Multi-channel e‑commerce and VAT OSS: how to consolidate your reporting

Spis treści

VAT reporting in the European Union is built around the principle that tax should be paid in the country where the customer lives. Sounds simple, but in practice, every sale you make across borders can fall under a different VAT rate, and each sales channel records transactions in its own way. Add a few hundred orders a month, some returns, and varying VAT rates across 27 Member States, and suddenly your tidy little business dashboard feels more like a tangled spreadsheet jungle.

Fragmented reporting across platforms

The problem isn’t just the VAT rules themselves, but the way data gets scattered across different systems. Marketplaces like Amazon often provide detailed reports, but the format doesn’t match what Shopify or WooCommerce generates. Social commerce platforms may give you almost no tax details at all, forcing you to dig deeper just to figure out which orders should appear in your VAT return.

This fragmentation creates extra work and, more importantly, opens the door to mistakes. Misreporting VAT isn’t just an accounting headache—it can also lead to fines, back payments, and stressful audits. For a small e-commerce company, where the team is usually just the founder plus a handful of helpers, managing this patchwork of numbers is exhausting. Many entrepreneurs admit they spend far more time chasing tax compliance than actually growing their business.

A new solution: VAT OSS

To make life easier for businesses selling across borders, the European Union introduced the One Stop Shop (OSS) system. Instead of filing VAT returns separately in every country where you have customers, you can now submit a single quarterly return through one Member State. That Member State then handles the redistribution of VAT to all the other countries.

For multi-channel e-commerce, OSS has the potential to change the game. Rather than fighting with half a dozen dashboards and manually building reports for each, you can centralize your data, automate much of the reporting, and focus on running your shop instead of decoding tax rules. Of course, it’s not as simple as clicking one button—there are workflows to set up, rules to understand, and best practices to follow. But once you know how to consolidate your reporting across all channels into the OSS framework, VAT compliance becomes a manageable routine instead of a monthly nightmare.

What is VAT OSS and why does it matter?

A single system for EU-wide VAT

On 1 July 2021, the European Union introduced the One Stop Shop, or OSS, a scheme designed to simplify VAT compliance for businesses selling to consumers across different Member States. Instead of being forced to register and file VAT returns in each country where customers are located, a seller can now submit a single quarterly return through their Member State of identification, which is usually their home country. That authority then redistributes the collected VAT to the Member States of consumption.

For an entrepreneur running a small online shop, this change is significant. The old system often required multiple VAT registrations across Europe, each with its own rules, languages and deadlines. OSS reduces that complexity to one registration and one filing rhythm, giving small businesses the chance to expand across borders without drowning in paperwork.

How the old rules worked

To appreciate why OSS is important, it is worth looking back at how things functioned before 2021. Each EU country operated its own distance-selling threshold, often set at either thirty-five or one hundred thousand euros. Once a seller’s annual turnover to customers in a particular country passed that threshold, they were obliged to register for VAT there and to file returns directly with that country’s tax office.

This meant that even modest success abroad could quickly create a burden of multiple registrations. A business based in Spain, for example, that grew popular in Germany and France might suddenly find itself handling three or more sets of VAT obligations, with forms in different languages and deadlines scattered throughout the year. For small teams, the administrative load could feel impossible to manage.

The new EU-wide ten thousand euro rule

With the arrival of OSS, those national thresholds were abolished and replaced with a single EU-wide threshold of ten thousand euros, calculated across all cross-border B2C sales of goods and certain digital services. Once a business passes that threshold, it must charge VAT at the rate of the customer’s country, a system known as destination VAT. At that point, the seller can declare everything through OSS in their home country rather than juggling separate foreign registrations.

Even businesses that remain below the threshold can opt to use OSS voluntarily. For many, this is a strategic choice because it avoids switching systems mid-growth and ensures a consistent way of charging and reporting VAT across all markets.

What OSS covers

OSS is not a single flat scheme but rather a family of special arrangements. The Union OSS is the main system for EU-based sellers, covering distance sales of goods and certain services supplied to consumers in other Member States. The Non-Union OSS extends access to businesses established outside the EU that supply services to EU consumers. Alongside them is the Import OSS, or IOSS, which applies to consignments of up to one hundred and fifty euros imported from outside the Union. Under IOSS, VAT is collected at the checkout stage and reported monthly, sparing customers the unwelcome surprise of paying VAT on delivery.

Marketplaces also have a special place in the framework. In some cases, particularly with low-value imports or when non-EU sellers supply goods via a European platform, the marketplace itself may be treated as the deemed supplier. That means the platform, not the individual seller, becomes responsible for collecting and remitting VAT.

For most multi-channel sellers who operate across marketplaces like Amazon or Zalando, run their own shops on Shopify or WooCommerce, or use social platforms such as Instagram Shops, OSS will capture the vast majority of cross-border transactions. It does not, however, replace ordinary domestic VAT returns in the seller’s home country, nor does it eliminate the need for local VAT registrations when goods are stored in warehouses across several Member States, as is the case with pan-European fulfilment.

Why OSS matters for multi-channel sellers

The real advantage of OSS is that it allows small and growing businesses to scale across Europe without the constant fear of triggering a new set of obligations in every market where they find customers. With one registration and one quarterly return, an entrepreneur can cover all cross-border consumer sales, paying their local tax office once per quarter and letting that office redistribute the funds to the relevant Member States.

The deadlines are predictable, always falling on the last day of the month following each quarter. Even when there are no sales to report, a nil return is still required, which ensures consistency and avoids any gaps in compliance.

The benefits of this system are both practical and strategic. Less administrative work means fewer errors, and fewer errors mean lower risk of fines or audits. More importantly, OSS gives young businesses the confidence to grow. If sales suddenly increase in Italy or the Netherlands, there is no need to scramble for an immediate local registration. OSS takes that worry off the table and lets entrepreneurs focus their energy on the parts of their business that actually drive growth — marketing, customer relationships and product development.

The multi-channel challenge

Why selling on multiple platforms complicates VAT

For most e-commerce entrepreneurs, growth rarely comes from a single channel. A shop may begin on Shopify, then expand into Amazon or Zalando, and eventually test the waters on Instagram Shops or Facebook Marketplace. Each additional channel promises more customers and more revenue, but every new point of sale also creates another layer of complexity in how transactions are recorded, reported, and taxed.

The reason is that every platform structures its data differently. Amazon’s reports look nothing like Shopify’s exports, while social commerce platforms often provide only partial VAT information. What might seem like a straightforward sale quickly breaks down into a long list of data points: invoice dates, customer addresses, VAT rates, order identifiers, payment references, and marketplace flags such as whether a platform is acting as the deemed supplier. For VAT compliance, every one of these details matters. Yet they rarely appear in a standardized format, making the task of turning fragments from multiple dashboards into a single, accurate OSS return feel more like assembling a puzzle with mismatched pieces than straightforward bookkeeping.

Fragmented data and the risk of mistakes

When sales data is scattered across different systems, reconciliation becomes slow and error-prone. It is easy to miss a transaction, accidentally count one twice, or misclassify a sale as domestic instead of cross-border, or as B2C instead of B2B. These small errors can accumulate into larger problems: VAT underpayments, inconsistencies in OSS returns, and potential exposure during audits. For a small team, the stress of catching every detail across multiple channels can be overwhelming.

Different VAT rates across Europe

The challenge deepens when you factor in the variation of VAT rates across the European Union. A product that carries a twenty-three percent standard rate in one Member State might be taxed at twenty-one or twenty-five percent in another. Certain categories, such as books or children’s clothing, often qualify for reduced or super-reduced rates, which differ country by country. Under the OSS system, sellers must apply the rate of the customer’s country, a principle called destination VAT. That means every single order must be evaluated in the context of the customer’s location and the product category. Some platforms may not apply or surface this information consistently, leaving sellers to bridge the gap themselves.

Record-keeping obligations that stretch a decade

Another layer of responsibility is the long-term record-keeping requirement. Under OSS, businesses must keep electronic records of all reported transactions for ten years, starting from the end of the year in which the transaction occurred. These records must be stored in a way that allows them to be provided electronically not only to the Member State of identification but also to any Member State of consumption. Importantly, this obligation continues even if a business stops using the scheme. For sellers already juggling multiple dashboards, ensuring that data is complete, consistent, and accessible over a full decade represents a heavy administrative burden.

Marketplace rules that shift VAT liability

Marketplaces add yet another wrinkle. In certain cases, the platform itself is treated as the deemed supplier and is therefore responsible for charging and remitting VAT. This happens, for example, with low-value consignments of up to one hundred and fifty euros imported into the EU when a marketplace facilitates the sale, or when a non-EU seller makes intra-EU supplies of goods through a European platform. In such situations, the marketplace, rather than the individual seller, reports the VAT due on the consumer sale.

For the underlying seller, however, the responsibility does not vanish. Those sales must be excluded from their own OSS return but still need to be reflected in internal records. In many cases, the seller must also account for the underlying deemed business-to-business supply to the platform, reconcile payouts, and track stock movements. Misunderstanding this mapping can easily lead to double reporting or, conversely, to omissions that raise red flags in future audits.

Why this challenge matters

The difficulty for multi-channel e-commerce sellers is rarely the act of charging VAT itself. The true challenge lies in consolidating divergent data sources into one accurate report. OSS does simplify where VAT is filed, reducing everything to a single quarterly return in the Member State of identification. But it does not standardize how platforms present their data or apply VAT rules in practice. Without a central process — and often specialized tools — to normalize transactions, apply the correct destination VAT rates, and track marketplace liability shifts, the administrative effort grows with every additional sales channel. Only when the reporting pipeline is under control can the promise of OSS be realized: a single portal, one consolidated return, and smoother growth across the EU.

How to consolidate reporting with VAT OSS

Central registration as the starting point

The first step in working with the OSS system is registration in your Member State of identification. For EU-established businesses this will usually be the country where the company is based, while non-EU sellers can also access the scheme but must register in a single chosen Member State according to the rules of the Union scheme. Registration is completed through the national online tax portal, such as FinanzOnline in Austria or ELSTER in Germany. Once the registration is approved, the business receives an OSS identifier and can begin reporting all eligible cross-border B2C sales through this one account. Instead of maintaining multiple VAT registrations across Europe, everything flows through a single portal.

Bringing data together from every sales channel

After registration, the real work begins with data collection. Each sales platform—whether Amazon, Shopify, Zalando, or Instagram Shops—structures its reports in its own way. What one system calls an order ID, another might label differently, and not all of them provide full VAT details. Relying on manual spreadsheets quickly becomes unmanageable. To solve this, many sellers adopt integration tools or middleware that connect to the platforms through APIs and pull the data in a consistent format. The essentials are always the same: the invoice date, the customer’s country, the taxable amount, the VAT rate applied, and the VAT collected. Without these core fields, reconciliation becomes guesswork, and preparing an accurate OSS return is nearly impossible.

Building standardized records that can stand the test of time

Collecting the right data is only half the challenge. It must also be standardized and archived in a durable form. A consolidated database that aligns the key fields—customer country, VAT rate, taxable base, and VAT amount—across all platforms makes reconciliation possible and ensures that nothing slips through the cracks. Standardization is not only about efficiency today but also about compliance tomorrow. Under the OSS rules, detailed electronic records must be retained for ten years and must be accessible to any Member State that requests them. If the data is scattered across platforms or stored in incompatible formats, meeting this obligation becomes almost impossible.

Automating VAT allocation for accuracy

Once the records are standardized, the next task is to make sure VAT is allocated correctly. Software built for OSS compliance can handle this by mapping sales to the right destination country VAT rate, distinguishing between standard and reduced rates depending on the product type, and keeping watch over the ten thousand euro EU-wide threshold. When that threshold is crossed, the system automatically switches to applying destination VAT. At the same time, it can exclude transactions in which marketplaces are deemed suppliers and therefore responsible for VAT themselves. Automation reduces the risk of human error and ensures consistency across multiple sales channels, something that becomes increasingly important as a business grows.

Preparing the quarterly return

Each quarter, the seller must report sales grouped by the Member State of consumption, showing both the taxable turnover and the VAT due in that country. When data flows from standardized inputs, this breakdown can be generated automatically instead of being assembled manually from different spreadsheets. The result is less stress at reporting time and a much shorter turnaround from closing the books to submitting the return.

Filing and paying through one portal

With the return prepared, the next step is filing it electronically through the OSS portal of the Member State of identification. The deadline is always the last day of the month following the end of the quarter, such as 30 April for the first quarter. Payment is made once to the national tax authority, which then redistributes the VAT to all the other Member States where customers are located. For the seller, this eliminates the need to deal with multiple foreign tax offices and payment systems.

Making corrections and keeping records ready

Mistakes are inevitable, but the OSS system has mechanisms to handle them. Errors cannot be amended in past returns but must instead be corrected in later ones, with a window of up to three years for adjustments. This means that if a sale was omitted or misreported, it can be fixed in a future filing without creating permanent liabilities. At the same time, compliance does not stop with filing. The requirement to maintain a complete, audit-ready archive of electronic records for at least ten years is as important as the quarterly return itself. These records must remain standardized and retrievable, ready to be provided not only to the Member State of identification but also to any other country where the sales were consumed.

Best practices and recommended tools

Choosing platforms that are built for OSS

Once a business is registered for the One Stop Shop, the greatest challenge is no longer the filing itself but keeping the reporting pipeline accurate and reliable. Managing this manually is rarely sustainable, particularly for businesses selling across multiple channels. Many entrepreneurs therefore turn to specialized compliance platforms such as SimpleVAT, Taxually, or Avalara. These services connect directly to sales channels, gather the required data, and prepare OSS returns in the correct format.

For small businesses without in-house tax expertise, these tools are a lifeline. They automate VAT allocation by Member State, generate quarterly returns in line with the official structure, and significantly reduce the errors that often arise from manual reconciliation. The real advantage is time: what once required hours of combing through spreadsheets from Amazon, Shopify, and Instagram can be reduced to a streamlined workflow where all sales data flows into one system. For sellers whose orders are spread across many marketplaces and webshops, that time saving can be the difference between struggling to stay compliant and scaling confidently across borders.

Combining OSS reporting with e-invoicing

Another important best practice is pairing OSS reporting with electronic invoicing. E-invoicing is not yet mandatory everywhere in the EU, but the trend is clear. Several Member States, including Italy, Poland, France, and Spain, have already introduced their own requirements, and the European Commission is preparing broad reforms under the initiative known as VAT in the Digital Age. Over time, structured and often real-time invoicing will become the standard across the Union.

Integrating e-invoicing into the OSS process creates two key benefits. First, invoices become a standardized and machine-readable source of VAT information, feeding directly into the reporting pipeline without the inconsistencies of platform exports. Second, structured invoices provide an automatic audit trail that reduces human error and ensures compliance with the ten-year retention requirement under OSS. For sellers, this means that the same system which generates customer invoices also underpins VAT reporting, creating both efficiency and security.

Monitoring thresholds proactively

Although OSS swept away national distance-selling thresholds, the EU-wide limit of ten thousand euros remains a critical rule. Below this amount, cross-border sales can still be taxed in the home country. Once exceeded, destination VAT must be applied, and the seller must either register locally in each Member State of consumption or, more sensibly, use the OSS system.

The key is that the threshold applies cumulatively across all Member States and covers both intra-EU distance sales of goods and TBE services such as telecommunications, broadcasting, and electronic services. Sellers therefore need to keep a constant eye on their overall cross-border turnover. Modern compliance platforms usually track this automatically and alert businesses as they approach the threshold. Even without such tools, entrepreneurs should set up manual tracking to ensure the switch to destination VAT happens as soon as it is required. Delays in recognising that the threshold has been passed can lead to misapplied VAT and later corrections that complicate compliance.

Reconciling channels regularly

Automation is a powerful tool, but reconciliation remains essential. Each platform has its own way of presenting sales, and marketplace payouts rarely align perfectly with transaction-level data. The safest approach is to reconcile sales data against platform reports regularly, either monthly or at least each quarter before filing. This not only ensures that the OSS return includes all cross-border B2C sales but also helps sellers identify which transactions were handled by marketplaces as deemed suppliers, where the platform rather than the seller is responsible for VAT remittance.

Early reconciliation prevents discrepancies from building up over time and provides peace of mind that the figures reported to the tax authorities truly reflect the business reality. For a small seller, this means avoiding unpleasant surprises months down the line and staying confident that audits, should they occur, will confirm compliance.

Staying informed as the rules evolve

VAT in the EU is not static, and the One Stop Shop is still a relatively new system. The European Commission’s VAT in the Digital Age initiative signals further change, including the potential for mandatory real-time reporting of intra-EU transactions, a shift toward EU-wide e-invoicing requirements, and expanded responsibilities for marketplaces.

For entrepreneurs selling across multiple channels, staying informed about these developments is essential. Subscribing to official updates from the European Commission, following national tax authority portals such as FinanzOnline in Austria or ELSTER in Germany, and consulting advisers who specialize in OSS compliance all help keep businesses ahead of the curve. Those who adapt early often find that new requirements, rather than adding complexity, actually simplify their processes by forcing a move to more automated, digital solutions. In this way, regulatory change becomes an opportunity rather than a burden, giving small e-commerce businesses a chance to compete with larger players on equal terms.

Key takeaways

The value of one-stop reporting

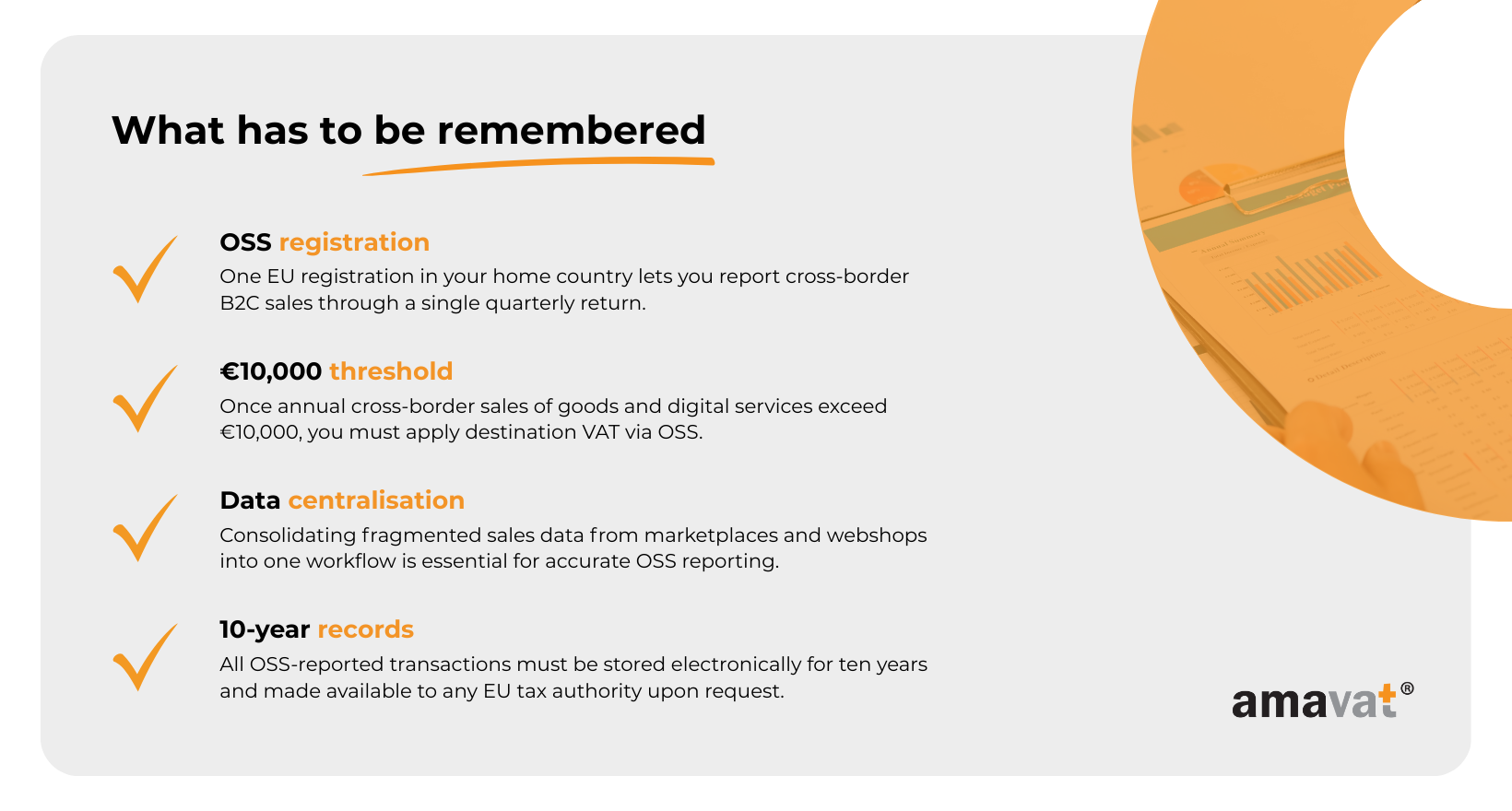

The launch of the One Stop Shop in July 2021 fundamentally reshaped how small and growing e-commerce businesses handle VAT across the European Union. Where previously sellers had to register and file in every country where their customers were located, eligible cross-border B2C sales can now be reported in a single quarterly return through the seller’s Member State of identification. For entrepreneurs running their shops across multiple channels, this centralisation removes a huge administrative burden and makes scaling across borders feel achievable rather than overwhelming.

Why centralising data matters most

Registering for OSS is only the starting point. The greater challenge lies in consolidating data from different sales platforms into one coherent system. Amazon, Shopify, Zalando, and Instagram each export their reports differently, and when these fragments are stitched together by hand the risk of mistakes rises sharply. Businesses that create a centralised reporting pipeline gain more than efficiency: they also gain confidence that their OSS filings accurately reflect their real sales, quarter after quarter.

Automation as a safeguard

Manual reconciliation may be manageable when order volumes are low, but it quickly becomes unsustainable as a business grows. Automation provides the safeguard that ensures accuracy at scale. By linking directly to platforms, allocating VAT according to the correct Member State and rate, and generating OSS returns in the required format, software solutions allow entrepreneurs to focus on building their businesses rather than chasing errors in spreadsheets. Automation does not eliminate human oversight but supports it, providing a reliable framework that reduces errors and saves time.

Compliance as an ongoing commitment

The OSS scheme is not something that can be set up once and forgotten. Long-term compliance depends on continuous attention. Sellers need to monitor when their cross-border turnover crosses the ten-thousand-euro EU-wide threshold, reconcile data from their different channels on a regular basis, and retain electronic records for a full decade. These obligations are designed to ensure that tax authorities across the Union can verify transactions whenever necessary. Businesses that put strong processes in place early enjoy smoother audits, fewer corrections, and greater confidence as they expand into new markets.

More than a filing portal

Ultimately, OSS is more than just a filing portal. It is a framework that, when combined with centralised data management and digital compliance tools, enables small businesses to grow confidently across Europe. Entrepreneurs who approach VAT compliance as part of their growth infrastructure, rather than as an afterthought or burden, are the ones best placed to scale quickly, enter new markets, and compete effectively with larger players.

Conclusion

VAT compliance has long been one of the most intimidating aspects of cross-border e-commerce. For years, the patchwork of national thresholds and multiple registrations forced even small sellers to spend disproportionate time and energy on administration. The introduction of the One Stop Shop changed that equation. By offering a single portal, one quarterly return, and a system where the home tax authority redistributes the VAT, the European Union created a way for small businesses to participate in the single market without being crushed by bureaucracy.

Yet registering for OSS is not the full solution. The real work lies in how businesses prepare their data. Multi-channel selling, whether through Amazon, Shopify, Zalando, or social platforms, generates fragmented information in different formats. Unless this information is centralised, standardised, and automated, the quarterly return remains a stressful, error-prone task. That is why the most successful sellers treat OSS as part of a wider compliance workflow: one built on clean data pipelines, reliable automation, and robust record-keeping that can withstand the ten-year audit horizon.

What OSS truly offers is more than just a way to file VAT returns. It is a framework that makes growth across Europe sustainable. For young entrepreneurs, the message is clear. Invest early in the systems and processes that keep your reporting pipeline smooth. Use automation where possible, but maintain oversight so you remain in control. And see compliance not as a hurdle but as an enabler. The businesses that thrive are those that understand that sound reporting is not a distraction from growth but part of the foundation that makes scaling possible.

As EU VAT rules continue to evolve under initiatives such as VAT in the Digital Age, the importance of building a resilient compliance infrastructure will only increase. Those who prepare now will be well placed to adapt to real-time reporting, mandatory e-invoicing, and whatever changes the next decade brings. OSS is the starting point — and for many businesses, it is also the doorway to confident, borderless expansion across the European Union.