How fiscal representation works in EU VAT compliance and when your business needs it

Spis treści

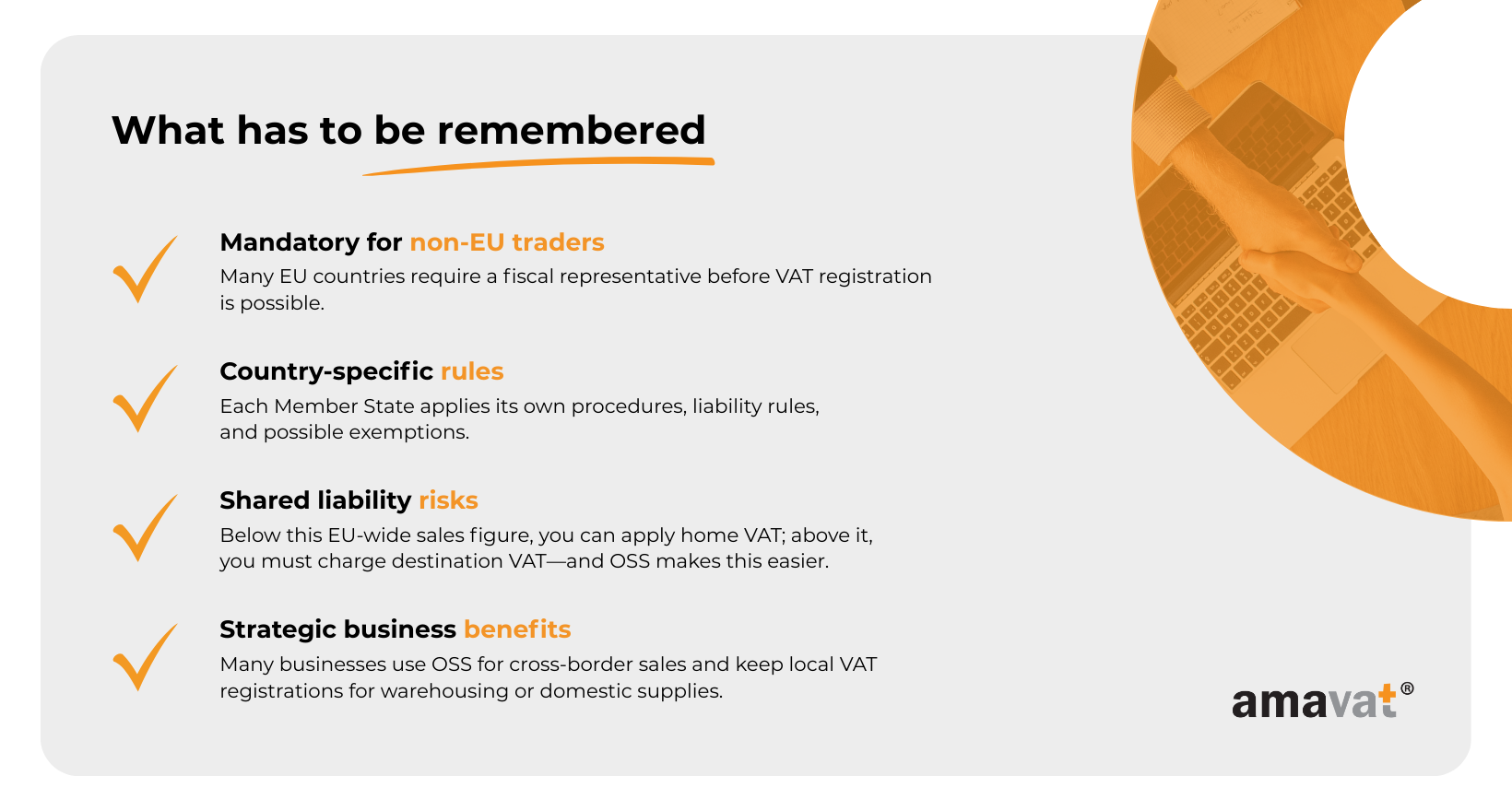

Fiscal representation applies mainly to non-EU established businesses, as many EU countries require such companies to appoint a local representative before they can trade and meet VAT obligations. For EU-established companies, it’s usually optional—unless a specific country’s rules make exceptions, often in higher-risk sectors or where complex VAT schemes are involved. In either case, a fiscal representative is someone on the ground in a specific EU country who knows the local tax system inside and out, speaks the language, and can take care of your VAT-related obligations for you. This role is specific to VAT (and related filings such as Intrastat or EC Sales Lists)—it does not extend to corporate income tax or other indirect taxes.

Their work includes handling your VAT registration, filing returns, paying your VAT liabilities on time, and communicating with the local tax office—while taking on legal responsibility for ensuring everything is done correctly. In some countries, particularly for non-EU companies trading in places such as Spain, France, Italy, and Poland, you cannot even register for VAT without first appointing a fiscal representative.

In this article, we’ll break down what fiscal representation is, when it’s mandatory, and how it works in practice. We’ll explore the different models available, explain the key responsibilities and liabilities involved, and highlight which EU countries currently require it. We’ll also walk you through the risks of not appointing a fiscal representative when you should, and give you practical advice on choosing the right partner for your business.

The bottom line? If you trade in the EU without the right fiscal representation, you’re risking fines, delays, and even being blocked from certain markets. This guide will help you understand exactly how to stay compliant and make VAT work for your growth—not against it.

What Is Fiscal Representation?

Fiscal representation is a formal arrangement where a local expert—either an individual or a company—acts on behalf of a foreign business to manage its VAT obligations in a specific EU country. This requirement is most often aimed at non-EU established businesses, where many Member States mandate the appointment of such a representative. For EU-established companies, fiscal representation is generally optional, though certain Member States still require it in specific cases.

The role of a fiscal representative is strictly focused on VAT and closely related reporting obligations. It does not include corporate income tax or other indirect taxes. For non-EU businesses, it’s often a legal requirement; for EU-based businesses, it can be a strategic choice—particularly when language barriers, complex administrative rules, or access to special VAT schemes make direct registration impractical. Either way, the fiscal representative acts as your point of contact with the national tax authority, ensuring your VAT-related obligations are fulfilled on time and in the correct format.

Core functions include registering your business for VAT in the local jurisdiction, preparing and submitting VAT returns, paying VAT liabilities to the tax authorities, and managing related reports such as EC Sales Lists and Intrastat declarations. They also oversee VAT refund claims where applicable, ensuring you don’t miss out on reclaiming tax you’re entitled to.

In some Member States—often those with a higher perceived risk of VAT fraud—the fiscal representative must provide a financial guarantee such as a bank guarantee or insurance bond to secure potential VAT debts. France, for example, typically applies this requirement to non-EU traders, while other countries do not.

A defining feature of fiscal representation is the concept of joint and several liability, meaning the representative can be held responsible for unpaid VAT. However, the scope of this liability is not uniform across the EU—some countries limit it to VAT debts only or tie it to whether a financial guarantee is provided. Because of this potential liability, fiscal representatives have a vested interest in ensuring your compliance is precise and up to date.

In short, fiscal representation is more than an administrative service—it’s a legally recognised safeguard that keeps your VAT affairs in order, protects public revenue, and enables you to operate with confidence in markets where you don’t have a direct establishment.

Legal Basis and When It’s Mandatory

The EU law behind fiscal representation

Article 204 of Council Directive 2006/112/EC allows a Member State to require a tax (fiscal) representative in that Member State where the person liable for VAT is not established there. This is a country-level option that applies specifically in the Member State where VAT is due—not a blanket EU-wide rule. The intent is to give tax authorities a reliable local contact who can ensure compliance and, if necessary, settle VAT debts.

How it applies to non-EU businesses

If your company is established outside the EU, several Member States make fiscal representation a precondition for VAT registration. Without it, you cannot register for VAT or file returns in those jurisdictions. Countries that require this include France, Spain, Poland, Bulgaria, and many others. In some cases, exemptions exist—Bulgaria, for example, waives the requirement if your country has a mutual-assistance treaty with the EU.

In these situations, the fiscal representative often has joint and several liability for your VAT debts, although the exact scope and whether a financial guarantee is required will depend on the country. Some states require substantial bank guarantees to protect against potential unpaid VAT; others impose liability without a guarantee.

It’s worth noting that fiscal representation is a VAT compliance matter. While certain import VAT deferment schemes do require a fiscal representative or special authorisation (such as the Netherlands’ Article 23 or France’s limited import VAT representation), this is separate from customs representation for moving goods across borders.

How it applies to EU businesses

If your business is established in the EU, you can usually register for VAT directly in other Member States without appointing a fiscal representative. However, some companies still choose to appoint one for convenience—for example, to overcome language barriers, simplify local filings, or access cash-flow benefits through import VAT deferment schemes (e.g., the Netherlands’ Article 23 licence). In these cases, the decision is strategic rather than mandatory.

Typical activities that trigger VAT registration (and when a rep is needed)

Activities such as importing goods, storing inventory locally (including in marketplace fulfilment centres), or providing taxable services in another Member State without a fixed establishment will usually trigger the need to register for VAT. Whether you must then appoint a fiscal representative depends primarily on your place of establishment and the rules of the country where you are registering. For non-EU businesses, these activities will often mean both VAT registration and fiscal representation in countries that mandate it.

What this means for your next move

Treat fiscal representation as part of your VAT compliance planning, not just an afterthought. Start by mapping where you trade and identifying which countries require a representative for your business type. Then assess whether a voluntary appointment could still benefit you—especially if it unlocks import VAT deferment, speeds up local processes, or reduces your compliance burden.

Types of Fiscal Representation

General representation – full-scope compliance and varying liability

General fiscal representation is the most comprehensive form available in most Member States. Your representative takes care of all VAT-related compliance in that country—VAT registration, filing periodic returns, paying VAT on your behalf, maintaining records, managing audits, and handling communication with the tax office. In many jurisdictions, the representative also assumes joint and several liability for certain VAT debts, meaning the tax authorities can recover unpaid amounts directly from them. However, the exact scope of liability varies by country. Some Member States, such as France or Belgium, limit the liability or secure it through a bank guarantee or insurance bond rather than imposing full automatic liability.

Because of the risk to the representative, some countries require a financial guarantee as part of the arrangement. General representation is typically mandatory for non-EU established businesses in those jurisdictions and is best suited to companies with ongoing, high-value, or complex operations—such as continuous imports, local warehousing, or frequent high-volume sales. In these cases, the investment in a general representative can deliver smoother compliance and significantly reduce operational risk.

Limited representation – narrowed scope under local law or contract

Limited fiscal representation is not an official EU-wide legal category, but rather a commercial term used to describe arrangements where the representative’s role is restricted to specific VAT obligations. This could mean handling only VAT return filings, managing certain payments, or representing the business solely for specific transactions, such as imports under special VAT or customs arrangements.

The scope and liability of such arrangements depend on local law and the contract between the business and the representative. Some Member States do not formally recognise a “limited” model in legislation; they simply allow service providers to offer reduced-scope services where legally possible.

This approach can suit businesses that carry out only occasional taxable transactions in the country, or those that already manage most VAT processes internally but need local support for certain functions. In some Member States, access to import VAT deferment schemes is only possible via a local intermediary, making a limited arrangement an efficient option for that specific purpose.

Choosing between them – when you have a choice

The decision between general and limited fiscal representation depends on how much of your VAT process you want—or are able—to outsource, the legal requirements of the Member State, and the complexity of your operations. In some countries, particularly for non-EU traders, only the general model exists in law, leaving no option to choose a reduced scope. Where both options are possible, general representation offers the highest level of hands-off compliance and protection, while a limited arrangement can be a cost-effective way to meet specific legal or operational needs.

Key Responsibilities and Liabilities of a Fiscal Representative

VAT registration – the first step to compliance

A fiscal representative oversees the VAT registration process from start to finish, but the exact requirements vary significantly between Member States—especially for non-EU established businesses. In some countries, such as France, Spain, and Poland, appointing a fiscal representative is a prerequisite for non-EU VAT registration. Others allow direct registration without one.

The process typically involves preparing and submitting the application to the local tax office and providing supporting documents to prove your business activity. Depending on the country, you may need notarised copies, certified translations, or additional declarations. Your representative is equipped to manage these country-specific procedures and ensure they are completed correctly.

Filing and reporting obligations

Once registered, the fiscal representative is responsible for preparing and filing VAT returns by the deadlines set by the local tax authority. They may also prepare and submit EC Sales Lists—where required—and Intrastat declarations for goods movements within the EU. Both of these have country-specific thresholds and reporting formats. For example, Portugal’s Intrastat threshold is €400,000, while other countries set it far lower.

Not every Member State requires EC Sales Lists for all transaction types, and some have national equivalents. In non-EU jurisdictions that operate a fiscal representation model (such as Norway or Switzerland), the reporting formats differ entirely, so your representative’s role adapts to local rules.

Managing VAT payments and compliance

One of the most critical functions is ensuring VAT liabilities are calculated accurately and paid on time. Missing a deadline or submitting incorrect figures can lead to penalties and interest, which vary widely by country. For example, Norway applies automatic fines even for relatively small reporting errors, while other jurisdictions may take a more lenient approach. By monitoring due dates, checking calculations, and arranging payments, the representative helps safeguard your compliance record.

Recordkeeping and responding to audits

Fiscal representatives are responsible for maintaining full transaction records in line with local legal requirements. Under EU Directive rules, certain VAT records must be kept for up to 10 years, though some countries have shorter or longer retention periods—Portugal, for example, requires VAT invoice storage for the full 10 years. These records are vital if the tax authority launches an audit or requests additional information. In such cases, the representative acts as your official contact, handling communications and providing the necessary documents.

Financial security and guarantees

In some jurisdictions—often where non-EU traders are involved—fiscal representatives must provide a bank guarantee or deposit to the tax authority as security against potential VAT debts. This is not a universal EU requirement and often depends on the country’s fraud-prevention measures. The amount can be influenced by your business’s turnover, transaction volume, perceived risk level, or the representative’s own assessment.

The weight of liability

In many countries, fiscal representatives have joint and several liability for the VAT they manage on your behalf, meaning the tax authorities can recover unpaid amounts from them. However, the scope of this liability is set by local law and can sometimes be limited or capped by the size of the financial guarantee provided. Because of this, representatives tend to be highly diligent, verifying documentation, monitoring transactions, and ensuring each filing is correct and timely. Their vested interest in your compliance becomes an additional safety net for your business.

When Your Business Needs a Fiscal Representative

For non-EU companies – when it’s required in many, but not all, Member States

If your business is established outside the EU, a fiscal representative is often a legal prerequisite for VAT registration in many Member States, though not in all. Whether you must appoint one depends on the country’s rules rather than the activity alone.

Common scenarios that typically trigger the need to register for VAT include:

- Importing goods into an EU Member State for sale, whether directly to consumers or to other businesses.

- Storing goods in an EU warehouse under your company’s name, including fulfilment centres such as Amazon FBA hubs.

- Providing taxable services in an EU country without having a permanent establishment there.

In Member States where fiscal representation is mandatory for non-EU traders, you will have to appoint one before you can complete VAT registration. In others, you may be able to register directly without a representative. Lack of a representative will not in itself block customs clearance, but if you plan to use certain import VAT deferment schemes, some countries will only grant access through a local fiscal representative or other authorised intermediary.

For EU companies – when it’s optional or linked to special schemes

If your business is established in the EU, you can usually register for VAT directly in other Member States without appointing a fiscal representative. However, in certain Member States, a representative may still be needed for specific special VAT regimes or cash-flow schemes—for example, import VAT deferment under the Netherlands’ Article 23 licence or certain French and Spanish arrangements.

In many other cases, businesses choose to appoint a representative for practical convenience—such as overcoming language barriers during registration and correspondence, or relying on local expertise to ensure filings are accurate and timely.

Assessing your own situation

To determine whether you need a fiscal representative, start by mapping your activities and target markets against each country’s VAT rules:

- Am I importing goods or storing inventory in that country? These activities will usually trigger VAT registration, and in some Member States, if you are non-EU established, they will also trigger a fiscal representative requirement.

- Am I providing taxable services without a local office? This can require VAT registration and, in some countries, a fiscal representative—mainly for non-EU suppliers.

- Would a local expert help with language or procedural complexity? This is not a legal requirement but can make compliance far easier.

If you answer “yes” to the first or second question, check the specific VAT registration rules in that country to see whether a fiscal representative is mandatory. If your “yes” is to the third, a representative may not be legally required but could still save you time, cost, and risk.

Countries Requiring Fiscal Representation for Non-EU Businesses (as of mid-2025)

Where a fiscal representative is required

If your business is established outside the EU and you plan to trade within its borders, a number of Member States will only allow you to register for VAT through a local fiscal representative. As of mid-2025, this requirement applies in:

Austria, Belgium, France, Bulgaria, Croatia, Cyprus, Estonia, Greece, Hungary, Italy, Latvia, Lithuania, Netherlands, Poland, Portugal, Romania, Slovenia, Spain, and Sweden.

In some of these countries, the rule is not absolute. Where there is a mutual administrative assistance agreement between the EU and the trader’s country of establishment (e.g., Norway, often Switzerland), the fiscal representation requirement can be waived. Germany, while not generally requiring a fiscal representative, may apply the rule to certain non-EU traders if no such cooperation agreement exists.

In these jurisdictions, the fiscal representative becomes your official point of contact with the tax authority and is liable for your VAT debts. The scope of liability varies — in some Member States it is full joint and several liability, while in others it is covered by a bank guarantee or other form of financial security.

Where direct registration is possible

Not all Member States impose the same rule. In certain jurisdictions, non-EU businesses can register for VAT directly without appointing a representative, provided they meet the standard application requirements. As of mid-2025, this is possible in:

Ireland, Finland, Malta, Luxembourg, Czech Republic, Slovakia, and the United Kingdom (post-Brexit).

In the UK, there is no blanket fiscal representation requirement for non-UK traders, but Northern Ireland follows EU VAT rules for goods. While a local representative is not mandatory, many traders appoint one for practical reasons such as handling local correspondence and payments.

Even in “direct registration” countries, some businesses still choose to work with a fiscal representative voluntarily — particularly to overcome language barriers, manage complex reporting, or gain access to special VAT schemes that may otherwise be difficult to secure.

Why the difference matters

Knowing which countries require fiscal representation — and which waive it under treaty arrangements — can save weeks of wasted time and prevent compliance bottlenecks. It also shapes how you plan your market entry strategy: where to store goods, how to route imports, and how to manage VAT cash flow. By understanding the difference between mandatory and optional representation, you can build a trading footprint that keeps compliance smooth, predictable, and cost-efficient.

Risks and Consequences of Non-Compliance

Financial penalties – more than just a fine

Failing to meet VAT obligations in the EU can lead to substantial financial penalties, but the way these are calculated varies significantly between Member States. Some jurisdictions set penalties as a percentage of the unpaid VAT, others apply fixed amounts per infringement, and some impose daily interest until the debt is cleared. In countries like Portugal, you may face both interest charges and separate fines for each reporting error.

Criminal liability is possible but generally applies only in cases of proven VAT fraud or deliberate evasion, not routine late filings or accidental mistakes. The bigger risk for most businesses is the financial drain of penalties combined with the administrative effort of rectifying errors.

Tax authorities can also withhold or delay input VAT reclaims if your compliance record is poor. While EU law requires that penalties and restrictions be proportionate—meaning a simple late submission doesn’t automatically remove your right to deduct—failure to provide key documentation (such as invoices) or evidence of taxable activity can lead to a refusal.

Operational disruptions – the hidden cost

VAT non-compliance can also impact your day-to-day operations. Customs authorities may detain goods if import VAT or customs duties are unpaid, or if you lose eligibility for an import VAT deferment scheme due to non-compliance. This is different from domestic VAT reporting errors, which generally do not cause goods to be held at the border unless directly linked to import procedures.

Online marketplaces such as Amazon or eBay take VAT compliance seriously because, under EU and national rules, they may be held jointly liable for unpaid VAT. If tax authorities flag irregularities with your account, these platforms can suspend your seller privileges quickly—cutting off access to customers and disrupting cash flow. Freight forwarders and logistics providers may also delay releasing goods until outstanding VAT obligations are resolved.

For businesses with tight delivery schedules or just-in-time inventory systems, such interruptions can cascade into missed deadlines, unhappy clients, and even contract breaches.

Reputational impact – trust is harder to rebuild

In the B2B space, reputation is currency. Word of non-compliance can spread through official and informal channels. Tax authorities across the EU exchange information through VIES and Eurofisc, particularly when there is suspected fraud or repeated non-compliance. This can result in heightened scrutiny or more frequent audits in other Member States.

While a single minor penalty is unlikely to be broadcast across Europe, repeated issues or fraud risk will quickly erode trust. Suppliers may tighten payment terms, partners may hesitate to collaborate, and customers may seek out more reliable alternatives. Internally, your team may have to divert time and resources to repairing relationships and re-establishing credibility.

Why prevention is better than repair

Addressing VAT compliance problems after the fact is almost always more costly, time-consuming, and stressful than preventing them in the first place. A qualified fiscal representative helps by monitoring deadlines, ensuring filings are complete and accurate, managing payments, and acting as your point of contact with the tax authorities.

However, appointing a fiscal representative does not transfer legal responsibility—the taxable person remains liable for VAT compliance. What it does provide is a structured, proactive process that significantly reduces the risk of penalties, operational interruptions, and reputational damage. In a competitive EU market, this can mean the difference between constant firefighting and smooth, predictable growth.

How to Choose the Right Fiscal Representative

What to look for in a trusted partner

Choosing a fiscal representative isn’t just about ticking a legal box—it’s about finding a partner who can genuinely protect your business in a complex VAT environment. While VAT is harmonised under EU law, each Member State implements the rules differently. Your representative should have in-depth knowledge of national implementation differences, including any unique procedural steps, language requirements, or country-specific VAT schemes.

Experience in your specific industry is another plus—it means your representative can anticipate the compliance challenges that are most relevant to your operations.

A strong working relationship with the local tax authorities can also be valuable. While there’s no official preferential treatment—all businesses are expected to be treated equally—experienced representatives know how to navigate processes efficiently, who to contact for specific matters, and how to prepare documentation in a way that reduces back-and-forth delays.

Proactive compliance monitoring is a must. This includes tracking country-specific VAT deadlines, keeping an eye on Intrastat and EC Sales List thresholds, monitoring changes in financial guarantee rules for fiscal representatives, and alerting you to any legislative changes that could affect your business.

Red flags to watch out for

Not all fiscal representatives operate to the same standard. Be cautious if a provider is vague about their fees or unwilling to offer a clear service agreement—this can hide unexpected charges or gaps in service scope. Poor communication, slow response times, or reluctance to provide references are also warning signs.

If they cannot clearly explain how joint liability works in the countries where you operate—or if they overlook the fact that liability rules vary (some jurisdictions require a bank guarantee, some cap liability, others impose full joint and several liability)—that’s a signal they may not be equipped to protect your interests.

Finally, be wary of firms claiming to cover multiple countries without a strong local presence or qualified in-country partners. Some multi-country providers work through certified local offices or trusted partners, which can be an advantage. But without that infrastructure, the quality of service and local knowledge can suffer.

Why we’re the right representative for your business

At this point, you know how much is at stake when it comes to VAT compliance. That’s why we position ourselves not just as a service provider, but as a compliance partner invested in your success. We combine deep local knowledge with a proven record of accurate, on-time filings, and we maintain efficient working relationships with tax authorities in multiple EU countries. Our team monitors legal changes daily, meaning you’re never caught off guard by new requirements.

We believe in transparent pricing, clear communication, and a proactive approach to managing your VAT obligations. Whether you need full general representation or a reduced-scope representation arrangement where permitted by local law, we adapt our services to match your business model and growth plans.

In short: we take on the complexity so you can focus on scaling your business confidently—knowing your compliance is in expert hands.

Conclusion

Navigating VAT compliance in the EU is not just a matter of filling out forms and meeting deadlines—it’s about ensuring your business has the right structure, safeguards, and local support to operate smoothly across borders. Fiscal representation sits at the heart of this process for many companies, acting as both a legal requirement and a practical tool for reducing risk. Whether it’s securing your VAT registration, filing accurate returns, or communicating with tax authorities, a capable fiscal representative keeps you compliant and shields you from costly errors.

But the value goes well beyond simply avoiding penalties. The right representative can be a strategic asset, smoothing your entry into new EU markets, unlocking cash-flow benefits like import VAT deferment, and removing language or procedural barriers that could otherwise slow down your operations. This kind of support doesn’t just help you meet the law—it helps you move faster, plan more confidently, and focus your time on growing your customer base.

If your business is already operating in multiple EU countries, or if you’re preparing to enter a new market, now is the time to assess your fiscal representation needs. Map out where you trade, identify any local requirements, and evaluate whether having a representative—mandatory or not—could make your life easier and your business more efficient.

And remember, you don’t have to navigate this alone. With the right partner by your side, VAT compliance stops being a headache and becomes a competitive advantage. If you’re ready to take the complexity off your plate and put your focus back where it belongs—on your customers—we’re here to help make that happen.