Amazon FBA and VAT in Belgium

Spis treści

In practice, VAT means the country where you actually sell your products or store them has the right to collect tax on those sales. For cross-border sales within the EU, the system is complex — but predictable. If your products physically sit in a warehouse in a given country, you’re obliged to handle VAT there. FBA allows inventory to move between warehouses in different countries, so the exact place your products “live” matters a great deal for where you must be registered for VAT.

For years, Belgium didn’t top many sellers’ priority lists. The first steps usually led to Germany, France or Italy — large customer bases with mature e-commerce ecosystems. That started to shift when Amazon launched its Belgian marketplace, Amazon.be. From that moment, Belgium took on a new relevance for sellers using FBA.

Belgium may be smaller than Germany, but it has advantages that draw in EU-based merchants. It’s one of the best-connected logistics hubs in Western Europe — quite literally at its heart. Amazon’s Belgian facilities enable faster delivery not only to Belgian buyers, but also to neighbouring markets such as the Netherlands, Luxembourg and northern France. Meanwhile, Belgian consumers have grown steadily more comfortable buying online, and Amazon.be quickly gained traction as a safe, convenient place to shop.

All of this has led many FBA sellers to direct inventory to Belgian Amazon warehouses — sometimes without realising they were triggering tax obligations. From 2024, Amazon introduced very clear rules: if you store goods in Belgium or sell there via FBA, you must be registered for Belgian VAT. This isn’t discretionary. Amazon requires every seller operating in the country to provide a Belgian VAT number or document that they are using the OSS (One Stop Shop) scheme.

That requirement came into force on 1 January 2024, and it’s more than a box-ticking exercise. As a marketplace operator, Amazon is legally obliged to verify that sellers trading on its platform comply with tax rules. In practice, if you don’t have a Belgian VAT number and cannot show that you report your sales through OSS, Amazon may suspend your selling account or block you from sending goods to Belgian warehouses.

The change caused confusion among many businesses using the Pan-European FBA model. In this setup, Amazon decides where to place your stock — it might be Germany, France, Spain, and now very possibly Belgium. For plenty of sellers, that meant suddenly needing to register for VAT in yet another country, even if they never planned to operate there directly.

That’s why Belgian VAT has become such an urgent topic. This isn’t about abstract tax theory; it’s about a very practical question: what, exactly, do you need to do to sell legally and confidently on Amazon if your goods can end up in a Belgian warehouse? How long does registration take? What does it cost? What does ongoing reporting look like, and how do you keep up with rules that seem to change year after year?

In this article, I’ll answer those questions step by step, explaining what you need to know about Belgian VAT as an Amazon FBA seller operating within the EU. I’ll show when registration is mandatory, which documents you’ll need, how the reporting process works, what VAT rates apply in Belgium, and what happens if you ignore these obligations.

This won’t be a dry tax lecture. It’s a practical guide to how the Belgian VAT system works, what it really means for e-commerce sellers, and how you can prepare to avoid headaches. VAT may never be a headline-grabber, but understanding it can be one of the most important steps toward building a stable, compliant and scalable Amazon business.

When You Need to Register for VAT in Belgium

For many Amazon FBA sellers, the topic of VAT registration in Belgium surfaces suddenly — usually when Amazon sends an email informing you that your products have been moved to a Belgian warehouse. In practice, that message means one thing: you are now required to register for VAT in Belgium, because a taxable event has been triggered. This isn’t a matter of interpretation, but a direct result of EU tax law, which treats the movement of your own goods between member states as a “transfer of own goods” — in other words, a deemed intra-Community supply and acquisition.

This mechanism is what makes simply storing goods in Belgium enough to create a VAT registration obligation — even if you haven’t yet sold a single item there.

Storing Goods in Amazon’s Belgian Warehouses

If you use the Pan-European FBA programme, Amazon has the right to redistribute your inventory between its fulfilment centres across the EU. You don’t control that process — which means your products might end up in Belgium, even if you never planned to target that market.

From the perspective of the Belgian tax authorities, this counts as a non-transactional transfer of own goods. Under EU VAT rules, it’s as if you “sold” your goods from one country (for instance, Germany) to another (Belgium), even though they remain your property.

This movement triggers two obligations:

– Registration for VAT in Belgium

– Submission of periodic VAT returns and, in some cases, Intrastat reports

Amazon doesn’t leave room for interpretation here. Under both EU and Belgian law, you must hold a Belgian VAT number if your goods are physically stored there. The OSS (One Stop Shop) system doesn’t apply in this case, because OSS is designed solely for distance sales (B2C sales from one EU country to another) — not for storing stock.

In short: if your products are in an Amazon warehouse in Belgium, you must be VAT-registered there, file Belgian VAT returns, and report your intra-Community transfers accordingly.

Distance Sales Above the €10,000 Threshold

Another situation applies to sellers who don’t store stock in Belgium, but ship products from another EU country to private customers (B2C) within the EU. In that case, a common EU-wide threshold of €10,000 applies to the total annual value of all cross-border distance sales.

As long as your yearly turnover from such cross-border B2C transactions (EU-wide) stays below €10,000, you can continue to handle VAT in your home country. Once you exceed that threshold, however, VAT becomes due in the countries of consumption — that is, in the countries where your customers are located.

This is where the One Stop Shop (OSS) scheme comes in handy. It allows you to avoid separate VAT registrations in each EU country. Instead of registering in Belgium, France or Italy individually, you can report all your EU B2C distance sales through one quarterly OSS VAT return in your home member state.

However, an important rule applies: OSS does not replace local registration if you keep stock in another country. If your goods are physically in Belgium — for instance, in an FBA warehouse — you cannot rely solely on OSS. You still need a Belgian VAT number.

The €25,000 Threshold and the New SME VAT Regime

Belgium currently operates a VAT franchise for small businesses, allowing companies established in Belgium to remain outside the VAT system until their annual turnover exceeds €25,000. This simplified scheme means that small Belgian firms below that limit don’t need to charge VAT or submit returns.

However, from 2025, a new EU-wide SME VAT regime will come into force, extending this principle to small businesses from other member states. This means that a company established elsewhere in the EU could also benefit from the simplified VAT exemption if:

– its total annual turnover across the EU does not exceed €100,000, and

– its annual turnover in Belgium does not exceed €25,000.

This new framework is intended to make life easier for micro-entrepreneurs operating across borders. Still, it does not apply if you store inventory in Belgium (such as through FBA). In that case, standard VAT registration remains mandatory.

VAT Obligations for Non-EU Sellers

If you operate a business based outside the European Union — for example, in the United Kingdom, the United States or Canada — and you sell goods to Belgian customers through Amazon, you may still be subject to Belgian VAT.

If your goods are shipped from within the EU to Belgium, you can usually handle VAT via the Union OSS scheme, provided that you do not store stock in Belgium. It’s a convenient solution that eliminates the need for a local VAT registration.

However, if your products are stored in a Belgian Amazon warehouse, local VAT registration becomes mandatory — regardless of whether your company is based in or outside the EU.

For non-EU businesses, there’s an additional requirement: you must appoint a fiscal representative in Belgium. This is a Belgian-registered company or tax advisor who shares joint responsibility for your VAT compliance before the Belgian tax authorities. In practice, such representatives often require a financial guarantee or security deposit, though the amount isn’t set by law. It’s agreed case by case, depending on your business volume and perceived risk.

If you sell goods from outside the EU directly to Belgian consumers — for instance, from the UK or China — you can use the Import One Stop Shop (IOSS) scheme, as long as the value of each shipment does not exceed €150. The IOSS is optional, but very practical: it allows you to collect VAT from the customer at the point of sale, preventing import delays and additional fees. If you choose not to use IOSS, VAT will be collected by the courier or postal operator (e.g. DHL or FedEx) at the border.

Practical Examples

Imagine you run a company based in an EU country and use the Pan-European FBA programme. Amazon transfers part of your inventory to a Belgian warehouse to shorten delivery times. At that moment, you must be VAT-registered in Belgium — even if you aren’t yet actively selling to Belgian customers. The simple fact that your stock is stored there creates a tax obligation.

Now consider another case: your goods are stored in your home country, but you sell to Belgian retail customers (B2C). Once your total EU cross-border sales exceed €10,000 in a year, you can report Belgian VAT through the OSS system — without registering locally in Belgium.

A third scenario: you’re a UK-based business sending goods from Germany to Belgium. You can still use the OSS scheme as long as you don’t keep stock in Belgium. The moment Amazon relocates part of your inventory to a Belgian fulfilment centre, however, local VAT registration becomes mandatory.

Finally, if you send goods directly from a non-EU country to a Belgian consumer, you may (but don’t have to) use IOSS. If you don’t, VAT will be charged by the courier or the Belgian customs authorities when the goods enter the EU.

VAT Obligations When Using Amazon FBA

Using Amazon FBA offers major logistical advantages — Amazon handles warehousing, packing and delivery for you. But in tax terms, that convenience has a cost. Amazon manages your inventory across the entire EU, and every transfer of stock between countries carries VAT consequences. In practice, the FBA system often creates registration obligations in several member states, sometimes without you even realising it.

How the Pan-European FBA System Works and Its Tax Consequences

The Pan-European FBA programme allows Amazon to store your products in various EU countries and automatically dispatch them from the warehouse closest to the customer. You don’t choose where your stock goes — Amazon’s logistics network does.

From a VAT perspective, each movement of goods between EU countries is considered a non-transactional movement of own goods. It’s not a commercial sale but a fictional tax event: in one country you record an intra-Community supply (with a 0% rate), and in the destination country an intra-Community acquisition.

Under Article 17 of the EU VAT Directive (2006/112/EC) and Belgian tax administration guidance (SPF Finances – Administration de la TVA), both this “supply” and “acquisition” must appear in your VAT returns. The fact that the goods remain yours and no actual sale took place doesn’t matter — the tax authorities treat it as a reportable operation.

In practice, it works like this:

– In the country where the goods were shipped from (for example, Germany), you declare an intra-Community supply (WDT) with a 0% VAT rate.

– In the country where the goods arrived (in this case, Belgium), you declare an intra-Community acquisition (WNT), applying Belgian VAT (normally 21%, or a reduced rate if applicable).

In Belgium, the WNT must be reported in fields 82–83 of the VAT return, while WDT transactions (supplies from Belgium to other EU countries) are reported both in the VAT return and in the EC Sales List (listing intracommunautaire), filed via the Intervat portal.

This means that if Amazon transfers part of your inventory from Germany to Belgium, you are required to:

– hold a Belgian VAT number,

– submit periodic Belgian VAT returns,

– report both WDT and WNT transactions, and

– file Intrastat reports where applicable.

Amazon does not handle these filings for you. The platform only provides detailed reports from which you (or your accountant) must prepare the VAT declarations. The most important of these are the FBA Inventory Event Detail Report and the FBA Inventory Movement Report — these show every cross-border movement of your stock between EU warehouses.

“Non-Transactional Movements of Goods” — How to Report Them

From a formal perspective, every transfer of your stock under FBA counts as a “non-transactional” intra-EU movement. The principle is straightforward:

- Country of dispatch (e.g. Germany): report an intra-Community supply (WDT) at 0%, assuming you hold a valid VAT number there.

- Country of arrival (e.g. Belgium): report an intra-Community acquisition (WNT), applying Belgian VAT at 21% (or the applicable reduced rate).

The VAT due and deductible from WNT normally offset each other, meaning there’s no actual payment to the tax office. However, the movement must still appear in your VAT declaration.

In Belgium, there is no exemption threshold for such movements — even microbusinesses must report them. Only Belgian-resident businesses can benefit from the local VAT exemption for small enterprises (up to €25,000 per year), and this does not extend to foreign Amazon FBA sellers.

Intrastat Reporting — Thresholds and Obligations

In addition to VAT declarations, some businesses are also required to submit Intrastat reports. These are not tax documents but statistical reports used by Belgium’s national statistics office, Statbel, to monitor the flow of goods within the EU’s internal market.

The obligation to file Intrastat arises when the total annual value of arrivals (imports from other EU countries) or dispatches (exports to other EU countries) exceeds a specific threshold.

From 2025, the thresholds are:

– €1,500,000 for arrivals (imports),

– €1,500,000 for dispatches (exports),

with a simplified reporting threshold of €400,000 for companies under the basic Intrastat regime.

In practice, most smaller FBA sellers do not reach these levels. However, businesses moving large volumes of goods between Amazon warehouses across Europe may indeed cross the threshold and become subject to monthly Intrastat reporting. These reports are also submitted through Belgium’s Intervat platform.

Why One VAT Registration Is Not Enough Across Countries

A common question among new Amazon sellers is whether it’s enough to have a single VAT registration in one EU country — for instance, Germany, where Amazon has major warehouses. Unfortunately, the answer is clear: no, it’s not enough.

Under Articles 32 and 33 of the EU VAT Directive, VAT is due in the country where the goods are located at the time of sale or storage. This means that if your products are physically in Belgium, Belgium has the right to tax those sales.

The OSS (One Stop Shop) system simplifies distance sales (B2C) across borders, but it does not cover the physical storage of goods. That’s why OSS cannot replace local VAT registration in countries where your stock is held.

If you’re part of the Pan-European FBA programme, your goods can be moved at any time between warehouses in Belgium, France, Italy, Spain, or the Netherlands. Each of these countries requires its own VAT number — and therefore its own registration, reporting, and compliance procedures.

This may sound bureaucratic, but there’s a logic behind it: every EU member state considers goods located on its territory as part of its tax system. That’s why Amazon requires sellers to maintain an active VAT number in every country where their inventory is stored.

Failing to register for VAT in the country where your goods are kept is a serious breach of EU tax law and carries significant risks. As a marketplace operator, Amazon is legally obligated to verify VAT compliance. If you don’t provide a valid Belgian VAT number, your account could be suspended, or you may be removed from the Pan-European FBA programme entirely.

For small and medium-sized sellers, the best approach is proactive planning. If you know your products may be stored in Belgium, France, or Italy, start your VAT registration process early. This will save you from downtime, stress, and unnecessary costs.

In essence: the Pan-European FBA system is a powerful sales tool, but from a tax perspective, it requires careful management. Every stock transfer between EU countries creates a deemed intra-Community supply and acquisition (WDT/WNT), which must be reported in VAT returns. Amazon won’t do it for you. A single VAT registration isn’t enough — you need as many as the number of countries where your goods are physically stored.

It may seem complicated, but understanding these principles is key to running a compliant, stable and scalable FBA business across Europe.

VAT Rates in Belgium

Belgium’s VAT system is structured around four main rates: 21%, 12%, 6%, and 0%. Each applies to different categories of goods and services, and applying the correct rate is crucial in e-commerce. For Amazon FBA sellers operating cross-border within the EU, knowing which VAT rate applies in Belgium is not just a compliance issue — it directly impacts your pricing, margins, and profit structure.

The Standard Rate — 21%

Belgium’s standard VAT rate is 21%, applying to the vast majority of goods and services on the market. This is the rate that will apply in most Amazon FBA transactions. It covers consumer products such as electronics, clothing, cosmetics, furniture, homeware, toys, tools, and household appliances. It also applies to digital services — including software, mobile apps, e-learning courses, and streaming services.

For e-commerce sellers, this is the default rate. In practice, if you are unsure whether your product qualifies for a reduced rate, you should always apply the 21% rate until you receive confirmation from the Belgian tax authorities (Service Public Fédéral Finances) or a professional tax advisor. That’s the safest option.

The Reduced Rate — 12%

The 12% VAT rate applies to a narrower range of goods and services, mainly those with a social or infrastructural purpose. It covers restaurant services, catering, and ready-to-eat meals, as well as domestic electricity, gas, and heating supply, and certain agricultural products or materials used in social housing projects.

In the context of e-commerce, this rate rarely applies, as it’s mostly linked to local services rather than goods. You might encounter it only if you operate a food delivery business or sell prepared meals locally in Belgium.

The Reduced Rate — 6%

Belgium’s lowest reduced rate, 6%, applies to goods and services considered essential for everyday life. This includes most food products (bread, meat, dairy, fish, fruit, vegetables, drinking water), books and e-books, pharmaceuticals and medical equipment, orthopaedic and rehabilitation products, passenger transport, hotel accommodation, and cultural or sporting events.

Belgium does not distinguish between raw food and prepared meals for VAT purposes — all food products are taxed at 6%, while catering services are taxed at 12%. This distinction is particularly relevant for FBA sellers planning to distribute food, supplements, or diet products.

Belgium also applies a unified VAT rate for printed and digital books, meaning e-books and audiobooks are taxed the same way as physical publications. However, dietary supplements and functional foods may fall under different classifications. Depending on how they are listed in the Belgian TVA Tariefboek (VAT Tariff Book), they may be subject either to 6% or 21% VAT.

The Zero Rate — 0%

Belgium’s zero VAT rate (0%) has very limited application and is reserved for exports and international trade. It applies to goods sold outside the EU — for instance, to the UK, Norway, or Switzerland — as well as to intra-Community supplies within the EU, which are technically taxable but benefit from a 0% rate with the right to deduct input VAT.

The zero rate also applies to some international transport services, sales to international organisations, and certain print media, such as newspapers and periodicals published at least monthly and meeting specific informational, non-commercial criteria.

For Amazon FBA sellers, the 0% rate comes into play when shipping goods from a Belgian Amazon warehouse to customers outside the EU. To apply it, you must retain documented proof of export — typically a Movement Reference Number (MRN) from a Belgian customs declaration. Without this, the transaction cannot be treated as a 0%-rated export.

The Importance of VAT Rates for Amazon FBA Sellers

Understanding Belgian VAT rates isn’t just a formality — for FBA sellers, it directly influences pricing strategy, profit margins, and competitiveness. Applying the wrong rate can lead to underpaid tax, correction filings, and, in some cases, financial penalties. On the other hand, applying a rate that’s too high can make your products less competitive on price-sensitive marketplaces.

In practice, most Amazon FBA sellers across Europe apply the standard 21% VAT rate by default, at least until they can confirm that their products qualify for a reduced rate. The Belgian tax authorities regularly update classification guidelines, so it’s worth keeping an eye on official communications from the Service Public Fédéral Finances, especially if you operate in sectors such as organic food, supplements, pharmaceuticals, or digital publications.

To summarise: Belgium applies four VAT rates — 21%, 12%, 6%, and 0%. The standard rate covers most goods; the reduced rates apply to food, culture, healthcare, and social services; while the zero rate covers exports and intra-Community supplies. For an Amazon FBA seller, knowing how to correctly assign your product to the appropriate rate category is both a matter of compliance and a powerful tool for maintaining your tax security and competitive edge in the Belgian market.

The VAT Registration Procedure in Belgium

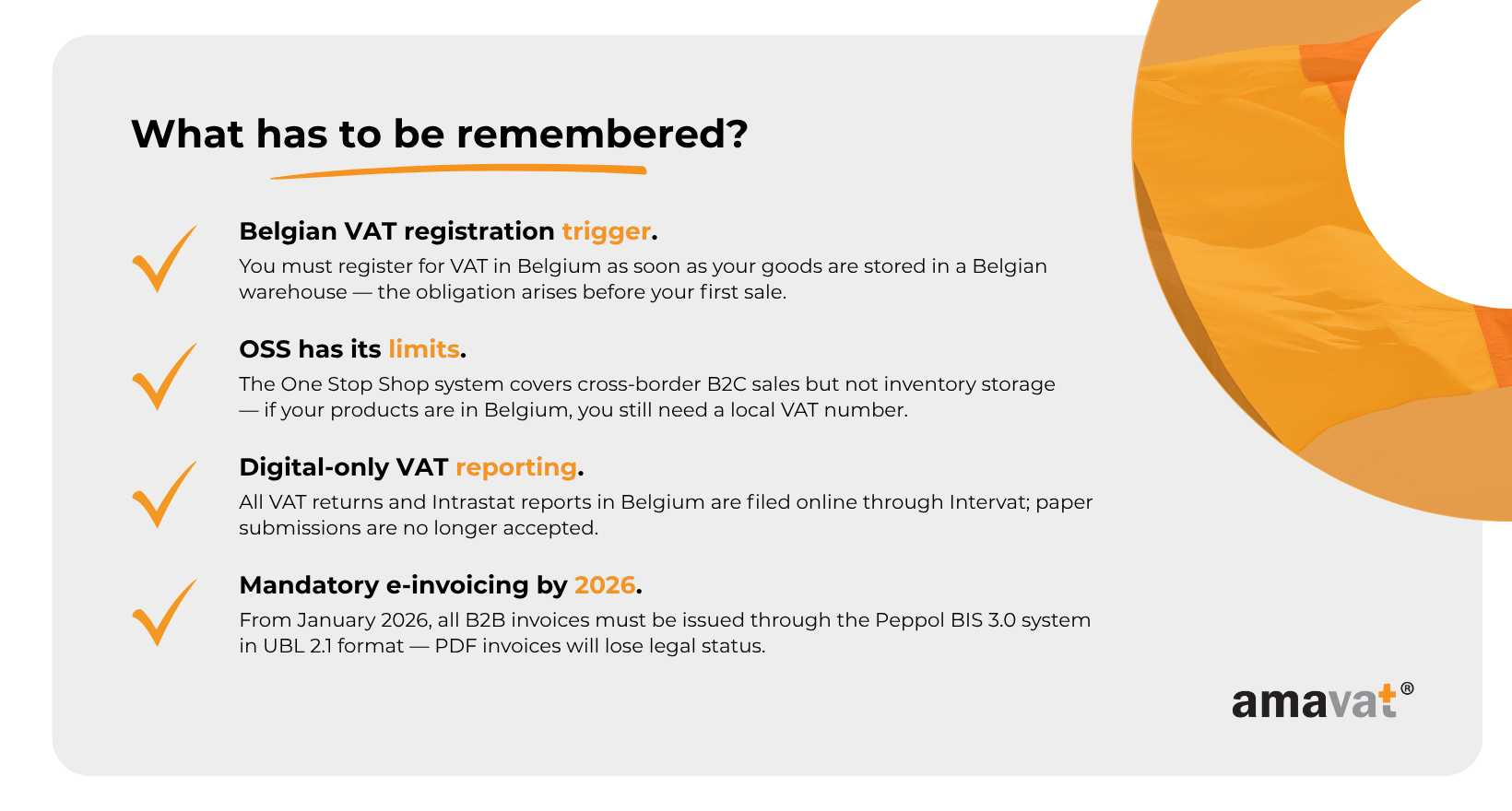

VAT registration in Belgium is a mandatory step for any seller who stores inventory in Amazon’s Belgian warehouses or sells directly to Belgian consumers. The obligation to register arises not when you make your first sale, but when your goods are first moved to a Belgian warehouse. This rule applies whether your business is based inside or outside the European Union.

The process is fully digital, though the specific steps and requirements vary depending on whether your company is EU-based or not.

Registration for EU-Based Companies

Businesses established within the European Union can register for Belgian VAT without appointing a fiscal representative. The process is carried out online via Belgium’s MyMinfin portal, using the Form 604A — the official VAT registration application.

This form requires basic details about your business, including company information, ownership structure, and the nature of your operations. If you sell through Amazon FBA, you must clearly indicate that your activity involves the storage and sale of goods via an e-commerce platform.

Once submitted, the application is handled by the Centre Étranger de Bruxelles (Bureau Étrangers) — a specialised branch of the Belgian tax administration responsible for foreign businesses. While most of the process is digital, the office may request additional documents to confirm the authenticity and substance of your business operations.

Belgian VAT numbers follow the format BE0XXXXXXXXX (prefix “BE” + ten digits, starting with zero). Your number becomes valid for EU cross-border transactions once it appears as “active” in the VIES system — only then can it be entered in your Amazon Seller Central account. Belgium no longer issues paper confirmation letters; registration status must be verified online via VIES.

Registration through MyMinfin is the standard route for EU businesses. Paper applications are accepted only in exceptional cases — for example, if digital submission is impossible. After approval, the company gains access to the official eBox system, where all correspondence from the Belgian tax office is received electronically.

Registration for Non-EU Companies

Companies based outside the EU must appoint a fiscal representative in Belgium (known as a représentant fiscal or fiscaal vertegenwoordiger). This is an authorised individual or firm recognised by the Belgian Ministry of Finance, empowered to act on the foreign company’s behalf. The representative is jointly liable for VAT compliance and communicates directly with the tax authorities.

The fiscal representative submits Form 604A on your behalf and coordinates the entire registration process. The tax office may request further documents confirming the legitimacy of the business relationship and the scope of responsibility.

In practice, fiscal representatives typically require a financial guarantee or deposit, usually around 10% of the estimated annual VAT liability. This amount is not fixed by law but determined by the representative’s risk assessment. Some firms accept a bank guarantee instead of a cash deposit, allowing businesses to avoid tying up liquidity.

Registration for non-EU businesses is handled by the Centre Étranger de Bruxelles, located at North Galaxy Tower, Boulevard du Roi Albert II 33, bte 42, 1030 Brussels. Inquiries can also be sent via email to foreignregistration@minfin.fed.be.

After verification, the company receives a Belgian VAT number in the standard BE0XXXXXXXXX format, which becomes active upon inclusion in the VIES database. Only then can the number be added to the seller’s Amazon account, allowing sales under the Pan-European FBA programme.

Required Documentation

To complete VAT registration in Belgium, businesses must submit documentation proving their legal existence and economic activity. The Belgian tax authorities place significant emphasis on demonstrating genuine commercial operations — a simple company registration extract is not enough.

The standard documentation package includes:

– a recent extract from your national business register,

– a valid VAT certificate from your home country,

– a copy of the owner’s or authorised representative’s ID,

– proof of registered business address (e.g. a utility bill or company document),

– and evidence of actual trading activity.

For Amazon FBA sellers, this typically includes screenshots from Amazon Seller Central, FBA inventory movement reports, purchase invoices, or proof of deliveries to Amazon fulfilment centres.

Registration Timeline

The processing time for Belgian VAT registration depends on your company type and the completeness of your documentation. For EU-based entities, the process typically takes four to six weeks, while for non-EU businesses it can take up to twelve weeks.

The authorities reserve the right to request clarifications or additional documents, which may extend the timeline. Registration is considered complete once the VAT number is activated in VIES. From that moment, you can start submitting VAT returns and reports through Belgium’s electronic systems.

In Belgium, all VAT returns and related filings — including EC Sales Lists and Intrastat reports — must be submitted electronically via the Intervat platform. The same portal is used for submitting corrections and handling VAT payments.

The Most Common Mistakes During VAT Registration

The majority of registration problems arise from formal errors in documentation. A frequent issue is the absence of a valid VAT certificate or incomplete information in Form 604A, particularly in the section describing the business activity. The Belgian tax authority requires a precise declaration that the seller operates via Amazon FBA and stores goods in a Belgian warehouse. Omitting this statement can lead to the application being rejected or returned for resubmission.

Another common mistake is starting the registration process too late. Many sellers begin shipping goods to Belgium or even start selling before obtaining their VAT number — a technical violation of Belgian tax law. The Belgian tax authorities consider the registration obligation to arise the moment goods cross the border and enter a Belgian warehouse, not when the first sale occurs.

A third issue involves incorrectly appointing a fiscal representative. Only tax advisors or firms authorised by the Belgian Ministry of Finance can serve as an official représentant fiscal. Working with an unapproved intermediary will result in your registration being automatically rejected.

Finally, sellers often forget that their VAT number must be active in the VIES database before Amazon recognises it as valid. Failure to activate the number or entering it incorrectly in Seller Central can lead to account suspension or exclusion from the Pan-European FBA programme.

VAT registration in Belgium isn’t difficult, but it demands accuracy, patience, and an understanding of how detail-oriented Belgian tax administration can be. When done properly, registration ensures compliance and opens access to one of the fastest-growing e-commerce markets in Europe.

VAT Reporting and Payments in Belgium

Belgium operates one of the most digitally integrated VAT systems in the European Union. Since 2024, all VAT-related processes — from registration to filing, payment, and correspondence — take place exclusively online. Paper forms have been fully discontinued.

Businesses now use three main platforms:

– MyMinfin, for registration and profile management;

– Intervat, for filing VAT returns and EC Sales Lists;

– eBox, a secure electronic mailbox for all communication with the Belgian tax authorities.

Reporting Frequency: Monthly and Quarterly

Belgian law allows for two reporting schedules — monthly and quarterly.

The monthly regime is mandatory for businesses with annual turnover exceeding €2.5 million. This category includes large e-commerce operators and high-volume Amazon FBA sellers.

Smaller companies below that threshold can report quarterly, submitting one return every three months and paying VAT in aggregate. This reduces filing frequency, but not responsibility: if the total VAT due exceeds €50,000 in a quarter, the tax office may revoke quarterly reporting rights.

Both monthly and quarterly VAT returns must be submitted on time. The Belgian tax administration treats even a one-day delay as a formal violation.

New Deadlines from 2025

As of January 2025, Belgium has updated its VAT filing deadlines:

– Monthly reporters must file and pay VAT by the 20th day of the month following the reporting period. For example, the January return is due by 20 February, February by 20 March, and so on.

– Quarterly reporters have until the 25th day of the month following the end of the quarter. This extension, introduced by a Royal Decree in March 2025, was designed to give businesses more time to finalise their accounting data and improve reporting accuracy.

Deadline Extensions and Penalties for Late Filing

Contrary to some assumptions, Belgium has not abolished automatic deadline extensions. If a due date falls on a weekend or public holiday, the deadline automatically moves to the next working day — as stipulated by Article 53 of the VAT Code and the Act of 10 June 1999 on tax deadlines.

However, the Belgian tax authorities have tightened enforcement. Even a single day of delay can trigger late-payment interest of 0.8% per month, in addition to an administrative fine ranging from €100 to €1,000, depending on the frequency of violations.

For Amazon FBA sellers, this means that VAT reporting should be automated or outsourced to professional accountants to avoid costly errors and delays.

The Intervat Platform — Submitting VAT Declarations

All VAT returns in Belgium must be filed electronically through the Intervat platform, hosted by the Belgian Ministry of Finance. Intervat handles both VAT returns and EC Sales Lists (intra-Community supplies). Intrastat reports, on the other hand, are submitted separately via the OneGate platform, managed by Statbel, Belgium’s statistical office.

Access to Intervat requires authentication via a Belgian eID or the European eIDAS system. As of early 2024, Belgium discontinued support for third-party certificates such as Isabel and Globalsign, leaving only these two secure login options.

Once logged in, users select the relevant reporting period, enter sales and purchase data, and confirm submission. The system then generates an electronic acknowledgment receipt, which must be retained for company records.

After filing, VAT must be paid directly to the Belgian Ministry of Finance. The payment must include a communication structurée — a structured reference number unique to each declaration — in the payment reference line. Without it, the payment cannot be matched to your return.

All corrections, refund requests, and additional reports are also submitted through Intervat, making it the central communication hub between businesses and Belgian tax authorities.

API and Digital Reporting — The Next Stage of Transformation

Belgium’s tax system is entering a decisive new stage of its digital evolution. In the final quarter of 2025, the Belgian Ministry of Finance is scheduled to launch a pilot phase of the Intervat API — an interface that will, for the first time, allow authorised accounting offices to submit VAT returns directly from their accounting or ERP software. This pilot will run under limited access, but the plan is clear: from the second half of 2026, the API will become available to all taxpayers, marking the full integration of accounting systems with the state’s tax infrastructure.

This change is part of a much broader agenda. In parallel with the new API, Belgium is preparing to roll out mandatory electronic invoicing in line with the Peppol BIS 3.0 standard. The implementation will be gradual and will start with the largest enterprises — from 1 July 2025, all companies with annual turnover above €9 million will be obliged to issue and receive invoices electronically. From 1 January 2026, the rule will extend to all B2B transactions, effectively phasing out paper and PDF invoices across the Belgian market.

The e-invoicing system will operate through the Peppol network, using the UBL 2.1 format, which is already recognised as the European benchmark for structured data exchange. The integration of Peppol with the Intervat platform will enable a flow of information that is not just automatic but immediate. Every invoice sent through Peppol will feed directly into the VAT system, meaning that in the near future, many fields in VAT returns will be pre-filled automatically by the administration.

In practice, this transformation will bring Belgium closer to real-time VAT reporting. The government’s ambition is not only to simplify compliance but also to prevent fraud, reduce manual data entry, and enhance the accuracy of returns. Once fully implemented, the system will operate as a continuous digital loop — from invoice creation, through accounting, to VAT declaration and reconciliation.

Digital Compliance and What It Means for Amazon FBA Sellers

For sellers operating under Amazon FBA, these technological reforms are far more than a background update. They redefine what it means to be compliant in the European digital marketplace. The direction of travel is clear: Belgium is turning its VAT system into a fully transparent, automated ecosystem, where every transaction, movement of goods, and tax declaration is synchronised in real time.

For sellers, this means greater transparency — but also greater accountability. Errors that once could be attributed to human oversight will be visible to tax authorities almost immediately. The same automation that simplifies reporting also tightens control. For FBA sellers, who already deal with multiple cross-border transfers of goods, this means the margin for error is narrowing fast.

To stay ahead of these changes, sellers should begin preparing now. Synchronising sales and accounting systems with Belgian requirements will be essential, particularly as both Peppol and Intervat move toward full interoperability. Amazon transactions, invoices, and VAT data will need to align seamlessly. Automating the flow between your sales platform, accounting software, and tax filings will soon be not a luxury but a necessity.

Regular filing through Intervat, monitoring payment reference numbers, and preparing your invoicing tools to issue and receive Peppol BIS 3.0–compliant e-invoices are practical steps that will determine your readiness for 2026. For FBA sellers, that also means ensuring that your Amazon sales data — exports, intra-EU transfers, and domestic sales — are properly mapped and categorised in your accounting system.

In a broader sense, Belgium’s full VAT digitalisation does more than just modernise tax administration. It sets a precedent for the entire European Union, offering a glimpse of what the future of VAT in Europe will look like — a system where data, invoices, and tax filings form a single, unified digital record of economic activity. For businesses, this future promises less bureaucracy, but also zero tolerance for inconsistencies.

Amazon’s VAT Requirements and the Role of Local Registration

For Amazon, VAT compliance has long ceased to be a side issue. It’s now a fundamental part of its marketplace infrastructure — a prerequisite for participation, not an afterthought. Since the launch of Amazon.be in 2023, the platform has required all sellers operating in the Belgian marketplace to have a valid, active Belgian VAT number, or to account for sales through the One Stop Shop (OSS) system if they sell remotely and hold no stock within Belgium.

However, this distinction ends the moment goods are stored on Belgian soil. In the Pan-European FBA model, Amazon reserves the right to move your products freely between its European warehouses — including its logistics hub in the Antwerp region. From a tax perspective, that movement is sufficient to trigger a Belgian VAT registration obligation. It is not a matter of sales volume or turnover; the physical presence of goods is what counts.

Amazon’s compliance framework reflects this reality. The company monitors whether each seller holds a verified local VAT number for every EU country where Amazon stores their goods. If no valid Belgian number is linked to your Seller Central account, Amazon is required to restrict your access to the Belgian market.

Adding and Verifying Your VAT Number in Seller Central

The process of linking your Belgian VAT number to your Amazon account is straightforward but critical. After logging into Seller Central, navigate to the Account Information section, then open the VAT Information module. Choose Belgium as your country, enter your VAT number in the format BE0XXXXXXXXX, and save the entry.

Once submitted, Amazon will automatically send the number for verification via the VIES (VAT Information Exchange System). While the verification is pending, your number will appear in Seller Central with the status “unverified”. When VIES confirms activation, that status changes to “verified”, and your account is officially recognised as VAT compliant for Belgium.

If Amazon requests supporting documentation, keep on hand your registration confirmation from SPF Finances or any correspondence confirming activation. These documents may be needed not only for verification but also for future audits or compliance reviews.

Format of the Belgian VAT Number

Belgium’s VAT identification number follows a standardised format: the prefix “BE” followed by ten digits, usually beginning with zero. The structure looks like this: BE0XXXXXXXXX. This number is used across all tax and trade documentation — on invoices, in VAT returns filed via Intervat, in correspondence with the tax office, and in all cross-border reporting.

For Amazon sellers, the number’s VIES validation status is crucial. An unverified number, even if entered correctly in Seller Central, is not considered valid for marketplace operations. Only once the VIES system marks it as active does Amazon treat the registration as compliant.

The Consequences of Failing to Register — When Compliance Becomes Urgent

Failure to maintain an active VAT registration in any country where you store inventory or conduct sales can have immediate commercial consequences. On Amazon, this typically manifests as restricted visibility on Amazon.be, suspension of shipping to Belgian warehouses within the Pan-European FBA network, or even the temporary withholding of payments until the issue is resolved.

A typical scenario unfolds when Amazon issues a compliance notice requesting confirmation of a Belgian VAT number. If, after thirty days, the number is still not validated in VIES, Amazon automatically initiates a payment hold. This means all disbursements from your seller account are frozen until a valid VAT registration is verified. The platform does not attempt to “estimate” or “adjust” VAT obligations internally; its policy is clear and automatic — no valid VAT number, no full trading rights.

For sellers, the message is equally clear. VAT registration is not an administrative nuisance but an operational necessity — a key component of maintaining access to the European single market through Amazon.

How Amazon Verifies Compliance

Amazon’s compliance verification process is not a single check but a layered system designed to align with EU regulatory standards. The first step involves verifying the VAT number format and its active status in the VIES database. This happens automatically whenever a seller adds or updates their VAT details in Seller Central. At the same time, Amazon’s internal systems analyse logistical data connected to the account — warehouse locations, inventory transfers, and FBA stock movements across Europe.

If Amazon’s algorithms detect that inventory is being stored in Belgium without a valid Belgian VAT number, the account is immediately flagged as “non-compliant.” This triggers a set of automatic restrictions that remain in place until the discrepancy is resolved. The system is designed to prevent sellers from inadvertently breaching local VAT obligations.

Beyond this automated layer, Amazon also conducts periodic manual compliance audits under its VAT Services on Amazon programme. During these checks, sellers may be asked to provide copies of VAT returns, payment confirmations, or registration documents from the Belgian tax authority (SPF Finances). These reviews help Amazon ensure that sellers trading across the EU comply with both VAT registration and reporting obligations.

Amazon’s role as a compliance gatekeeper is not coincidental. It stems directly from EU legislation, particularly Article 14a of the EU VAT Directive, which in certain cases classifies online marketplaces as “deemed suppliers.” In addition, the DAC7 Directive obliges digital platforms to report detailed information about their sellers — including VAT numbers, turnover, and identifying data — to the relevant tax administrations. In practice, Amazon submits annual DAC7 reports containing this information to national authorities, including Belgium’s SPF Finances, ensuring that every active seller’s tax footprint is transparent.

For sellers, the conclusion is clear: if you store inventory in Belgium or plan to start selling locally, obtain your Belgian VAT number in advance and add it to Seller Central immediately after it appears as active in VIES. If you only sell to Belgian consumers through distance sales from another EU country and have no stock in Belgium, you can manage VAT through the OSS system. However, the moment your goods are transferred to a Belgian warehouse, OSS no longer covers your activity — you’ll need a local Belgian VAT number. Acting early is the simplest way to avoid account suspensions, sales interruptions, and retroactive corrections.

Invoicing and the New E-Invoicing Regulations

Belgium is among the first European countries to implement mandatory e-invoicing for all transactions between VAT-registered businesses. This reform represents a cornerstone of the country’s digital VAT transformation, aiming to strengthen tax control, automate data exchange between businesses and the tax administration, and phase out both paper and PDF invoices entirely. For Amazon FBA sellers and e-commerce businesses operating in Belgium, this means that accounting and billing systems will need to be upgraded to comply with Peppol BIS 3.0 requirements well before 2026.

Mandatory B2B E-Invoicing from 1 January 2026

Under the Act of 23 May 2024 on electronic invoicing between VAT taxpayers, all B2B invoices issued in Belgium must, from 1 January 2026, be generated and transmitted in a structured electronic format. Paper and PDF invoices will lose their legal status in business transactions. They will no longer qualify as VAT invoices, and recipients will lose the right to deduct input VAT based on them.

The transition is divided into two stages. From 1 July 2025, e-invoicing becomes mandatory for large enterprises with annual turnover exceeding €9 million. From 1 January 2026, the rule will extend to all VAT-registered entities — including small and medium-sized companies and Amazon FBA sellers active in Belgium.

Technical Requirements — The Peppol BIS 3.0 Standard

Belgium has adopted the Peppol BIS 3.0 framework, based on the UBL 2.1 (Universal Business Language) standard. Every e-invoice must contain structured data fields such as the seller and buyer identifiers, VAT numbers, invoice date, net and gross amounts, tax codes, and item-level details.

All invoices will be transmitted via the Peppol network, a secure EU-wide infrastructure for exchanging structured business documents between companies and tax authorities. Each taxpayer will be required to have a Peppol ID, which can be obtained from a certified access point provider or through accounting software already integrated with Peppol.

Once sent through Peppol, invoices pass via Mercurius, Belgium’s central e-invoicing gateway, which forwards the data to the SPF Finances database. The data synchronisation process is nearly instantaneous — the tax administration receives full transaction details within 24 hours of issuance. This enables automatic reconciliation of invoice data with VAT declarations, effectively closing the information loop between businesses and the government.

According to SPF Finances’ current roadmap, from 2027 onwards, data from e-invoices will be used to pre-fill VAT returns in the Intervat system. This means that reporting will become increasingly automated, with the tax administration automatically calculating output and input VAT based on the submitted invoices.

Penalties for Non-Compliance

The Belgian e-invoicing law introduces strict penalties for failure to comply with Peppol BIS 3.0 requirements. Issuing invoices in an unapproved format — such as paper or PDF — or sending them outside the Peppol network constitutes a breach of tax obligations.

The penalties are graduated: a first violation results in a €1,500 fine, the second in €3,000, and each subsequent offence in €5,000. These sanctions apply both to missing invoices and to those issued in a non-compliant format. In addition, invoices that fail to meet Peppol BIS 3.0 standards will not be recognised as valid VAT invoices, meaning that the buyer cannot deduct the associated input tax.

In practice, every business operating in Belgium — regardless of size — will need to ensure that its accounting systems are fully Peppol-compatible. For Amazon FBA sellers, this requirement extends beyond invoices issued to customers. It also includes invoices for logistics services, packaging, or B2B supplier transactions conducted within Belgium. Updating accounting software or adopting a cloud-based invoicing solution integrated with Peppol is therefore a necessity, not an option.

B2C Transactions — No E-Invoicing Requirement (For Now)

It’s important to note that Belgium’s e-invoicing obligation currently applies only to B2B transactions — that is, between VAT-registered businesses. Consumer sales (B2C) remain outside the scope of the new law. For Amazon FBA sellers, this means that most retail transactions, directed at individual consumers, will not require Peppol-format e-invoices.

Amazon itself generates purchase confirmations for consumer transactions, which are sufficient as proof of purchase in the B2C context. However, sellers conducting business-to-business sales within Belgium — for example, wholesalers or suppliers selling to Belgian companies — will need to adopt the e-invoicing system in full by 2026.

The Belgian Ministry of Finance has already announced that, once B2B e-invoicing is fully implemented, it will evaluate extending the system to B2C transactions in 2027–2028, as part of the EU’s VAT in the Digital Age (ViDA) initiative. The long-term objective is to introduce digital receipts or consumer e-invoices, integrating all retail transactions into a unified, real-time VAT system.

The Digital Revolution in Invoicing

What Belgium is building goes far beyond a change in invoice format. It represents the emergence of a fully automated tax ecosystem, where invoicing, reporting, and payment are connected components of a single digital process. The Peppol network and its integration with Mercurius and Intervat form a real-time infrastructure that unites business and government data in one transparent environment.

For Amazon FBA sellers, this means that every invoice issued to Belgian suppliers or business clients must be fully digital, transmitted through Peppol, and structured in UBL 2.1 format. Adapting these systems before the end of 2025 will be critical to avoid disruption, fines, or compliance issues — and to ensure that your operations are future-proof ahead of the EU’s broader ViDA reforms.

Ultimately, Belgium’s model is likely to become a template for the entire European Union: a system in which invoices, VAT reports, and accounting data converge into a single source of truth. For sellers, this digital transformation marks not just a regulatory change, but a turning point — the beginning of a new era in which fiscal transparency, automation, and cross-border consistency become defining features of doing business in Europe.

Practical Guidance for Amazon FBA Sellers

Selling on Amazon.be opens the door to a fresh, promising market, but the Belgian VAT system does not forgive improvisation. Success here demands precision, planning and respect for a bureaucracy that operates like clockwork. Below is a refined, battle-tested set of practical insights — built around the real-world realities of Amazon FBA, complete with the latest technical and administrative updates.

Plan Your VAT Registration in Advance

VAT registration in Belgium takes time. The process can last anywhere between four and twelve weeks, and the obligation doesn’t begin with your first sale — it starts the moment your goods physically cross into Belgium and are placed in a local warehouse. That’s when the Belgian tax authorities consider you to have established taxable activity.

If you’re planning to include a Belgian fulfilment centre in your Pan-European FBA network, start the registration procedure before your inventory reaches the border. Amazon is known for enforcing VAT compliance rigorously; if your Belgian VAT number (the “BE” registration) isn’t active in the VIES database, Amazon can — and often does — restrict shipments, suspend FBA functionality, or freeze payments without warning.

Prepare Your Documents Before Shipping

Belgium’s tax administration expects a complete and well-structured registration package. You’ll need a recent business registry extract (from your home country’s commercial register), a VAT certificate confirming your existing EU registration, proof of identity for the business owner or managing director, and tangible evidence of real business activity — for example, invoices, logistics contracts, or screenshots from Seller Central and FBA inventory reports.

Certified translations aren’t required, but the documents must be clear, consistent and up to date. The application itself (Form 604A) is submitted online via MyMinfin, Belgium’s official digital portal. Submitting electronically not only shortens processing time but also reduces the risk of requests for clarification or missing information.

Add Your VAT Number to Seller Central Without Delay

While Amazon doesn’t publicly state a fixed “60-day” deadline, its internal verification workflow operates roughly within that window. If your Belgian VAT number isn’t added and verified within two months of issuance, your account may face sales restrictions or a payment hold.

As soon as your BE number appears as active in the VIES database, add it in Seller Central under Account Information → VAT Information. If VIES validation is taking longer than expected, you can temporarily upload a confirmation of registration from FPS Finance. In most cases, this is sufficient to prevent a suspension while final verification is pending.

Track Deadlines and Pay on Time

Belgium’s VAT schedule is simple — but merciless. Monthly filers must submit and pay by the 20th day of the following month, while quarterly filers have until the 25th day of the month after each quarter ends. Late submissions cost double: interest of 0.8% per month, plus administrative penalties ranging from €100 to €1,000, depending on how often you’ve been late before.

Set automated reminders in your calendar and align your accounting closing dates with Amazon’s reporting cycle. Always share the key FBA reports — especially the Inventory Movement and Transaction Reports — with your accountant on the last day of each period to avoid reconciliation delays.

Don’t Forget Your Intervat Access

Since 2024, all Belgian VAT returns and EC Sales Lists must be filed exclusively through Intervat, using secure authentication via eID or eIDAS. Older commercial certificates such as Globalsign or Isabel are no longer accepted. Before the reporting deadline, double-check that your login credentials work — missing access on filing day can mean missed deadlines and unwanted penalties.

Prepare for E-Invoicing in 2026

Belgium’s B2B sector is moving entirely to e-invoicing. From 1 January 2026, all invoices between VAT-registered entities must be issued and transmitted in Peppol BIS 3.0 (UBL 2.1) format, and for large companies (annual turnover above €9 million), the requirement starts even earlier — on 1 July 2025.

In practice, this means every business must have a Peppol identifier and access to the Peppol network via an access point provider. Most modern accounting systems already support this integration, but implementation takes time.

E-invoices sent through Peppol are routed to the Mercurius hub and delivered to the tax authorities within 24 hours. By 2027, Belgium plans to use this data to pre-fill VAT returns in Intervat, effectively automating most of the reporting process. Even if your core activity is B2C, remember that B2B obligations still apply to services, logistics and supplier invoices — so prepare your systems by 2025 to stay ahead of compliance.

Keep Your Data Consistent Under DAC7

Since 2023, Amazon has been automatically reporting seller data to EU tax authorities under the DAC7 directive. This includes your turnover, transaction details and VAT numbers. The data visible to the tax authorities must match the figures in your VAT returns and FBA reports. Any inconsistencies are flagged systemically and can trigger immediate follow-ups from local authorities. Keeping your data aligned across all systems — Amazon, accounting, and Intervat — is the simplest way to avoid costly misunderstandings.

Consider Working with a Local Tax Advisor

While only non-EU companies are legally required to appoint a fiscal representative, many EU-based sellers find it advantageous to work with a Belgian tax consultant. Belgium operates in three official languages, and communication with FPS Finance often moves faster when handled by someone fluent in the system.

A good advisor can coordinate your Intervat filings, Intrastat reporting via OneGate, Peppol setup, and ensure that your submission schedules are perfectly synchronised — down to the day and the cent.

In short: plan your registration early, gather your documents, add your VAT number immediately after activation, respect every filing deadline, and prepare for e-invoicing. Beyond that, it’s all about operational discipline — and peace of mind when Amazon’s algorithms and Belgian tax authorities start comparing your numbers.

Summary

Belgian VAT is not just another administrative box to tick — it’s an essential component of doing business within the European Union. Belgium operates one of the most advanced and digitised tax systems in Europe, and for Amazon FBA sellers, this means acting with precision, punctuality and strict adherence to local rules.

Key Obligations

If you participate in the Pan-European FBA programme, your goods can be transferred automatically to Belgian warehouses. This movement alone triggers the obligation to register for Belgian VAT — not at the point of sale, but the moment your stock physically enters the country. Registration is done via MyMinfin, and once the number is active, it must be added in Seller Central.

All VAT returns and EC Sales Lists are filed digitally through Intervat, while official correspondence happens via eBox with authentication through eID or eIDAS. Most sellers report quarterly, by the 25th day after the quarter ends; larger traders report monthly, by the 20th day of the following month. Late filings incur 0.8% monthly interest and administrative fines up to €1,000.

It’s equally important to correctly report intra-EU transfers — those “fictional” supplies that occur when goods move between Amazon warehouses in different countries. Belgium requires these to be included in VAT declarations and, for higher volumes, in Intrastat reports.

Non-EU sellers must appoint a fiscal representative (représentant fiscal), while EU-based entrepreneurs may register independently, though many still prefer local tax advisors for efficiency and language support.

Key Dates for Amazon FBA Sellers

2024 – Mandatory VAT registration or OSS enrolment for all sellers on Amazon.be. Intervat access restricted to eID/eIDAS authentication only.

2025 – Introduction of the new reporting deadlines (monthly by the 20th, quarterly by the 25th). Launch of the Intervat API pilot. Start of e-invoicing for large enterprises using Peppol BIS 3.0 from July.

2026 – Full mandatory B2B e-invoicing under Peppol BIS 3.0 (UBL 2.1). Paper and PDF invoices lose legal validity. B2C transactions remain exempt, pending further EU-wide discussions under the VAT in the Digital Age (ViDA) initiative.

Belgium’s VAT system may be demanding, but it is also highly transparent and consistent. It operates like a finely tuned machine: once you understand its rhythm, everything runs smoothly and digitally. Register early, respect deadlines, and integrate your systems with Amazon, Intervat, and Peppol — and your business in Belgium will function efficiently, without stress or compliance risks.

The Belgian market is growing fast, and Amazon.be remains relatively under-saturated. For European e-commerce sellers, this is the moment to act — but in Belgium, there’s one rule above all: compliance is non-negotiable. The regulations are clear, the systems are digital, and enforcement is relentless. For those who prepare properly, however, Belgium is one of the most stable and rewarding Amazon markets in the EU.