EPR System in Spain

Spis treści

What has changed is not the existence of EPR itself — every EU country has some version of it — but the scale and strictness of Spain’s rules from 2025 onward. The big shift came with Royal Decree 1055/2022, which expanded obligations far beyond the old household-packaging-only system. Suddenly commercial and industrial packaging entered the game too, and the expectations for online sellers skyrocketed. If you ship your orders in cardboard boxes, if you sell products in branded retail packaging, if your items contain lithium batteries, if you place an electronic gadget on the market, or if you sell through a platform like Amazon or eBay, then these rules now apply to you. Spain is also enforcing them aggressively, and marketplaces are being legally required to block non-compliant sellers, so ignoring the topic is no longer an option.

The new system raises the bar on almost everything: you now need a Spanish tax ID number, a registration in the national Product Producers Registry, an official EPR number, annual declarations, new invoice formats, and potentially more than one registration if your products fall under multiple categories. On top of that, every package placed on the market after January 2025 must follow strict labeling rules, and by 2026, EU-wide changes will expand the obligations even further. This means the era of “I’ll sort it out later” is over. Spain expects businesses to take responsibility for what they sell from the moment it enters the market.

Marketplaces have become the unofficial enforcement police. Amazon, Zalando, eBay, and others are now demanding proof that sellers are properly registered. If you can’t provide your ENV number — the unique code that proves you’re in the system — listings can be frozen or removed entirely. In some cases, marketplaces may even pay EPR fees on your behalf and then charge you back with an administrative markup. For small online sellers running slim margins, that kind of surprise cost can sting. Worse, failing to comply can trigger fines from Spanish authorities that range from uncomfortable to genuinely painful, especially once retroactive penalties are added.

This guide is for the people who feel this most directly: the entrepreneurs building small shops, running side hustles, or scaling their first online brands. If you’re a cross-border seller shipping to Spain, a marketplace merchant trying to stay compliant with Amazon’s ever-growing rules, a dropshipper testing new products, a private-label brand owner, or an importer working with EU fulfillment warehouses, this is for you. You don’t need to be a regulatory expert — you just need clarity, honesty, and a map through the maze.

The goal here is to make Spain’s EPR system readable, not stressful. You’ll understand what the rules actually say, what you’re expected to do in practice, and what deadlines and documents matter most. We’ll walk through the changes that arrived in 2025, look at what happens if you ignore the rules, and break down what steps you must take to stay compliant, avoid penalties, and keep your marketplace listings safe. Most importantly, you’ll learn how to manage this without drowning in administrative chaos, because while the system is complex, navigating it doesn’t have to be.

Let’s get started.

What Is the EPR System in Spain?

Spain’s Extended Producer Responsibility system is the legal framework that makes businesses responsible for the waste created by the packaging, electronics, and batteries they place on the Spanish market. If something you sell eventually becomes waste in Spain, then you’re expected to help fund the collection and recycling of that waste — either directly, if you’re established in Spain, or through an Authorized Representative if you’re not. It’s a simple principle wrapped in a very detailed set of rules, and for anyone selling online, it affects far more than just the product inside the box.

EPR exists across the whole EU, so the concept isn’t new, but Spain’s version is among the more demanding because it covers multiple waste streams, requires specific registrations, and relies heavily on detailed reporting. It also applies to a wide range of business models, including cross-border e-commerce. So if you’re shipping orders to customers in Madrid, Barcelona, Valencia, or anywhere else in Spain, EPR is part of your business whether you realise it or not.

Legal Basis

The entire system is built on a combination of one framework law and several Royal Decrees that define obligations for specific product categories. The foundation is Law 7/2022, which sets the overall waste and circular economy framework for the country. This law brings EU waste rules into Spanish legislation and introduces the modern version of Extended Producer Responsibility.

From there, each product category gets its own dedicated rule set. Royal Decree 106/2008 regulates batteries and accumulators; Royal Decree 110/2015 covers electrical and electronic equipment; and Royal Decree 1055/2022 focuses on packaging. That last one, RD 1055/2022, is the big one for most e-commerce sellers. It reshaped the entire packaging landscape by merging household, commercial, and industrial packaging into a single system.

Before this decree, only household packaging — the stuff that reaches consumers — fell under mandatory EPR. With the update, commercial and industrial packaging joined the party, and those obligations effectively began in January 2025. For online sellers, this shift means your shipping boxes, protective materials, and even certain logistics packaging are now part of the system. Once packaging enters Spain in any of these forms, it’s covered by the decree. There are additional thresholds for large producers when it comes to things like prevention plans, but the core EPR duties — registering, reporting, and financing waste management — apply to everyone.

That’s why so many online businesses started paying attention between 2023 and 2025. The scope widened, the deadlines became strict, and marketplaces began enforcing compliance. The legal foundation explains the sudden pressure: Spain isn’t inventing new obligations out of thin air; it’s rolling out a unified system that finally covers all major packaging categories.

Who Is Considered a “Producer”?

In EPR language, the word producer doesn’t simply mean the person who manufactures a product. It means the business that first places that product — and its packaging — on the Spanish market. That might be the manufacturer, but it could just as easily be an importer, a brand owner, or an online seller shipping orders directly to Spanish customers.

If you manufacture your own products and sell them in Spain under your brand, you’re a producer. If you import products from another country and they enter Spain for the first time through your business, you’re a producer. And if you sell online from abroad directly to customers in Spain — whether through your own shop or via platforms like Amazon, Etsy, or eBay — Spain considers you a producer for EPR purposes. Even if your supplier handles packaging, even if a fulfillment center ships the order, you’re still the one placing the product on the Spanish market.

Private-label or rebranded products fall under the same rule. If the item bears your logo or brand name, you take on the producer role when that product reaches Spanish customers. This matters for smaller online brands and dropshippers who rely on unbranded items and redesign them under their own label. As soon as your brand appears on the product or packaging, you’re the one responsible for EPR.

For businesses not established in Spain, there’s one more important step. You can’t fulfil EPR obligations directly with the authorities, because foreign companies aren’t allowed to register or report on their own. Instead, you must appoint an Authorized Representative, a Spanish entity that acts on your behalf for all EPR duties — registration, reporting, fee payments, communication with authorities, everything. Without an Authorized Representative, you can’t obtain your required EPR registration numbers, and without those numbers you’re not legally permitted to place products on the Spanish market.

In cases where a foreign seller doesn’t appoint an Authorized Representative, Spain can shift the producer role to the first Spanish distributor or, in some circumstances, a marketplace. But marketplaces don’t want this liability, which is why they now demand proof that sellers are properly registered. The goal is simple: every product placed on the market must be traceable to a responsible producer, and Spain wants to ensure that the correct business is carrying that responsibility.

Understanding who counts as a producer is the most important piece of the EPR puzzle. Once you understand that the “producer” is defined by market entry, not manufacturing, the rest of the system becomes much clearer — especially for cross-border e-commerce sellers who may never have realised they fall under Spanish waste law at all.

Core EPR Obligations for E-commerce Sellers

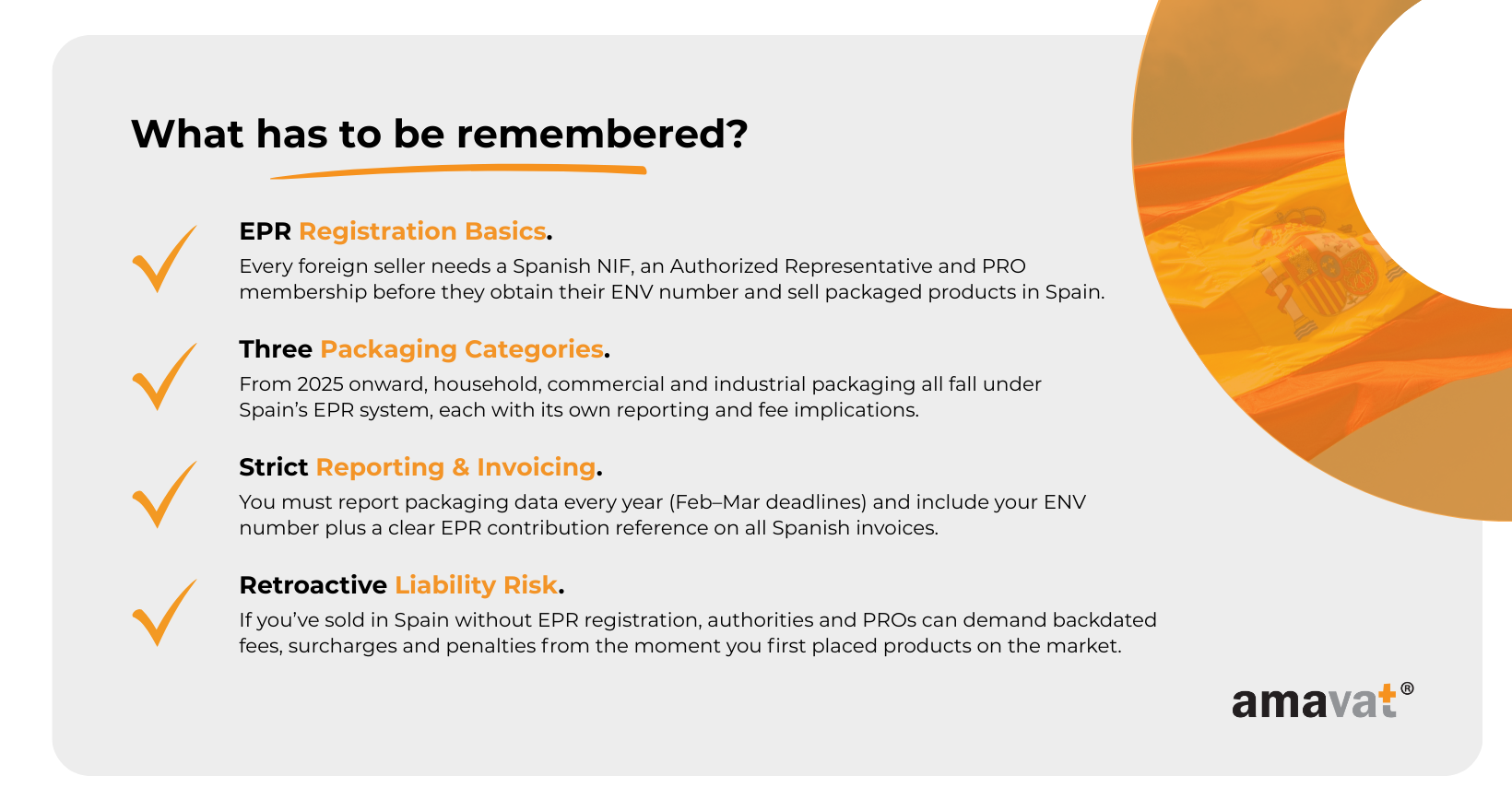

Once you know that Spain sees you as a producer when you put products on its market, the next step is understanding what that actually means day to day. In practical terms, your EPR obligations as an e-commerce seller fall into six main areas: getting registered, joining a Producer Responsibility Organisation, reporting your data every year, paying eco-contribution fees, updating your packaging labels, and adapting your invoices.

It looks like a lot at first, but once you build it into your normal operations, it becomes another piece of doing business in the EU rather than a constant fire to put out.

Registration Obligations

Spain’s EPR system starts with one simple question: who are you in the eyes of the authorities? To answer that, you need to show up in the right registers with the right identifiers.

If you are not already established in Spain, you will first need a NIF, the Spanish tax identification number for businesses. This is the key ID the Product Producers Registry uses to track who is placing packaging on the market. Foreign producers typically obtain a NIF with the help of a local tax or legal representative, and your Authorized Representative for EPR will normally insist that this is in place before anything else.

Once you have a NIF, your next step is registration in the Registro de Productores de Producto, the Product Producers Registry managed by MITECO. For packaging, that means the “envases” section of the register. This is where Spain officially recognises you as a producer of packaging placed on the Spanish market. Without this registration, you are not legally allowed to place packaged products on the market in Spain, and you will not get the number that marketplaces and business customers increasingly expect to see.

When your registration is approved, you receive an ENV number, which looks like “ENV/Year/XXXXXXXXX”. Technically, this is your Product Producers Registry number for packaging EPR, but in practice everyone treats it as your packaging EPR ID. It ties together your company, your packaging declarations, and your formal status as a registered producer. MITECO expects this number to appear on invoices and commercial documents along the supply chain, and platforms like Amazon and Zalando use it as proof that you have done your homework.

From your point of view, registration is the moment you “enter the system”. After that, most of your work is about keeping that entry alive and accurate.

Joining a Producer Responsibility Organisation (PRO / SCRAP)

Registration is only half the story. Spain does not expect you to run your own recycling trucks, but it does expect you to help finance them. That is where Producer Responsibility Organisations come in, often called SCRAPs in Spanish.

For packaging, there are a few names you will bump into very quickly. Ecoembes is a large, multimaterial organisation that covers domestic, commercial, and industrial packaging, especially the classic household streams like plastic, metal, paper, and cardboard. Procircular is another multimaterial system that works at national level for household, commercial, and industrial packaging, and is often mentioned in connection with commercial and industrial streams. Ecovidrio is traditionally the specialist for glass packaging and now positions itself as a “single window” for glass and related streams.

On top of these, Spain now has other authorised PROs focusing on specific sectors or types of packaging, particularly for commercial and industrial streams. For many small and mid-sized e-commerce sellers, though, Ecoembes, Procircular, and Ecovidrio are the most visible entry points.

In theory, the law allows you to set up an individual system instead of joining a collective one, but in practice that is something only very large players or industry groups attempt. For almost all online sellers, membership in one or more PROs is the realistic route. You sign an agreement, report how much packaging you place on the market in their formats, and they calculate and invoice your contributions.

In short, the PRO turns your legal obligation to “finance waste management” into a clear, operational process.

Annual Data Reporting

Once you are registered and have joined a PRO, annual reporting becomes part of the rhythm of your business. Spain expects you to declare your packaging data both to your PRO and to MITECO, and the two sets of numbers need to tell the same story.

Your first key date each year is around the end of February. Many PROs, including Ecoembes, ask for your previous year’s packaging declaration by 28 February. In this declaration, you report how much packaging you placed on the Spanish market in the previous year, broken down by material and category. That usually means kilograms of plastic, paper and cardboard, metal, glass, and other materials, and distinguishing between household, commercial, and industrial packaging. Some systems also ask you to split out primary, secondary, and tertiary packaging so they can understand where in the product journey each piece is used.

Your second major date is 31 March. By then, you normally need to submit an informative packaging declaration to the Product Producers Registry at MITECO. This is based on the same underlying data but formatted according to the ministry’s template. It’s the state’s high-level overview of how much packaging you placed on the market and confirmation that you are fulfilling your obligations through one or more PROs. In some recent years, MITECO has extended this deadline into April, but the general rule is “by 31 March of the following year”, and that is what you should plan around unless the ministry officially says otherwise.

From a practical standpoint, the hard part is not filling in the forms, but generating the data. You need a way to estimate or calculate your packaging volumes by material and category. If you run a simple product range with standard boxes, it may be enough to calculate weights once and multiply by units sold. If you have dozens of SKUs, different packaging formats, and seasonal bundles, you will want to build this logic into your inventory or ERP system so you can pull numbers out without rebuilding spreadsheets from scratch every year.

Eco-Contribution Fee Payments

Reporting is what tells the system how much waste you are responsible for. Eco-contribution fees are how you pay for it.

Once your PRO receives your packaging declaration, it applies its tariff schedule to your volumes. These tariffs are generally set per kilogram and per material, sometimes further differentiated by packaging category or other characteristics. For example, commercial and industrial cardboard might have one rate, rigid plastics another, metals another, and hazardous or special packaging a much higher rate. Some PROs also apply minimum annual fees so that very small producers still contribute something toward the fixed cost of running the system; a typical example is a minimum total around fifty euros per year for a given stream.

On top of the basic per-kilo rates, Spain has embraced eco-modulation. This means that the design of your packaging influences the fee you pay. If your packaging is easy to recycle, contains a decent amount of post-consumer recycled material, or is reusable, you might benefit from small discounts on the base tariff. If, on the other hand, your packaging is hard to recycle, made from problematic combinations of materials, or unnecessarily heavy, you may face surcharges. Some current fee schedules offer bonuses of around five to six percent for packaging with significant recycled content and apply penalties of around ten percent for certain difficult-to-recycle designs. The exact numbers depend on the material, the PRO, and the specific criteria, but the logic is always the same: better design equals better pricing.

For a growing e-commerce brand, this turns packaging from a static cost into a lever you can optimise. Switching to monomaterial packaging, cutting unnecessary weight, or increasing recycled content can improve your sustainability story and shave a little off your annual EPR bill at the same time. The bigger your volumes, the more noticeable the impact.

Packaging Marking Requirements (2025 Onward)

From 1 January 2025, EPR in Spain is no longer just about what you do in the back office. It also affects what your customer sees on the packaging itself.

If you place packaging destined for households on the Spanish market, that packaging must now carry clear, visible, and durable information telling consumers how to dispose of it correctly. In simple terms, your product packaging needs to tell people which bin it goes into under Spain’s container system. That might mean, for example, indicating that a particular component belongs in the yellow container, another in the blue container, and so on, depending on its material.

The exact implementation details can vary and are often guided by the PROs and sector-specific guidelines, but the principle is always the same: someone holding your packaging in their kitchen should not have to guess which bin it belongs in. If you sell across multiple EU countries, you may need to fit Spanish and other countries’ symbols or wording onto the same artwork, which is another reason to plan ahead with your designer.

There is a transitional window so you do not have to scrap perfectly good stock printed under the old rules. Packaging that was placed on the market before 31 December 2024 can usually be sold for a limited time, around the first half of 2025, as long as you can prove when it was first placed on the market. After that, anything new entering the Spanish market is expected to comply with the marking rules.

For e-commerce sellers, the main takeaway is that packaging design is now part legal document, part marketing tool. When you commission new prints or redesigns, you have to leave room for disposal information alongside your logo and product story.

Invoice Requirements

Finally, we come to one of the areas where Spain stands out compared to many other countries: what it expects to see on your invoices.

First, Spain wants your ENV number to appear on your invoices and other commercial documentation linked to packaged products. This is how customers and auditors can quickly see that you are registered in the Product Producers Registry. In B2B chains, especially, large buyers are increasingly asking suppliers for their ENV number and may build it into their onboarding checks. Marketplaces also rely on this number when they verify your EPR compliance status in Spain.

Second, Spain expects the eco-contribution related to packaging waste management to be clearly identified on the invoice. The idea is that anyone reading the invoice can see that the cost of financing waste management has been included and can distinguish it from other commercial elements of the price. In practice, many companies add a separate line or clearly marked section that describes the contribution to the PRO or EPR scheme, often referencing the relevant packaging category.

VAT treatment follows general invoicing rules rather than a special EPR rule, which is why you will see different technical approaches in the market. Some businesses show the contribution as an informational line that does not change the taxable base calculation, others include it within the overall price but highlight it separately so the amount is transparent. What matters from an EPR perspective is that the contribution is identified and differentiated, not hidden.

For a small e-commerce business, this usually means tweaking your invoicing setup at least once. You will need fields for your ENV number and a consistent way to show the EPR contribution, especially on B2B invoices. It can feel like a lot of effort for one country, but once the template is in place, it becomes routine — and it keeps you on the right side of both Spanish law and marketplace compliance checks.

Packaging Categories Explained

Spain’s EPR system is built around three packaging streams: household, commercial, and industrial. These categories existed before, but since Royal Decree 1055/2022 came into force, and especially with full financing and reporting obligations starting in 2025, they now play a central role in how producers — including e-commerce sellers — must register, report, and pay their fees.

Even if your online shop feels small, understanding these three categories matters. They determine the numbers you report, the fees you pay, the PRO you join, and the compliance checks marketplaces apply to your account. Once you understand where your packaging actually ends up — in a home, at a business, or somewhere in the logistics chain — the categories start making sense.

Household Packaging

Household packaging is everything that typically ends up in a consumer’s home. It includes the classic retail packaging your customer opens — cartons, sleeves, bottles, labels, jars — as well as any outer packaging you send directly to a private end user. It’s what Spanish households throw into the yellow or blue containers and what most people imagine when they think about recycling.

This category has long been regulated in Spain, and it continues to be the most visible, partly because it is the one consumers actually touch. It’s also the category that gets the new disposal labelling rules from 1 January 2025. If your product is aimed at B2C customers, most of your packaging almost certainly falls into this stream.

What matters legally is the destination, not the design. A cardboard box shipped to a household is household packaging. That same box sent to a company might not be. The same is true for e-commerce mailers, filler paper, tissue wrap — it all depends on where it ends up.

Commercial Packaging

Commercial packaging lives in the world between consumers and logistics. It is packaging used in retail, hospitality, offices, and B2B settings. It might look similar to household packaging, but its destination is different.

Think of the boxes that stores receive before breaking them down for shelf stocking, the packaging that cafés or restaurants use to store ingredients, or the outer packaging a business receives alongside products it intends to resell. When you ship to a company rather than a private consumer, the packaging in that shipment is usually commercial.

Before RD 1055/2022, this category wasn’t part of Spain’s EPR financing structure. Since 2025, it is — which is why many online businesses have suddenly found themselves rethinking part of their data reporting. If your shop sells both B2C and B2B, the correct classification depends on the final intended user, not on your intention or the type of product. That distinction affects your fees, and it’s something PROs will eventually expect you to handle correctly.

Industrial Packaging

Industrial packaging is the upstream heavyweight of the system. This is packaging used during production, large-scale transport, or bulk distribution. It includes pallets, large cardboard containers, industrial shrink wrap, drums, protective boxes used in shipping containers, and other logistics materials that never appear in a consumer’s home or a shop shelf.

If you manufacture in Spain, you may use industrial packaging yourself. But if you import products into Spain — from another EU country or from outside the EU — then you become the first person to place that industrial packaging on the Spanish market. And that means you are responsible for it under the EPR rules. This is the part that catches many smaller online businesses off guard. Importers often think the factory is responsible for that packaging, but under Spanish law, the responsibility sits with whoever brings it into Spain.

Industrial packaging was not previously part of Spain’s EPR fee system. Under RD 1055/2022, the obligations now apply fully from 1 January 2025, which means registering, declaring, and financing the waste management of that packaging. If most of your business is import-driven, this stream can be more significant than you expect.

Why the 2025 Expansion Matters

The move to bring commercial and industrial packaging fully into the EPR system is one of the biggest shifts Spanish waste law has seen in years. For e-commerce sellers, it means you can no longer look only at the packaging the end customer receives. You must consider everything in the chain — from the bulk shipment arriving at your warehouse to the e-commerce box delivered to a business customer.

The result is a more complete, more realistic picture of your actual packaging footprint. But it also means more detailed reporting, more interactions with PROs, and often more cost. If you sell across multiple streams — for example, household and commercial — you may even need membership in more than one PRO to cover everything properly.

How Incorrect Classification Affects Fees

Misclassifying packaging isn’t just a technical mistake; it changes your EPR bill. Fee tables differ from one packaging category to another, and some of the differences are substantial. For example, industrial packaging might have a different rate structure from household packaging, and if you report the wrong stream, your contributions may be too high or too low.

Authorities and PROs can audit your data, and when they do, they look closely at whether your classification matches the real destination of your packaging. If they find systematic errors, they can require back payments, corrections, or — in more serious cases — administrative fines under RD 1055/2022.

Marketplaces also care about this. When you submit your EPR registration and packaging data to platforms like Amazon or eBay, they expect it to align with the right stream. A mismatch between what you declare and what your packaging actually is can trigger compliance flags or listing freezes. That’s why accurate classification is one of the simplest ways to avoid trouble.

Once you understand these three categories and see how they map to the way your business actually ships products, the Spanish EPR system becomes far easier to work with. It’s the foundation for everything else you need to do — from registration and reporting to fees, labels, and invoices.

If you’re running an online shop from outside Spain but sending packaged products into the country, the EPR registration process can feel a little bureaucratic at first. But once you understand the rhythm, it becomes a straightforward administrative journey: establish your identity in Spain, appoint someone who can legally act for you inside the country, join the right recycling system, and then complete your inscription in the national Product Producers Registry. After that, everything turns into annual maintenance rather than constant setup work.

Registration Process for Foreign E-commerce Sellers

Step 1 — Obtain a Spanish NIF

Your entry point into Spain’s administrative world is the NIF, the Spanish tax identification number. It’s the number the Product Producers Registry uses to recognise your company, and without it the system simply won’t let you register as a producer. Most foreign businesses obtain their NIF through a fiscal representative who submits the paperwork and verifies your company’s legal status. It’s worth noting that a NIF doesn’t automatically register you for VAT or create tax obligations — those only arise if your activities actually trigger VAT duties. In the EPR context, the NIF functions more like an official ID card than a tax registration.

Step 2 — Appoint an Authorized Representative

Because you are based abroad, you can’t deal directly with Spanish authorities for EPR compliance. Spanish law requires you to appoint an Authorized Representative, a person or company legally established in Spain who takes over your EPR responsibilities. They become your local legal presence for everything related to packaging, from filing your registration to submitting declarations and communicating with MITECO. You grant this representative power of attorney, and from that moment on, they are the one who interacts with the registry and the recycling systems. Marketplaces also check that you have an AR when required; if you don’t, the law can shift responsibility to your Spanish distributor or even to the marketplace itself, which is exactly the scenario platforms try to avoid when they run their EPR compliance checks.

Step 3 — Join a PRO before Registration

Once you have your NIF and your Authorized Representative, the next move is joining a Producer Responsibility Organisation. This part often surprises sellers, because in Spain you have to join a PRO before your registration in the Product Producers Registry can be completed. MITECO requires your AR to attach your PRO contract during the inscription process; the registration won’t be validated without it. Depending on the packaging materials you use, you might join Ecoembes for multimaterial household, commercial and industrial packaging, Procircular for a similarly broad material mix, or Ecovidrio if your products mainly rely on glass. Other sector-specific PROs exist too, but these three are the most common for small and mid-sized e-commerce businesses. Once you’re accepted by the PRO, they issue a membership confirmation that your AR will later file with the registry.

Step 4 — Register with the Product Producers Registry (MITECO)

With a NIF, an Authorized Representative and a PRO contract in hand, you are finally ready to complete the inscription in the Registro de Productores de Producto. Your AR submits your company details, attaches your PRO contract, and declares the types of packaging you place on the Spanish market. After reviewing the documents and confirming your PRO membership, MITECO issues your ENV number, usually shown in the format “ENV/Year/XXXXXXXXX”. This is your official packaging EPR identifier in Spain, and you’ll see it appear everywhere — on invoices, on commercial documents, in marketplace compliance checks and in your annual reporting cycle. Once you receive that ENV number, you are formally recognised as a producer in Spain.

Step 5 — Submit Initial and Annual Declarations

After your inscription is approved, you move straight into the yearly reporting cycle. There isn’t a separate “initial declaration” after receiving the ENV number, because the crucial first step — linking your company to a PRO by attaching the PRO contract — already happened inside the registration procedure itself. The work that follows repeats every year: you report your packaging data to your PRO and then to MITECO. The declaration to your PRO usually happens by the end of February, and it includes detailed information about how much packaging you placed on the market during the previous year, broken down by materials and by household, commercial and industrial streams. Once the PRO has this data, they calculate your eco-contribution and prepare the invoices for your fees.

After that, your AR submits the official annual declaration through the Product Producers Registry, normally by the end of March. This declaration mirrors the data you sent to your PRO and confirms your packaging footprint for the year. Occasionally, the ministry extends the March deadline into April for administrative reasons, but unless you see an official announcement, you should work with the standard dates.

Once both declarations have been submitted and the corresponding contributions are paid, your responsibilities for that year are complete. The cycle starts again the following January, but the heavy lifting — the registration, the PRO membership, the ENV number — is already behind you.

Key Deadlines & Compliance Timeline (2024–2026)

Spain’s EPR system doesn’t land all at once; it arrives in waves. Some pieces are already in motion, others crystallise in early 2025, and the European-wide reform through the PPWR begins in 2026. If you’re selling online into Spain, understanding this timing makes the difference between a smooth compliance routine and an unwelcome platform warning.

Registration Deadlines for Packaging in 2025

Spanish law requires producers to be registered in the Product Producers Registry before placing packaging on the market, but many foreign sellers only encountered the requirement in practice during 2023 and 2024. As the system expands to cover all three packaging streams — household, commercial and industrial — the year 2025 becomes the first cycle in which everyone must file a complete annual declaration for all categories. Because that declaration is due by 31 March, producers who are still unregistered by early 2025 will simply be unable to file what the ministry expects. For that reason, March 2025 has turned into a very real turning point: not a formal legal deadline, but a practical compliance cutoff. Marketplaces increasingly treat missing registration the same way they treat missing VAT numbers — as a sign that something is off — so being fully registered before the reporting season begins is now the safest path.

Annual Reporting Deadlines in February and March

Once you have your ENV number, your participation in the system shifts into a predictable yearly rhythm. PROs such as Ecoembes and Procircular expect your detailed packaging declaration by the end of February, because they need that information to calculate your eco-contributions. Shortly after that, by the end of March, your Authorized Representative submits the state-level declaration through MITECO’s registry, confirming the same data in the official format. Although MITECO has occasionally extended the March deadline into April, the underlying rhythm stays the same: the PRO declaration comes first, followed by the government declaration a few weeks later. These two moments anchor the entire compliance cycle each year.

Labelling Requirements from January 1, 2025

The beginning of 2025 introduces the new disposal-instruction requirement for household packaging. From 1 January onward, packaging destined for consumers must include clear and durable information telling them which waste container each component belongs in — yellow for plastics and metals, blue for paper and cardboard, green for glass, and so on. Spain has not mandated a single official symbol, but the information must be easy to understand and must follow the structure of Spain’s selective-collection system. Packaging printed before the end of 2024 can still be sold for a limited transition period, but anything newly placed on the market in 2025 needs to comply. For brands that sell mostly B2C, this becomes part of the packaging-design workflow going forward.

B2B E-Invoicing Requirement from July 2025

In the middle of 2025, another change arrives, this time affecting how invoices are issued rather than how packaging is labelled. Spain plans to introduce mandatory electronic invoicing for B2B transactions under the Crea y Crece law, with July 2025 being the earliest realistic start date. The exact timing depends on the publication of the final technical regulation and the readiness of the national infrastructure, so the date may shift. Even so, it is clear that e-invoicing is coming soon, and because Spanish invoices must already show your ENV number and a separate reference to your EPR contributions, most companies will update their EPR-related invoice fields at the same time as they upgrade their e-invoicing setup.

Future PPWR Deadlines in 2026

From 2026 onward, the EU’s Packaging and Packaging Waste Regulation begins rolling out in phases. Some elements take effect immediately, such as the harmonised definition of a producer, clearer marketplace obligations and the requirement that remote sellers have an Authorized Representative in every EU Member State where they sell directly to end users. Other obligations arrive later, including recyclability requirements, recycled-content targets and various reuse measures that stretch into 2027, 2028 and even 2030. For cross-border e-commerce sellers, 2026 marks the moment when EPR stops being a patchwork of national systems and starts to behave like a coordinated EU-wide framework.

Taken together, these milestones form a timeline that moves quickly: registration aligned before the 2025 reporting cycle, updated labelling from the first day of 2025, new e-invoicing rules expected in the summer, and then a much broader transformation as the PPWR begins in 2026. Planning ahead doesn’t just keep you compliant — it keeps your business running smoothly during a period when the rules are evolving fast.

Eco-Modulation, Fees and Smarter Packaging Design

Once you’re registered and reporting, the next question most sellers ask is what all of this actually costs. Spain answers that with eco-modulation — a pricing logic that adjusts your fees depending on how recyclable, heavy or sustainable your packaging is. It’s a simple idea with very real financial consequences for any e-commerce brand shipping physical products into Spain.

How Eco-Modulation Works

Eco-modulation is Spain’s way of nudging companies toward better packaging. When you submit your annual data, your PRO looks not only at how many kilos you place on the market, but at how “circular” that packaging is. Recyclability is usually the most influential factor. Materials that fit well into Spain’s waste-sorting and recycling system tend to attract lower rates, while materials that are difficult to separate or process move into higher-cost categories.

Recycled content is another lever. Some PROs offer small fee reductions — often just a few percentage points — for packaging that contains a meaningful share of post-consumer recycled material. Others apply similar adjustments for designs that avoid multi-layer or composite formats in favour of cleaner mono-materials. These adjustments vary by PRO and by material stream, but the pattern is consistent: the more circular the design, the more favourable the fee.

Weight always matters. Because contributions are calculated per kilogram, heavy packaging gets expensive fast. This is why “lighter and simpler” often turns out to be the most reliable cost-saving strategy, especially for sellers shipping thousands of orders per month.

Example Fee Ranges in 2025

The actual tariffs depend on which PRO you join, but the general shape is easy to understand once you’ve seen a few tables. Paper and cardboard sit at the lower end, which is why so many brands switch their outer packaging to cardboard mailers. Metals usually land in the middle. Plastics can swing much more widely: rigid mono-material plastics like HDPE may be relatively inexpensive in some PROs but more costly in others, while complex or less recyclable plastics sit noticeably higher. Hazardous packaging — anything needing specialised treatment — is an entirely different cost tier.

Most PROs apply a minimum annual fee per material stream, often somewhere around forty to fifty euros. Even very small sellers therefore contribute something, but for anyone shipping at scale, the real cost driver is the material mix and how many kilos you ultimately declare.

Strategic Packaging Adjustments to Reduce Costs

Once you understand how fees are calculated, it becomes much easier to redesign your packaging strategically. Many e-commerce brands start by reducing the number of different materials they use, because fewer materials usually mean fewer reporting categories, fewer eco-modulation penalties and fewer surprises.

Lightweighting is another straightforward win. When you shave a few grams off a box or mailer, that savings repeats across every shipment you send. Switching to mono-materials is often the next move, since mono-material packaging integrates better with recycling flows and avoids the higher tariffs linked to composite or multi-layer options. Some brands explore adding recycled content to unlock small discounts, and others focus on removing decorative or unnecessary components that complicate recycling.

Designing with Spain’s disposal-instruction rules in mind also helps. Clearer, simpler packaging is not just better for consumers — it’s cheaper to declare, easier to label and less likely to trigger questions during PRO audits.

Altogether, eco-modulation isn’t a threat. It’s a price signal. Once you adjust your packaging with that logic in mind, your compliance bill usually improves naturally.

WEEE and Battery Obligations for Sellers of Electronic Devices

If you sell electronics or products containing batteries, packaging EPR is only half of your compliance picture. Spain also enforces strict rules for electronic waste (WEEE) and batteries, and these obligations apply even if you’re selling from another EU country or from outside the EU entirely. For many online sellers, this is where the compliance workload becomes more layered — but the logic is the same: if you’re the one placing the device or battery on the Spanish market, you’re the one responsible for its end-of-life management.

WEEE Obligations for Electronic Devices

WEEE is regulated through Royal Decree 110/2015, and its scope covers everything from kitchen tools to toys, LED lighting, grooming devices, small appliances, chargers and smart gadgets. If a product plugs in, charges or has an electrical function, it probably falls under WEEE.

Foreign sellers must appoint an Authorized Representative before they can register. Registration happens in the national WEEE Producer Register, and once accepted you receive a WEEE producer identification number. That number must appear on your invoices and your product documentation. The device itself must show the crossed-out wheeled bin symbol and a producer identifier, but not the registration number; that part stays in the paperwork.

Reporting for WEEE works on a quarterly cycle rather than annually. Your AR submits data four times a year, covering the categories and quantities of devices you’ve placed on the market. This reporting feeds into the national scheme that pays for the collection and treatment of electronic waste.

Battery EPR Obligations

Batteries fall under Royal Decree 106/2008 and require their own registration, whether the batteries are removable or embedded inside devices. Spain distinguishes between portable, automotive and industrial batteries, and each of these categories comes with different reporting rules and different PRO options. Foreign sellers must again appoint an AR, because battery producers established outside Spain cannot fulfil obligations directly.

A surprising number of products trigger battery EPR without sellers realising it. Electric toothbrushes, earbuds, toys, vacuum cleaners, laptops, e-mobility accessories, handheld tools and even some beauty devices can require both WEEE and battery registration. The two systems run in parallel: one for the device, one for the battery inside it.

Platform Enforcement During 2025

The last piece of the puzzle is platform enforcement, which becomes far stricter through 2025. Amazon, in particular, is tightening checks for electronics that contain batteries. Throughout 2025 the platform is rolling out verification steps that require sellers to provide valid WEEE and battery registration numbers before listings can remain active. Sellers who cannot provide the correct documentation may see their listings paused or moved into a pay-on-behalf system where Amazon charges eco-fees directly.

eBay follows a similar model and increasingly requests evidence of WEEE and battery compliance when sellers list electronics in Spain. These checks already exist for packaging EPR and are now expanding into the electronics categories.

For sellers, this means the message is simple: packaging registration alone is no longer enough. If your products plug in, charge or contain a battery, Spain expects full WEEE and battery registration, and marketplaces now enforce that expectation as a condition for selling.

Penalties and Legal Consequences

Spain’s EPR rules come with real enforcement behind them. Most brands that register, report on time and keep their data clean never see the sanctions side of the law, but it’s important to know what’s at stake. Spain regulates environmental responsibilities through Law 7/2022, and that law applies to all EPR streams — packaging, electronics, batteries and beyond. When something goes wrong, the consequences can be financial, operational, or retroactive. Understanding the landscape simply helps you avoid the headaches.

Financial Penalties

Spain classifies violations as minor, serious or very serious, and the fine ranges escalate quickly when more than one obligation is missing. Minor infractions can cost up to two thousand euros, usually for small administrative issues. Serious infractions climb from just over two thousand to one hundred thousand euros, and these typically include failures such as skipping declarations, not keeping proper records or placing products on the market without being fully registered. Very serious infractions carry fines that can reach three and a half million euros, especially when non-compliance is repeated or affects large volumes of products.

In practice, authorities can combine several breaches if a producer is missing registration, has not joined a PRO, has not appointed an Authorized Representative, and has never submitted data. This is why the top end of the fine structure rarely applies to small sellers, but the legal ceiling is there — and it explains why businesses take EPR obligations seriously once they understand how Spain structures its environmental sanctions.

Operational Penalties

Money isn’t the only tool Spain uses. The law allows authorities to suspend a company’s ability to sell in Spain, to prohibit it from placing products on the market until the issue is fixed, or to require the removal of non-compliant products from circulation. These measures are meant for cases where a producer simply doesn’t engage with the system at all, but they can be triggered more quickly when multiple obligations are ignored.

Marketplaces add an extra layer of enforcement on top. Amazon, eBay and other major platforms already block listings when EPR registration numbers are missing or inconsistent. Sometimes sellers receive a warning or a deadline to fix it, but interruptions can also happen suddenly when the platform flags a product category as non-compliant. Because platforms share responsibility under EU law, they are cautious and often act faster than government agencies. For small e-commerce brands, a listing suspension is usually the most disruptive consequence of all.

Retroactive Liability

The part of Spanish EPR that most sellers misunderstand at first is retroactive liability. Spain doesn’t just require compliance from the day you register — it looks back to the day you first began placing products on the Spanish market. That means if you’ve been shipping into Spain for months or years without registration, you may still be responsible for the packaging, WEEE or battery obligations from that earlier period.

When this happens, PROs usually ask for historical data so they can calculate the contributions that should have been paid. Those invoices can cover multiple years, and authorities may add late-reporting surcharges or administrative penalties. It’s not designed to punish newer sellers; it’s simply Spain’s way of ensuring that all waste generated inside the country is properly financed, no matter when the product entered the market.

The good news is that once you are registered, reporting accurately and paying contributions on time, the risk drops to almost zero. Retroactive issues only affect sellers who delay compliance. For everyone else, the system becomes routine: predictable reporting, predictable fees, and no surprises.

Recommendations for E-commerce Businesses

Once you understand how Spain’s EPR system works, the path forward becomes much clearer. Compliance isn’t just a legal duty; it’s an operational layer you build into your business so things run smoothly year after year. Here’s how to turn all of these rules into a manageable, future-proof workflow.

Immediate Actions to Get Yourself Compliant

The first step is simply getting into the system. If you’re selling into Spain without registration, make the essentials your priority: get your Spanish NIF, appoint an Authorized Representative and join the PRO or PROs that match your packaging materials. Those three steps unlock your ENV number, which you’ll use in reporting, in invoicing and in platform compliance checks. If you’ve already registered for packaging, this is a good moment to make sure your registrations actually match what you sell — including any obligations for electronics or battery-powered products. Many sellers discover they’re fully covered for packaging but still missing WEEE or battery registration, especially if their catalogue has gradually expanded into tech or gadgets.

Upgrading Systems for Data, Reporting and Invoicing

Spain’s reporting cycle exposes gaps in internal systems more than anything else. If your product database doesn’t reliably track packaging weights or materials, you’ll feel that pain in February when your first PRO declaration is due. Investing a bit of time now in updating your inventory fields or adding packaging attributes to your ERP saves an enormous amount of manual spreadsheet work later. The same applies to invoicing: because Spanish invoices must show your ENV number and a clear reference to your EPR contribution, it’s worth updating your templates early. These tweaks are small, but they make the entire compliance cycle far easier — especially as Spain moves toward mandatory e-invoicing for B2B transactions.

Improving Packaging in a Strategic, Cost-Saving Way

Once you understand eco-modulation, packaging becomes a cost lever instead of a compliance chore. Simpler, lighter, mono-material designs usually attract lower fees and make recycling easier for customers. Reducing unnecessary decorative elements, increasing recycled content or consolidating materials often leads to real savings. And with Spain’s disposal-instruction requirements now in force for household packaging, updating your packaging design once — with both recyclability and labelling in mind — is far better than redesigning twice. Most e-commerce brands find that these improvements aren’t just good for compliance; they make packaging more professional and reduce shipping costs too.

Aligning with Platform Compliance Requirements

Legal compliance and platform compliance are no longer the same thing. Amazon, eBay, Zalando and others regularly check for ENV numbers, WEEE IDs and battery registration details, and they often ask for these long before any authority contacts you. Occasionally they give sellers time to fix things, but at other times they simply pause or hide listings until everything matches their requirements. Treating EPR data like part of your listing workflow — the same way you’d handle VAT, EANs or safety documents — prevents those interruptions. For electronics or anything with a battery, this becomes even more important as platforms continue tightening their EPR checks in 2025 and beyond.

Strategic Long-Term Planning

Spain is only one part of a much bigger shift. The EU’s upcoming Packaging and Packaging Waste Regulation will start phasing in from 2026, gradually reshaping packaging rules across all Member States. Under the new system, remote sellers will need an Authorized Representative in every EU country where they sell directly to consumers, and recyclability and recycled-content targets will rise steadily toward 2030. This means the smartest long-term strategy is to choose packaging and compliance partners that won’t box you into one country’s rules. If you’re already improving packaging for Spain, it makes sense to choose materials that will meet the future EU-wide standards, not just today’s national requirements. And if you sell across multiple marketplaces, it helps to treat EPR data like VAT data — simply part of the infrastructure of cross-border commerce.

In the end, once you put the right structure in place, the system becomes predictable. A clean registration, reliable data, smart packaging choices and consistent platform documentation are all you really need. With that foundation, selling into Spain stops being a compliance puzzle and becomes the smooth, scalable business opportunity it should be.

Conclusion

Spain’s EPR system can feel complex when you first zoom out and see all the moving parts — packaging rules that now cover every stream, WEEE and battery obligations for anything electronic, strict invoice requirements, new labelling expectations and a reporting calendar that arrives like clockwork every year. But when you break it down, the obligations follow a simple logic: if you place products on the Spanish market, you register; if you generate waste, you report it; and if your packaging or devices create environmental impact, you contribute to managing that impact responsibly. Once you’ve got your NIF, your Authorized Representative, your PRO membership and your ENV number in place, everything else becomes a rhythm of data, documentation and smart packaging choices.

Early compliance isn’t just about staying on the right side of the law. It’s a genuine competitive advantage. Platforms increasingly reward sellers who have their EPR data in order, and they are quick to freeze or delist listings from sellers who don’t. Customers care more than ever about sustainability and transparent waste management. And as eco-modulation shapes future fee structures, brands with lighter, simpler, more recyclable packaging will simply operate more efficiently. The sellers who adapt early avoid last-minute scrambles, avoid retroactive liabilities and enjoy a smoother relationship with marketplaces and regulators.

The real takeaway is that EPR isn’t going away — it’s expanding across Europe. Spain is just one of the first countries where the full picture has come into focus, and the lessons you learn here will prepare you for what’s coming across the EU as the new PPWR rolls out from 2026 onward. So use this moment. Register before the reporting deadlines catch up with you, clean up your data and documentation, redesign your packaging once (not twice) and integrate EPR checks into your product launch workflow. If you stay proactive, Spain becomes a stable, predictable market where compliance supports your growth instead of slowing you down.