VAT OSS threshold explained – what happens after €10,000

Spis treści

That’s where the One Stop Shop – or OSS – comes in. OSS is an EU-wide system designed to make VAT compliance easier when you’re selling to customers in other EU member states. Instead of registering for VAT separately in every single country where your customers live, you can submit a single return and payment through the OSS in your own country, and it will be distributed to the relevant tax authorities. Think of it as the EU’s way of giving you one central checkout instead of twenty-seven different tills. Registration isn’t mandatory, but once you pass the threshold it’s strongly recommended because it greatly simplifies compliance compared to managing multiple VAT registrations.

Before July 2021, the rules were far messier. Each country had its own distance selling threshold – typically somewhere between €35,000 and €100,000 – and you only had to charge that country’s VAT once you passed its limit. Now, those individual thresholds are gone, replaced by a single €10,000 limit that applies across the entire EU. This amount is calculated on the net value of all cross-border distance sales of goods (WSTO) plus certain services (TBE – telecommunications, broadcasting, and electronic services) made to consumers in the EU, with all countries combined in a single calendar year.

It’s a simple rule, but it has big consequences: once you cross it, you’re no longer charging your own country’s VAT rate. You must charge the VAT rate of your customer’s country for all eligible cross-border sales.

In this article, we’re going to unpack exactly what that means. We’ll look at how the €10,000 threshold works, what changes the very moment you pass it, and the practical steps you’ll need to take to stay compliant. We’ll explore the OSS registration process, how to handle invoicing when different customers pay different VAT rates, and what this all means for your pricing. By the end, you’ll know exactly what to expect, how to prepare, and how to make sure that crossing the €10,000 line is a growth milestone for your business – not a paperwork nightmare.

Because if you play it smart, crossing the threshold doesn’t have to be stressful. In fact, it can be the moment your business moves from local success to true European player.

The €10,000 VAT OSS threshold – a quick overview

The €10,000 VAT OSS threshold might look like a small number, but for small businesses selling across the EU, it marks a major turning point in how you handle VAT. To understand why, you first need to know what the threshold covers, why it was introduced, and who it applies to.

What the threshold actually covers

The €10,000 figure is calculated net of VAT and applies to the total value of certain B2C cross-border sales within the EU in a calendar year. It covers two specific categories:

- Intra-EU distance sales of goods (WSTO) – for example, shipping clothing from Germany to customers in Spain or Italy.

- Telecommunications, broadcasting, and electronic (TBE) services – the EU’s official term for digital services such as downloadable software, e-books, streaming subscriptions, or paid webinars.

It does not cover other types of services, which are generally subject to different VAT place-of-supply rules.

It’s worth stressing that this threshold applies to all your EU cross-border B2C sales in these categories combined. You don’t get a separate €10,000 allowance for goods and another for digital services – they’re counted together. And it’s EU-wide: you don’t measure sales country by country. Every qualifying sale to a customer outside your home country within the EU is part of the same pot.

For example, if you’re based in France and sell €4,000 worth of goods to customers in Spain, €3,000 to Germany, and €4,000 in online courses to people in Italy, your total is €11,000 (net of VAT). You’ve crossed the threshold, even though no single country’s sales exceed €10,000.

From many thresholds to one unified rule

If you were selling online in the EU before 1 July 2021, you might remember a very different system. Each country had its own distance selling threshold, typically set around €35,000, although a few countries had much higher limits. Under that setup, you could sell to customers in multiple countries and only start charging their local VAT if you crossed their specific national limit.

The problem was obvious: it was messy. Businesses had to track sales separately for each country and keep up with more than two dozen different thresholds. It was easy to make mistakes, and tax authorities struggled to monitor compliance effectively.

That’s why the EU scrapped the national thresholds in 2021 and replaced them with a single €10,000 limit for the entire EU. This reform simplified the rules, made enforcement easier, and created a single, clear trigger point for VAT obligations.

Who the €10,000 rule applies to

This threshold is only available to EU-based businesses – meaning you are established in the EU or have at least one permanent establishment in an EU member state.

If you’re a non-EU seller, there is no threshold at all. You must apply the VAT rate of your customer’s country from your very first sale. In practice, many non-EU sellers use the IOSS (Import One Stop Shop) for low-value goods (up to €150) imported into the EU, while others rely on local VAT registrations for different supply chains or product categories.

For EU-based sellers, the €10,000 limit acts as a kind of breathing space before multi-country VAT compliance kicks in. For non-EU sellers, the rulebook applies from day one – the only question is which compliance route you take.

Before you cross the threshold

Before your cross-border sales start brushing up against €10,000, VAT rules are far simpler. You’re operating within a framework that’s designed to be manageable for small and growing businesses, and in many ways, the administrative burden is kept intentionally light. But it’s important to understand exactly what happens at this stage – because the way you handle VAT before the threshold will shape how you need to adapt once you pass it.

Charging VAT at your domestic rate

When your total net value (excluding VAT) of qualifying cross-border B2C sales within the EU stays below €10,000 in a calendar year, you can continue charging your domestic VAT rate – the same rate you apply to sales within your own country. The €10,000 figure is cumulative for all eligible EU cross-border B2C sales combined, not per country. At this stage, it doesn’t matter whether your customer is in Portugal, Finland, or Greece – for VAT purposes, it’s treated as though you made the sale in your home country.

This “domestic rate” rule applies only to intra-EU distance sales of goods (WSTO) and TBE services. Other types of services often have different place-of-supply rules, so they may need separate treatment regardless of your turnover.

Even below the threshold, you can opt in to OSS voluntarily. This allows you to start applying destination-country VAT rates before you are required to – which can be useful if most of your customers are abroad and their VAT rates are lower than your own. In some countries, such as Poland, this is done via a VAT-29 form.

Reporting through your domestic VAT return

The simplicity extends to reporting. If you’re under the threshold and haven’t opted in to OSS, you simply include your cross-border B2C sales in your regular domestic VAT return. The VAT you’ve collected – even on sales to other EU countries – is paid to your own tax authority, just as it would be for domestic sales.

This is why many microbusinesses and early-stage e-commerce sellers don’t notice much difference when they first start selling to other EU countries. The compliance process is effectively the same as it is for sales at home.

An example: a small seller under the threshold

Let’s imagine Elena, who runs a small handmade jewellery business from Italy. She sells mostly within Italy but has started to get a few orders from Spain, France, and Austria. Over the course of the year, her cross-border sales look like this: €2,500 to Spain, €1,800 to France, and €1,200 to Austria.

Her total for the year is €5,500 net of VAT – well below the €10,000 limit. Because of this, Elena charges Italian VAT (currently 22%) on all her sales, whether the buyer is in Rome or Paris. When it’s time to file her VAT return, she simply reports everything to the Italian tax authority, just as she always has.

At this point, Elena’s VAT life is straightforward. She doesn’t need to know the VAT rates in France or Austria, she doesn’t have to change her invoices for each customer, and she isn’t required to register for OSS. But she’s keeping an eye on her numbers – because once her EU cross-border sales pass €10,000 net, the game changes entirely.

The moment you cross €10,000 – what changes immediately

The place of supply rule switch

Passing the €10,000 VAT OSS threshold flips one of the most important VAT rules instantly. Up to that point, your home country is treated as the place of supply, meaning you apply your own VAT rate to customers anywhere in the EU. The moment your net turnover for eligible intra-EU B2C sales of goods (WSTO) and TBE services exceeds €10,000 within the calendar year, the place of supply shifts to the customer’s country. From the sale that pushes you over, you must apply their VAT rate, not yours — there is no grace period until the next year. This is why closely monitoring your turnover is critical, so you can make the switch immediately and avoid errors.

Moving to destination-based VAT

This shift puts you into the destination-based VAT system. Every subsequent eligible cross-border B2C sale in that calendar year — and for the whole of the following year — is taxed according to the rules and rates of the customer’s country. In some cases, this works in your favour, such as when selling to Luxembourg where the standard rate is just 16%. In others, it can increase your prices, like when selling to Hungary where the rate is 27%. The difference can be enough to affect both your pricing strategy and your profit margins.

How invoicing is affected

Once you enter the destination-based system, every invoice for an eligible sale must list the correct VAT rate for the customer’s country and show the VAT amount calculated at that rate. In certain member states, there may also be specific invoice wording or language requirements. For most small businesses, this means ensuring their invoicing or e-commerce system can automatically determine the customer’s location and apply the correct rate in real time.

A practical example

Take Elena, the Italian jewellery maker we met earlier. Before crossing the threshold, a €100 necklace attracted Italian VAT at 22%, so a French customer paid €122. Once Elena’s total net EU cross-border sales exceed €10,000, that same necklace for a French buyer is taxed at France’s 20% rate, so the total drops to €120. For a Hungarian buyer, however, the total would rise to €127 because Hungary’s rate is higher.

Managing compliance after the switch

Once you’re over the threshold, you have two ways to comply. You can register for OSS in your home country, allowing you to report all eligible sales across the EU in a single quarterly return — this is the simpler and more common approach. Alternatively, you can register for VAT locally in each country where your customers live, but this requires separate filings and is far more complex for most small businesses.

Crossing the €10,000 line is far more than a bookkeeping detail. It’s the moment VAT compliance becomes multi-country and rate-specific, requiring systems that can keep up from the very first sale above the limit.

OSS registration – your two main options

Once you pass the €10,000 VAT OSS threshold (net of VAT, covering eligible intra-EU B2C sales of goods and TBE services), you need a way to handle your new destination-based VAT obligations without drowning in admin. There are two ways to do it: using the One Stop Shop or registering for VAT separately in each country where you sell. Both achieve compliance, but they work very differently.

Using the One Stop Shop (OSS)

The OSS is designed to be the simpler route for EU-based businesses selling to customers in multiple member states. Instead of registering for VAT in every single country where you have buyers, you register once for OSS in your own country. You then submit a separate quarterly OSS VAT return — in addition to your regular domestic VAT return — that includes all your eligible cross-border B2C sales, broken down by customer country and VAT rate. Your local tax authority collects the payment and distributes the VAT to the relevant countries.

Even after you cross the threshold, OSS registration is optional. However, if you don’t use OSS, you must register for VAT in each country of consumption (the customer’s country) and handle local filings there.

The quarterly OSS process is straightforward: list your sales per country, show the VAT charged, and pay the total in one go to your home tax authority. The deadline is the end of the month following the end of the quarter, so the first quarter’s return is due by 30 April, the second by 31 July, and so on.

Registering for OSS can be done online through your national tax authority’s portal. Once you’re approved, the scheme applies to all your eligible cross-border sales from that point forward, and you stop charging your domestic VAT rate to foreign customers unless their VAT rate happens to match yours. One important detail: if you deregister from OSS, there’s a two-year “quarantine” period before you can rejoin.

Separate VAT registration in each country

The alternative is to register for VAT individually in every EU country where you make cross-border B2C sales. This was the only option before OSS existed, and while it’s still available, it’s far more demanding. Each country has its own registration process, deadlines, return frequency, and sometimes even unique requirements for invoice content. Local fiscal representation is often required, particularly if you don’t speak the language or aren’t familiar with their digital systems.

A business might still choose this route if it has a warehouse or physical presence in another member state, stores goods there for fulfilment, or sells products that benefit from specific local VAT treatment. But for most small businesses that simply ship goods or provide TBE services across borders, this path means juggling multiple sets of VAT records, filing separate returns in each country, and paying for accounting support in several jurisdictions.

For the majority of sellers passing the €10,000 threshold, OSS is the more practical and cost-efficient option. It keeps compliance centralised, reduces the administrative burden, and lets you focus on growing your business instead of managing tax filings in multiple languages.

All sales above threshold are subject to destination VAT

No Going Back Once You Cross

Crossing the €10,000 VAT OSS threshold isn’t something that just affects the single transaction that tipped you over the limit. From that moment onward, all your eligible cross-border B2C sales of goods (WSTO) and TBE services for the rest of the calendar year must be taxed according to the VAT rules of the customer’s country. This applies even if your very next order is worth just €50. The change is immediate and follows the EU’s place-of-supply rules for these categories. The threshold test is always applied on a calendar-year basis.

The rule carries over into the next year

Once you’ve crossed the threshold, the destination-based VAT rules also apply for the entire following calendar year. Only if your cross-border sales remain below €10,000 net of VAT for that full year can you revert to charging your domestic VAT rate from the start of the next year. In effect, there’s a one-year “lock-in” period once you pass the limit. This lock-in applies equally if you voluntarily opt to apply destination VAT before crossing the threshold — something you can do by notifying your tax authority in advance.

No partial reset mid-year

There’s no mid-year reset. Even if your sales later fall back under €10,000, you must continue applying destination VAT until the end of the year, and for the whole of the next year, unless you meet the criteria to revert. This is why regular monitoring of your turnover is critical — knowing when you’re close gives you time to adjust systems and pricing before the switch happens.

OSS commitment rules

If you decide to manage compliance via the OSS in your home country, you must remain in it for at least the period covered by those sales. Deregistering part-way through the lock-in period doesn’t remove your obligation to apply destination VAT, and in most cases, deregistration triggers a two-year “quarantine” period before you can rejoin OSS.

An example in practice

Imagine you’re based in Portugal and your cross-border sales are steadily rising. In mid-August, a series of large orders to customers in Spain pushes your total from €9,900 to €10,500 net of VAT. That extra €600 means you’ve crossed the threshold. From the very next sale — whether it’s to Spain, Germany, or Finland — you must apply the customer’s local VAT rate. This rule remains in force until 31 December of the current year. Even if sales slow down after that, you’ll still be charging destination VAT for the entire following year. Only after that second year, if you remain below €10,000 for the full 12 months, can you return to charging your domestic VAT rate on cross-border sales.

For small businesses, this “carry-over” rule can be a surprise. But once you understand it, you can treat the threshold not as a temporary inconvenience, but as a long-term compliance change — one you can plan for in your pricing, invoicing, and reporting processes.

Practical compliance steps after crossing the threshold

Mapping your customer locations

The moment you cross the €10,000 VAT OSS threshold, knowing exactly where your customers are located becomes critical. Since VAT now depends on the customer’s country, you can’t simply rely on a delivery address and assume it’s correct — you need reliable, verifiable data.

For TBE services, EU VAT law explicitly requires collecting at least two pieces of non-conflicting evidence to determine location, such as the billing address, IP address, or the bank’s country code. For goods, this rule is not as rigidly codified in the Directive, but tax authorities often expect similar evidence in OSS audits as part of proving the correct place of supply. Having this data organised and stored is essential in case your VAT treatment is ever challenged.

Updating your invoicing systems

Your invoicing process must now adapt to reflect the correct VAT rate for the customer’s country and show the VAT amount based on that rate. This can be challenging to manage manually, especially as VAT rates differ across the EU and may vary by product category. The safest route is to use invoicing or e-commerce software that can detect the customer’s location and automatically apply the right rate. If your current system can’t do this, upgrading is no longer optional — it’s a compliance necessity.

Showing location-specific VAT-inclusive prices

Once you’re in the destination-based VAT world, the prices customers see on your site or in your store may vary depending on where they are. Sometimes the difference will be minor, but higher local VAT rates can make products noticeably more expensive. You’ll need to decide whether to adjust the displayed VAT-inclusive price for each location or keep prices uniform across the EU and let your profit margin absorb the variation. Whatever approach you take, transparency is key — customers should always see the final price without having to calculate it themselves.

Keeping evidence for every sale

Maintaining evidence of customer location isn’t just good practice — it’s a legal requirement for transactions declared under OSS. The 10-year record-keeping rule applies to all such transactions, whether they involve goods or TBE services. This means keeping digital records of location evidence, invoice details, and VAT calculations for a full decade, ready to present if a tax authority requests them.

If you sell both goods and TBE services, your systems must be able to handle both correctly within the same OSS return. That means mapping each transaction to the right VAT rate and country, ensuring that reporting stays accurate across all product and service types.

Crossing the threshold isn’t just about charging a different VAT rate — it’s about building systems that ensure every sale, every invoice, and every reported figure is correct from the start. Once those systems are in place, compliance becomes routine, and you can focus on running and growing your business rather than firefighting VAT issues.

Special cases & notes

Non-EU sellers have no threshold benefit

If your business is based outside the EU, the €10,000 VAT OSS threshold does not apply. From your very first cross-border B2C sale into the EU, you must charge destination VAT according to the customer’s country. There’s no grace period or small-business exemption.

However, the compliance route depends on where your goods are shipped from. If you are a non-EU seller but your goods are shipped from within the EU — for example, via an EU-based fulfilment centre — you can still use the OSS Union scheme to report sales. If your goods are shipped from outside the EU, the Union OSS does not apply. In that case, you’ll need to use the IOSS (Import One Stop Shop) for consignments up to €150, or register for VAT locally in each country of import for higher-value goods.

For non-EU sellers of services, the OSS non-Union scheme remains available, working in a similar way but designed for businesses without an EU establishment.

Choosing to apply destination VAT from the start

Even if you’re well below €10,000, you can choose to start applying destination-based VAT voluntarily. This is often done to avoid a sudden mid-year shift in pricing, invoicing, and systems when the threshold is crossed. By opting in early, your VAT treatment stays consistent year-round, and your record-keeping is simplified.

Once you make this choice, you must stick with it for at least two calendar years. This is not just a national option — it is an EU-wide rule under the VAT Directive, and it applies in all Member States.

Mixed sales of goods and TBE services

If you sell both physical goods and TBE services, the threshold calculation combines them. The €10,000 limit applies to the total net value of these sales across all EU countries. For example, if you sell €6,000 worth of handmade furniture to France and €5,000 worth of downloadable design templates to Spain, your total is €11,000. Crossing the threshold means both your goods and your TBE services must now be taxed according to the customer’s local VAT rate, even if only one product category pushed you over.

These special cases often catch business owners off guard, especially those who assume the rules only apply to one type of sale or only to EU-established sellers. In reality, once you reach the threshold, all qualifying cross-border sales must follow the same VAT treatment — so knowing where you fit in these exceptions is essential to staying compliant.

Key takeaways

What changes at €10,000

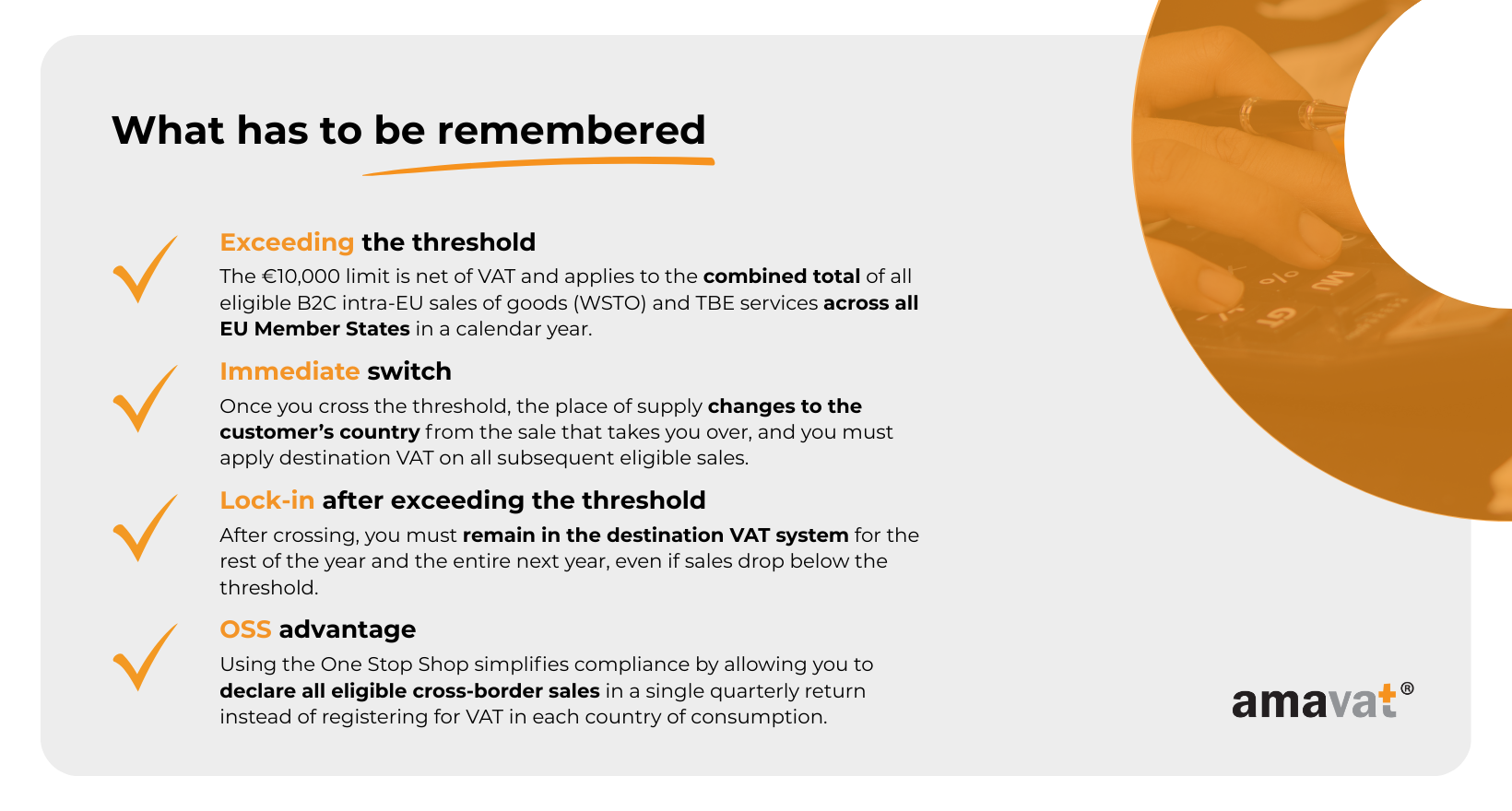

Crossing the €10,000 VAT OSS threshold is more than just reaching a sales milestone — it’s the moment the VAT rules for your business change fundamentally. The €10,000 figure is net of VAT and applies to the combined total of eligible intra-EU B2C sales of goods (WSTO) and TBE services across all EU Member States in a calendar year.

Before you pass this point, you can keep things straightforward by charging your domestic VAT rate on all qualifying cross-border B2C sales and reporting everything through your local VAT return. Once you cross it, the place of supply shifts to the customer’s country, and you must apply destination VAT for every eligible sale — not just the one that pushed you over.

Why the change lasts beyond the current year

The change applies for the remainder of the current calendar year and for the entire following year. You’ll need to adapt your invoicing so that it includes the correct VAT rate for each customer’s country, manage multiple VAT rates, and maintain solid evidence of customer location for every transaction. Choosing between OSS registration and separate VAT registrations in each country becomes a key decision, with OSS being the most efficient option for most small businesses.

Why proactive monitoring is crucial

Because the rule takes effect from the exact sale that pushes you over the threshold, tracking your sales totals regularly is essential. Knowing when you’re close gives you time to prepare your invoicing systems, adjust your pricing strategy, and put your VAT reporting process in place before the switch happens.

Where to find official guidance

For complete details, including step-by-step OSS registration instructions and up-to-date VAT rates for each EU Member State, visit the European Commission’s dedicated VAT OSS portal here: EU VAT OSS Official Guidelines. Bookmarking this resource will help you stay compliant whether you’re approaching the threshold or already past it.

Conclusion

The threshold Isn’t the end of simplicity

Crossing the €10,000 VAT OSS threshold can feel intimidating when you first understand what it involves. Suddenly, you’re no longer just charging your home country’s VAT rate — you’re dealing with a patchwork of different rates across the EU, updating your invoicing, and keeping more detailed sales records. It’s natural to worry that this will eat into your time and energy, especially if you’re running a lean small business where every hour counts.

But here’s the reality: with the One Stop Shop in place, compliance is far simpler than it used to be. Instead of juggling multiple VAT registrations and reporting to different tax offices in different languages, OSS gives you a single, centralised process for qualifying B2C intra-EU sales of goods (WSTO) and TBE services. It doesn’t replace local VAT registration where you have other obligations — such as storing goods abroad or supplying services outside the OSS scope — but for eligible sales, it keeps everything under one roof.

OSS returns are filed separately from your domestic VAT return, even if both go to the same tax authority. And for all sales declared under OSS, you must keep detailed records for 10 years and make them available electronically to both your Member State of Identification and any Member State of consumption upon request.

Preparing for success

Smooth compliance doesn’t happen by accident. You need to stay proactive. Monitor your cross-border sales totals regularly so you can see the threshold approaching rather than being caught off guard. Keep your invoicing and e-commerce systems updated so they can automatically handle different VAT rates, and ensure you’re capturing reliable customer location data for every transaction. These small steps make a big difference — when your systems are ready, the actual moment you pass the threshold becomes a seamless transition rather than a disruptive shock.

Turning compliance into an advantage

Instead of treating the threshold as a hurdle, think of it as a sign that your business is expanding. Reaching €10,000 net of VAT in eligible cross-border B2C sales means you’ve tapped into demand beyond your own country — you’re playing on a bigger stage now. Being compliant with destination VAT is part of operating confidently in that space, showing both your customers and tax authorities that you take cross-border trade seriously.

Your next step

If you’re close to the line, now is the time to prepare. If you’ve already crossed it, make sure your OSS registration is in place and your systems are aligned with the rules. Either way, the smartest move is to make VAT compliance part of your growth strategy rather than a distraction from it. That way, the threshold isn’t something to fear — it’s simply a milestone on the road to becoming a true European business. Good thing you’re not alone in all of this – you’ve got us. And we’re all but ready to help you. Just give us a call, and we’ll sort your OSS situation right out.