to register, report, and pay environmental fees.

This structure ensures that all businesses, regardless of size, share responsibility for the environmental impact of the goods they sell. Even smaller sellers should factor compliance costs and administrative tasks into their pricing and logistics planning before launching in Hungary.

Quarterly Reporting

Registered companies must submit quarterly reports through the OKIR system, detailing the type and mass of packaging and products placed on the market. Reports are due by the twentieth day of the month following the end of each quarter. Based on these reports, MOHU issues an invoice for the applicable EPR fees, which must be paid within fifteen days.

Efficient data management is critical. Businesses should establish systems to record packaging and product data continuously rather than attempting to compile it later. Automating the process through order management or compliance tools can significantly reduce the risk of mistakes and missed deadlines. Late or missing reports can result in financial penalties or administrative sanctions.

Green Fees and Payment Structure

The environmental contributions required under the EPR scheme — commonly referred to as green fees — are calculated according to the weight and material type of the packaging and products placed on the market. These payments represent a company’s share in funding Hungary’s recycling and waste management system and should be treated as a standard operational expense when selling to Hungarian customers.

Fee levels vary depending on material type. Packaging made of plastic or aluminium generally carries higher rates than paper or cardboard, reflecting the cost and complexity of recycling different materials. Choosing lighter, more sustainable packaging can therefore reduce both environmental impact and business costs. In this way, the EPR system not only enforces compliance but also incentivises environmentally conscious product design and packaging decisions.

Record-Keeping and Documentation

Accurate documentation is fundamental to compliance. Companies must maintain detailed records of all products and packaging introduced to the Hungarian market. These records must be complete, verifiable, and available for inspection if requested by authorities. The precision of your data directly affects the accuracy of your reports and the amount of fees owed.

Integrating record-keeping with your e-commerce or enterprise systems helps ensure consistency and transparency. Manual reporting increases the risk of human error, which can lead to discrepancies, inflated invoices, or compliance issues during audits. Continuous, well-structured documentation demonstrates that your business takes its environmental responsibilities seriously and operates in full alignment with Hungarian regulations.

Required Clause on Invoices

Sales invoices for products subject to EPR obligations must include a specific note confirming that the seller is responsible for paying the extended producer responsibility fee. The standard English version of this statement is:

“The seller is liable for paying the extended producer responsibility fee.”

This declaration enhances transparency and signals to partners, auditors, and customers that the seller operates in full compliance with Hungary’s environmental regulations.

Deposit and Labelling Requirements

Hungary operates a deposit return system for certain beverage packaging, including plastic and metal bottles and cans. Businesses selling drinks in such containers are required to participate in the deposit system, which is managed by MOHU. Consumers can return the empty packaging and reclaim the deposit, while producers and distributors handle the corresponding reporting and payment obligations.

For standard e-commerce packaging — such as cardboard boxes, film, and fillers — the responsibility is limited to accurate record-keeping and paying EPR fees. There is no requirement to collect packaging back from consumers.

Additionally, all packaging placed on the Hungarian market must comply with EU labelling rules, including recycling and material identification symbols. These markings guide consumers on how to dispose of packaging properly and demonstrate that your business operates within the European framework for environmental compliance.

Electrical Equipment and Batteries

Since 1 July 2023, Hungary’s EPR framework has been expanded to cover electrical and electronic equipment (EEE) and batteries. Any company placing such products on the market — even in small quantities — must include them in its registration, reporting, and fee calculations.

Foreign businesses selling directly to Hungarian consumers must appoint a Hungarian authorised representative to manage these obligations on their behalf. The representative acts as a liaison with MOHU and ensures that all EPR duties are fulfilled correctly, although ultimate legal responsibility remains with the seller.

Registration Process and Technical Aspects

Registration with MOHU and OKIR

Registering under Hungary’s EPR system requires careful preparation and attention to detail. The process begins with creating an account in the MOHU Partner Portal, the official online platform managed by MOHU, the sole concession holder responsible for Hungary’s waste management operations. Through this portal, businesses submit their company details, product information, and packaging data.

The next step is to register in OKIR, Hungary’s national environmental information system. This is where all quarterly reports are submitted, and the data entered there becomes the basis for invoices issued by MOHU.

Although the registration forms are available in both English and Hungarian, the procedure can be time-consuming, and each submission must be precise. Missing or incorrect information can delay approval. In practice, authorities allow a certain degree of flexibility: once a registration application has been submitted, companies may begin trading while the process is being completed. Any data or payment corrections for the interim period must, however, be reconciled later. This transitional approach ensures that businesses can start operating without being paralysed by administration, provided they later regularise their reporting and payments.

Product Classification According to KF Codes

A critical part of registration and ongoing compliance is the correct classification of products and packaging under Hungary’s KF code system. Each product and packaging type is assigned an eight-digit code that determines its EPR category and, consequently, the applicable fee rate. For instance, cardboard boxes, plastic bottles, and aluminium cans are each classified under different codes, with distinct environmental fee levels.

Getting this classification right is essential. Incorrect coding can result in either overpayment or underpayment, both of which can lead to corrections or penalties during audits. Because many e-commerce businesses use multiple types of packaging, it is advisable to prepare a product and packaging catalogue in advance, assigning KF codes to each item. This not only simplifies quarterly reporting but also reduces the risk of administrative errors later.

Obligations for Foreign Companies

For companies based outside Hungary, the EPR obligations apply in full. Any business selling directly to Hungarian customers — even without a local office, warehouse, or tax registration — is considered the first placer on the market and must comply with the same EPR rules as domestic firms.

Foreign sellers typically appoint a local authorised representative to handle the administrative side of compliance. This representative manages registration, prepares and submits reports, communicates with MOHU and the authorities, and ensures that deadlines are met. For businesses unfamiliar with Hungarian law or language, this arrangement simplifies operations considerably.

While working through an authorised representative provides practical and linguistic support, it does not shift legal liability. The company placing the products on the market remains ultimately responsible for the accuracy of all reports and payments. Choosing an experienced representative is therefore crucial, as it ensures reliable communication with authorities and protects your business from compliance risks.

Extended Reporting for Electrical Equipment and Batteries

Once registered, businesses must include not only packaging but also electrical and electronic equipment (EEE) and batteries in their quarterly reports if they sell such items. The reports must specify the weight of each category of products and batteries placed on the market. Companies are required to maintain detailed records of all relevant transactions, classify products according to the correct codes, and retain documentation for the legally required period.

From 1 April 2025, Hungarian authorities will introduce stricter enforcement rules for inaccurate or missing declarations. If the reported quantities are lower than the actual figures, fines may be imposed, calculated as the difference between the declared and actual quantities, multiplied by half of the applicable unit rate. This underscores the importance of accurate data management and proper classification from the outset.

EPR Rates for Equipment and Batteries

Hungary has set specific EPR fee rates for different categories of electrical devices and batteries. The fees depend on both the type and the weight of the product. Categories include small household appliances, IT and communication equipment, and various types of batteries such as portable and industrial cells.

The introduction of EPR for these product groups has replaced the previous system of separate product fees. Businesses now only need to comply with the EPR structure managed by MOHU, which simplifies administration and consolidates all payments under a single scheme.

MOHU calculates fees based on the data provided in quarterly reports and issues invoices accordingly. In line with Hungarian regulations, invoices for products subject to EPR must include the following statement in English:

“The seller is liable for paying the extended producer responsibility fee.”

This clause confirms that the seller assumes full responsibility for fulfilling their EPR obligations and paying the corresponding environmental charges.

Most Common Questions from Businesses

When Did the EPR System Come into Effect in Hungary

Hungary’s Extended Producer Responsibility (EPR) system came into force on 1 July 2023, introducing a new, unified framework for managing packaging waste, electrical equipment, and batteries. From that date, the Hungarian government granted MOHU a thirty-five-year concession to organise and operate the national EPR structure.

Under this model, MOHU became responsible for coordinating all aspects of the waste management process — registration, fee collection, and the financing of recycling activities. Every business that places products or packaging on the Hungarian market, whether domestic or foreign, must now register and comply with reporting and payment obligations.

To allow companies time to adapt, the authorities introduced a transitional period during which sales could continue after registration applications were submitted. Any missing reports or payments for that initial phase, however, must later be reconciled. This approach helped ensure a smooth transition into the new system without disrupting trade.

What Are the Penalties for Non-Compliance

Failure to register, submit reports, or pay the required environmental fees can result in significant financial penalties. Hungarian law does not specify a fixed schedule of fines, leaving the exact amount to the discretion of the competent authority. In practice, penalties can range from several hundred to several thousand euros, depending on the scale and duration of non-compliance, and may include interest on overdue payments.

Authorities may also impose additional administrative measures, such as temporary restrictions on business operations within Hungary. For that reason, EPR compliance should be viewed as a legal obligation equivalent in importance to tax or customs duties. Late reports, inaccurate data, or missing registrations can quickly escalate into costly and time-consuming issues.

Are Small or Micro Businesses Also Covered by the EPR System

Yes. The Hungarian EPR system applies to all businesses, regardless of their size or annual turnover. The obligations start with the very first delivery of a product or packaging to the Hungarian market. Even small online retailers or sole traders sending only a few parcels per year are required to register, report, and pay the corresponding environmental fees.

The system is designed to ensure that every company contributes fairly to the cost of waste management. For small businesses, this means additional administrative steps, but the fees themselves are proportionally low, reflecting the smaller quantities of materials placed on the market. Preparing early, maintaining accurate records, and using digital tools for reporting can make compliance much more manageable, even for microbusinesses.

How Is Hungary’s EPR System Structured Compared to Other EU Models

Although all EU Member States have implemented Extended Producer Responsibility in some form, Hungary’s approach is one of the most centralised. Many European countries operate through multiple waste management organisations or industry-specific collectives. Hungary, by contrast, has entrusted the entire system to a single concessionaire — MOHU — which oversees registration, reporting, invoicing, and fee collection.

This centralised model provides consistency and transparency across industries but also leaves little room for flexibility. Every company interacts with the same operator and follows the same procedures, regardless of its size or sector.

Another distinguishing feature is Hungary’s strict enforcement of the “first placer on the market” rule. This means that foreign companies selling directly to Hungarian consumers are treated exactly like local producers or importers, even if they have no physical presence in the country.

Finally, unlike some EU countries that exempt very small volumes or provide de minimis thresholds, Hungary applies EPR obligations from the first product shipped. This all-inclusive approach reflects the country’s emphasis on environmental accountability and ensures that every business contributes to the sustainability of its market footprint.

Practical Tips for Businesses

How to Prepare for Registration and Reporting

The best time to prepare for compliance with Hungary’s EPR system is before you make your first sale to a Hungarian customer. Start by reviewing your product range and packaging materials — these will form the foundation of your EPR obligations. Identify what materials you use, how much they weigh, and how they should be classified under Hungary’s KF coding system. Creating an internal catalogue of products and packaging with assigned codes will make later reporting faster and more accurate.

The registration process itself is detailed and can take time. Applications must include complete company data, product information, and supporting documentation. Because of the system’s complexity, even small errors can lead to delays. Fortunately, the Hungarian authorities have introduced some flexibility: companies can begin selling after submitting their registration, as long as they later reconcile any missing reports or fees. This approach prevents trade disruption while maintaining accountability for accurate reporting.

Why It’s Worth Working with Local Experts

The Hungarian EPR framework is still relatively new and not always straightforward, particularly for foreign businesses unfamiliar with local procedures. Communication with MOHU and OKIR is available in Hungarian and English, but navigating the registration and reporting process can still be challenging.

For this reason, many international companies rely on local legal or compliance experts who specialise in EPR. These professionals help with registration, manage quarterly reporting, and ensure that all data is classified correctly. While hiring external support adds to operational costs, it greatly reduces the risk of fines, reporting delays, and administrative errors.

For smaller companies, this support can be especially valuable. Without an in-house legal or accounting department, managing compliance in another language and regulatory system can be overwhelming. A local expert allows you to stay focused on your sales operations while maintaining full compliance with Hungarian environmental rules.

Tools to Support Record-Keeping and Reporting

Effective record-keeping is at the heart of EPR compliance. Managing product and packaging data manually becomes impractical as sales volumes grow. Implementing digital tools to automate data collection can dramatically simplify the process.

This can take the form of integrated modules in your e-commerce or ERP system, spreadsheets tailored to Hungarian reporting standards, or specialised compliance platforms designed for businesses operating in multiple European markets. Automation not only reduces the time needed for reporting but also minimises the risk of human error.

A well-organised documentation process also facilitates cooperation with your representatives or advisors. When your data is structured and accessible, it’s easier to submit accurate reports, verify invoices, and respond to any inspection requests from authorities. It’s also a strong sign of good compliance management — showing that your company handles its environmental obligations systematically and transparently.

Working with EPR Outsourcing Providers

Many foreign businesses choose to outsource their Hungarian EPR obligations to local service providers or authorised representatives. In practice, this means you share your sales and packaging data with a trusted partner, who then manages registration, reporting, classification, and communication with MOHU and OKIR on your behalf. This arrangement allows you to focus on your commercial operations rather than administrative tasks.

However, outsourcing does not transfer legal responsibility. Even when you work through a representative, your company remains legally liable for fulfilling all EPR obligations. If your representative submits incorrect data or misses deadlines, the penalties still apply to you as the seller. For that reason, outsourcing should be seen as a compliance support tool, not as a way to delegate responsibility entirely.

The most effective approach is to choose partners with proven expertise and experience in managing EPR obligations for international companies. Maintain visibility over your data and ensure that all submissions reflect your actual sales volumes and materials used. A transparent relationship with your service provider safeguards both your compliance status and your reputation.

Summary

At first glance, Hungary’s Extended Producer Responsibility (EPR) system may seem complex and highly administrative. Yet, once understood, it becomes clear that it is simply another structural element of doing business within the European single market — one that aligns environmental responsibility with commercial activity.

The system is built around a straightforward principle: any business that first places a product or its packaging on the Hungarian market must register with MOHU and OKIR, maintain precise records, submit quarterly reports, and pay environmental fees based on the type and quantity of materials used. The obligation starts from the very first shipment and applies equally to domestic and foreign sellers, regardless of size or sales volume.

Because Hungary has entrusted its EPR operations to a single concessionaire, the system is centralised, uniform, and tightly controlled. This brings clarity but also leaves little room for error. Late registrations, inaccurate reports, or incorrect product classifications can all lead to financial penalties that quickly become costly if left unresolved.

The best approach is a proactive one. Before entering the Hungarian market, analyse your products and packaging, assign the correct classification codes, and establish a clear reporting process. Consider implementing automated tools for data collection, and if needed, work with local compliance experts or authorised representatives. They can help you navigate the process efficiently — but remember, the legal responsibility always remains with your company.

Expanding into Hungary represents a valuable opportunity to grow your e-commerce operations and reach new consumers. By integrating EPR compliance into your business planning from the start, you can operate confidently, avoid unnecessary complications, and demonstrate your commitment to sustainable business practices.

In the end, EPR compliance isn’t just about meeting legal obligations. It’s a reflection of how modern, responsible businesses operate — with transparency, accountability, and an understanding that growth and sustainability go hand in hand.