Understanding VAT rates across the EU: how to avoid common errors in OSS declarations

Spis treści

Before 1 July 2021, businesses making B2C distance sales had to keep track of national thresholds, which were usually set at either €35,000 or €100,000 per country. Once you passed that threshold in a specific Member State, you were obliged to register locally for VAT. Holding stock in a warehouse in another country could also trigger VAT registration. In practice, this meant that even a modestly growing online store could be forced into managing multiple VAT numbers and filing separate returns across several markets.

That changed in July 2021, when the EU introduced the One-Stop Shop (OSS) scheme. Instead of registering in every country where you sell to consumers, OSS lets you declare your eligible intra-EU B2C distance sales of goods and certain services through a single quarterly return. You file this through the online portal of your Member State of identification, which for EU-based sellers is normally your home country. Once submitted, your home authority distributes the VAT and accompanying data to the Member States of consumption where your customers are based.

This centralization is a real benefit for small and growing businesses. You no longer need to hire tax agents in ten different countries just to remain compliant with cross-border B2C sales. However, OSS does not replace your domestic VAT obligations, nor does it cover every possible sales scenario. Domestic sales, certain stock or warehouse arrangements, and some special transactions may still require local VAT registrations. It’s important to understand that OSS simplifies compliance, but it doesn’t eliminate it entirely.

And even within OSS, one major responsibility remains firmly in place: you must still apply the correct VAT rate for each Member State of consumption. That is where the real complexity lies.

The core challenge: fragmented data and hidden risks

Filing an OSS return is not the hardest part. The real difficulty comes before you submit the declaration. To be accurate, you need to know exactly where each of your customers is located, which VAT rate applies to each product or service you sold, and whether that product qualifies for a reduced or super-reduced rate in the customer’s country.

Rules have also evolved. Since December 2018, EU law allows Member States to apply reduced VAT rates to e-publications, aligning them with printed books. But the exact rate varies from one country to another, and the classification of products can differ too. For example, an e-book may fall under a reduced rate in one Member State but remain at the standard rate in another. This makes product categorization more than just an accounting detail—it’s a compliance risk.

The challenge grows when you consider where your data lives. A typical e-commerce seller might use Shopify, Amazon, WooCommerce, and one or two regional platforms. Each platform structures and exports its data differently. Customer addresses may not always be complete or consistent, and invoices might not capture VAT rates in a uniform way. When quarter-end approaches, you’re faced with the task of combining data from all these sources, checking country-by-country sales totals, confirming applied rates, and reconciling everything into a single OSS declaration.

This is the stage where errors often creep in. You might overlook a VAT rate change in a particular Member State. You might classify a B2B sale as B2C by mistake. You might even forget to include smaller markets where your sales volumes are low but still above the EU-wide €10,000 threshold. Each mistake carries risks: late payment charges, compliance penalties, or even audits that consume valuable time and resources. For small businesses where margins are tight, the financial and operational impact of these errors can be significant.

The main takeaway: centralization and automation

The solution is not to memorize every VAT rule or manually triple-check every invoice. The real key to smooth OSS compliance is building a system that minimizes human error through centralization and automation.

Centralization means gathering all your sales data in one place instead of juggling multiple spreadsheets from different platforms. Automation means ensuring that VAT rates are applied correctly and updated automatically whenever a Member State adjusts its rules. Together, these two practices drastically reduce the risk of mistakes while freeing you from hours of manual data reconciliation.

It also helps to be aware of timing. Under the Union OSS, returns are filed quarterly and must be submitted by the end of the month following the quarter. Payment is made to your Member State of identification, which then distributes the funds to the Member States of consumption. Missing these deadlines can lead to penalties or interest charges, so timing your workflows around OSS deadlines is just as important as getting the VAT rates right.

By understanding these fundamentals—and by building the right processes—you can make OSS work for your business rather than against it. In the next sections, we’ll explore how VAT rates are structured across the EU, why applying them correctly is so crucial, the common mistakes many businesses fall into, and the strategies that will help you avoid them. By the end, you’ll have a clear plan to handle OSS compliance in a way that is scalable, reliable, and much less stressful.

OSS Registration

Why OSS registration is the foundation

Before you start thinking about VAT rates, automation, or integrating marketplace data, the very first step is registering for the One-Stop Shop, usually shortened to OSS. Registration is what allows you to declare eligible cross-border B2C supplies in a single place through the online portal of your Member State of identification. Without OSS, once your EU-wide cross-border sales exceed the €10,000 threshold—or if you voluntarily decide to tax at the customer’s destination country—you are normally obliged to register and file VAT returns separately in every Member State where your customers are located.

What OSS does is centralise all those scattered filings. It is optional, and it does not replace your domestic VAT return, but for most small and growing businesses it is a decisive turning point. Once you are in the system, your own tax authority becomes your single point of contact for OSS. You submit one return there, and your authority forwards both the VAT payments and the reporting data to the Member States where your customers are based. The returns are quarterly under the Union and non-Union schemes, and monthly under the Import OSS for consignments up to €150.

How the Member State of identification works

The Member State of identification—often shortened to MSI—is normally your home country if you are an EU-based business. A seller established in Spain will use Spain as their MSI, while a business registered in Germany will use Germany. Non-EU businesses can also use OSS, but the rules differ depending on the scheme. For Union OSS used by non-EU sellers who are dispatching goods into the EU, the MSI is the country from which the goods are sent, and if dispatch happens from several countries the seller may choose between them. For the non-Union scheme covering B2C services supplied by non-EU sellers, any Member State can be chosen as the MSI. For the Import OSS, which applies to low-value goods shipped from outside the EU, non-EU sellers usually need an intermediary established in the EU who then handles the MSI obligations on their behalf.

Regardless of the scheme, the concept is the same: you deal with one portal. Once you are registered, you log into that portal each quarter, submit your OSS return showing your B2C supplies into other Member States, and break the information down by country and applicable VAT rate. Your MSI then distributes the money and the data onward. You are still responsible for your normal domestic VAT filings outside OSS, and you are required to submit nil returns if you have no eligible sales in a quarter. The deadline for filing and payment is the end of the month following the quarter.

Examples of national OSS portals

Although the underlying rules are harmonised, each country provides its own portal for OSS. In Germany, OSS is accessed through the BZSt Online-Portal, hosted at the “bportal” section of elster.de. It is not the same as the standard ELSTER flow used for domestic VAT returns, so you need to be careful to use the correct entry point. In Austria, OSS is handled through FinanzOnline, the well-established platform already used by Austrian businesses for their domestic tax filings. Other Member States follow the same principle, integrating OSS into their own e-filing systems, though the interfaces and log-in processes differ slightly.

Why you need registration before data integration

Some businesses try to set up VAT-rate automation or connect their marketplaces to accounting tools before they have officially registered. In practice, registration should come first. This is because registering for OSS confirms your effective start date and tells you exactly how your MSI structures and expects data to be submitted. By default, registration takes effect from the first day of the calendar quarter after you apply. If you have already begun making OSS-covered sales, you can request to have the start date brought forward to the date of your first supply, but you must notify your MSI by the tenth day of the following month.

Knowing your effective period and your portal’s formatting requirements before you invest in automation ensures that your systems are aligned with official expectations. If you build integrations too early, you risk working with the wrong reporting periods or incompatible formats. Registration first, automation second—that sequence makes your compliance process much more reliable.

Centralize Data Collection Across Marketplaces

The problem with fragmented data

If your business sells on more than one platform, you’ve probably noticed how messy the data side can get. Amazon exports transaction reports in one format, Shopify does it in another, and Etsy or Zalando each have their own structures. Instagram Shops adds yet another layer of complexity, especially when sales are processed through Facebook’s commerce system. Each platform may capture customer addresses differently, sometimes missing details you need for VAT classification, and each may present the applied VAT rates in its own way—or not at all.

At the end of a quarter, when it’s time to file your OSS return, you end up with half a dozen spreadsheets or CSV files that don’t match one another. Even simple tasks like checking how many sales you made in France versus Italy can become frustrating when the underlying data doesn’t line up. Manually piecing everything together is not only time consuming but also prone to mistakes. If the wrong country is assigned to a sale or if a VAT rate field is missing, your OSS declaration risks being inaccurate.

The case for consolidation

The only practical way to manage this complexity is to bring all your sales data into a central system before you start working on VAT. Many businesses do this through API connectors or middleware platforms that automatically pull sales data from each marketplace and consolidate it into a uniform format. Instead of dealing with five different exports, you end up with one set of records where each sale has the same fields: customer country, invoice date, product type, and applied VAT rate.

When your data is centralised in this way, reconciliation becomes far easier. You can quickly see your total sales into each Member State, check whether the correct VAT rate was applied, and prepare the information for your OSS return without hours of manual rework. For young businesses that are growing quickly across multiple sales channels, this kind of integration isn’t just a time saver—it’s what makes compliance scalable.

Compliance considerations

It’s important to remember that not every transaction from your marketplaces belongs in the OSS return. Some platforms act as deemed suppliers for VAT purposes. A common example is Amazon handling low-value imports or certain intra-EU supplies through its own VAT system. Those sales are not your responsibility under OSS, even though they appear in your marketplace reports.

That doesn’t mean you should delete them. Keeping all transactions in your centralised records helps with reconciliation and ensures your reported sales match what the platforms show in their accounts. The trick is to separate deemed-supplier transactions from those that actually fall within OSS. That way, your return is accurate, but your internal records still cover the full picture of your sales activity.

Standardize and Archive Records

Why standardization matters

Once your sales data from different marketplaces is consolidated, the next challenge is making it consistent. A central database is only useful if the records inside it follow the same structure. Without standardization, you still face the same problems as before: incomplete fields, mismatched formats, and gaps that make it hard to prepare an accurate OSS return.

For example, one platform might call the field “buyer country” while another labels it “shipping destination.” Some platforms include VAT amounts directly, while others only show the gross or net price. If you leave these differences unresolved, you’ll spend valuable time trying to clean up the data each quarter, and there’s always the risk of overlooking an error that leads to incorrect VAT reporting. By standardizing your records as they enter your central system, you ensure that every transaction looks the same, no matter where it came from.

The essential fields

At minimum, each transaction record should include the customer’s country of residence, the taxable base, the VAT rate applied, the VAT amount charged, and a transaction identifier that lets you trace it back to the original sale. These fields together allow you to sort your sales by Member State, verify that the correct VAT rate was used, and reconcile totals against your quarterly OSS return.

Think of these fields as the backbone of your compliance process. If one of them is missing or misaligned, it weakens the integrity of your entire VAT reporting workflow. For instance, a transaction without a VAT rate cannot be properly classified, and a transaction without a unique ID cannot be checked against your original invoice if a tax authority asks for clarification later.

Long-term archiving obligations

Standardization isn’t only about making life easier in the short term. It also matters for long-term compliance. Under EU rules, records relating to OSS-covered supplies must be kept for ten years. That means the system you build today has to be capable of storing accurate, accessible records for an entire decade.

Imagine what happens if your records are scattered across different spreadsheets and platforms. Five years from now, when a tax authority requests information on a specific transaction, you may find that the marketplace has changed its export format or no longer provides historical data in the same way. If your central system has been capturing standardized fields from the start, you can retrieve that information in seconds rather than scrambling to piece it together from old backups.

Archiving in a structured way also protects your business against staff turnover or changes in software. Even if you move from Shopify to another e-commerce platform, or if you switch accountants, your standardized records will remain consistent. This continuity is what gives you confidence that you can pass an audit even years after the sale was made.

Automate VAT Allocation and Exclusions

Mapping sales to the correct VAT rates

Once your records are centralized and standardized, the next step is to ensure that every transaction is mapped to the right VAT rate automatically. Doing this manually is not realistic once you sell across multiple Member States, because each country has its own standard and reduced rates, and those rates can change over time. Automation tools—whether through dedicated VAT software, middleware connectors, or ERP integrations—allow you to match the customer’s country and the product category with the correct VAT rate in real time. This removes the guesswork and ensures that your OSS declaration reflects the actual rules in force on the date of supply.

Automation is especially valuable for products that may qualify for reduced rates, such as e-books, food items, or cultural services. Instead of relying on memory or static spreadsheets, your system applies the correct rate based on pre-configured rules or API updates. This lowers the risk of applying outdated or incorrect rates and reduces the number of adjustments you need to make later.

Keeping an eye on the €10,000 threshold

For smaller businesses, one of the most important triggers is the EU-wide €10,000 threshold for cross-border B2C sales. Below that figure, EU-established micro-sellers may continue to charge their domestic VAT rate rather than the customer’s country rate. Once you pass the threshold, however, you must switch to destination-based VAT across all Member States.

Automating the monitoring of this threshold helps you avoid a situation where you unknowingly exceed it and continue charging the wrong VAT. A well-configured system tracks cumulative cross-border sales during the year and flags the point where the €10,000 limit is crossed. From that moment, the software should automatically apply the destination country’s VAT rate to all affected sales, so your compliance adapts seamlessly without requiring a manual reset.

Excluding marketplace-liable transactions

Another area where automation helps is in separating the transactions that belong in your OSS return from those that don’t. Marketplaces such as Amazon or eBay can sometimes be deemed suppliers for VAT purposes, especially in the case of low-value imports or specific intra-EU supplies. In those situations, the marketplace itself is responsible for collecting and remitting VAT, not you.

If you rely solely on raw marketplace data, these transactions may appear mixed in with your own, creating the risk of double reporting. Automation allows you to filter them out systematically. The transactions remain in your central archive for reconciliation and audit purposes, but they are excluded from your OSS submission. This distinction is crucial for accurate compliance, and it spares you the headache of untangling sales data manually every quarter.

Why automation pays off

For a growing business, automation is not just about saving time. It delivers efficiency, because your VAT allocation and exclusions are handled in the background rather than through repeated manual checks. It brings accuracy, because the rules and rates are applied consistently without relying on memory or outdated spreadsheets. And it provides scalability, because the system can handle rising transaction volumes and new sales channels without adding to your workload.

By building automation into your OSS process, you create a structure that is resilient to human error and flexible enough to support growth. Instead of treating VAT compliance as a quarterly scramble, it becomes a continuous, reliable process that runs alongside your sales.

Integrate E-Invoicing for Seamless Reporting

The rise of e-invoicing in the EU

E-invoicing has been steadily expanding across Europe, and for many Member States it is no longer just an option but a legal requirement. Italy led the way by making electronic invoicing mandatory for most domestic transactions several years ago. Poland has announced that its KSeF platform will become compulsory, while Spain is rolling out its own e-invoicing framework for B2B transactions. Other countries are following with their own timelines, driven partly by the EU’s broader push toward digital reporting obligations and real-time tax data collection.

The common thread is that e-invoicing shifts records from being static PDF or paper documents into structured, machine-readable data. Instead of invoices that need to be interpreted or retyped, each invoice is created and transmitted in a digital format that tax authorities can process automatically. For businesses that already struggle to keep records aligned across multiple platforms, this is more than just a regulatory change—it is an opportunity to make compliance more reliable.

Why e-invoicing improves accuracy

When your invoices are generated in a machine-readable format, the chances of inconsistencies drop dramatically. The key fields—such as customer country, taxable base, VAT rate, VAT amount, and transaction identifiers—are captured in a structured way that can be imported directly into your central database. This not only reduces manual errors but also creates an automatic audit trail, since every invoice is digitally signed and time-stamped.

Tax authorities value this traceability, but so should you. If a question arises years later about how VAT was applied to a particular sale, having a structured invoice on file means you can provide the evidence quickly without hunting through archived PDFs. For businesses preparing OSS returns, this kind of consistency means that the invoice data already matches the fields required for reporting, which makes quarterly reconciliation much smoother.

Strengthening the OSS pipeline

The connection between e-invoicing and OSS is straightforward. The more structured and standardized your invoices are, the more easily they can feed into your OSS process. If your invoicing system is integrated with your central sales database, every transaction comes pre-tagged with the information needed for VAT reporting. That reduces the need for last-minute data cleaning and lowers the risk of discrepancies between what you reported and what your underlying invoices show.

For growing e-commerce sellers, this integration can be transformative. Instead of maintaining separate systems for invoicing, sales data, and VAT reporting, everything flows through the same digital pipeline. Orders are captured at the point of sale, invoices are issued in a compliant e-format, records are archived in a standardized database, and OSS declarations are prepared from that same dataset. The result is a seamless reporting process that scales with your business and stays compliant with both national e-invoicing rules and EU VAT requirements.

Ongoing Compliance Best Practices

The value of quarterly reconciliations

Even with automation and centralization in place, OSS compliance isn’t something you can set and forget. The most effective way to stay on top of your obligations is to build reconciliation into your regular quarterly routine. At the end of each reporting period, before filing, compare the figures from your central database against the exports from your marketplaces and payment processors. This check gives you the chance to catch mismatches early, whether it’s a transaction missing a VAT rate, a misclassified country, or a deemed-supplier sale that slipped into your OSS totals.

Catching errors at this stage is far less painful than discovering them months later in the middle of an audit. It also builds confidence in your numbers. When you submit your OSS return, you know it reflects not just what your system says but what your marketplaces and invoices confirm. That consistency is what keeps your compliance robust as your business grows.

Adapting to shifting marketplace rules

One of the trickier parts of VAT compliance today is the evolving landscape of marketplace liability. Platforms such as Amazon, eBay, or Zalando may be deemed suppliers in certain cases, particularly with low-value imports or cross-border transactions where the platform facilitates the sale. These rules are not static. They continue to evolve as the EU and national authorities refine how VAT is collected in e-commerce.

For small businesses, this means the rules you operate under today may look slightly different in six months. Staying informed about these changes is essential. If you rely on outdated assumptions—such as believing you are liable for VAT on transactions that the marketplace has already reported—you risk either double-reporting or under-reporting. Both scenarios create unnecessary compliance risks. Making it a habit to review marketplace liability rules each quarter ensures your OSS filings reflect the current regulations, not last year’s.

Building long-term record resilience

Finally, ongoing compliance is not just about the return you file this quarter but also about how you will respond to questions years down the line. Under EU law, businesses must retain OSS-related records for ten years. That requirement makes electronic storage not only convenient but essential. A decade is a long time in the life of a small business, and relying on local files, outdated software, or ad hoc backups is a recipe for trouble.

By archiving records in a secure, centralized system with reliable access controls, you ensure that your business can withstand an audit even long after the original sale was made. Equally important, your archive should be easily searchable. If a tax authority requests details on a specific transaction, you should be able to locate the invoice and VAT data quickly rather than digging through old spreadsheets. This level of preparedness not only keeps you compliant but also reduces stress when external checks occur.

Conclusion

Building the full OSS pipeline

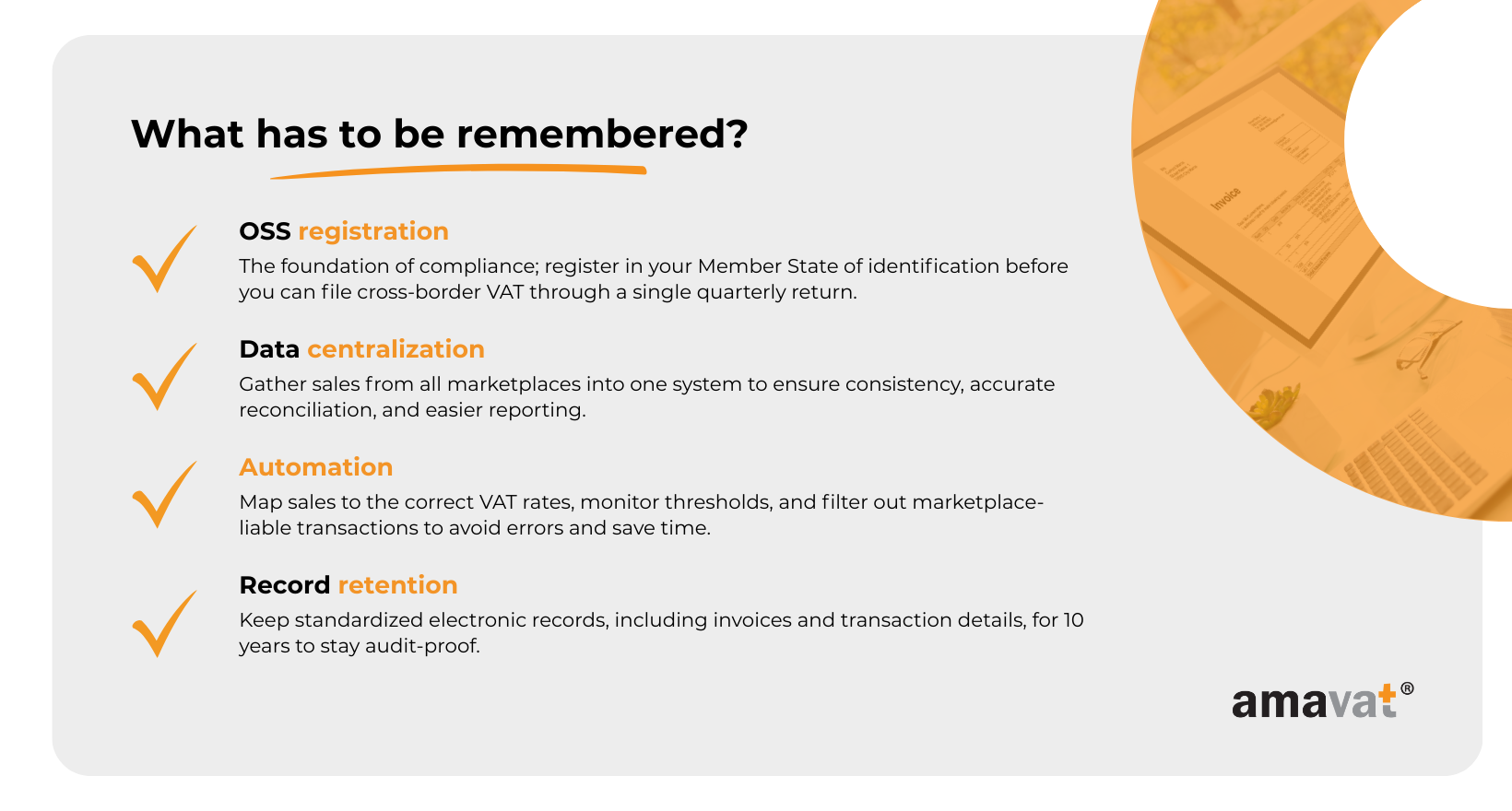

The journey through OSS compliance can feel overwhelming at first, but when broken down into clear steps the process is far more manageable. It begins with registration, the foundation that allows you to access the scheme and replace multiple national filings with a single quarterly return through your Member State of identification. From there, the real work happens behind the scenes: consolidating data from every marketplace you sell on, standardizing those records into a uniform structure, and ensuring they are archived for the long haul.

Automation then becomes the engine that powers the system. By mapping sales to the correct VAT rates, tracking the €10,000 threshold, and excluding transactions that fall under marketplace liability, your compliance workflow transforms from a manual burden into a scalable process. E-invoicing strengthens this further by producing structured, machine-readable invoices that reduce inconsistencies and create a reliable audit trail. Finally, ongoing best practices—such as quarterly reconciliations, monitoring changes in marketplace rules, and maintaining a ten-year electronic archive—turn compliance into a habit rather than a quarterly scramble.

The key message

What these steps show is that OSS compliance is not just about meeting a regulatory obligation. With the right structure and the right tools, it becomes a process that is both scalable and resilient. Instead of worrying about mistakes or audits, you operate with confidence, knowing that your VAT reporting is consistent, accurate, and ready for growth. OSS was designed to simplify life for cross-border sellers, and when you build your compliance system around it properly, it delivers on that promise.

Looking ahead

For small e-commerce businesses, the most important decision is not whether OSS applies to you—it almost certainly does once you begin to sell across borders—but how you will integrate it into your daily operations. Investing early in centralization, data integration, and automation pays dividends for years to come. It saves time, prevents costly errors, and ensures you are ready if authorities ever review your records.

If your goal is to grow your shop beyond your home market, now is the time to put these structures in place. OSS reporting does not have to be a source of stress. With the right systems, it becomes just another smooth part of running a modern, international e-commerce business.