Common VAT OSS misconceptions – B2B vs B2C in the EU

Spis treści

This is where the European Union tried to make life easier by introducing the VAT One Stop Shop, or OSS. At first glance, OSS looks like the perfect solution. Instead of registering for VAT in every single country where you sell to private customers, you can handle everything in one return through the OSS system in your own country. For a small online business, this sounds like a miracle: one registration, one place to declare, one payment.

But here comes the catch. OSS was built to cover B2C transactions, meaning sales to private individuals who are not VAT-registered. It was never designed for B2B transactions, meaning sales to other businesses. And this is exactly where many young entrepreneurs trip up. Because OSS feels so universal, many assume it works for both types of sales. Unfortunately, that mistake can be costly.

Mixing up B2B and B2C in the OSS system can lead to filing errors, missed VAT payments, and even penalties from tax authorities. What looks like a simple shortcut can quickly become a compliance trap. The truth is that while OSS simplifies life for B2C sellers, B2B transactions continue to follow a completely different set of rules, mainly the reverse-charge mechanism.

This article will walk you through the most common misconceptions about VAT OSS in the European Union and explain, in plain language, how to separate B2C and B2B obligations. The goal is not only to make sure you avoid problems but also to give you a clear picture of how to plan your cross-border sales strategy without nasty surprises.

OSS applies only to B2C transactions

The most important thing to understand about the VAT One Stop Shop (OSS) is that it was designed exclusively for sales to private individuals. This is where many misconceptions begin. Because OSS centralizes VAT reporting, it feels like it should cover every cross-border transaction. The reality is different: OSS has a very narrow scope, and business-to-business transactions are left out entirely.

The scope of OSS: Union and Non-Union schemes

For online sellers there are two relevant versions of OSS, depending on where the business is established.

The first is the Union OSS, which applies to companies based inside the European Union. It covers two main situations: distance sales of goods to private customers in other EU countries, and certain services provided to consumers across borders. A simple example is a Polish clothing shop shipping parcels to buyers in Germany, France, or Italy. Instead of having to register for VAT in each of those countries, the seller can declare all those sales in a single quarterly OSS return filed in Poland.

The second is the Non-Union OSS, which applies to businesses established outside the EU. This scheme is narrower and focuses mainly on services provided to EU consumers, especially digital ones such as e-books, streaming, software subscriptions, or online courses. A company from the United States can register in one EU country of its choice and handle all its consumer VAT obligations through OSS, avoiding multiple local VAT registrations.

There is also a separate procedure called Import OSS (IOSS), which often causes confusion. IOSS applies to goods imported from outside the EU with a value up to 150 euro. While its name sounds similar, it is a distinct system and does not replace the Union or Non-Union OSS.

What all of these versions have in common is their strict B2C focus. OSS was created to simplify VAT reporting for consumer sales. Once the buyer has a valid VAT number and qualifies as a business, OSS cannot be used.

Why OSS does not apply to B2B sales

When selling to another VAT-registered company, the transaction follows a different path. The seller normally issues an invoice without VAT, and the buyer accounts for the tax in their own country under the reverse charge mechanism.

This means that the seller does not collect VAT in the buyer’s country. Instead, the buyer declares both the VAT payable and the VAT deductible in their return. In practice, this keeps the process cash neutral while making sure the tax is reported where consumption takes place.

It is important to stress that the reverse charge is not optional. Even if a seller would prefer to declare all sales through OSS for simplicity, the law does not allow it. Any attempt to report B2B sales through OSS would immediately create inconsistencies between the seller’s returns and the buyer’s reporting, which tax offices can easily detect.

The risks of misreporting B2B through OSS

For small e-commerce shops, this is where mistakes often happen. Picture a Polish online store that sells handmade products both to German consumers and to German companies. If the owner mistakenly reports both sales in their OSS return, the filing will not align with EU VAT rules. This can result in double taxation, underpayment of VAT, or penalties for submitting incorrect data.

The problems go beyond money. Incorrect invoices can damage credibility. A German business receiving an invoice with VAT included — when it should have been issued under reverse charge — will spot the error quickly. This raises doubts about the supplier’s understanding of VAT rules and can make cooperation more difficult.

On top of that, fixing mistakes is rarely straightforward. OSS corrections can involve contacting tax authorities in more than one country, amending earlier filings, and justifying the error. For a small business with limited resources, the time and stress involved can be far more draining than the VAT amount itself.

The €10,000 Threshold Misconception

One of the most misunderstood rules in EU VAT is the €10,000 threshold. At first glance, it looks like a universal limit for all cross-border sales, but this is not the case. The threshold was introduced for very specific B2C situations, and it never applies to business-to-business transactions.

What the threshold actually covers

The €10,000 threshold came into effect on 1 July 2021 as part of the EU’s e-commerce VAT package. It applies only to cross-border sales made to consumers and combines two categories: intra-EU distance sales of goods, and telecommunications, broadcasting, and electronic services.

To illustrate, imagine a Polish online shop sending clothing to private customers in Germany and Slovakia. If the total value of all these cross-border B2C sales stays under €10,000 net in a calendar year, the shop can keep things simple: it continues charging Polish VAT and reports everything in its domestic VAT return.

Once the sales exceed the €10,000 limit, the rules change. The seller must apply the VAT rate of the customer’s country. At that point, there are two options: declare everything through the OSS return (which is usually the easier route) or register for VAT separately in each Member State of consumption.

The idea behind this rule is to give micro-sellers a breathing space, so they do not face complex cross-border VAT obligations from the very first euro.

Why B2B sales are excluded

This is where many small businesses get it wrong. The threshold has nothing to do with B2B transactions. From the very first sale to a VAT-registered buyer in another Member State, the reverse charge mechanism takes over.

That means the seller issues an invoice without VAT, provided the buyer has a valid VAT number, and the buyer accounts for VAT in their own country. Whether you sell €100 or €100,000 to businesses abroad, those sales never enter the €10,000 calculation.

Common errors in practice

In reality, confusion often arises because entrepreneurs add up all foreign revenue without separating B2C and B2B. The most frequent mistakes are including B2B turnover in the threshold calculation, which creates a false impression of crossing the limit, or applying the threshold rule to B2B invoices. Some sellers think that below €10,000 they can continue charging Polish VAT even to foreign companies — but that is never correct. Reverse charge applies from the very first business sale.

Why the distinction matters

Mixing up B2B and B2C in VAT reporting is more than just a technical error. It can result in incorrect filings, underpayment or overpayment of VAT, and the need to issue corrected invoices. Business customers, in particular, notice mistakes quickly. For them, a wrongly issued invoice is a red flag, and it can harm your reputation as a reliable partner. Even small errors in VAT treatment can undermine trust and slow down business relationships.

Different rules for invoicing and reporting

Once you understand that OSS applies only to B2C transactions, the next step is to see how invoicing and reporting differ depending on whether your customer is a consumer or a business. The treatment of these sales is fundamentally different, and mixing them up is one of the quickest ways to run into VAT compliance problems.

B2C sales under OSS

When selling to private consumers in the EU, the seller must charge VAT at the customer’s local rate once the €10,000 threshold is exceeded. For instance, a Polish online shop shipping goods to Germany must apply the German VAT rate, not the Polish one, once its total cross-border B2C sales go beyond €10,000 in a year.

From a reporting perspective, these transactions are declared through a quarterly OSS return in the seller’s home country, rather than registering separately in each Member State of consumption. The local tax office then redistributes the VAT to the appropriate Member States. To illustrate: if in one quarter you sell €3,000 to Germany, €1,500 to France, and €500 to Spain, you declare the €5,000 total in your Polish OSS return, broken down by country and tax rate. From there, the Polish authorities forward the correct amounts to Germany, France, and Spain.

Invoicing rules for B2C sales vary between countries. Some Member States do not require formal invoices for consumer transactions, but if you do issue them, they must include VAT at the correct local rate. Consumers rarely check these details, but tax offices do — which means applying the wrong rate can quickly become a compliance problem.

B2B sales under the reverse charge

When the customer is another VAT-registered business, the rules are very different. Instead of charging VAT, the seller issues an invoice without VAT, provided the buyer has a valid VAT number that can be confirmed in the VIES system.

The invoice must include both the seller’s and the buyer’s VAT numbers, along with a clear note such as “reverse charge” or the local language equivalent. The buyer then declares the VAT due in their own country as output VAT and, at the same time, usually deducts it as input VAT. This means the transaction nets out with no actual VAT payment. For the seller, this avoids the need to register for VAT in the customer’s country.

It is worth noting that if the buyer does not have a valid VAT number, the sale cannot be treated as B2B. In that case, the transaction is considered B2C and falls under the OSS rules instead.

Why the contrast matters

The difference between B2C and B2B treatment is clear-cut. In B2C via OSS, the seller charges VAT at the customer’s local rate, declares it in the OSS return, and remits it through their domestic tax office. In B2B via reverse charge, the seller charges no VAT, the buyer accounts for it domestically, and the sale is excluded from OSS entirely.

This split has real compliance consequences. Cross-border B2C sales go into the OSS return every quarter, while B2B sales appear only in the seller’s domestic VAT return.

For small e-commerce sellers, the practical takeaway is to always separate B2C and B2B processes clearly. Treating a business as a consumer can result in rejected invoices and correction requests. Treating a consumer as a business can leave you underpaying VAT and facing penalties. The safest approach is to verify whether your customer has a valid VAT number before issuing an invoice, since that single decision determines whether OSS or reverse charge applies.

OSS does not eliminate domestic VAT obligations

One of the biggest myths around the One Stop Shop is that registering for OSS means you no longer need to deal with VAT registrations anywhere else in the European Union. The idea of a single system that replaces all local obligations is attractive, but it is not the reality. OSS has a limited scope: it was designed for cross-border B2C distance sales of goods and certain services. Activities such as warehousing or B2B sales continue to create local VAT obligations that cannot be avoided through OSS.

The myth of “one registration for everything”

When the EU launched OSS in July 2021, much of the communication around it was simplified: one registration, one return, one payment. Many sellers understood this as a total replacement of all VAT registrations across Europe. In practice, OSS only works for intra-EU B2C distance sales and some consumer services. If your business model goes beyond that, OSS will not cover everything.

When local VAT registration is still required

There are several common situations where OSS does not apply and local VAT registration is unavoidable.

Warehousing abroad

If you store goods in another Member State — for example through Amazon FBA, a logistics partner, or your own warehouse — you usually need to register for VAT in that country. This is because once the goods are in a foreign warehouse, sales made from that stock to local customers are treated as domestic supplies. They cannot be reported through OSS.

For example, a Polish seller who uses a German Amazon FBA warehouse must register for German VAT. All sales from that warehouse to German customers, whether businesses or private individuals, are local transactions under German law.

B2B sales

OSS is strictly limited to B2C transactions. If you supply goods or services to VAT-registered businesses, those sales are excluded. Depending on the circumstances, they either fall under the reverse charge rules (for cross-border supplies) or under domestic VAT rules (if the stock is already in the buyer’s country).

Domestic sales abroad

If you hold stock in another Member State and sell directly to customers in that same country, those sales are domestic and must be reported locally. For instance, goods shipped from a Czech warehouse to Czech buyers are not cross-border transactions and therefore cannot be included in OSS.

Why ongoing local compliance matters

Even though OSS is a powerful tool for simplifying B2C reporting, it does not remove the need for local VAT compliance in many cases. Ignoring this distinction can cause serious problems.

Tax authorities in countries like Germany, France, or Italy actively monitor foreign sellers with stock in their territory. If you sell without registering locally, you risk audits, penalties, and even restrictions on your ability to operate.

Marketplaces also play a role. Platforms such as Amazon and eBay often demand proof of local VAT registration before they allow you to sell through their warehouses. Without it, you may be blocked from expanding your sales.

Finally, thinking OSS is a complete solution can hold back your business. As soon as you move into warehousing or B2B sales abroad, local VAT compliance becomes unavoidable. Understanding this early helps you plan your growth without interruptions.

Reverse charge vs OSS: who bears the VAT?

By this stage it should be clear that B2C and B2B transactions follow entirely different VAT rules in the European Union. At the heart of this difference is one simple question: who is responsible for paying and declaring the VAT? Understanding this distinction helps avoid costly mistakes and makes both invoicing and reporting much easier.

Applicability

The OSS system applies only to cross-border B2C sales. This includes intra-EU distance sales of goods as well as certain consumer services, particularly digital or electronic services. Once the €10,000 threshold is exceeded, the seller must charge VAT at the rate applicable in the customer’s country and declare those sales through OSS.

The reverse charge mechanism, on the other hand, applies exclusively to cross-border B2B transactions. When the buyer has a valid EU VAT number, the sale cannot be reported through OSS. Instead, the responsibility for VAT shifts to the buyer, who declares it in their home country.

VAT treatment

In B2C sales under OSS, the seller charges VAT at the customer’s local rate, collects it as part of the sales price, and then declares it in the quarterly OSS return. For instance, a Polish shop selling to a French customer must apply French VAT, report it via OSS in Poland, and the Polish tax office will then transfer the payment to France.

In B2B sales under reverse charge, the seller does not charge VAT at all. Instead, the buyer accounts for VAT in their own country, recording it as both output and input VAT in the same return. For the seller the transaction is VAT-free, while for the buyer it is generally tax neutral.

Registration obligations

One of the main benefits of OSS is that it allows sellers to avoid multiple VAT registrations. With a single OSS registration in the home country, B2C sellers can cover their cross-border consumer sales across the EU.

By contrast, the reverse charge does not require OSS registration, since B2B sales are outside its scope. The seller simply reports the transaction in their domestic VAT return. However, local VAT registration may still be required if goods are stored in another Member State, for example in a German Amazon FBA warehouse. This obligation stems from warehousing, not from the reverse charge itself.

Invoicing requirements

For B2C transactions under OSS, invoices — if required in the buyer’s country — must include VAT at the correct local rate. Consumers may not notice errors, but tax offices do, so accuracy here is essential.

For B2B transactions under reverse charge, invoices must be issued without VAT but must include both the seller’s and the buyer’s VAT numbers, along with a clear note such as “reverse charge” or its equivalent in the local language. This signals to tax authorities that the VAT obligation lies with the buyer, not the seller.

Why the distinction matters

The difference between OSS and reverse charge is not just technical — it has direct practical and financial consequences. In B2C sales, the seller collects and remits VAT through OSS. In B2B sales, the buyer accounts for VAT in their own country.

For small e-commerce businesses, misclassifying a customer can create real problems. Charging VAT to a business customer usually leads to invoice corrections and delays in payment. Issuing a VAT-free invoice to a consumer can result in underpaid tax and penalties. The safest approach is always to verify the buyer’s VAT number in the VIES system. That one step determines whether the transaction should be reported through OSS or treated under reverse charge.

Non-Union OSS and fiscal representation

Up to this point, the focus has been on the Union OSS, which applies to businesses established inside the European Union. But there is also a version designed for companies based outside the EU: the Non-Union OSS. This scheme is important for non-EU businesses that want to sell to European consumers without registering for VAT in every Member State.

How Non-Union OSS works

The Non-Union OSS allows non-EU businesses to register for VAT in just one Member State, even if they sell to consumers across all 27. Its scope, however, is limited. It applies only to cross-border supplies of services to consumers, most commonly digital products such as e-books, software downloads, online games, streaming subscriptions, online courses, and other electronic services.

To illustrate, consider a U.S. company offering a design tool as a subscription service to EU customers. Instead of registering for VAT in each Member State, the company can choose one country — for example Ireland — as its Member State of identification. It registers there, files its Non-Union OSS return in Ireland, and pays all VAT due on its EU consumer sales through that single return. The Irish tax office then redistributes the VAT to the relevant Member States. Without this system, the company would face the almost impossible task of registering separately in every country where it had customers.

B2B supplies excluded

Just as with the Union OSS, the Non-Union OSS is restricted to B2C transactions. If the customer is a business with a valid VAT number, the supply is excluded and handled under the reverse charge mechanism. Only when the customer is a private individual does the seller need to charge VAT at the customer’s local rate and report it through the Non-Union OSS.

This makes customer classification critical. If a non-EU business mistakenly treats a B2B sale as B2C and charges VAT, it not only creates unnecessary complications but also risks damaging its reputation with business clients, who expect reverse charge invoices.

The role of fiscal representation

For some non-EU businesses, registering for OSS is not the end of the story. Depending on the country of registration, a fiscal representative may also be required. A fiscal representative is a local tax agent who acts on behalf of the foreign business and is often jointly liable for its VAT debts.

Whether fiscal representation is required depends on the Member State. In countries such as Ireland, the Netherlands, and Luxembourg, it is usually not necessary. In Poland and several other Member States, however, fiscal representation is often mandatory. This is one of the reasons why many non-EU companies choose to register in countries that do not impose this requirement, as it simplifies compliance and reduces costs.

Why this matters for EU sellers

Even if you are an EU-based seller who will never use the Non-Union OSS, it is worth knowing how it works. Many of the global platforms you compete with — from SaaS providers to streaming services and digital marketplaces — rely on it to handle their EU VAT compliance efficiently.

The main lesson is consistency. Whether Union or Non-Union, OSS always applies to B2C sales. B2B sales remain excluded and must be handled under reverse charge rules. For EU sellers, the message is clear: OSS belongs firmly on the consumer side of VAT law.

Conclusion

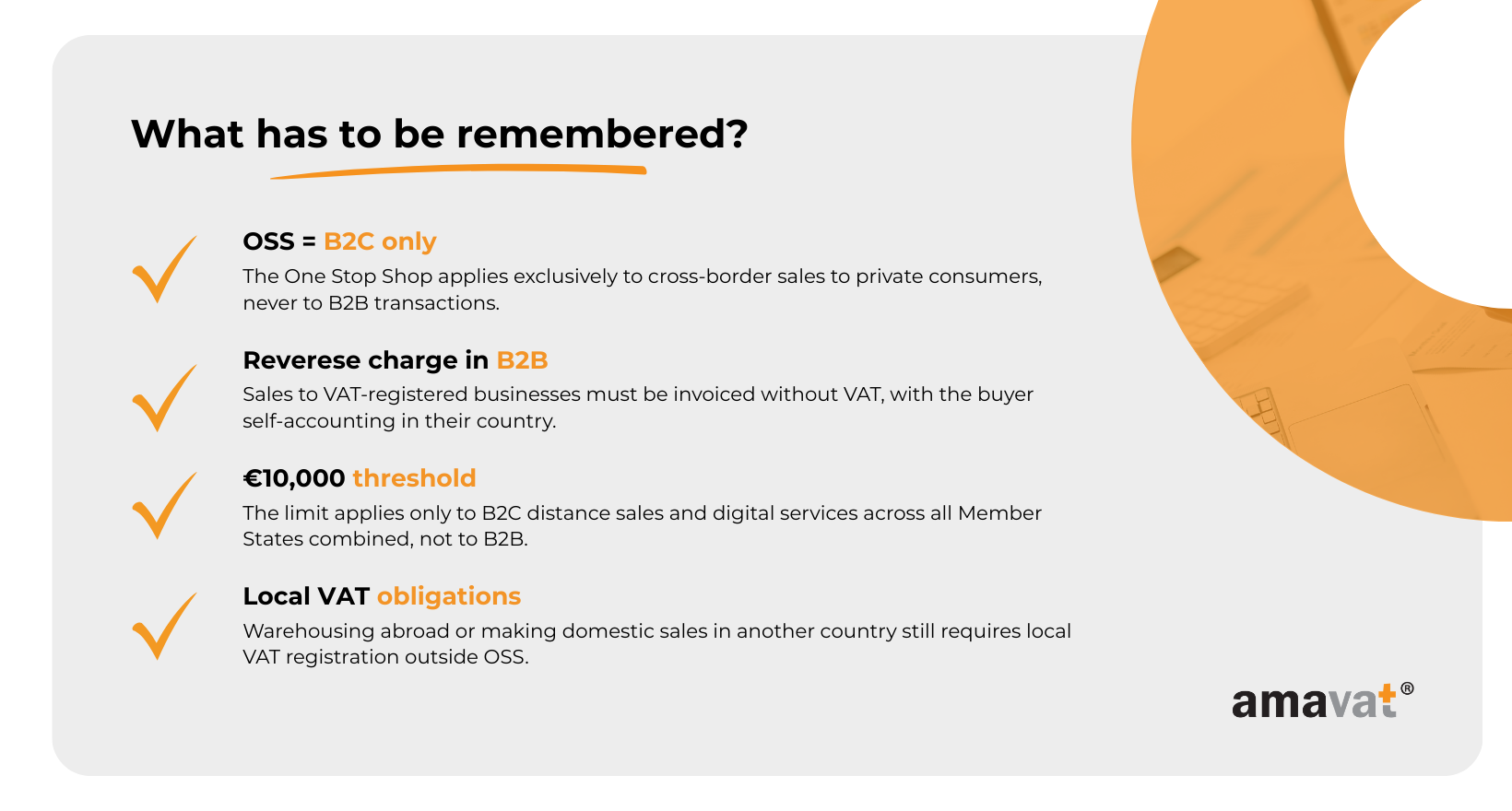

Understanding the VAT One Stop Shop is essential for any business selling across borders in the European Union. OSS was introduced to simplify compliance for cross-border B2C sales, giving sellers the ability to declare all such sales in a single quarterly return in their home country instead of registering for VAT separately in every Member State of consumption.

OSS is for B2C, not B2B

The most important takeaway is that OSS applies only to sales made to private consumers. Once the buyer is a VAT-registered business, OSS no longer applies. In those cases, the reverse charge mechanism takes over, or — in some scenarios such as warehousing abroad — local VAT registration becomes necessary.

This distinction affects day-to-day operations in very practical ways. It determines whether VAT is charged on an invoice, whether a transaction goes into the OSS return or the domestic VAT return, and ultimately whether the seller or the buyer is responsible for accounting for VAT.

Why this matters for small businesses

For small e-commerce sellers in Poland and across the EU, misunderstanding the scope of OSS can have serious consequences. Reporting B2B transactions in OSS, applying the €10,000 threshold incorrectly, or issuing invoices with the wrong VAT treatment can all trigger compliance problems. The result may be double taxation, audits, penalties, or even blocked sales on platforms such as Amazon or Allegro.

Taking the safe route

The safest strategy is to treat VAT compliance as a core part of business management rather than an afterthought. Always separate B2C and B2B transactions, check every customer’s VAT number in the VIES database, and apply the correct invoicing and reporting rules.

If there is any doubt, it is better to consult a tax advisor or use automated VAT tools that reduce the risk of error. A small investment in compliance today prevents much greater costs and disruptions in the future — and ensures that your business can grow across EU borders with confidence.