Amazon FBA and VAT in the UK

Spis treści

At first glance, VAT might seem like a dry, bureaucratic topic filled with paperwork and potential pitfalls. In reality, it’s the cornerstone of running a stable and compliant business on Amazon.

Many sellers — especially those just starting with the FBA model — don’t always realise that the moment their products enter an Amazon fulfilment centre in the UK, they automatically become part of the British tax system. It doesn’t matter whether your monthly sales are £100 or £100,000; simply storing goods in the UK creates a tax obligation.

Understanding what VAT is, how registration works, and how to stay compliant isn’t just about avoiding penalties. It’s about ensuring your business runs smoothly, legally, and professionally in one of Europe’s most lucrative online markets.

What Is VAT — and Why It Matters for Amazon FBA Sellers in the UK

VAT, or Value Added Tax, is a consumption tax applied to most goods and services sold in the UK. Its standard rate is currently 20%. While it’s similar to VAT systems across the EU, the UK has its own rules for registration, reporting, and invoicing.

When selling through Amazon FBA (Fulfilment by Amazon), the situation becomes more complex. Amazon gives sellers access to its extensive UK warehouse network, allowing products to be stored closer to customers. This improves delivery times and boosts sales potential — but it also triggers specific tax obligations.

Placing products in a UK fulfilment centre creates what’s known as a taxable presence. In practice, this means that even if your business is based outside the UK, you’re still required to register for VAT there. It’s not optional — it’s a legal obligation, and Amazon enforces it strictly.

Sellers are typically expected to provide a valid UK VAT number within 90 days of sending their first shipment to a UK warehouse. Failing to do so can lead to serious consequences: account suspension, delayed payouts, or even blocked listings. VAT registration isn’t just a formality — it’s a fundamental step in entering the UK market.

At the same time, VAT registration offers tangible benefits. It allows you to issue proper invoices, reclaim VAT on business-related purchases, and build credibility with customers and partners. In the UK, a valid VAT number signals professionalism and compliance — something both Amazon and buyers value highly.

Why VAT Compliance Is Essential to Avoid Amazon Account Suspension

VAT in the UK isn’t merely a tax requirement; it’s also a matter of trust — between you, Amazon, and the UK tax authority (HMRC).

Amazon has a long-standing partnership with HMRC, sharing information about sellers who use its platform. If you store goods in UK warehouses but haven’t registered for VAT, HMRC can alert Amazon directly. The platform, in turn, is legally entitled to suspend or even terminate your account until the issue is resolved.

This isn’t a hypothetical risk — hundreds of seller accounts are frozen every year due to VAT non-compliance. In some cases, even a delay in registration can trigger a warning or restriction. For small businesses relying solely on Amazon sales, such interruptions can be financially devastating.

However, understanding and managing VAT properly can also give you a competitive edge. Being VAT-compliant demonstrates professionalism and reliability. It reassures customers and partners that your business operates transparently and by the rules — qualities that often translate into higher sales, stronger partnerships, and easier access to financing.

For entrepreneurs expanding across Europe, navigating the UK VAT system may feel complex at first. But the sooner you view VAT not as an obstacle, but as part of doing serious business, the smoother your growth will be. Registering for VAT isn’t just about ticking a box — it’s your entry ticket into a trusted, rules-based marketplace where compliance and credibility are the foundations of success.

VAT Registration Obligations for Amazon FBA Sellers

For sellers operating under the Amazon FBA model in the United Kingdom, VAT registration is not an option but a required part of market entry. The key distinction lies in the seller’s status. If you are a non-established taxable person (NETP), you are not entitled to a local registration threshold, which means you must register for VAT from the moment you make your first taxable supply. In practice, once you place your stock in an Amazon warehouse in the UK and intend to begin sales to British customers, you should submit your VAT registration before starting to sell and remember that HMRC must be notified within thirty days from the date the obligation arises.

For businesses established in the UK, the registration threshold currently stands at £90,000 within a rolling twelve-month period, but this rule does not apply to NETPs. It is therefore important to avoid the mistaken assumption that you can “wait until you reach the threshold.” If your business is not established in the UK, you are required to register as soon as you plan to sell goods located there.

When the Obligation to Register Arises

The obligation to register does not arise solely from storing goods in a third-party logistics warehouse but from beginning, or intending to begin, taxable supplies in the United Kingdom. In the FBA model, the moment you place inventory in an Amazon warehouse is generally an indication that sales will start soon, which is why the correct and safest approach is to complete your VAT registration before your first sale. You have thirty days to notify HMRC, counting from the moment the obligation arises, that is, from the time you begin or intend to begin making taxable supplies within the next thirty days.

It is also useful to clarify terminology. The expression “taxable presence” is often used, but within the VAT framework, the correct terms are “establishment” and “fixed establishment.” Simply storing goods in an Amazon warehouse, without human or technical resources on the seller’s side, usually does not constitute a fixed establishment. The essence of the obligation, however, lies in the fact that as a NETP, you cannot benefit from a threshold and therefore must register from the first taxable supply.

Furthermore, particular scenarios apply when selling through marketplaces. In certain cases, the marketplace itself accounts for VAT on sales — for example, for low-value consignments or where the seller is a non-established entity. However, this does not exempt you from local registration where it is required for B2B transactions, input VAT recovery, import VAT accounting (including postponed VAT accounting), or proper record keeping. All these responsibilities remain with you as the seller.

Amazon’s Requirements

Amazon explicitly requires sellers who use UK warehouses to hold a valid VAT number and expects this number to be entered into Seller Central within ninety days of the first stock placement. This window is designed to allow for technical implementation but does not change the fact that, under UK tax law, registration should take place before sales begin. If no VAT number is provided after this period, Amazon may restrict listings, delay payouts, or even suspend the seller account. The platform cooperates with HMRC, and long-term non-compliance may result in action from the authority, including potential penalties.

The safest approach is to prepare in advance: submit your VAT registration application, configure the correct tax rates and codes in your listings, enable compliant invoicing, and maintain records that meet digital reporting requirements. By doing so, your account remains stable, and VAT compliance under Amazon FBA in the UK becomes a predictable part of your business rather than a risk.

VAT Registration Threshold and Exceptions

Understanding the VAT registration framework in the United Kingdom is one of the most important compliance tasks for every Amazon FBA seller. The essential distinction lies between businesses established in the UK and those operating from abroad as non-established taxable persons. These two categories are subject to entirely different rules regarding registration thresholds.

As of 1 April 2024, the VAT registration threshold in the United Kingdom is £90,000, and this figure remains valid in 2025. It represents the total VAT-taxable turnover — the combined value of taxable sales, excluding VAT, over a rolling twelve-month period. This includes sales taxed at the standard 20% rate, the reduced 5% rate, and zero-rated sales, but excludes exempt transactions such as certain financial services. This is not a calendar-year calculation: HMRC requires businesses to monitor their turnover each month over the previous twelve months to determine whether they have exceeded the threshold.

For UK-established firms, exceeding this limit triggers the obligation to register for VAT. The requirement may also arise earlier if you know that your turnover will exceed £90,000 within the next thirty days — the so-called forecast threshold. In that case, registration must take place within thirty days of the point at which it becomes clear that the limit will be surpassed. The effective date of registration is then the beginning of the second month after the threshold has been exceeded. HMRC expects businesses to monitor their turnover actively; it will not detect this automatically.

In practice, however, most non-UK FBA sellers cannot rely on this threshold because they are not established in the country.

When the Threshold Does Not Apply

If your company is based outside the United Kingdom, you are considered by HMRC to be a non-established taxable person. In this situation, the VAT threshold does not apply. You must register for VAT in the UK as soon as you make or intend to make taxable supplies of goods within its territory.

For Amazon FBA sellers, this means that once your inventory is shipped to an Amazon warehouse in the UK, it is evident that you plan to start selling to local customers. The appropriate moment for registration is therefore before sales begin, and no later than thirty days after the obligation arises — that is, from the time you actually start selling goods located in the UK.

Simply storing goods does not, in the legal sense, create a registration event, but in practice, it marks the beginning of your market entry. Amazon requires you to enter a VAT number in Seller Central within ninety days of stock arriving in the UK. Failure to do so may result in restrictions, paused sales, or withheld payments. The platform follows HMRC regulations and its own compliance policies in this respect.

HMRC also has the right to notify the marketplace officially if it determines that a seller is trading without VAT registration. In such cases, Amazon must block the account until the issue is resolved. This is not an automatic process for every warehouse entry but a measure under the “joint and several liability” regime, under which the marketplace shares responsibility for ensuring that sellers are compliant.

For NETP sellers, the conclusion is straightforward: failure to register for VAT in the United Kingdom presents a genuine risk of losing the ability to sell through Amazon.

Practical Scenarios

Example 1 – European seller storing inventory in an Amazon warehouse

Marta runs a small business selling kitchen accessories. She sends 500 units of her products to Amazon’s fulfilment centre in Coventry. Although she has not yet started selling, she plans to do so within the next few weeks. Because the goods are already located in the United Kingdom and will be sold to local customers, Marta must register for VAT before her first sale, ideally even before shipping her stock.

Example 2 – UK-based company

Adam owns a limited company registered in London. His business has generated sales of £82,000 over the past twelve months. At this stage, he is not yet required to register for VAT. However, if he forecasts an additional £15,000 in sales over the next month, bringing his total turnover above the £90,000 threshold, he must submit his VAT registration to HMRC within thirty days. In this case, his registration date will fall at the beginning of the second month following the month in which the limit was exceeded.

Example 3 – Marketplace as the VAT-collecting entity

If Marta sells goods where the consignment value is below £135, then under UK VAT rules, the marketplace (in this case, Amazon) may be responsible for accounting for VAT as the so-called “deemed supplier.” If the goods are already located in the United Kingdom, the marketplace may also be liable for VAT regardless of the consignment value. However, even in such cases, the seller may still need to register locally—for example, to account for import VAT, including through postponed VAT accounting (PVA), to issue invoices for B2B sales, or to reclaim VAT on business purchases.

VAT Rates and Invoicing Rules

For Amazon FBA sellers in the United Kingdom, understanding the principles of VAT and invoicing is a fundamental part of running a business. While many entrepreneurs tend to focus on logistics and marketing, in the British e-commerce environment, it is correct VAT accounting that determines both the seller’s credibility and the stability of their Amazon account. HMRC is not an institution to experiment with. Applying the wrong VAT rate, issuing incorrect invoices, or keeping incomplete records can result in costly corrections, and in more serious cases, financial penalties.

Current VAT Rates in the United Kingdom

In 2025, three main VAT rates apply in the UK: 20% (standard rate), 5% (reduced rate), and 0% (zero rate). Each covers a different range of goods and services, and applying the correct one is essential for accurate tax reporting and to avoid disputes with HMRC.

The standard rate of 20% applies to most goods and services, including the typical products sold through Amazon FBA such as electronics, cosmetics, clothing, and household accessories. Within Amazon Seller Central, the rate can be assigned to individual products using the appropriate tax code, which helps prevent invoicing errors.

The reduced rate of 5% applies to a narrower category of goods and services, including domestic energy, installation of energy-saving materials such as solar panels and heat pumps, and certain equipment designed to assist elderly or disabled individuals when installed in private homes. It is worth noting that some children’s products, such as car seats and booster cushions, have been subject to the 0% rate instead of 5% since 1 January 2024, according to VAT Notice 701/59.

The zero rate applies to goods that are technically subject to VAT but taxed at 0%. This means that the sale is VAT-taxable even though the rate is zero, allowing the seller to reclaim input VAT on related business purchases. This category includes printed books, newspapers, basic food items, children’s clothing, and some hygiene products. It is important to emphasise that zero-rated sales count towards VAT-taxable turnover, which affects the point at which a business becomes required to register for VAT.

Zero-rated sales should not be confused with VAT-exempt sales. Exempt supplies, such as certain financial, educational, or rental services, are not subject to VAT and do not count towards the registration threshold. Moreover, sellers providing exempt goods or services cannot reclaim VAT on related business purchases.

In practice, most Amazon FBA sellers deal primarily with the 20% and 0% rates. In case of doubt, it is advisable to consult the latest HMRC guidance (“VAT rates for goods and services” on GOV.UK), as the scope of each rate can change over time.

How to Issue VAT Invoices Correctly

Proper invoicing in the United Kingdom is not merely an administrative requirement—it is part of professional business conduct. A VAT invoice serves as a legal proof of sale and allows both the seller and their business clients to report VAT correctly.

Each VAT invoice must include the full name and address of the seller, the VAT registration number with the GB prefix, the buyer’s name and address (for B2B transactions), a unique invoice number, the date of issue and the date of supply (if different), a description of the goods or services provided, the quantity and unit price, the net value, the VAT rate applied, the VAT amount, the gross value, and the currency used. Under VAT Notice 700, invoices for UK VAT-liable sales should normally be issued in pounds sterling (GBP). If another currency is used, the VAT amount must always be shown in GBP, converted using the appropriate exchange rate.

The distinction between B2B and B2C invoicing is also significant. For B2B sales, issuing a VAT invoice is mandatory, as business clients may need it to reclaim VAT. For B2C sales to consumers, an invoice is not required unless the customer specifically requests one, in which case it should be provided within a reasonable timeframe, usually within thirty days. Amazon allows automatic access to invoices via the “Your Orders” section, eliminating the need for manual document handling.

Many sellers use Amazon’s VAT Calculation Service (VCS), which automatically generates VAT invoices on behalf of the seller. However, under UK law, the seller remains the legal issuer of the invoice and is responsible for ensuring the accuracy of the information, VAT rate, and numbering. Amazon acts only as a technical intermediary.

Common errors among sellers include applying the Polish VAT rate instead of the UK rate, issuing invoices in another currency without converting VAT into GBP, omitting the VAT number, misclassifying zero-rated sales as exempt, and failing to archive invoices according to HMRC requirements.

As for record keeping, HMRC requires invoices to be retained for at least six years. Under the Making Tax Digital (MTD) regime, businesses must maintain digital VAT records and submit VAT returns online, although invoices themselves can be stored either in paper or electronic format, provided they are legible and easily accessible upon request.

Correct invoicing not only protects you from penalties but also strengthens your reputation on Amazon. Customers in the UK place great importance on transparency and compliance. A VAT invoice bearing a valid GB number and correctly calculated tax is a signal that they are buying from a credible and professional seller who understands and respects the rules of the British market.

Submitting VAT Returns and Payments

Registering for VAT in the United Kingdom means more than simply charging tax on your sales. It also involves regularly reporting and paying VAT to HMRC. For Amazon FBA sellers, this becomes a routine part of doing business — systematic and predictable, but requiring precision and good organisation. HMRC allows no room for improvisation: late returns, inaccurate data, or delayed payments can result not only in penalties but also in damage to your tax compliance record.

Since April 2022, all VAT-registered businesses — including those registered voluntarily — have been required to operate under the Making Tax Digital (MTD) system. This means VAT returns must be filed electronically, and financial data must be kept in digital form with a continuous digital link between accounting systems.

Frequency and Format of VAT Returns

Many business owners wonder how often VAT returns must be submitted in the UK. The standard reporting frequency is quarterly, although in some cases — for example, where turnover is high or the business is frequently in a refund position — it is possible to switch to monthly or annual reporting. Each return covers a three-month period and must be submitted within one month and seven days after the end of that period. For instance, if your quarter ends on 31 March, your VAT return and payment must be received by HMRC no later than 7 May.

Returns are submitted through HMRC’s VAT Online Services or via approved MTD software. Under MTD, data must be transmitted digitally, which means manual entry or copying between spreadsheets and systems is not permitted. There must be a continuous digital link connecting your accounting records to the submission software.

It is also important to remember that VAT payments must clear into HMRC’s account by the deadline day. If you use the BACS payment method, which can take up to three working days, it is advisable to initiate the payment at least three days in advance.

VAT returns in the United Kingdom are significantly simpler than their equivalents in many EU countries, consisting of nine boxes in total. They include VAT due on sales within the UK and on services supplied abroad, VAT due on certain purchases or imported services, total VAT due, input VAT available for deduction, the VAT payable or reclaimable, the net value of sales and purchases, and the value of goods supplied to or acquired from EU countries, which in most cases is now zero following Brexit.

For Amazon FBA sellers, correct reporting of Postponed VAT Accounting (PVA) is particularly important. This system allows import VAT to be accounted for on the VAT return without the need to pay it at customs clearance. Import VAT is reported within the same return — VAT due on imports is entered as output tax, and the same amount is claimed as input tax, with the net value of imported goods also included. The data is obtained from the Monthly Postponed Import VAT Statement (MPIVS) available through the HMRC portal. PVA is especially valuable for businesses importing high-value goods, as it prevents unnecessary cash flow disruption by eliminating the need for upfront VAT payments at the border.

VAT Payments

Once a return has been submitted, the corresponding VAT liability must be paid on time — by the seventh day of the month following the month in which the accounting quarter ends. For example, if your VAT period ends on 30 June, the deadline for submitting and paying VAT is 7 August.

HMRC accepts several payment methods, although it strongly encourages electronic options. The most convenient and secure method is Direct Debit, which allows HMRC to collect the amount automatically on the due date. Faster Payments or BACS transfers can also be used, as well as debit or credit card payments made through the HMRC portal.

If you use BACS, bear in mind that processing can take up to three working days, so the payment should be initiated ahead of time. The payment must reach HMRC’s account by the end of the deadline day; simply authorising the transfer on that date is not sufficient.

In cases of late submissions or payments, HMRC applies the Penalty Points System. Each missed deadline results in a penalty point. For quarterly returns, the limit is four points; for monthly returns, five; and for annual returns, two. Once the threshold is reached, a fixed financial penalty of £200 is applied for each subsequent late submission. Points can be reset after a defined period of full compliance and timely filings.

In addition, interest is charged on overdue VAT at the Bank of England base rate plus 2.5%. The rule works both ways: if HMRC delays a VAT refund, the taxpayer is entitled to repayment interest at the base rate minus 1%.

For businesses that regularly receive VAT refunds, often due to high import volumes or investment in stock, HMRC pays the refund directly into the bank account specified in the VAT registration. In practice, this process typically takes between five and twenty working days, provided that the bank details are correct and match the registration data.

Accounting Organisation Tips

Well-organised bookkeeping is the best insurance against mistakes that can cost a business both time and money. For Amazon FBA sellers processing hundreds of transactions every day, manually managing VAT records is simply unrealistic. This is why integrating your Amazon account with an MTD-compatible accounting system through automation tools is so important.

Some software automatically retrieves data from your Amazon account, applies the appropriate VAT rates, generates reports in line with HMRC requirements, and transmits them digitally to the MTD system. This approach eliminates the risk of human error and reduces the time needed to prepare VAT returns from several days to just a few minutes.

It is also worth working with an accountant or tax adviser experienced in e-commerce accounting. The British system differs from that of other European countries in many details, particularly regarding import procedures, VAT on services, and PVA rules. Local expertise can help you avoid misinterpretations and errors that may have long-term financial consequences.

Finally, remember that HMRC can request access to your records even years after a transaction takes place. For this reason, sales, import and VAT return records should be retained for at least six years. This is a standard requirement of UK tax law and part of the Making Tax Digital framework.

VAT Services on Amazon

Many Amazon FBA sellers begin their international expansion through the United Kingdom. For many of them, the main barrier is not logistics but bureaucracy — particularly VAT compliance. To help sellers overcome this, Amazon created an integrated tax support system known as VAT Services on Amazon. Its purpose is to simplify VAT registration, invoicing, and return submission across multiple countries.

In practice, this is a convenient tool, but it should not be mistaken for full accounting support. Amazon does not act as your accountant or taxpayer. Instead, it provides the platform and connects you with a certified tax partner who acts on your behalf. It is a support system, not a delegation of responsibility.

How VAT Services on Amazon Works

VAT Services on Amazon (often simply referred to as “VAT Services” to avoid confusion with the VISA brand) integrates VAT compliance processes across the United Kingdom and eight major European countries. In 2025, the service covers the UK, Germany, France, Italy, Spain, Poland, the Czech Republic, the Netherlands and Sweden.

Its scope includes three main areas: VAT registration, VAT invoicing (for Amazon marketplaces), and VAT return submission.

After activating the service in Seller Central, the seller completes a form with company details, business activity, and registration country. They must then accept the service terms and grant Amazon’s tax partner — for example Avalara, KPMG, VATGlobal or Meridian Global Services — a power of attorney to represent them before HMRC or the relevant authority in another country. Only then can the partner submit the VAT registration application.

Amazon shares only basic account data with the partner; other required documents such as bank statements, proof of address or company incorporation papers must be provided by the seller directly. Once registration is complete, the VAT number is automatically linked to the seller’s account in Seller Central.

Automatic VAT invoicing under VAT Services operates in the countries where Amazon has its own marketplaces — the UK, Germany, France, Italy and Spain. In these markets, Amazon generates VAT-compliant invoices and makes them available directly to customers through their accounts. In other countries, such as Poland or the Czech Republic, the service covers only registration and VAT return submission, without automated invoicing.

The main advantage of this system is its integration with Making Tax Digital in the UK. Sales data is transmitted digitally through the MTD API directly from the partner’s software to HMRC. Amazon does not have access to the content of the VAT returns; Seller Central only displays the submission status, such as “submitted” or “pending.”

VAT Services also allows sellers to monitor return statuses and payment history in one place. For businesses trading across multiple countries, this offers significant convenience — there is no need to contact tax offices or accountants in each jurisdiction separately.

Amazon often offers the first year of VAT Services free of charge, for example under a promotion running until 31 March 2026. After the promotional period, the monthly fee depends on the number of countries covered, usually ranging between €33 and €50 per country.

Seller Responsibility

Although VAT Services on Amazon simplifies VAT compliance, one rule remains unchanged: Amazon and its partners do not bear tax responsibility for your filings. The seller remains the formal taxpayer in every country where they are registered and is fully accountable to the local tax authority for the accuracy and timeliness of their returns and payments.

Amazon acts purely as a technical intermediary. It provides the platform and integrates data but does not sign any declarations or applications on your behalf. Partners such as Avalara, KPMG or VATGlobal act on behalf of the seller but without taking on legal responsibility. If a return is filed with errors, HMRC will still hold you accountable, not the partner.

Furthermore, the partner can only prepare VAT returns based on the data you provide. If the information is incomplete, outdated or inaccurate, the resulting declaration will also be incorrect — and HMRC will treat you as responsible. Amazon clearly emphasises this in the VAT Services terms and conditions.

Amazon is also not a “taxpayer on your behalf.” There are specific cases where a marketplace becomes a “deemed supplier” responsible for accounting for VAT, such as for consignments under £135 or sales of goods already located in the UK made by sellers established abroad. Even in such cases, sellers usually still need a local VAT registration to handle import VAT, issue B2B invoices, or reclaim input tax.

If you miss a filing or payment deadline, HMRC will not contact Amazon or its partner — it will contact you directly. Any fines, interest, or penalty points under the VAT Penalty Points system will be recorded against your own taxpayer profile.

For this reason, even when using VAT Services on Amazon, it is crucial to maintain active oversight of your compliance. Check your sales reports, monitor the submission status of your returns, and keep proof of filing and payment. These are your tax records, and Amazon merely serves as a bridge between you and the tax authorities.

Practical Tips for Amazon FBA Sellers

For many European entrepreneurs, expanding into the UK market through Amazon FBA is one of the most important steps in the growth of their business. But wherever international e-commerce begins, new obligations follow — and VAT in the United Kingdom is one that cannot be ignored. Understanding how to prepare for registration and how to organise ongoing VAT compliance is not only a matter of legality but also a mark of professionalism in running a business.

Below are practical step-by-step tips to help you navigate the VAT registration process in the UK and then optimise your reporting to make it as efficient and risk-free as possible.

How to Prepare for VAT Registration

The first step is to determine whether you need to register. If your business is established outside the UK and you plan to sell through Amazon FBA, VAT registration is virtually unavoidable. Non-established taxable persons (NETPs) are not entitled to the £90,000 threshold — registration is required as soon as you begin or intend to make taxable supplies in the UK. In practice, this means you should complete registration before your first sale, or even before sending goods to an Amazon warehouse.

Next, prepare the necessary documents. HMRC requires that the VAT registration application be complete and supported by credible evidence of business activity. The most common documents include a certificate of business registration, proof of address, a copy of an identity document for the business owner or director, a description of your business activity and planned UK sales, and information on where your inventory will be stored. If you are using VAT Services on Amazon, the partner handling your registration will request these documents electronically. Scanned copies may also need to be certified or officially translated into English.

Once you have the documentation, complete the registration form online via HMRC’s portal. The VAT1 form collects basic business information, the nature of your trade, expected turnover, and the date sales will begin. If you are based outside the United Kingdom, you will also need to complete the VAT1TR form for NETPs.

After submission, you will need to wait for your VAT number to be issued. The process typically takes between two and six weeks but can take longer for non-UK businesses, especially if HMRC requests additional information. Once approved, you will receive your VAT number, beginning with the “GB” prefix followed by nine digits.

You must then enter your VAT number into your Amazon Seller Central account within 90 days of your first stock placement in a UK warehouse. If you fail to do so, Amazon may pause your sales. Once the VAT number is verified, it will automatically appear on your invoices issued to customers.

After registration, your VAT account must be connected to software compatible with the Making Tax Digital system. This integration allows you to submit returns digitally and ensures full compliance with HMRC’s reporting standards.

Most sellers report quarterly, but monthly submissions are also possible if you process a high volume of transactions or wish to reclaim VAT more frequently. Whatever frequency you choose, deadlines must be observed carefully, as late returns or payments can result in penalty points and financial fines.

Finally, keep all documentation for at least six years. HMRC can request access at any time during this period. Ensure that invoices, import confirmations, sales ledgers, and Amazon reports are archived securely — digitally or on paper, but always complete, legible, and easily accessible.

How to Optimise VAT Reporting in the UK and EU

Selling through Amazon FBA rarely means operating in just one country. Many sellers use fulfilment centres in both the UK and the European Union. Managing VAT correctly not only prevents compliance issues but can also optimise your cash flow and improve your overall efficiency.

If you import goods into the United Kingdom, take advantage of Postponed VAT Accounting (PVA). This mechanism allows you to account for import VAT on your VAT return instead of paying it upfront at customs. In practice, you declare the same VAT amount as both output and input tax, resulting in a net value of zero. This improves liquidity and eliminates the need to finance VAT on imports.

If you also sell in EU markets, consider using OSS (One Stop Shop) or IOSS (Import One Stop Shop) to simplify your EU VAT compliance. The UK is no longer part of the OSS scheme, but you can maintain parallel compliance — one VAT registration for the UK and another for the EU. Structuring your logistics efficiently can help minimise the number of VAT registrations you need across different jurisdictions.

Keep your UK accounting separate from your EU data. This is a common mistake among new sellers. Sales from UK warehouses must be reported independently and cannot be merged with transactions from warehouses in Germany, France, or elsewhere. Even if you use Amazon’s Pan-European services, the data submitted to HMRC must reflect only UK-based transactions.

Automate your invoicing and reporting. Instead of manually exporting data from Seller Central, use software that integrates Amazon with your accounting system. This reduces the risk of reporting errors and speeds up VAT preparation.

Monitor VAT rates in your product categories. The UK regularly updates VAT classifications — for example, from 2024, children’s car seats were moved from the 5% rate to 0%. Keep an eye on updated VAT Notices on GOV.UK, especially if you sell products that may fall between categories, such as food, supplements, or medical goods.

Review your VAT data regularly. Once a quarter, check your sales reports and VAT returns to confirm that rates are assigned correctly, there are no duplicates, and all Amazon transactions are included. This small effort can prevent errors and avoid the need for costly corrections.

If your monthly turnover exceeds several tens of thousands of pounds, consider working with a tax professional specialising in e-commerce VAT. A specialist who understands both UK and EU rules can help you streamline compliance and advise on how to best use cross-border VAT mechanisms to your advantage.

In short, VAT in the United Kingdom for Amazon FBA sellers requires preparation, but it doesn’t have to be stressful. The key is to stay organised, use automation tools, and review your data regularly. When managed properly, your VAT process becomes predictable and compliant, allowing your business to grow confidently across Europe. Key VAT Rules for Amazon FBA Sellers in 2025

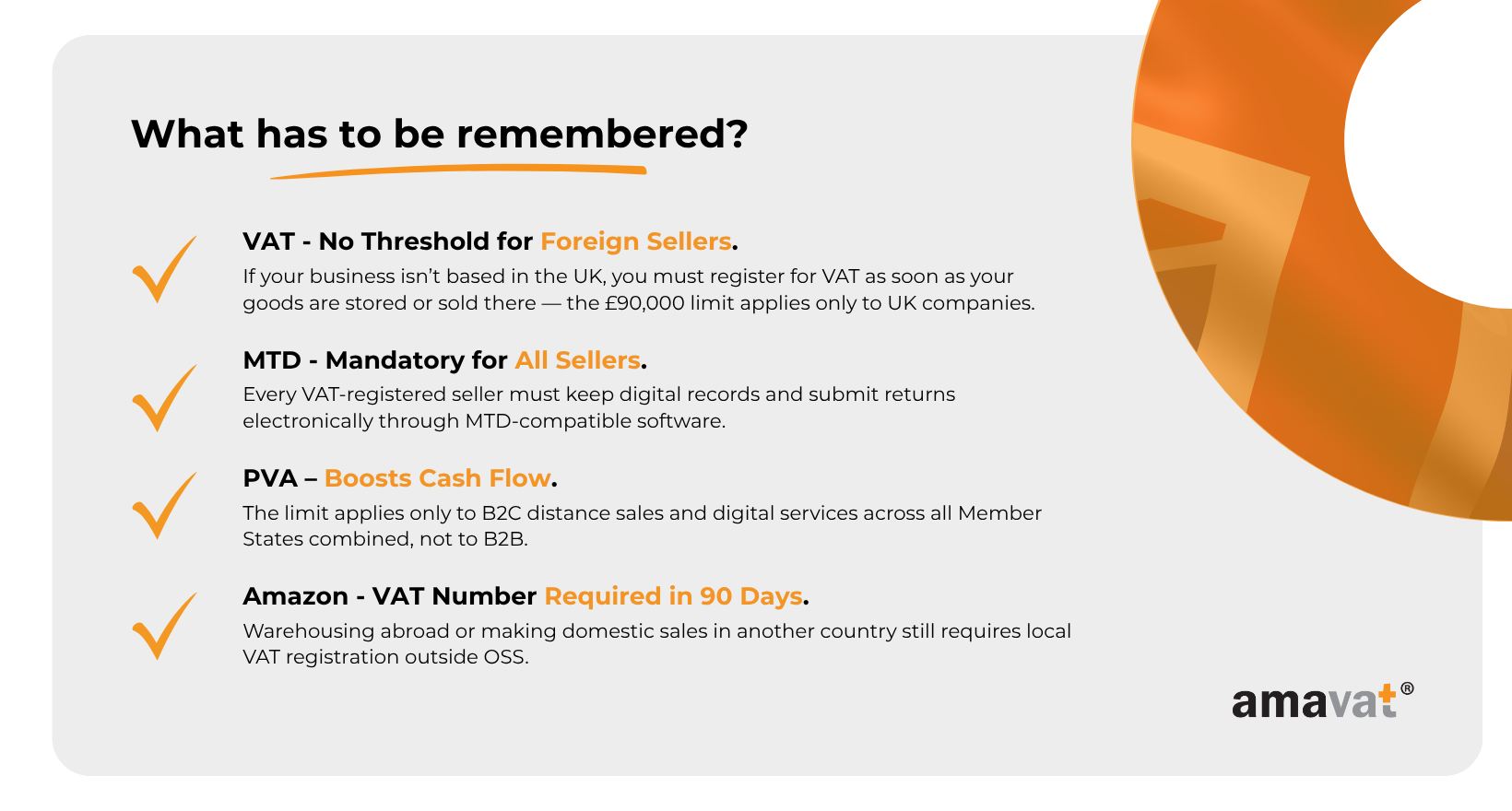

In 2025, the basic principles are clear, though they are often misunderstood by new sellers. Every entrepreneur using Amazon FBA warehouses in the United Kingdom must register for VAT before starting sales, because storing goods in the UK indicates an intention to carry out taxable business activity there.

The VAT registration threshold in the United Kingdom remains at £90,000, but it applies only to businesses established in the UK. For sellers based abroad — known as Non-Established Taxable Persons (NETPs) — the obligation to register arises immediately, regardless of turnover. The VAT registration application must be submitted to HMRC within thirty days of beginning, or intending to begin, taxable sales.

After registration, sellers are required to maintain records compliant with the Making Tax Digital (MTD) framework, file VAT returns (usually quarterly), and pay tax on time. The standard VAT rate in the UK is 20%, with reduced (5%) and zero (0%) rates applying to categories such as food, books, newspapers and certain children’s products.

For Amazon FBA sellers, the rules concerning Postponed VAT Accounting (PVA) — which allows import VAT to be declared without upfront payment — and the deemed supplier model, under which Amazon itself accounts for VAT in some cases (for example, consignments under £135), are equally important.

It is also essential to remember that the VAT number must be entered into Seller Central within ninety days of storing goods in a UK fulfilment centre. Failure to register or delays in doing so can lead to account suspension, restricted sales, and official notices from HMRC.

The Importance of Compliance and Avoiding Penalties

From HMRC’s perspective, Amazon FBA sellers are among the most closely monitored groups of online traders. The tax authority cooperates directly with marketplaces and regularly verifies sellers’ VAT data. As a result, tax compliance is no longer a matter of choice — it is a condition for keeping your account active and maintaining the right to trade.

Failure to register, submitting returns late, or providing incorrect data can result not only in financial penalties but also in a loss of trust from the platform itself. Amazon is legally obliged to respond to HMRC notifications and may suspend the account of any seller who fails to comply.

The new Penalty Points System, introduced in 2023, rewards consistency and timeliness. Each missed deadline adds a penalty point, and once the limit is reached, a £200 fine is imposed for every subsequent delay. Late payments also incur interest, calculated at the Bank of England base rate plus 2.5%. In serious cases, HMRC may even refuse to process VAT refunds if it determines that the returns are unreliable.

On the other hand, proper and punctual compliance brings tangible benefits. Once registered, you can deduct VAT on eligible business expenses — such as imports, Amazon fees, or advertising costs — and receive tax refunds while demonstrating reliability to financial partners and authorities. For HMRC, transparency is synonymous with credibility; for the seller, it is a guarantee of stability and peace of mind.

Looking Ahead: Possible VAT Threshold Changes and Financial Planning

The VAT registration threshold in the UK is set at £90,000 for 2025, but its future remains a topic of debate. Proposals to raise it to £100,000 or lower it to include more small businesses are regularly discussed in public consultations. The final decision rests with the government and will depend on fiscal strategy and the condition of public finances.

For Amazon FBA sellers, the key is to plan ahead. Even if the threshold changes, businesses established outside the UK (NETPs) will remain unaffected, as they are always required to register immediately. Sellers operating through UK limited companies, however, should monitor their turnover closely to avoid exceeding the threshold unintentionally and being forced into late registration.

Financial planning in the context of VAT is also about liquidity management. It is wise to set aside funds throughout the quarter to cover future VAT payments and avoid surprises. If your import volumes are significant, using PVA can improve your cash flow. If you operate across multiple EU markets, consider using VAT OSS to simplify reporting and reduce the number of registrations required.

Amazon continues to expand its compliance tools — such as VAT Services on Amazon — to make cross-border VAT management easier. Yet no matter how automated the system becomes, the responsibility for the accuracy of the data always lies with the seller.

Final Takeaways

VAT in the United Kingdom does not have to be a challenge for Amazon FBA sellers, provided you approach it with preparation and understanding. Learn the rules, gather the right documentation, use MTD-compatible software, automate your filings, and above all — meet your deadlines.

Compliance is not just protection against penalties; it is the foundation of a sustainable business. In 2025, the UK remains one of the most attractive e-commerce markets in Europe, and a well-managed VAT system is your gateway to growth, scalability, and long-term success.

Summary

Selling through Amazon FBA in the United Kingdom offers enormous potential for European entrepreneurs — access to one of the world’s most advanced e-commerce markets, millions of customers, and a highly developed logistics infrastructure. But with these opportunities comes responsibility, and VAT in the UK is a crucial part of that. For Amazon FBA sellers, it is not just a formality, but an integral element of running a legal, stable, and professional business.