Step-by-step guide: VAT OSS quarterly filings and common errors

Spis treści

The VAT One Stop Shop (OSS) scheme was created to make this easier. Instead of juggling multiple registrations, you can handle VAT for all your EU sales through a single portal in one country. That means less admin, fewer headaches, and more time to focus on running your business.

For young e-commerce owners in Poland, especially those just starting to scale beyond borders, OSS is more than just a convenience. It’s a tool that can keep your company compliant while you grow.

The key to staying compliant

While OSS simplifies things, it doesn’t eliminate your responsibilities. To use the scheme properly, you need to make sure you register in the right way, keep detailed sales records, apply the correct VAT rates depending on where your customers are located, and submit quarterly filings on time.

Missing any of these steps can lead to penalties, audits, or even exclusion from the scheme, which would put you back in the old system of multiple registrations. That’s why understanding the rules upfront is essential.

What you will learn in this guide

This article is designed as a step-by-step companion for business owners who want to master VAT OSS. We’ll walk through the process from registration to record-keeping, preparing and submitting returns, making payments, and correcting errors. Along the way, we’ll also cover the most common mistakes sellers make — things like applying the wrong VAT rates or missing deadlines — and show you how to avoid them.

By the end, you’ll not only know how OSS works but also feel confident that you can handle your quarterly filings without unnecessary stress.

Understanding VAT OSS: A Quick Overview

What is VAT OSS?

The One Stop Shop, often shortened to VAT OSS, is an EU-wide system designed to simplify how businesses handle value added tax on cross-border sales to private customers. In simple terms, it’s a single portal where you can declare and pay VAT for all sales within the EU, instead of registering separately in each country where your customers live.

Before OSS was introduced, if you sold even a small number of products to Germany, France, or Spain, you were technically required to register for VAT in each of those countries once you passed their local thresholds. That meant dealing with foreign tax offices, filling out forms in different languages, and paying accountants abroad. For small online shops, this was often overwhelming and sometimes made expansion into other EU markets feel impossible.

With OSS, the process has been streamlined. You only need to register once in your home country (for Polish sellers, that means with the Polish tax office). From there, you file a single quarterly return that includes all of your EU sales, and the system ensures the VAT is allocated to the correct country.

Who needs to use VAT OSS?

OSS is aimed at businesses selling directly to consumers in other EU countries. If you run a Polish e-commerce shop and send goods to private customers in France, Italy, or any other EU Member State, you fall under this system once your cross-border sales exceed the EU-wide threshold of 10,000 EUR per year.

There are two main versions of OSS, depending on where your business is established:

- Union OSS is for companies based in the EU, like Polish online stores. This applies to most small and medium-sized e-commerce sellers.

- Non-Union OSS is for businesses located outside the EU that sell to EU consumers. Think of an American brand shipping directly to customers in Germany or Spain.

For young Polish sellers, it’s almost always the Union OSS that matters. The system is optional, but in practice, once you start selling abroad and pass the 10,000 EUR threshold, registering is the only sensible way to stay compliant without drowning in administration.

Benefits of the scheme

The biggest advantage of VAT OSS is simplicity. Instead of juggling multiple VAT registrations and deadlines across Europe, you only deal with the Polish tax office. That means fewer forms, less bureaucracy, and no need to hire accountants in every country where you make sales.

Another benefit is the single payment system. You submit your return once per quarter, make one payment, and the Polish tax office distributes the money to the tax authorities of other EU countries. From your perspective, it feels like paying VAT domestically, even though you’re covering obligations across the whole EU.

Finally, OSS helps you stay compliant as your business grows. Expanding into new markets is less risky when you know that VAT reporting won’t spiral out of control. This can give young entrepreneurs the confidence to explore selling in countries they might have avoided before because of tax complexity.

Step 1 – Registration for VAT OSS

Choosing the Member State of identification

The first step in using the OSS scheme is registering in the right place. Every business must choose a “Member State of identification,” which is the EU country where the company is established. This country becomes your main point of contact for all OSS obligations. From then on, you file your quarterly returns through its tax portal and make a single payment that is redistributed to the tax authorities in all other Member States where your customers are located.

To give a concrete example: if your company is based in France, you register in France; if your shop is established in Poland, you register in Poland. Each country has its own designated authority for handling OSS filings.

Union vs Non-Union OSS explained

The OSS framework is divided into two systems. Union OSS applies to businesses established within the EU. It covers distance sales of goods to consumers in other EU countries as well as certain digital services. For most EU-based e-commerce shops, this is the relevant scheme.

Non-Union OSS applies only to non-EU businesses that supply services, such as digital subscriptions or online courses, directly to EU consumers. It does not cover goods. When non-EU companies sell physical products to customers in the EU, those transactions may instead fall under the Import One Stop Shop (IOSS) scheme, but only if the consignment value does not exceed 150 EUR.

For EU sellers, it is Union OSS that matters most, but knowing the distinction helps avoid confusion when reading about VAT systems that involve third-country businesses.

Required documents for registration

Although OSS is designed to simplify VAT reporting, registration still requires you to provide certain information. Typically, this means showing proof of establishment in your Member State of identification, usually through your existing VAT number. You must also provide your business name, registered address, and contact details, as well as confirmation that you are making cross-border B2C sales that qualify for OSS. Once this information is submitted, the national tax office reviews your application. If everything is correct, you are officially enrolled in the OSS scheme and gain access to the electronic portal where returns will be filed.

Backdating rules and notification deadlines

Many businesses worry about what happens if they pass the threshold for OSS but forget to register right away. The rules do allow for backdating, but only if you act quickly. If you exceed the EU-wide threshold of 10,000 EUR and make your first OSS-eligible sale, you must notify your Member State of identification by the tenth day of the following month. Meeting this deadline ensures that your registration applies retroactively from the date of that first sale.

If you miss the deadline, the registration will only apply from that point forward. Any earlier transactions would then need to be declared under local VAT registrations in each country where you sold to customers, which adds complexity and cost. For growing e-commerce businesses, this can be a serious setback, so it’s vital to monitor sales carefully and register for OSS as soon as you approach the threshold.

Step 2 – Record-Keeping Requirements

Mandatory 10-year record retention

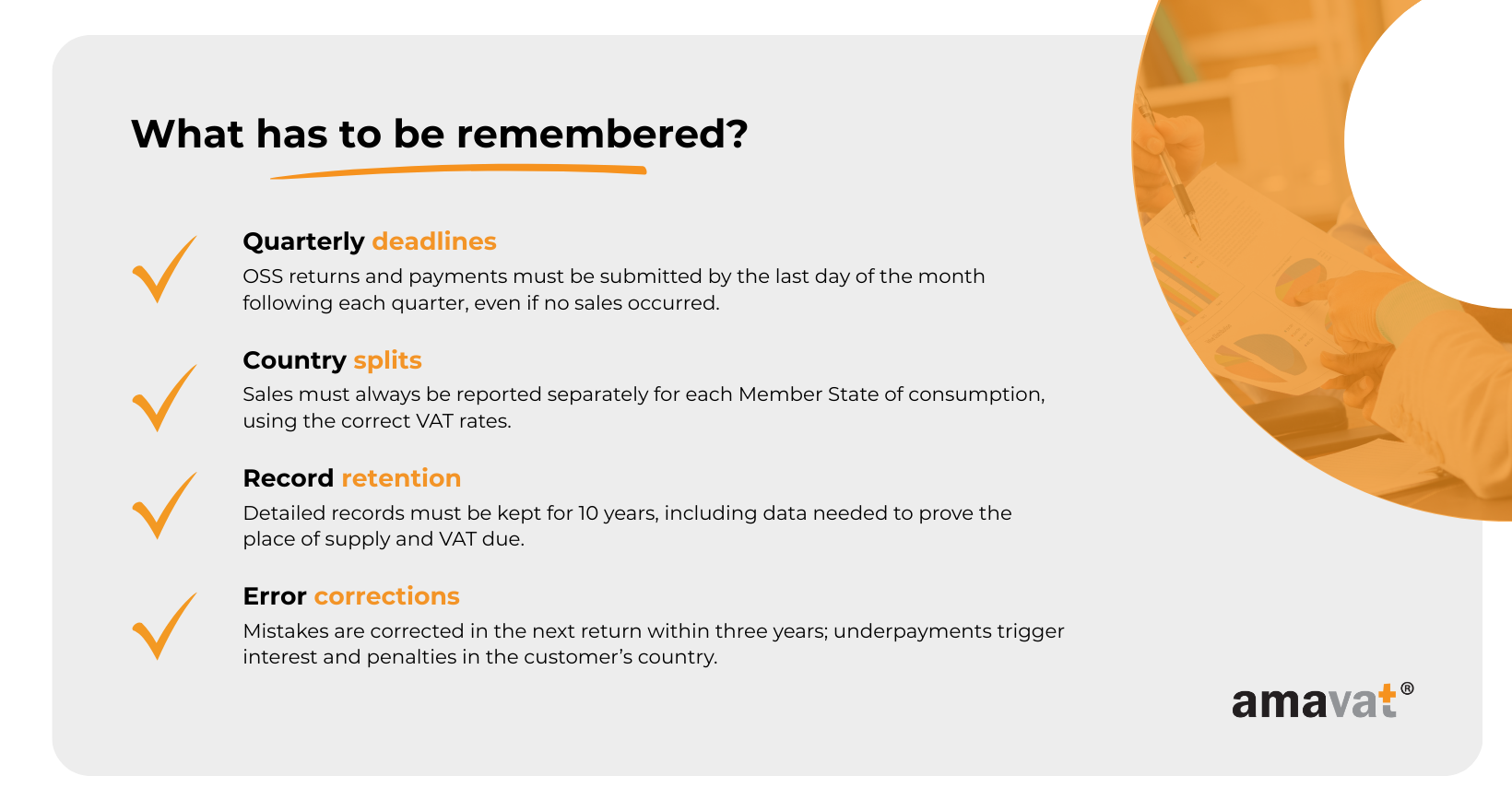

When you register for the OSS scheme, you also commit to maintaining detailed records of your cross-border sales. These records must be kept for ten years from the end of the year in which the transaction took place. The length of this period reflects the fact that tax authorities in different EU Member States may need to check your filings years later. During that time, your records must be accessible and ready to present if requested. Electronic storage is allowed and often the most practical option, but it must be secure, well-organised, and backed up so that nothing is lost.

What needs to be recorded

The OSS rules require you to keep enough information to allow tax authorities to verify the place of supply and the VAT due. At a minimum, this means keeping the Member State of consumption, the type of supply (goods or services), the date of the transaction, the taxable amount, the VAT rate applied, the amount of VAT due, the date and amount of payment received, and any subsequent increase or reduction of the taxable amount.

Supporting documentation also plays an important role. For goods, this can include proof of dispatch or delivery to show that the sale was cross-border and therefore falls under OSS. For digital services, at least two non-contradictory pieces of evidence must be kept to establish the customer’s location — for example, a billing address combined with an IP address. These details ensure that VAT has been calculated using the correct country’s rate.

Importance of splitting sales by country

OSS returns must be completed separately for each Member State where your customers are located. You cannot simply report one total figure for the entire EU. That means your accounting records need to clearly separate transactions by country of consumption.

Without this breakdown, preparing your quarterly OSS return becomes almost impossible, and mistakes are likely to occur. For many small e-commerce businesses, this is where manual spreadsheets start to show their limits. Automating the process with accounting software that can tag sales by destination country makes compliance much easier and reduces the risk of errors. Proper organisation at this stage also saves considerable time when deadlines approach, freeing you up to focus on running your business instead of scrambling to fix incomplete records.

Step 3 – Preparing quarterly OSS returns

Reporting periods and deadlines

OSS returns are submitted on a quarterly basis. The reporting periods run from January to March, April to June, July to September, and October to December. The deadline for submission is always the last day of the month following the end of the quarter. That means the first quarter must be filed by the end of April, the second by the end of July, the third by the end of October, and the fourth by the end of January of the following year.

Importantly, the obligation applies even when no cross-border sales have taken place during the period. Returns must be submitted even if no supplies have been made, otherwise the filing is considered missing. In addition, the VAT due must be paid by the same deadline. Filing without payment is treated as incomplete, and late payment can lead to interest charges or other penalties. For businesses, this means that both submission and payment should be treated as one compliance step, not two separate tasks.

What each OSS return must contain

The quarterly OSS return is designed to give each Member State a clear picture of the VAT due from sales made to its consumers. For that reason, sales must be reported separately for every country of consumption. If your business sells to customers in Germany, France, and Italy during the same quarter, each of those countries must appear as a distinct entry in your return.

For each Member State, you must report the taxable amount of sales, the VAT rate or rates applied (whether standard or reduced), and the VAT due. Any adjustments to previous transactions must also be included, for example credit notes or refunds issued to customers. This ensures that the return reflects the true net position for the quarter.

Once the return is submitted, the system generates a unique reference number. This number must be used when making your payment, because it links the return to the transfer of funds. Without it, payments can be delayed or misallocated, which in turn creates compliance risks.

Preparing an OSS return therefore requires more than recording sales totals. It requires a reliable system that can split sales by Member State, apply the correct VAT rates at the time of the transaction, and capture adjustments. Businesses that put these structures in place early find that quarterly filings become a routine task rather than a stressful scramble at the deadline.

Step 4 – Submission and payment

Filing through the electronic portal

Once your OSS return is ready, it must be submitted through the electronic portal of your Member State of identification — the EU country where your business is registered for OSS. Each country integrates OSS into its national online VAT platform, so the process usually feels like completing a domestic VAT return. You log in with your credentials, enter the required information for each Member State of consumption, review the figures carefully, and then submit. The portal automatically generates a unique reference number, often abbreviated as UNR, which connects your return to the payment that follows. Without this number, the system cannot reliably match the two steps.

The single payment mechanism

A key benefit of OSS is that you only make one payment, even if your sales span several countries. You transfer the total VAT due for all your EU sales to the tax authority of your Member State of identification. That authority then redistributes the money to the tax offices of the countries where your customers are located.

For example, a business registered in France pays the total VAT due to the French tax authority, which passes on the appropriate amounts to Germany, Italy, or any other relevant countries. A business registered in Poland pays into the account of Drugi Urząd Skarbowy Warszawa-Śródmieście, which handles redistribution for OSS on behalf of Poland. This centralisation saves time and removes the need for multiple bank transfers across the EU.

Timing of payments and avoiding late penalties

The deadlines for submission and payment are identical. Both must be completed by the last day of the month following the quarter being reported. Payments are considered timely only if they reach the tax authority’s bank account by the deadline and include the unique reference number generated by the OSS portal. If the number is missing or entered incorrectly, the payment may be treated as unpaid even if the money has arrived, which can lead to penalties.

Another important rule is that payments must be made in the currency of the Member State of identification. A seller registered in Germany must pay in euros, while a seller registered in Poland must pay in złoty. For businesses outside the eurozone, this often means dealing with exchange rates and ensuring transfers cover the exact amount due in the correct currency.

If your quarterly return shows no cross-border sales, you still need to submit the return, but in that case no payment is required. This distinction prevents confusion between nil returns and nil payments.

The safest approach is to plan ahead: schedule payments a few days before the deadline, double-check the UNR in the transfer title, and make sure the currency matches the requirement of your registration country. These small steps drastically reduce the risk of late-payment interest or compliance issues.

Step 5 – Correcting errors in OSS returns

How and when to correct errors

Even with well-structured processes, mistakes can slip through. You might apply the wrong VAT rate, record a sale under the wrong Member State, or forget to account for a refund. The OSS framework does not allow you to go back and edit a previously submitted return. Instead, all corrections must be included in your next quarterly OSS return. For example, if you notice an error in your first quarter filing, the adjustment must be made in the return for the second quarter. This method ensures that all changes are tracked consistently and remain transparent across Member States.

Time limits for amendments

The system also sets a firm time limit on corrections. Errors can be corrected for up to three years after the deadline of the original return. This gives businesses room to discover and fix mistakes that may only come to light later, but after this three-year period, amendments can no longer be made through OSS. At that point, unresolved discrepancies risk escalating into compliance issues. A good practice is to periodically reconcile your sales data with submitted returns, so problems are identified early and within the correction window.

Consequences of over- and under-declarations

When too much VAT has been declared, the excess is refunded by the Member State of consumption, not by the country where you are registered for OSS. Because the refund process depends on local procedures in that foreign tax office, it can sometimes take longer than a domestic VAT refund. Businesses should therefore expect timelines to vary from country to country.

If too little VAT has been declared, the shortfall must be paid, and any interest or penalties will be applied by the Member State of consumption. From the perspective of the authorities in that country, underpayment means lost revenue, which explains why these cases are treated with particular seriousness. Repeated errors, especially under-declarations, may lead to closer scrutiny and could even put continued access to the OSS scheme at risk.

Preventive advice

The best approach to error correction is to minimise the chance of errors in the first place. Applying the correct VAT rate at the point of sale, reconciling invoices against declared figures, and maintaining a clear audit trail all help reduce mistakes. An additional layer of protection is to keep sales data split not only by Member State but also by VAT rate, distinguishing between standard and reduced rates. Since this is the level of detail required in OSS filings, it makes both initial submissions and later corrections far easier to manage.

Common errors and how to avoid them

Misclassification of B2C vs B2B transactions

One of the most frequent mistakes in OSS reporting is mixing up sales to private consumers (B2C) with sales to businesses (B2B). The OSS scheme is designed only for B2C transactions. If a sale is actually B2B, different VAT rules apply, typically reverse charge mechanisms where the buyer accounts for VAT in their own country. Misclassifying a B2B transaction as B2C means charging VAT when you should not, and misclassifying a B2C transaction as B2B means underpaying VAT. Both scenarios distort your filings and can trigger audits.

To prevent this, make sure you clearly identify whether your customer is a business or a private consumer. Collecting and validating VAT identification numbers for B2B clients is a practical safeguard. Reconciling your invoices against customer data also helps, ensuring that each transaction is classified correctly before it ever reaches your OSS return.

Applying wrong VAT rates

Another common error is applying the wrong VAT rate. Since VAT rates vary across Member States, and often include multiple reduced rates alongside the standard rate, it is easy to make mistakes. The consequences can be costly: underpaying VAT leads to interest and penalties from the Member State of consumption, while overpaying ties up your cash flow and forces you into the slower refund process.

The simplest solution is to work with updated VAT rate tables and integrate them into your checkout or invoicing system. Automation tools can help ensure that the correct rate is applied based on the customer’s country and the type of goods or services sold. Regularly reviewing official sources or using software that automatically updates VAT rates reduces the risk of applying outdated information.

Missing country splits

OSS returns must show sales figures for each Member State of consumption. Reporting your sales as one EU-wide total is not acceptable. Failing to split sales correctly means incomplete returns and, in some cases, fines. This requirement may feel administrative, but it is central to the system, since each country must receive its share of VAT revenue.

For small businesses, the practical solution is to use accounting software or e-commerce platforms that can automatically tag and aggregate sales by country. This not only ensures accuracy but also saves time during quarterly reporting. Without such tools, manual country-by-country aggregation quickly becomes unmanageable as sales volumes grow.

Missed filing deadlines

OSS operates on strict quarterly deadlines. Missing one deadline creates problems, but missing several can have even more serious consequences. A business that fails to submit returns on time three times within a two-year period risks being excluded from the scheme altogether. If that happens, the company would once again need to register for VAT in each country where it sells, which brings back the complexity that OSS was designed to avoid.

The best way to stay on track is to treat OSS deadlines as fixed dates in your business calendar. Setting up reminders, using compliance software with deadline alerts, or simply blocking time in your workflow each quarter are simple but effective measures. Consistency is key — once the process becomes routine, the risk of missing deadlines drops sharply.

Poor record-keeping

Finally, poor record-keeping is a mistake that often goes unnoticed until it becomes a problem. Without detailed records, you cannot substantiate your OSS returns if questioned by tax authorities. Inconsistent or incomplete records also make it far harder to prepare accurate returns, which increases the risk of errors.

Good practice involves creating standardised templates for recording sales data, ensuring that transactions are split by Member State and VAT rate, and conducting periodic internal reviews. Even small shops benefit from a simple but consistent system. Regular checks mean errors are spotted before they snowball into compliance issues. With proper record-keeping, you can both defend your returns in case of an audit and streamline the filing process quarter after quarter.

Conclusion

Managing VAT under the OSS scheme may feel like an administrative hurdle at first, but with the right approach it becomes a predictable and manageable process. The five steps outlined in this guide — registering in your Member State of identification, keeping records that meet the ten-year requirement, preparing quarterly returns with country-by-country breakdowns, submitting and paying through the electronic portal, and correcting errors in the next return when they arise — together form the backbone of compliance.

What ties all these steps together is the need for accuracy, timeliness, and careful record-keeping. Submitting late, applying the wrong VAT rate, or failing to keep adequate documentation are the mistakes most likely to lead to penalties or audits. By contrast, a business that treats VAT reporting as a regular part of its operations, rather than a last-minute scramble, not only stays compliant but also avoids unnecessary stress.

The OSS system was created to make cross-border e-commerce simpler. To take full advantage of it, sellers should consider adopting compliance tools that automate VAT rate application and reporting, or working with accounting software that can generate country-specific sales reports. For growing businesses, professional advice from tax specialists can also provide peace of mind, especially when handling complex sales scenarios.

Above all, it is important to stay informed. VAT rules evolve, and what is correct today may be updated tomorrow. Following official guidance and keeping an eye on changes ensures you remain compliant as your business expands. With OSS in place, e-commerce sellers across the EU have a real opportunity to grow confidently, knowing that VAT reporting no longer has to be a barrier to scaling across borders.