EPR System in Slovakia

Spis treści

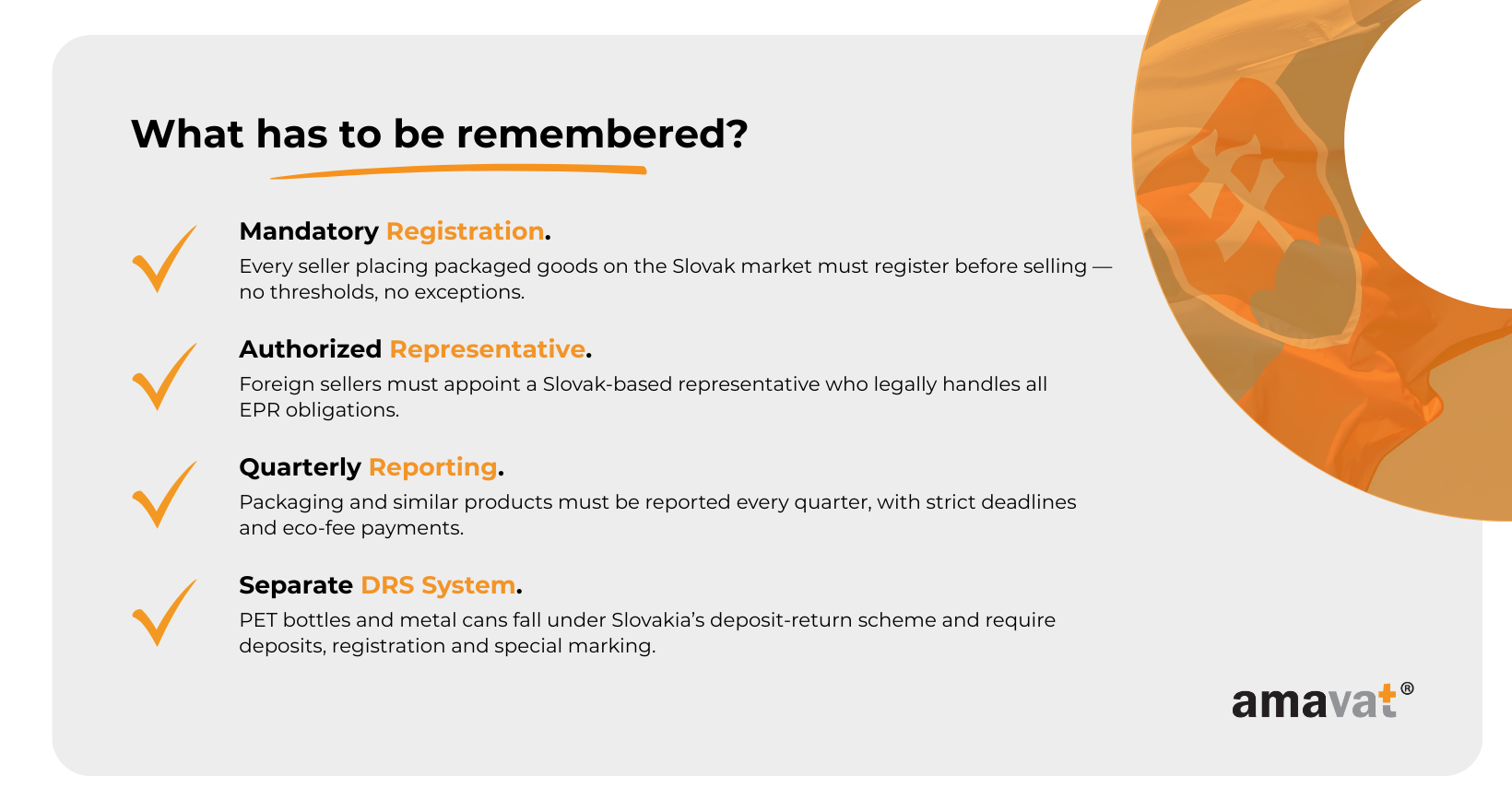

Slovakia is one of those EU countries where EPR isn’t just a formality. Their system is detailed, strictly enforced, and comes with real financial consequences if you miss something. Whether you’re shipping vintage shirts from Portugal, handmade candles from France, or beauty products from Germany, the moment your package lands on a Slovak doorstep, you’re part of the Slovak EPR system—whether you meant to be or not. For small e-commerce sellers, this matters a lot, because Slovakia doesn’t offer exemptions based on size or sales volume. There’s no “I only made ten sales this year” pass. If you place packaged goods on the Slovak market, you’re in.

That’s why this guide exists. If you’ve ever tried reading legislative documents or official government portals, you know they often feel like they were written for robots—not real people trying to run an online shop between customer messages, supplier talks and the occasional panic attack about ad costs. This guide breaks everything down in a way that actually makes sense for you. You’ll see how Slovakia’s EPR system works, what exactly you need to register for, how to report the data the authorities expect, and what happens if you ignore the whole thing and hope for the best (spoiler: not recommended). We’ll also walk through things like eco-fees, the Deposit Return System for beverage packaging, the role of authorized representatives if your business isn’t based in Slovakia, and why reporting rules have recently become more detailed.

By the end, you’ll understand what your responsibilities are, how to handle them without losing your mind, and what steps you need to take before selling— and while selling—into Slovakia. You don’t need a legal background. You don’t need to love spreadsheets. You just need clear information, explained in a human way, so you can get compliant and get back to focusing on growing your business.

Overview of the Slovak EPR Framework

When you start looking into EPR in Slovakia, everything circles back to Act No. 79/2015 Coll. on Waste, the main law that defines how waste management works in the country. This act is the foundation of all Extended Producer Responsibility rules in Slovakia, covering packaging, non-packaging products, electrical equipment, batteries, and even end-of-life vehicles. For anyone running an online shop and shipping orders into Slovakia, this is the law that decides whether you count as a “producer” — and in Slovakia, that definition is broad. If you place goods on the Slovak market, even through distance selling, you fall under these obligations. You don’t need a warehouse, a storefront or employees in Slovakia. You just need a customer there.

Slovakia didn’t invent this system from scratch. The Waste Act was written to align with EU directives on packaging and waste, especially the rules that push member states to make producers financially responsible for the waste their products generate. When the law became effective in 2016, it marked a pretty major shift. Before that, the structures were looser and reporting wasn’t as strict. The 2016 framework brought clearer responsibilities, stronger enforcement and a more unified approach to how waste is collected and recycled.

Since then, the system hasn’t stood still. Slovakia has amended the Waste Act several times to keep pace with EU requirements and to close gaps that appeared during implementation. Over the years, the expectations for what producers must report — and how precisely they must report it — have increased. This tightening didn’t happen overnight, and it certainly wasn’t Slovakia acting alone. Much of it came from broader EU legislation, especially updates to the Packaging Directive and the Circular Economy Package, which require more detailed and standardized data from every member state.

This all built up to one of the biggest shifts sellers have noticed: the expanded reporting requirements that took effect from 2023 onward. These changes were part of the EU’s push for more transparent and comparable data across countries, but Slovakia incorporated them directly into its national system through amendments and updated reporting templates. The result is that producers now have to provide much more specific information about the packaging they place on the market. Instead of simply declaring “plastic,” for example, you often need to specify the polymer type. You also need to distinguish between recycled and virgin material, break down composite packaging into its components and categorize plastic carrier bags by thickness. Paper packaging also requires differentiation into specific fractions.

If you’re running a small e-commerce shop, this might sound like a lot — and honestly, it is. But it’s also part of a bigger EU-wide transition toward greater traceability, more accurate environmental data and, eventually, Digital Product Passports. Slovakia isn’t doing anything unusual in that sense; it’s applying the same direction the entire EU is moving toward. It just means that sellers entering this market need to be ready for a detailed system that takes reporting seriously.

The bottom line is that Slovakia’s EPR structure is stable, well-defined and increasingly aligned with EU sustainability goals. Compliance isn’t optional, and the authorities do enforce the rules. But once you learn how this system works — especially the specifics around packaging data — you’ll find that it prepares you well for handling EPR across other EU markets too. If you can navigate Slovakia’s framework, you’re already ahead of the curve in understanding what the future EU packaging landscape is going to look like.

Product Categories Covered by EPR

If you want to understand how EPR works in Slovakia, the best place to start is by looking at which products the system actually covers. Under the Waste Act No. 79/2015 Coll., Slovakia officially has seven EPR product streams. Most small e-commerce sellers will only deal with one or two of them, but it’s still important to know the full list, because your obligations depend entirely on what you place on the Slovak market.

The official EPR categories are:

packaging, non-packaging products, electrical and electronic equipment, batteries and accumulators, vehicles, tyres, and certain single-use plastic products.

These are the only categories that currently create EPR obligations in Slovakia.

Packaging

For nearly all online sellers, packaging is the big one. Every time you ship something to a customer in Slovakia, you place packaging on the Slovak market, and that means you become a “producer” in the eyes of the law. Slovakia follows the usual EU approach and splits packaging into primary, secondary and tertiary layers. Primary packaging is the stuff touching the product. Secondary packaging bundles products together. Tertiary packaging is the transport layer used for logistics, such as pallets or shrink wrap.

Even though tertiary packaging never reaches a household, Slovakia still counts it under EPR if you place it on the market. So whether you’re selling handmade beauty products or reselling tech accessories, all the materials used to package your product — at every layer — need to be tracked, reported and accounted for. This is the core category almost every e-commerce seller must comply with.

Non-packaging products

This category catches a lot of people off guard because not every EU country has it. In Slovakia, non-packaging products include various items made of materials like plastic, paper, glass or metal that end up in household waste but are not packaging. Think of things like small plastic household items, certain glassware, disposable paper goods or similar products with a short lifespan.

There is a threshold here: if you place less than 100 kg of non-packaging products on the Slovak market per year, you can fulfil your obligations individually instead of through a PRO. But that doesn’t mean you have no obligations — you still need to keep records and ensure the products are properly managed. Most businesses eventually join a PRO anyway, simply because it’s easier. But knowing this category exists helps avoid those “wait, I didn’t realize this counted as EPR” surprises later.

Electrical and Electronic Equipment (EEE)

EEE is one of the most tightly regulated EPR categories in Slovakia, and it’s broader than people think. It includes almost anything with a plug, a battery or a circuit board. If you sell power banks, LED lights, headphones, kitchen gadgets, gaming accessories, smart devices, or even electronic toys, you’re likely placing EEE on the Slovak market.

Slovakia fully applies the EU’s WEEE Directive logic here. And if you’re based outside Slovakia, the rule is strict: you must appoint an authorised representative in Slovakia before selling even a single electronic item. This category comes with more complex end-of-life responsibilities than packaging, so it’s important to be sure which of your products fall under it.

Batteries and accumulators

Batteries and accumulators are regulated as their own EPR stream because they contain materials that require careful recovery and recycling. Slovakia follows the EU system here too: portable batteries, industrial batteries and automotive batteries are all covered.

For small online sellers, the relevant part is usually portable batteries — and yes, this includes batteries that are built into a device. If you sell a toy, a remote control, a gadget, or anything else with an internal battery, you may still have battery obligations. Foreign sellers must appoint an authorised representative here as well, just like with EEE.

Vehicles (End-of-life vehicles)

This stream applies mainly to manufacturers, importers and registered sellers of cars and light vans. Most online businesses will never touch this category unless you are somehow selling entire vehicles into Slovakia. Still, it’s part of the official EPR framework, so it belongs on the list.

Tyres

Tyres are another specialised category that most e-commerce entrepreneurs won’t need to worry about unless you’re in the automotive or sports equipment world. If you sell tyres for cars, motorcycles, bikes, scooters or similar products, then you are placing tyres on the Slovak market and EPR applies to you. The obligations here sit alongside vehicle EPR rules and are designed to ensure proper collection and recycling.

Certain single-use plastic products

This category comes directly from the EU’s Single-Use Plastics Directive. Slovakia’s version includes items like certain plastic cutlery, plates, straws and a few other disposable plastic products. The exact list depends on how Slovakia implemented the directive, but the main idea is that if you sell these kinds of items, you take on additional responsibility for their environmental impact.

It’s a smaller category compared to packaging or EEE, but if you sell catering supplies, party goods or anything in that universe, it’s important to check whether your products fall under the single-use plastics rules.

A quick note about textiles and footwear

You might be wondering why clothing and shoes aren’t on the list, especially since a lot of the EU conversation right now is about textile waste. Slovakia doesn’t yet have an official EPR category for textiles and footwear. However, this will change. The revised EU Waste Framework Directive makes textile and footwear EPR mandatory in all member states, with implementation deadlines over the next few years. That means Slovakia will introduce a textile EPR system, but it isn’t in place yet.

If you run a clothing brand or resell fashion items, keep this on your radar. Today your obligations relate mainly to packaging (and possibly non-packaging products), but textile EPR is coming and will eventually add another layer of compliance.

Who Must Register: Obligated Companies

One thing that surprises a lot of small e-commerce sellers when they first look into Slovak EPR is just how broad the definition of a “producer” is. In everyday language, you might think a producer is someone who manufactures goods. Under Slovak law, it’s much wider than that. If you place products or packaging on the Slovak market — even if you never set foot in Slovakia — you are treated as a producer and you must register. There’s no minimum sales threshold, no “starting out” grace period and no simplified rules for micro-sellers. The system applies from your very first sale.

Domestic producers and importers

For businesses that are established in Slovakia, the rule is straightforward: if you manufacture, import or otherwise place packaged goods or specified products onto the Slovak market, you must register under the relevant EPR categories. It doesn’t matter whether you sell through your own webshop, a marketplace or a physical store. If the product ends up with a consumer in Slovakia, and it belongs to one of the regulated product streams, you’re obligated.

Domestic companies also include Slovak-based importers who bring products in from other EU countries. In the EU Single Market, an importer is automatically considered the producer for EPR purposes because they’re the first entity placing goods on the national market. This means that even if you don’t manufacture anything yourself and simply purchase stock from abroad, the responsibility is still yours once those products cross into Slovakia.

Foreign distance sellers

For foreign e-commerce sellers, the rule is just as clear — and sometimes even stricter. If your business is based outside Slovakia, but you sell directly to Slovak consumers, you are treated the same as a local producer. This applies whether you run your own webshop or sell through a marketplace. It also applies whether you ship from inside the EU or from outside it.

If you ship a candle from Germany, skin-care products from France or handmade crafts from Spain, the moment your parcel arrives at a Slovak address, you have placed products and packaging on the Slovak market. That classifies you as a producer under the Waste Act. Many online sellers assume that selling cross-border within the EU means they’re exempt from national compliance rules, but Slovakia doesn’t work that way. If anything, the obligations for foreign sellers are more formal because you cannot register directly with the authorities without a local intermediary.

E-commerce platforms and marketplaces

The responsibility can also affect sellers who rely entirely on marketplaces like Etsy, Amazon or eBay. In Slovakia, the seller placing the product on the market is usually the one who carries the EPR obligations, not the platform. Some marketplaces provide support or require you to submit compliance data, but they don’t replace your legal obligations. If you “place” the goods — meaning you decide that they are made available to consumers in Slovakia — you are the one responsible.

The requirement to appoint an Authorized Representative

Here’s the part that catches foreign sellers by surprise: Slovakia requires any producer without a registered office or physical presence in the country to appoint an Authorized Representative. This is not optional. The law is clear that producers of specified products who are not established in Slovakia must designate a Slovak legal entity to take over their obligations.

The authorized representative acts in your name and on your behalf. They handle registration, reporting, communication with authorities and cooperation with your chosen Producer Responsibility Organization. From the Slovak government’s perspective, the authorized representative is the responsible party. This setup ensures that every producer — even those based abroad — has an accountable entity inside the country.

The representative must be officially appointed through a written authorization, and the appointment must last at least one year. This is one of the first steps foreign sellers must take before registering or signing a contract with a PRO. Without it, the authorities will not accept your registration, and you legally cannot place products on the Slovak market.

No exemption threshold — every seller is included

Unlike some EU countries where small businesses get simplified rules or low-volume exemptions, Slovakia has no de minimis threshold for packaging or most other EPR categories. Whether you sell a thousand products a month or ten products a year, you still count as a producer. You still have to register, pay eco-fees and submit reports. If you place anything on the Slovak market that falls under one of the EPR streams, the obligation applies from sale number one.

The only partial exception is the non-packaging products category, where businesses placing under 100 kg per year may fulfil obligations individually. But even in that case, the obligations still exist — they are simply handled differently. All other categories, especially packaging, apply without exceptions.

For a small online shop, this can feel overwhelming at first, but the system is built around PROs and authorized representatives to make compliance manageable. The important thing is recognizing that the obligations apply the moment you enter the Slovak market. Once you understand the structure, the process becomes much clearer, and you can move from worrying about compliance to simply maintaining it in the background while you focus on your actual work: running your business.

Registration Process (Step-by-Step)

Getting registered for EPR in Slovakia can feel intimidating the first time you do it, especially if you’re a small online seller doing everything yourself. But the process becomes much more manageable when you break it into clear steps. The goal is simple: get into the system before you start selling, choose how you’ll fulfil your obligations and set up the basic routines that allow you to stay compliant in the long run. Whether you’re a Slovak business or selling into Slovakia from somewhere else in the EU, the steps are similar — with one important extra step for foreign sellers.

Pre-requirements

Before you click anything or upload anything, it helps to slow down and prepare. The Slovak authorities expect producers to know which product streams they fall under, and they expect reasonably accurate data about their packaging or other specified products. Getting this part right saves you a lot of time later.

The starting point is identifying your EPR categories. Most small e-commerce businesses fall under packaging, because everything you send to a Slovak customer is packaged in some way. If you sell electronics, the EEE category enters the picture. If your products contain built-in batteries or you sell standalone batteries, then the battery category applies. And if you sell items that aren’t packaging but eventually become household waste — such as certain plastic or paper items — you might fall under the non-packaging products category as well. Knowing your categories helps you understand which obligations you must register for.

The second thing you need is packaging data. Slovakia expects producers to know the material types and approximate weights of the packaging they place on the market. This includes primary, secondary and tertiary packaging. If your supplier can give you this information, use it. If not, many small sellers simply weigh their packaging materials themselves. The data doesn’t need to be scientifically perfect, but it does need to be realistic, consistent and based on something measurable. As reporting becomes more detailed across the EU, building this habit now will help you in other markets too.

Registration Steps

Once your categories and packaging data are sorted, you can move into the actual registration phase. Everything in Slovakia happens through the Ministry of Environment, and the producer registers electronically via the ISOH system — the national Waste Management Information System. Legally, you’re being entered into the “Register of Producers of Specified Products,” which is maintained through the ISOH portal.

If you’re a foreign seller without a legal presence in Slovakia, your first step is not the ISOH portal. It’s appointing an authorised representative. The Waste Act makes this compulsory. As a foreign producer, you cannot register yourself. You need a Slovak-based legal entity that can act in your name, sign documents on your behalf and communicate with the authorities. The appointment must be done in writing and must last at least one year. Once the authorised representative is in place, they are the one who carries out the registration for you and handles everything from reporting to communication with your chosen PRO.

If you’re established in Slovakia, or once your authorised representative is appointed, the next step is the ISOH registration. This involves providing your company details, identifying which EPR categories apply to you, uploading the required authorisation documents and confirming that your information is correct. It’s a standard administrative process, but it must be completed before any products are placed on the Slovak market.

After registration, you need to decide how you’ll fulfil your EPR obligations. Legally, Slovakia gives you two options: individual fulfilment or collective fulfilment through a Producer Responsibility Organization. Individual fulfilment means setting up your own collection and recycling system and getting official approval from the Ministry — something only large producers usually attempt. For nearly all SMEs and e-commerce businesses, collective fulfilment through a PRO is the practical route. That means signing a service agreement with an authorised PRO, such as ENVI-PAK or NATUR-PACK, which then takes over most of the operational responsibility. In practice, unless you have a specific authorisation for individual fulfilment, you need a valid PRO contract. Without either a PRO contract or that special individual approval, you cannot legally place regulated products or packaging on the Slovak market.

The final internal step is organising your record-keeping. Slovakia expects producers to keep supporting documentation for at least three years, and many advisors suggest keeping it even longer. This includes things like packaging weights, the number of units placed on the market, invoices from suppliers, product specifications and any data you base your quarterly reporting on. You don’t need a complex system — even a spreadsheet works — but you need something reliable. If the Ministry or your PRO requests supporting evidence, you need to be able to produce it.

Timelines

The most important timing rule in Slovakia is that you must register before you place products on the market. That means before your first sale to a Slovak customer, not afterwards. If you’re planning to expand into Slovakia, it’s better to start the process early rather than scrambling once orders start arriving.

How long does it take to get fully registered? It varies. Some companies get through the process in just a few weeks; others need more time depending on document preparation and how quickly the PRO finalises their onboarding. A realistic working assumption for many sellers — especially foreign ones — is somewhere between a few weeks and up to two or three months when you include the time needed to appoint an authorised representative, collect documents, complete ISOH registration and sign the PRO agreement. The timeline depends heavily on how organised your documentation is and on the internal processing times of the PRO and the Ministry.

Finally, once you are registered, you need to keep your information up to date. If anything changes — your business name, your authorised representative, your contact information, your product categories — you must notify the authorities within thirty days. This ensures that the register stays accurate and that your PRO and the Ministry always have the right information for your reports and invoices.

Once you go through this once, the process becomes much clearer. Most sellers find that the biggest hurdle is simply getting started, and after the initial setup, the ongoing obligations fit naturally into their business routine. Let me know when you want to move on to the next section.

Producer Responsibility Organizations (PROs)

Once you get past the registration stage, the part of the Slovak EPR system you’ll interact with the most is the Producer Responsibility Organization, usually shortened to PRO. If you’re new to EPR, a PRO might sound like some kind of government inspector or waste company. In reality, it’s more like the behind-the-scenes partner that takes on the heavy lifting of your obligations so you don’t have to manage everything yourself.

The role of PROs in the Slovak system

Slovakia’s Waste Act is strict in terms of responsibilities, but it’s also designed for practicality. Small and medium-sized businesses — especially e-commerce sellers — simply can’t build their own national system for collecting and recycling packaging or other specified products. That’s where PROs come in. A PRO is a licensed organization that acts on behalf of multiple producers, pooling their obligations into one coordinated system.

Instead of each producer arranging their own waste collection, recycling contracts, sorting operations and compliance reporting, the PRO takes over those tasks. Producers pay eco-fees to the PRO, based on the volume and material type of the products or packaging they place on the market. The PRO then uses those fees to finance the entire waste management chain: collection, sorting, recovery, recycling and the administrative processes that tie everything together.

From the government’s perspective, PROs ensure that producers meet their legal obligations. From the producer’s perspective, they simplify compliance into a predictable routine — reporting your data each quarter, paying your fees on time and keeping the agreement active. Without a PRO (or a special individual compliance approval), a producer cannot fulfil their obligations, which is why PROs are at the heart of the Slovak EPR model.

Main PROs in Slovakia: ENVI-PAK and NATUR-PACK

Slovakia has several authorized PROs, but the two most recognized and widely used for packaging and related streams are ENVI-PAK and NATUR-PACK. Both have been operating in the Slovak market for years and are trusted by a large base of producers, from tiny online shops to large retailers.

ENVI-PAK is one of the longest-established PROs in Slovakia. They handle packaging and non-packaging products, and they also operate in other streams such as EEE and batteries. NATUR-PACK is similarly broad in scope, covering packaging, non-packaging products and multiple other EPR categories. While each PRO has its own internal processes, pricing models and support systems, they are all regulated under the same national legislation and must meet the same requirements for authorization and performance.

Foreign producers usually rely heavily on their PRO, because the PRO often works directly with the authorized representative. It’s quite normal for your PRO to be the one guiding you through reporting, explaining data structures and making sure your information is correct before anything is submitted to the Ministry. If you’re unsure which PRO to choose, it often comes down to the categories you need, the customer support style you prefer and the practical guidance they offer to small sellers.

What services PROs provide

A PRO’s job goes far beyond simply collecting fees. They act as the operational backbone of your compliance. One of their most important roles is data reporting. Every quarter, producers must report the quantities and materials of the packaging, EEE, batteries or other specified products they placed on the market. The PRO collects this information, checks it, formats it according to national rules and submits it to the authorities. This step is crucial because reporting errors can lead to penalties, and the PRO helps prevent that by ensuring your data is prepared correctly.

PROs also calculate and collect your eco-fees. These fees differ depending on the materials you use, the type of packaging and, in some cases, the complexity of recycling. The PRO invoices you based on the data you submit, and the money goes toward funding the national waste management system. For producers, this means you don’t need to worry about setting up your own recycling contracts — your payments to the PRO cover your share of the environmental cost.

Another major service is coordination with local municipalities and waste companies. The PRO ensures that collection systems exist to manage the waste generated by the products placed on the market. This includes financing recycling infrastructure, meeting national recycling targets and working with local governments to operate waste collection programs. As a producer, you don’t see this part directly, but it’s the reason the system works behind the scenes.

On top of this, PROs offer guidance and support. They help you understand how to categorize your packaging, how to prepare your reports correctly and how to stay compliant if the rules change. Some also support you with audits, compliance confirmations for marketplaces and general regulatory questions.

For most e-commerce sellers, the PRO becomes the main point of contact in the Slovak EPR system. Once you’re registered and your PRO contract is active, much of your ongoing work boils down to regular reporting, staying organized with your documentation and keeping your contract up to date. The PRO handles the rest — allowing you to stay compliant without needing to build a waste management system of your own.

Reporting Obligations

Reporting is the part of Slovak EPR you’ll deal with again and again, so it helps to understand not only the deadlines but also the logic behind them. Once you’re registered and working with a PRO, reporting becomes a routine rhythm: submit your data, get it checked, receive your eco-fee invoice and keep your documentation in case anyone ever asks for proof. The core idea is simple — Slovakia wants to know exactly what materials are being placed on the market so it can track recycling performance and meet EU targets. How detailed this gets depends on the category of product you sell.

Quarterly Reporting (Standard)

If you fulfil your obligations collectively through a PRO — which is what almost all online sellers do — quarterly reporting is your ongoing responsibility. However, one important detail often gets lost: the exact reporting deadlines depend on the EPR stream you fall under.

For packaging and non-packaging products, the quarterly cycle is fixed and predictable every year. If you place packaging on the Slovak market, your reports follow the familiar pattern: Q1 data is due by April 10, Q2 by July 10, Q3 by October 10 and Q4 by January 10. These dates come directly from how Slovak PROs structure the reporting calendar and are the same for virtually everyone in these streams.

For electrical and electronic equipment (EEE) and batteries, the picture is slightly more nuanced. Most PROs still require quarterly reporting, but some ask for additional monthly operational data, especially when take-back systems or collection points are involved. In some cases, the internal deadlines used by the PRO differ slightly from the packaging cycle. So while the concept of quarterly reporting still applies, the exact timing may vary, and your PRO will tell you which schedule applies to your products.

Regardless of the category, the process looks similar. You calculate how much packaging, EEE or battery material you placed on the Slovak market during the period. You enter the data into your PRO’s template or online portal. The PRO checks for inconsistencies — for example, if your numbers suddenly double or if a packaging material doesn’t match your usual structure. Once the data is validated, the PRO prepares the official submission to the Ministry in the correct format. After that, the PRO calculates your eco-fees, sends you an invoice and the quarter is complete.

If your products don’t change often, quarterly reporting becomes a routine that takes only a few minutes each time. If you release new products or update your packaging, you’ll spend a bit more time on it, but the overall structure remains the same.

Annual Reporting

Annual reporting works differently depending on how you fulfil your EPR obligations.

If you fulfil your obligations individually — meaning you have explicit Ministry approval to operate your own collection and recycling system — you must submit a full annual report directly to the Ministry via the ISOH portal. That annual report is due every year by July 31 and includes detailed information about your products, materials and how you met all collection, recovery and recycling targets. Only a very small number of producers use individual fulfilment, because the system must be approved in advance and requires significant resources.

If you fulfil your obligations collectively through a PRO, you do not submit your own annual report to the Ministry. Your PRO submits a consolidated annual report that covers all of its producers. The PRO might prepare an annual summary for you or ask you to confirm final numbers for the year, but they handle the official submission. So while an annual cycle exists inside every PRO, producers using collective fulfilment aren’t responsible for filing it directly — the PRO does it for them.

Enhanced Reporting Requirements (2023+)

In recent years, reporting in Slovakia has become more detailed, mainly because of EU-wide changes rather than purely national reforms. Several requirements were introduced gradually between 2022 and 2024, as Slovakia adapted to updated EU rules on packaging waste, plastics reporting and harmonised recycling targets. These changes now apply to all producers and shape the level of detail you must provide in your quarterly reports.

One major change is polymer-level reporting for plastic packaging. Instead of reporting “plastic” as a single category, you now need to identify the exact polymer type — such as PET, HDPE, LDPE, PP, PVC, PS or “other plastics.” This helps Slovakia (and the EU) understand recyclability more precisely and track how different polymers flow through the waste system.

Paper packaging must also be split into specific fractions. Instead of a single “paper and cardboard” category, you have to separate different paper types because they behave differently in recycling processes and contribute differently to national statistics.

Composite packaging — anything made of more than one material — requires a breakdown of its individual components. If your packaging item is mostly paper but has a plastic window, for example, the plastic component must be documented, even if it’s the minority material. The predominance rule still applies for classification, but the full component list must be recorded.

Another element of the enhanced reporting system is the distinction between recycled and virgin materials. Producers now need to indicate whether the packaging they use includes recycled content. This ties directly into eco-modulation, where PROs adjust fees based on recyclability and the environmental profile of the materials.

Plastic bags must be reported according to thickness categories as required by the EU’s Single-Use Plastics Directive. If you supply plastic carrier bags, you must classify them by thickness ranges rather than treating them as a single category.

These enhanced requirements might sound technical, but the basic idea is simple: Slovakia wants more accurate, more granular and more comparable data to meet EU targets. Once you set up your internal system to track materials and weights properly, the reporting becomes easier, and your PRO will guide you through any questions. The good news is that mastering Slovak reporting standards often makes compliance in other EU countries feel much simpler afterward.

Eco-Fees and Financial Obligations

Eco-fees are the part of EPR that most sellers feel most directly. You can think of them as the financial contribution you make to help fund the collection, sorting and recycling of the packaging or other specified products you place on the Slovak market. They’re not arbitrary fines or penalties — they’re simply the cost of participating in a shared waste management system. Every producer pays them, from small Etsy sellers to large multinational retailers. And just like everything else in the Slovak EPR world, the rules are clear: the fees are based on what you place on the market, how much of it you place and how easily it can be recycled.

Fee Structure

Eco-fees in Slovakia are calculated almost entirely on the basis of materials. The PRO you sign your contract with publishes a fee schedule, usually updated once per year, listing prices per kilogram for different packaging materials or specified product categories. So your cost depends on what your packaging is made of — paper, plastic, glass, metal or composite materials — and on the weight you report each quarter.

This means packaging choices have a direct financial impact. Lightweight paper or cardboard can be among the cheaper materials, while complex plastics, multilayer composites or packaging that’s hard to recycle can be more expensive. Glass often sits somewhere in the middle, and metals — depending on the type — can range from moderate to high cost. The fee structure is designed to reflect the real-world cost of collecting and recycling those materials. Materials that are widely collected, easy to sort and commonly recycled tend to have lower fees. Materials that are difficult to recycle or that require special treatment tend to have higher fees.

On top of this, Slovakia applies eco-modulation, a concept used across the EU to incentivise better packaging design. Eco-modulation means that the eco-fees you pay vary based not only on material type but also on how recyclable the packaging is. Recyclable packaging usually carries lower fees. Packaging that is technically recyclable but difficult in practice might cost more. And some PROs include “dissuasive fees” for packaging that is nearly impossible to recycle or actively harms the recycling process. These higher fees are meant to push producers toward more sustainable choices and help drive the broader EU circular economy goals.

For example, a recyclable PET bottle might sit at a moderate fee level. A paper box without coatings or problematic additives might be very inexpensive. But a multilayer composite pouch made of plastic and aluminium — something that’s extremely hard to recycle — will usually be at the higher end of the fee schedule. And some PROs have special fee categories for things like black plastics (which can interfere with sorting technology) or highly composite packaging where the components can’t be easily separated.

The result is that eco-fees are not just a cost of doing business; they’re also a signal. The more you understand the structure, the easier it becomes to choose packaging that’s both affordable and sustainable. For a small e-commerce shop, this is usually a matter of balancing materials you can easily source with the long-term cost of reporting and recycling.

Invoicing & Payment Terms

Once you submit your quarterly data and the PRO has validated your numbers, they calculate the eco-fees for that reporting period and issue an invoice. Most Slovak PROs operate on a fairly standard billing cycle, and the payment window is usually around fourteen days. This means you’re paying your contribution shortly after submitting your quarterly data.

Some PROs invoice after every quarterly report, while others offer different billing rhythms depending on your contract or the type of products you place on the market. Annual billing is sometimes an option for producers who place very low volumes on the market, though quarterly billing remains the standard for most businesses. If you place packaging or regulated products throughout the year, the quarterly rhythm generally fits best, because it matches the timing of your reporting and keeps your financial contributions aligned with your actual volumes.

For small e-commerce sellers, it helps to think of eco-fees as part of your packaging cost. If you use 100 kilograms of packaging in a quarter, your eco-fee invoice will correspond directly to those specific materials. There are no “surprise” charges; everything is tied to the data you submit. As long as your reporting is accurate and your packaging data is well organised, the invoicing process is smooth and predictable.

The key is simply to stay on top of your reporting deadlines and make sure you submit correct data. If you forget to report, report late or submit incorrect information, the PRO won’t be able to invoice you properly — and that’s when compliance issues can arise. Paying the invoice on time is part of fulfilling your EPR obligations, and PROs expect producers to take that responsibility seriously.

Once you get used to the rhythm, eco-fees become just another part of running an online business in the EU — like VAT, logistics or marketplace commissions. The difference is that these fees directly support a cleaner system for managing waste, which benefits everyone in the long run, including your customers. Let me know when you’re ready for the next section.

Deposit Return System (DRS) for Beverage Packaging

Slovakia doesn’t rely solely on the classic EPR approach for beverage packaging. It operates a full national Deposit Return System — a separate framework with its own rules, its own administrator and its own financial model. If you sell drinks in PET bottles or metal cans into Slovakia, you’re part of this system automatically. It exists in parallel with normal packaging EPR and applies only to certain types of beverage containers.

Scope of DRS

The Slovak DRS covers non-refillable PET bottles and metal cans with a volume between 0.1 litre and 3 litres. This category includes most ready-to-drink beverages that are water-based — soft drinks, still and sparkling water, energy drinks, flavoured drinks, beer, ciders and low-alcohol mixed beverages.

DRS does not apply to all kinds of packaging. A wine bottle, a spirit bottle or a carton of juice sits under the regular EPR system. But a 0.5L PET iced tea bottle or a 330ml aluminium can of sparkling water will definitely fall under DRS.

Foreign sellers aren’t exempt. The moment a beverage in an eligible container is placed on the Slovak market — even through cross-border e-commerce — the product is subject to DRS rules.

Deposit Fees

Every eligible beverage container carries a standard, mandatory deposit of €0.15. The amount is the same no matter the volume of the bottle or can.

For consumers, the deposit appears separately on receipts and can be redeemed at return machines or collection points. For producers, the deposit becomes a financial obligation that must be reimbursed to the DRS administrator. This reimbursement is separate from traditional EPR eco-fees and is used to fund consumer refunds, logistics, counting centres and the operational costs of running the DRS.

Excluded Products

Several beverage categories are explicitly excluded from the deposit system. These include:

- drinks containing milk or dairy-based ingredients

- syrups and concentrated drink bases

- alcoholic beverages with more than 15% alcohol content

These exclusions mean products like milk drinks, drinking yoghurts, milk-based iced coffees, spirits, liqueurs and fortified wines do not fall under the DRS and remain under normal EPR packaging rules.

One nuance worth noting:

Plant-based drinks are not automatically excluded, because the legal language refers specifically to “milk and milk-based beverages.” Some plant-based drinks may fall under DRS if they meet the ready-to-drink, water-based criteria. Others may be excluded depending on composition. In practice, classification is done case by case.

DRS Producer Obligations

If your product falls within the DRS scope, you have obligations that sit in addition to your standard EPR packaging duties.

The first step is registration with the DRS administrator (Správca zálohového systému). This must be completed before your beverage products enter the market. The administrator will require product data, packaging specifications and barcode registrations.

Foreign producers can’t realistically manage this alone. While the DRS law doesn’t use the same “authorised representative” terminology as the Waste Act, in practice foreign sellers almost always use their Slovak authorised representative or another local partner to sign the contract and manage communication with the DRS administrator.

Once registered, each unit you sell generates a €0.15 deposit liability. You must reimburse the DRS administrator for all deposits corresponding to your placed-on-market volumes. This is a completely separate financial flow from EPR eco-fees.

Producers must also pay administrative fees (sometimes called industry fees), which help cover the operational costs of the DRS — counting, logistics, material handling, IT systems and so on.

Another major requirement is mandatory marking. Every DRS-eligible bottle or can must carry the official Slovak deposit logo and a barcode registered in the system’s database. Without this marking, the container cannot legally be placed on the Slovak market as deposit packaging. Foreign sellers often need to work with suppliers to adapt labels or switch to packaging that already carries the correct Slovak DRS markings.

Performance of the system has been strong from the beginning. Slovakia launched the DRS in 2022 and achieved over 70% return rates in year one, quickly surpassing its initial targets. In year two, return rates climbed above 90%, putting Slovakia among the best-performing DRS systems in Europe. High performance also means strict enforcement: the administrator expects accurate reporting and proper marking from all producers.

If you sell beverages in PET bottles or cans into Slovakia, DRS compliance becomes part of your standard operational setup. Once registration, marking and reporting routines are in place, the system becomes predictable — just another part of selling beverages in an EU market with strong recycling goals.

Other Compliance Rules You Should Know

Even though packaging is the main EPR category most small online sellers have to deal with, Slovakia also runs a separate system for non-packaging products — everyday items like certain plastic goods, glass items or paper products that eventually end up in household waste but aren’t technically “packaging.” The rule is simple: you’re always considered a producer if you place these items on the Slovak market, but if you place under 100 kg per year, you’re allowed to fulfil your obligations individually. Once you cross that threshold, collective compliance through a PRO becomes mandatory. In practice, many sellers join a PRO anyway, because it keeps everything in one routine and avoids having to manage two systems.

If you’re selling into Slovakia from abroad, you’ll also deal with the requirement to appoint an authorised representative. Slovak law doesn’t let foreign companies register or report by themselves — you need a Slovak-based legal entity that acts on your behalf. The authorised representative handles your registration, signs documents, communicates with the Ministry and your PRO and makes sure your obligations are fulfilled correctly. The mandate must last at least a year, and for cross-border e-commerce, it’s simply a standard part of operating legally in Slovakia.

Finally, Slovakia enforces its EPR rules quite seriously, and the penalties for non-compliance can be substantial. Companies can face fines ranging from around €1,200 up to €120,000 depending on the severity of the issue, while natural persons can be fined up to €2,500. The most common triggers are things like failing to register before selling, missing quarterly reports, providing incorrect data or not having a PRO contract in place. None of these problems are hard to avoid if you stay organised — but they do make it clear that EPR compliance isn’t optional or something to postpone until you “get around to it.”

How to Stay Compliant Day-to-Day

Staying compliant in Slovakia isn’t complicated once you’ve set up the basics, but it does rely on a few habits that you repeat throughout the year. Before you even sell your first product, make sure you’ve confirmed which EPR categories apply to you, whether you need a Slovak authorised representative and that your registration in the ISOH system is complete. Most sellers also need an active contract with a PRO, which becomes the backbone of everything that comes after. Once you’re set up, the day-to-day work is mostly about keeping good packaging records, tracking what you actually place on the Slovak market and submitting those numbers to your PRO every quarter. Each reporting cycle leads to an eco-fee invoice, and paying those invoices on time is part of fulfilling your obligations. Keep your documentation for at least three years, update your registration details if anything in your business changes and double-check your PRO’s confirmations at the end of the year to make sure everything is accurate. If you stay organised, the whole system becomes a predictable routine rather than an ongoing headache.