Amazon FBA and VAT in Italy

Spis treści

For Amazon FBA (Fulfillment by Amazon) businesses, Italy offers access to millions of new customers through the same logistics network Amazon operates across Europe. However, this opportunity comes with a layer of complexity: Italy’s VAT (Value Added Tax) system is known as one of the most demanding within the EU. While it follows EU common market principles, it also introduces a series of local rules, additional obligations, and frequent regulatory changes.

As of 2025, new VAT regulations have come into force in Italy that significantly impact FBA sellers—particularly those based outside the European Union.

The 2025 Changes: Financial Guarantees and Local Representation

One of the most talked-about updates is the introduction of a mandatory €50,000 financial guarantee for non-EU businesses registering for Italian VAT. This measure is intended to protect the interests of the Italian tax authorities, but in practice, it presents a major financial and administrative challenge for many companies.

Non-EU sellers are also required to appoint a fiscal representative who will be legally responsible for ensuring VAT compliance and filing obligations. In addition, Italian VAT law demands electronic reporting and regular VAT returns, which means that businesses must maintain precise, digital records of all their transactions.

This guide explains how Italian VAT works in the context of Amazon FBA, what steps you need to take to stay compliant, and how to avoid fines or account restrictions. You’ll learn when registration is required, how to obtain an Italian VAT number (Partita IVA), what the financial guarantee involves, what the 2025 VAT rates are, and how to file your returns. We’ll also look at what these changes mean for sellers using Amazon’s Pan-European FBA program, where Amazon manages inventory movement between EU warehouses.

By the end, you’ll not only understand the legal framework but also have practical insights on maintaining compliance and avoiding costly mistakes. The goal is to help you navigate Italian VAT for Amazon FBA in 2025 with confidence, clarity, and a sound strategy.

When You Must Register for VAT in Italy as an Amazon FBA Seller

Entering Amazon.it can be highly rewarding, but VAT obligations can appear sooner than expected. The key factors are where your inventory is stored and how your products are shipped to Italian customers.

In the world of FBA, logistics determine whether your transactions are treated as cross-border distance sales or domestic Italian sales—the latter triggering a VAT registration requirement regardless of turnover.

EU vs Non-EU Sellers: Different VAT Rules

If your business is based in an EU country, you can benefit from the EU-wide €10,000 distance-selling threshold for B2C goods and selected digital services (TBE). This threshold applies to cross-border sales between EU member states and not to goods stored locally or imported from outside the EU.

As long as you’re shipping from another EU country and your total annual cross-border B2C sales remain below €10,000, you can declare VAT in your home country or use the OSS (One Stop Shop) scheme. Once your total EU-wide sales exceed the threshold, you must charge VAT at the rate of the customer’s country—typically through OSS.

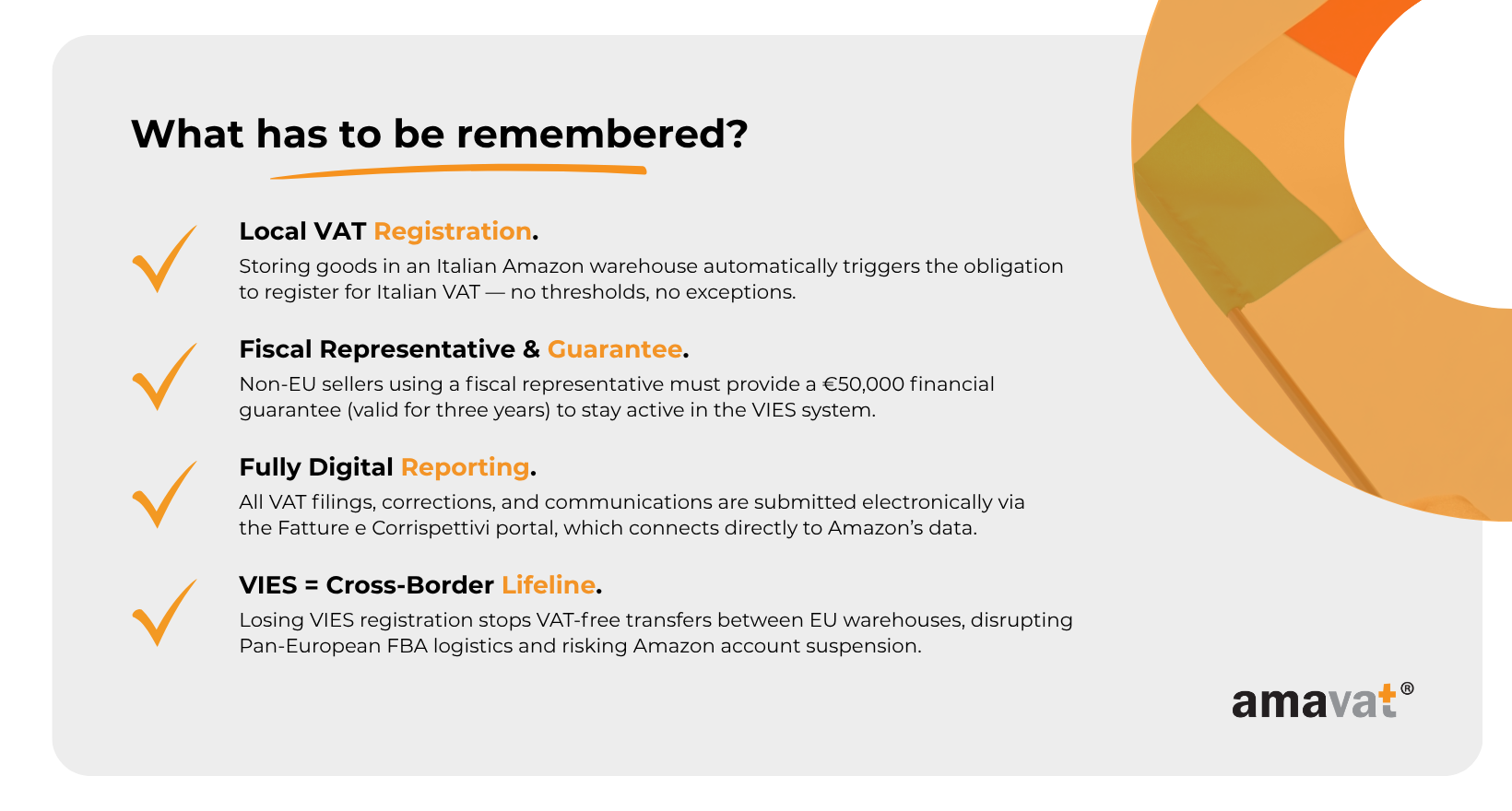

However, once your inventory is physically stored in Italy, your situation changes completely. Any sales fulfilled from Italian warehouses are considered local supplies, making VAT registration in Italy mandatory—regardless of your total sales volume.

For non-EU businesses, the rule is even stricter: VAT registration is required from the very first taxable transaction, such as a sale fulfilled from an Italian FBA warehouse. Moreover, non-EU sellers cannot use the Union OSS for goods (only the non-Union OSS for digital services). Therefore, they must proceed with local VAT registration and compliance in Italy.

When using Amazon’s logistics programs, such as Pan-European FBA or the European Fulfilment Network, what ultimately matters is the physical location of your stock. If your goods are stored in Italy—even temporarily—you must register for Italian VAT.

In short:

If your inventory is physically held in Italy under Amazon FBA, you must register for Italian VAT, regardless of your total sales. The €10,000 threshold only applies to cross-border B2C distance sales and does not cover goods stored locally.

The Role of the Fiscal Representative

While appointing a fiscal representative isn’t always mandatory, it’s highly common. For non-EU businesses, it is a legal requirement unless their country has a mutual administrative assistance agreement with the EU, in which case direct identification (under Article 35-ter of DPR 633/72) may be possible.

Still, many sellers—both EU and non-EU—choose to appoint a representative for practical reasons: language barriers, complex administrative procedures, and the risk of filing errors. In practice, this simplifies communication with Italian authorities and ensures that all filings are handled correctly and on time.

The VAT Registration Process in Italy

VAT registration in Italy is carried out through the Agenzia delle Entrate (Italian Revenue Agency) and concludes with the issuance of a tax identification number known as the Partita IVA. The process is formal but can be completed remotely, provided that all documents are accurate and complete. Depending on your business structure, you will need to submit the appropriate registration form—typically AA7/10 or AA9/12.

Non-resident entities must attach powers of attorney and registration documents and, where required, appoint a fiscal representative or apply for direct identification if they meet the legal conditions. Processing time generally takes a few weeks, though no official deadline is set, and the authorities may request clarifications or additional information. Once you receive your Partita IVA, you should add it to Amazon Seller Central to confirm your VAT compliance and validate your account.

Once registered, you move from planning to active operation. This involves filing periodic and annual VAT returns, maintaining electronic reporting, and—depending on your supply chain—possibly meeting Intrastat obligations for movements of goods within the EU. The frequency of VAT returns depends on your sales volume, but delays or administrative errors can quickly lead to penalties.

For this reason, it’s crucial to establish clear internal processes early on: organize your purchase and sales documentation, ensure correct VAT rates and classifications, set up declaration schedules, and define the role of your representative or tax advisor.

This stage marks a mature approach to managing Italian VAT for Amazon FBA sellers—you understand when the EU distance-selling threshold applies, when it stops being relevant, and that physically storing goods in Italy triggers a set of local tax obligations where precision and timeliness are just as important as a strong product listing.

Fiscal Representatives and the New €50,000 Financial Guarantee (2025)

The year 2025 has introduced a new regulatory landscape for Amazon FBA sellers operating in Italy—particularly those based outside the European Union. While the requirement for a fiscal representative is not new, the financial guarantee of €50,000, introduced on April 14, 2025, has significantly changed how Italian tax authorities monitor foreign taxpayers. Crucially, this new obligation does not apply equally to all non-EU businesses; its scope is precisely defined and linked to participation in the VIES system, not merely to holding an Italian VAT number.

The Fiscal Representative Requirement

Italian legislation allows two methods of VAT registration for non-Italian entities. The first involves appointing a fiscal representative under Article 17 of DPR 633/72, while the second permits direct identification under Article 35-ter of the same decree. The applicable option depends on the status of the country in which the business is established.

As a general rule, companies established outside the EU must operate through a fiscal representative. However, there are exceptions: if a business is based in a country that has mutual administrative assistance agreements with the EU regarding indirect taxes, it may opt for direct identification. This applies to countries such as Norway and also the United Kingdom, which, despite Brexit, retained this possibility under certain conditions.

In practice, this means that businesses from these countries can register for Italian VAT independently, although many still choose to work with local specialists due to language barriers and procedural complexity.

A fiscal representative is not merely a formal requirement—they are jointly liable with the foreign entity for correct VAT calculation, reporting, and payment. If errors occur or taxes go unpaid, Italian authorities can recover the amount directly from the representative. Therefore, choosing a trusted and experienced partner is critical.

Many Italian firms offering VAT representation services provide comprehensive support, from submitting returns and Intrastat reports to managing ongoing correspondence with the Agenzia delle Entrate.

In the context of Amazon FBA, the fiscal representative plays a particularly practical role, ensuring that goods transfers between Amazon’s EU warehouses are properly recorded in VAT and Intrastat reports. While there’s no explicit legal provision requiring “Intrastat oversight,” in practice, the representative often serves as the central point of control for all tax documentation.

In summary, non-EU companies are generally required to appoint a fiscal representative unless they qualify for direct identification under Article 35-ter of DPR 633/72. The choice between these two models also determines whether the new financial guarantee obligation applies.

The New Financial Guarantee (Effective April 2025)

Since April 14, 2025, Italy has introduced a new requirement for businesses established outside the European Union and the European Economic Area that operate through a fiscal representative and wish to obtain or maintain their registration in the VIES database.

VIES registration is essential for carrying out intra-EU supplies and acquisitions under VAT exemption rules and is therefore critical for any Amazon FBA seller using EU-based fulfillment centers.

This rule, introduced under Article 35(7-quater) of DPR 633/1972 (added by Legislative Decree 13/2024) and detailed in the Decree of December 4, 2024, as well as in the Agenzia delle Entrate Provision No. 178713 of April 14, 2025, requires that non-EU/EEA businesses represented in Italy submit a financial guarantee of at least €50,000. The guarantee must remain valid for a minimum of 36 months and can take the form of a bank or insurance guarantee issued in favor of the Italian tax authorities.

The purpose of the guarantee is to secure potential VAT liabilities that may arise from activities conducted in Italy. If the guarantee is not provided, the tax authorities may initiate procedures to remove the company from the VIES register. For new applicants, the absence of a guarantee results in a denied registration, while existing VIES-registered businesses are required to submit the guarantee within a set timeframe. Companies already registered before the new law took effect had until June 13, 2025, to comply, followed by an additional 60 days after formal notice before removal from the register.

It’s important to note that the penalty for failing to provide the guarantee is not the revocation of the VAT number but removal from the VIES system. However, for Amazon FBA sellers, the practical consequences are nearly identical: without active VIES status, it becomes impossible to move goods between EU countries under the VAT-exempt scheme used in the Pan-European FBA program. Losing VIES status effectively halts cross-border logistics and forces each intra-EU transfer to be treated as a domestic transaction, with full VAT due at the point of movement.

The measure serves as a preventive and anti-fraud mechanism, designed to protect the Italian treasury from potential VAT losses caused by foreign entities that cease operations or fail to settle their tax obligations. While large companies are unlikely to struggle with this requirement, for smaller non-EU sellers it represents a significant barrier to entry into the Italian market.

Businesses based in countries with mutual assistance agreements with the EU—eligible for direct identification—are exempt from this obligation, as they do not act through a fiscal representative.

Although controversial within the e-commerce community, the Italian authorities defend the rule as a necessary safeguard for the integrity of the national tax system. The regulation is fully in force, and non-compliance results in administrative sanctions, including removal from the VIES database.

For Amazon FBA sellers, the implications are substantial: losing VIES status means losing the ability to participate in Amazon’s Pan-European fulfillment network, effectively freezing or significantly slowing down cross-border sales across Italy and the EU.

In short, as of April 14, 2025, if you are a non-EU or non-EEA company operating in Italy through a fiscal representative and want to maintain your VIES registration, you must submit a €50,000 guarantee valid for at least three years. Failure to do so triggers removal from VIES—a step that, in practice, can bring your entire Amazon FBA operation in Europe to a standstill.

The Italian VAT system after 2025 sets strict compliance requirements for FBA sellers but offers clear and predictable rules. Understanding whether your business needs a fiscal representative and whether it falls under the VIES guarantee obligation is key to maintaining uninterrupted operations.

In the world of Amazon logistics, VAT compliance is no longer just a tax matter—it’s a prerequisite for business continuity across the European market.

VAT Rates in Italy

Although Italy’s VAT system is based on EU-wide principles, it features its own precisely defined categories of rates and exemptions. Understanding these distinctions is crucial for Amazon FBA sellers, as the correct application of VAT rates directly affects compliance, pricing, and profit margins.

The Italian market is closely monitored by the Agenzia delle Entrate (Revenue Agency), which frequently audits e-commerce operations. Authorities increasingly rely on automated data analysis tools that cross-check transaction data from major platforms such as Amazon, eBay, and Zalando.

Standard and Reduced VAT Rates

The standard VAT rate in Italy is 22%, in effect since October 1, 2013. Despite periodic discussions about increasing it, it remains unchanged. This rate applies to the vast majority of goods and services, including consumer electronics, cosmetics, clothing, furniture, homeware, appliances, sporting goods, and most retail e-commerce sales. For most Amazon FBA listings, 22% will be the default applicable rate.

The 10% rate applies to products and services considered important but not essential. According to Tabella A, Part III, Nos. 80–127 of DPR 633/72, this includes processed food and non-alcoholic beverages such as coffee, pasta, olive oil, canned foods, mineral water, and juices. It also covers hotel and catering services, as well as certain renewable energy products and installations (for example, solar or heating systems that meet specific technical standards). For many FBA sellers in the food or lifestyle sectors, this rate allows them to price competitively while remaining tax-compliant.

A 5% rate, introduced by the 2016 Stability Law (Legge di Stabilità 2016, Art. 1, c.960 L.208/2015), was designed to support socially beneficial and eco-friendly goods and services. It applies to certain health and dietary products—such as infant formulas, medical nutrition, and specialized dietary foods—as well as to public passenger transport, including rail and urban transport. More recently, it has been extended to environmentally friendly products, such as compostable bags and biodegradable disposable tableware, under Decreto Rilancio (DL 34/2020).

The super-reduced 4% rate applies to basic goods of essential importance. As defined in Tabella A, Part II, DPR 633/1972, this includes bread, milk, rice, fruit, vegetables, fresh pasta, flour, as well as books, e-books, and educational magazines. It also extends to certain products for people with disabilities and specific categories of social housing, such as first homes under the prima casa program.

Product classification and rate assignment are based on CN/TARIC codes (Combined Nomenclature), which determine the nature of goods. Amazon uses these through its Product Tax Code (PTC) system, but the ultimate responsibility for correct classification always lies with the seller. Applying an incorrect rate—especially a reduced one—can lead to VAT adjustments and financial penalties. It is therefore critical to verify product classification before listing items for sale.

Italy also applies a 0% rate (VAT exemption) for specific transactions, known as operazioni non imponibili. These include exports outside the EU (Article 8, DPR 633/72), intra-EU supplies (Article 41, DL 331/93), international transport, and certain educational or cultural publications. For Amazon FBA sellers, the intra-EU exemption is particularly important, as it applies to the movement of goods between Amazon warehouses in different EU countries—provided the seller holds an active VIES registration and correctly documents the transfer.

In practice, Italy’s VAT structure can be summarized in clear terms: 22% is the general rate, 10% covers food and tourism, 5% supports social and environmental goods, 4% applies to essential and educational items, and 0% covers exports and intra-EU deliveries.

The Agenzia delle Entrate closely monitors e-commerce operations, cross-referencing VAT, OSS, and Intrastat declarations with data provided by online platforms. This means that even minor discrepancies—such as a small VAT misclassification—can be automatically detected and trigger a correction notice or financial penalties with interest.

For Amazon FBA sellers operating across multiple EU markets, this serves as a clear reminder: accuracy in VAT classification is not a formality, but a fundamental aspect of business risk management. In Italy, tax authorities act swiftly, automatically, and with zero tolerance for errors. Every price in your catalog must rest on the correct VAT foundation.

Filing VAT Returns and Reporting Obligations

Italy’s VAT reporting framework is now fully digital—paper forms and manual filings are a thing of the past. All reporting is conducted electronically, and the Agenzia delle Entrate integrates data from VAT returns, e-commerce platforms, and OSS filings within an automated system known as Controlli Automatizzati IVA e-Commerce.

For Amazon FBA sellers, this means one thing: the Italian tax authorities see exactly what Amazon sees. This creates transparency and simplicity in reporting, but it also leaves no room for error.

Frequency and Types of Returns

Italian VAT-registered businesses must file Comunicazione delle Liquidazioni Periodiche IVA (LIPE)—periodic VAT returns—and an annual VAT declaration known as Dichiarazione Annuale IVA. The frequency of LIPE submissions depends on the total amount of VAT due annually.

Most small and medium-sized Amazon FBA sellers in the EU operate on a quarterly basis, as their annual VAT liability does not exceed €60,000. Quarterly returns (LIPE trimestrali) must be submitted electronically by the 16th day of the second month following the quarter’s end—that is, by May 16, August 16, November 16, and February 16 of the following year.

Sellers with larger operations—those exceeding €60,000 in annual VAT—must file monthly returns (LIPE mensili) by the 16th of the following month. This generally includes major brands, distributors, and logistics operators using multiple warehouses under the Pan-European FBA network.

Regardless of reporting frequency, all VAT-registered entities must also submit the annual VAT return (Dichiarazione Annuale IVA), even if no sales were made during the year. The return provides a full summary of sales, input VAT, and payments made. It must be filed electronically between February 1 and April 30 of the following year via the Fatture e Corrispettivi online portal.

For sellers using Pan-European FBA, additional Intrastat reports are often required for intra-EU goods movements. These reports cover both intra-EU supplies and intra-EU acquisitions (B2B). The reporting frequency depends on transaction volume and may be monthly or quarterly. The filings are submitted to the Agenzia delle Dogane e dei Monopoli (ADM), which oversees the registration of goods flows within the EU.

A separate but related issue is electronic invoicing (FatturaPA). Since July 1, 2022, all Italian VAT taxpayers must issue e-invoices through the Sistema di Interscambio (SDI) platform. However, there is an important exception: the obligation does not apply to non-resident sellers who have no fixed establishment (FE) in Italy and only make B2C sales via online marketplaces such as Amazon.

Thus, EU-based sellers registered for Italian VAT but without a physical establishment in Italy are not required to issue invoices through SDI, as long as Amazon documents and reports transactions to the authorities. Nonetheless, sellers must maintain complete sales records and ensure all data is accurately reflected in their VAT declarations.

In summary, Italy’s VAT regime for 2025 is a digitally integrated, highly transparent system that leaves little margin for administrative oversight. For Amazon FBA sellers, compliance goes beyond simply filing returns—it means maintaining consistency between internal records, marketplace data, and tax filings.

Precision in classification, timely declarations, and a clear understanding of your reporting obligations are not just formalities; they’re the foundation of business continuity in Italy’s fast-evolving e-commerce environment.

Reporting Rules and Penalties

All VAT declarations, corrections, and inquiries in Italy must be submitted electronically. The central tool for communication with the tax authorities is the Fatture e Corrispettivi portal — a digital hub where taxpayers can file returns, monitor payment statuses, receive correction notices, track refunds, and respond to any alerts issued by the Agenzia delle Entrate.

Since 2023, Italy has enhanced its VAT oversight system through the introduction of Controlli Automatizzati IVA e-Commerce, an automated data monitoring framework that cross-references information from LIPE, OSS, and Intrastat filings with data transmitted by online marketplaces. Transaction data from Amazon, Zalando, eBay, and other platforms are sent directly to the tax authorities, allowing the system to identify inconsistencies in real time.

If discrepancies arise, the seller receives an alert via their taxpayer account and has 30 days to provide clarification or submit a correction.

Penalties for errors and late payments in Italy are severe. Failure to pay VAT on time results in a 30% fine on the unpaid amount (Article 13, Legislative Decree 471/1997). Persistent non-compliance can push the sanction up to 60%, in addition to statutory interest — which in 2025 is set at 5.0% annually (tasso di interesse legale 2025).

Authorities may also impose administrative penalties, including the suspension of VIES registration, the temporary deactivation of the VAT number (partita IVA sospesa), or notifying marketplaces of non-compliance under the EU DAC7 directive (Legislative Decree 13/2024).

In practice, this means that a seller who fails to report VAT correctly or delays payments may face restricted sales on Amazon.it and, for Pan-European FBA participants, potentially in other EU marketplaces as well.

Regular, accurate VAT reporting is therefore not just a regulatory formality — it’s a key part of business risk management. Italy’s tax system is highly automated, but its purpose is not to trap sellers — it is to maintain ongoing compliance. If you operate transparently, report on time, and ensure that your Amazon Seller Central data aligns with what is sent to the Agenzia delle Entrate, your account remains protected.

For Amazon FBA sellers in 2025, the takeaway is simple: treat Italian VAT as a core business process, not a compliance afterthought. The Italian tax system operates quickly, precisely, and digitally — your tax data is now as visible to the authorities as your listings are to shoppers on Amazon.it.

The Impact on Amazon Pan-European FBA Sellers

The Amazon Pan-European FBA model offers scale and speed that few businesses could achieve independently — but it comes with one non-negotiable condition: tax compliance must move in sync with logistics.

If Amazon stores your inventory in Italy, local VAT registration is not optional — it’s mandatory. This requirement arises from both Italian VAT law and the mechanics of the Pan-EU program, where physical storage in any country automatically triggers a local tax presence.

Italy’s fulfillment centers — such as Passo Corese, Castel San Giovanni, and Vercelli — are major hubs in Amazon’s European network. What happens to your VAT or VIES status in Italy can therefore affect your entire Pan-European operation.

How Italian VAT Rules Affect Pan-EU FBA

Let’s start with VIES registration. Maintaining an active VIES entry is essential for applying the intra-EU VAT exemption on cross-border supplies and acquisitions. When your VIES status is suspended or revoked, you immediately lose access to this exemption regime.

Each transfer of goods between warehouses involving Italy must then be treated as a domestic transaction subject to full Italian VAT. In practice, this disrupts cross-border fulfillment, inflates costs, and undermines your margins and delivery timelines.

The new €50,000 financial guarantee, effective April 14, 2025, adds another layer of compliance for non-EU/EEA businesses operating via a fiscal representative. It applies only to those seeking to obtain or maintain VIES registration. Sellers eligible for direct identification under Article 35-ter (such as certain UK or Norwegian companies) are exempt, as they do not act through a representative.

Failure to provide the guarantee triggers VIES deregistration — and within the Pan-EU FBA structure, that effectively halts your ability to move stock across borders. Operationally, it’s the equivalent of hitting pause on your logistics network.

It’s also important to distinguish between OSS and local VAT. The OSS system simplifies cross-border B2C sales reporting across the EU but does not replace local VAT registration in countries where your goods are physically stored.

If your inventory is held in Italy, any sales from that warehouse are classified as domestic Italian supplies, which must be declared under Italian VAT, regardless of your OSS usage for other EU transactions. This distinction is crucial for Pan-EU sellers, where logistics and tax obligations are inseparable.

On top of that, Amazon enforces its own compliance checks. Under DAC7, the platform regularly transmits seller data — including tax status and reported turnover — to EU authorities. If the Italian tax office flags an issue with your VIES or VAT payments, your Seller Central account may be marked as VAT non-compliant.

Consequences can include cross-border fulfillment restrictions, temporary suspension of listings on Amazon.it, or, in prolonged cases, reduced visibility and a lower Buy Box score. In the Pan-EU FBA ecosystem, losing compliance is like removing a cog from a running machine — everything slows down.

Why Compliance is the Key to Continuity

In the Pan-EU FBA framework, tax compliance isn’t bureaucracy — it’s the infrastructure that keeps your logistics moving. The link between VAT compliance and account stability is direct: the cleaner and more transparent your tax profile, the less likely Amazon’s systems or national authorities are to interrupt your operations.

This translates into smoother stock transfers, shorter delivery times, and stronger Buy Box performance. It also means fewer unexpected costs from corrections or retroactive assessments.

In practice, three actions make the difference.

First, perform regular VAT and VIES audits across all FBA countries — at least quarterly. Check that each VAT number is active, declarations are complete, and there are no pending alerts in Fatture e Corrispettivi.

Second, work with a fiscal representative or tax advisor familiar with Italian procedures, capable of identifying risks before automated systems do.

Third, ensure timely and consistent reporting — whether it’s monthly or quarterly LIPE filings, the annual declaration, Intrastat submissions, or aligning your figures with Amazon’s data.

After the implementation of DAC7, marketplace data is now cross-checked with your VAT filings almost in real time — so consistency across systems is critical.

If you remember one rule, let it be this: OSS doesn’t replace local VAT where your goods are stored, and VIES is your passport for cross-border movement. Protect both, and Pan-European FBA remains a growth engine — not a compliance bottleneck.

Summary – What You Need to Remember

Italian VAT leaves no room for improvisation — it’s a system where precision, electronic reporting, and full data consistency with Amazon’s platform are non-negotiable. For Amazon FBA sellers, Italy is one of the most lucrative markets in Europe, but also one of the most demanding when it comes to tax compliance.

The key to success lies in understanding that compliance isn’t a cost — it’s a tool for protecting your business.

Key Takeaways for FBA Sellers

VAT registration in Italy is mandatory from the very first taxable transaction for businesses established outside the European Union. Italian law does not provide for registration thresholds or exemptions: even a single sale or the storage of goods in an Italian Amazon warehouse triggers the requirement to obtain a local VAT number (Partita IVA).

EU-based companies can benefit from the €10,000 annual EU-wide threshold for B2C distance sales under the WSTO (intra-EU distance selling) scheme, but only as long as goods remain outside Italian territory. The moment inventory enters an Italian Amazon fulfillment center, the threshold ceases to apply — and local VAT registration becomes compulsory.

For non-EU and non-EEA businesses, two pillars define the 2025 Italian VAT framework: the fiscal representative and the €50,000 financial guarantee. Companies operating through a representative and seeking to maintain active VIES registration must provide a financial guarantee of €50,000, valid for at least 36 months.

This obligation does not apply to businesses eligible for direct identification under Article 35-ter of DPR 633/72 (for example, certain companies from the UK or Norway). Failure to provide the guarantee results in removal from the VIES register, which for Pan-European FBA sellers means an immediate halt to cross-border stock transfers and the potential suspension of the Amazon account.

All VAT-registered entities must submit periodic and annual VAT declarations. Italy requires two primary types of filings:

Quarterly returns (LIPE trimestrali) are due by the 16th day of the second month following each quarter, while monthly returns (LIPE mensili) apply to businesses with more than €60,000 in annual VAT liability. In addition, every registered taxpayer must file an annual VAT return (Dichiarazione Annuale IVA) between February 1 and April 30 of the following year.

All submissions are made electronically through the Fatture e Corrispettivi portal, which also handles corrections, VAT refund claims, and communications with the tax office.

Since 2023, the Italian Revenue Agency has used Controlli Automatizzati IVA e-Commerce, an automated cross-checking system that compares VAT, OSS, and Intrastat declarations with transaction data received directly from marketplaces such as Amazon, eBay, and Zalando, under the EU DAC7 directive (Legislative Decree 13/2024).

When discrepancies are detected, the tax office sends an alert to the taxpayer’s account, allowing 30 days to correct or explain the issue. Penalties for errors or late payments range from 30% to 60% of the unpaid VAT, plus 5% annual interest (2025 rate).

One of the most serious risks for sellers is losing VIES registration. Without an active VIES entry, you can no longer apply the VAT exemption for intra-EU supplies or acquisitions (WDT/WNT), and every transfer between EU countries is treated as a domestic sale subject to local VAT. For Pan-European FBA participants, this means logistical disruption, higher costs, and the risk of blocked cross-border fulfillment.

Amazon and the Italian Tax Authorities – A Shared Compliance Framework

Amazon and the Agenzia delle Entrate operate in tight synchronization. Under DAC7, platforms like Amazon automatically share your sales data and VAT status directly with the Italian tax authorities.

If the Revenue Agency flags your account as “VAT non-compliant,” Amazon is immediately notified and may suspend your listings on Amazon.it or restrict Pan-European FBA shipments until compliance is restored.

The Bottom Line

The Italian VAT environment is digital, strict, but predictable. If you meet deadlines, file correctly, and monitor your VIES status regularly, you can operate smoothly — without interruptions or the risk of sudden account restrictions.

For Amazon FBA sellers expanding across Europe, Italy rewards those who combine ambition with diligence. Here, compliance isn’t bureaucracy — it’s strategy.