Amazon FBA and VAT in Germany

Spis treści

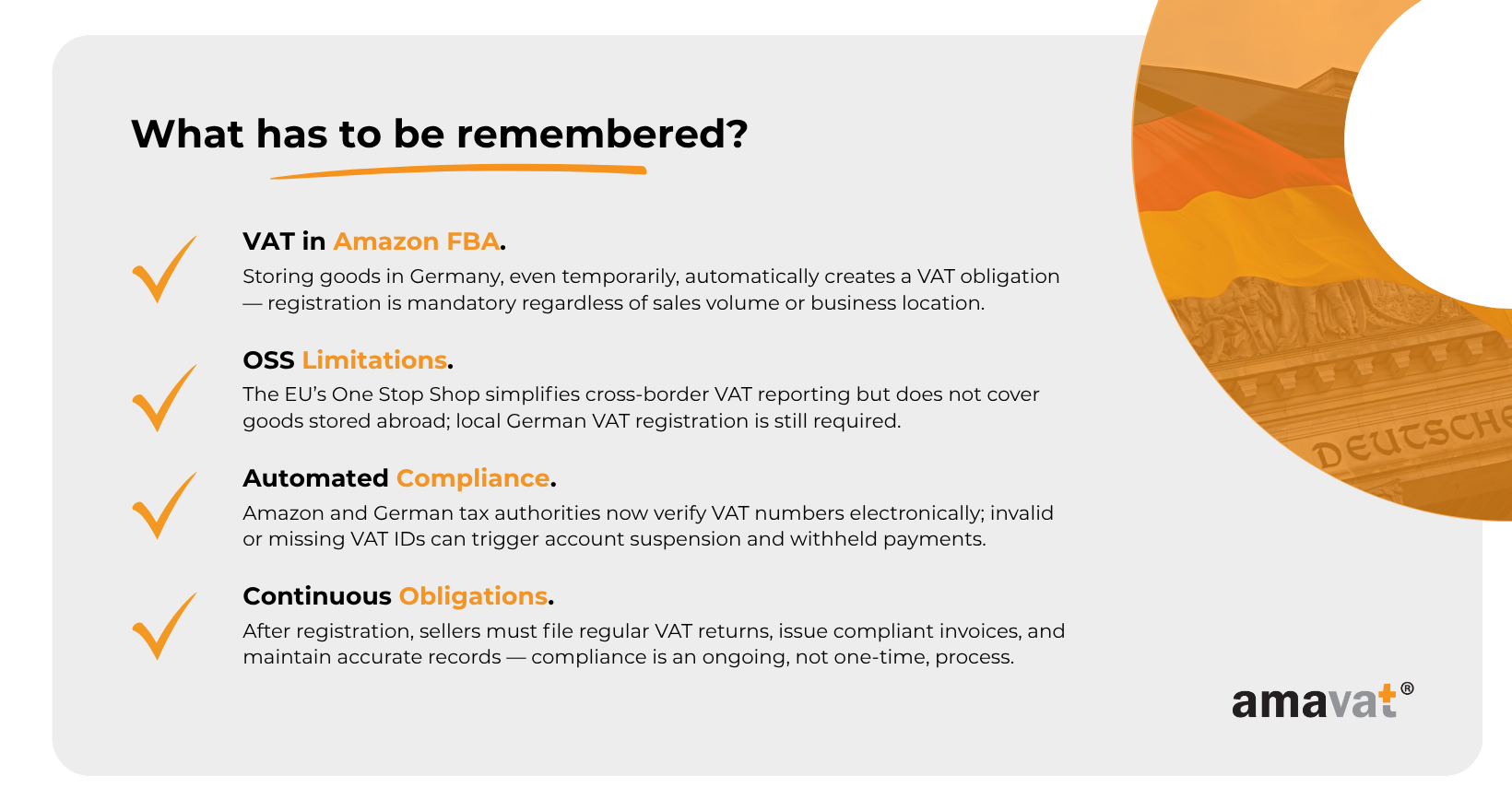

Yet behind that convenience lies a layer of legal and fiscal complexity that many sellers underestimate. Amazon FBA simplifies logistics, but it also changes how and where your business is taxed. The moment your inventory enters a warehouse outside your home country, a new set of VAT obligations arises. This is especially relevant in Germany—one of the largest and most active Amazon marketplaces in Europe—where tax rules are both strict and rigorously enforced. Storing goods in a German warehouse, even temporarily, can create an immediate tax presence, regardless of where your business is based or how much you sell.

Germany has become the beating heart of Amazon’s European logistics network. Its geographic location, advanced transport infrastructure, and consumer market size make it the hub through which countless cross-border orders pass each day. Thousands of sellers, from Spain to Sweden, choose to stock their products there to reach customers faster and benefit from Amazon Prime’s same-day delivery expectations. However, what many of those businesses fail to realize is that once their products are placed in a German fulfillment center, they are no longer operating solely under their domestic tax system. At that moment, German VAT law comes into play.

The rules are surprisingly simple in their logic but strict in their application. If your products are physically located in Germany, you are considered to be conducting taxable business activity within German territory. This rule applies whether you are a sole trader from Italy, a limited company from the Netherlands, or a larger brand with warehouses across the EU. There are no thresholds or minimum turnover requirements that delay this obligation. The trigger point is not the volume of sales but the presence of stock. In other words, the responsibility to register for VAT in Germany does not start when you sell your first product there—it starts when the first shipment of goods crosses the German border and enters an Amazon fulfillment center.

This is where many sellers fall into a trap. They assume that their participation in the EU’s One Stop Shop (OSS) scheme covers all VAT reporting obligations across the Union. It does not. OSS is designed for distance sales—transactions where goods are shipped from one EU country to customers in another—but it does not apply to goods stored and sold from warehouses abroad. Once your inventory is sitting on German soil, those sales are no longer considered cross-border; they are domestic German sales, fully subject to German VAT. The OSS declaration filed in your home country will not cover them.

The practical consequences of ignoring this are significant. Amazon itself is required by German law to ensure that every seller storing goods in Germany complies with local tax requirements. The platform’s systems are directly linked to the German tax authorities, which means that the absence of a valid German VAT number can result in immediate account suspension. In such cases, Amazon may withhold payments, remove listings, or block your ability to use the FBA service until proof of registration is provided. For small and medium-sized businesses, that kind of disruption can be catastrophic, often freezing cash flow overnight and damaging seller performance metrics that take months to rebuild.

But VAT in Germany Amazon FBA is not only about avoiding penalties. Understanding and complying with local VAT rules also opens up opportunities. Having a German VAT number allows your business to reclaim input tax paid on imports or other local costs, which can significantly improve profitability. It also enhances your credibility in the eyes of German customers and partners, who tend to value transparency and compliance. More broadly, registration demonstrates that your business operates legitimately within the EU’s internal market and understands the responsibilities that come with cross-border trade.

The aim of this article is not to provide an academic analysis of tax legislation but to offer a clear, practical guide for Amazon sellers operating across Europe. Whether you are running a small e-commerce shop in southern France or a growing online brand based in the Baltic states, if your products are stored in a German warehouse, this information applies to you. The following sections will walk through the essentials: when and why the obligation to register arises, how the registration process works, what the ongoing compliance requirements look like, and what happens if you ignore them. Along the way, we will clarify common misconceptions about OSS, discuss the historical background of the so-called §22f certificate, and examine how modern tax enforcement on marketplaces operates in practice.

Before diving into the technicalities, it is worth remembering one central principle that defines everything that follows. In the world of Amazon FBA, physical presence equals tax responsibility. Once your inventory is in Germany, you are in the German VAT system—no exceptions, no minimum thresholds, no shortcuts. Recognizing this early and acting accordingly is the difference between seamless European expansion and a sudden, expensive disruption to your business.

When and Why You Need to Register for VAT in Germany

Understanding When the Obligation Arises

For anyone selling through Amazon FBA, the question of when exactly you must register for VAT in Germany is not a matter of turnover or revenue—it is a matter of geography. In the German tax system, VAT obligations are triggered by the physical presence of goods, not by the number of transactions you complete. The rule is simple: as soon as your products are stored in a German warehouse, you are required to register for German VAT, even if you have not yet made a single sale.

This principle applies universally, regardless of whether your company is established in the European Union or outside of it. From the perspective of the German tax authority, known as the Finanzamt, placing your products into a warehouse in Germany is equivalent to conducting business activity on German territory. It does not matter whether you are based in Lisbon, Vilnius, or London. The very act of holding stock there creates a taxable presence.

This often surprises sellers who use Amazon’s Pan-European FBA system, a program that allows the platform to move inventory freely between multiple EU countries. The purpose of the system is to improve delivery efficiency and customer experience, but from a VAT perspective it can create significant complications. Many sellers believe that their stock remains in one country—the country from which they initially shipped it—but in reality Amazon frequently redistributes inventory between its fulfillment centers. A pallet that you sent to France may be divided and partially relocated to Germany, Poland, or the Netherlands, sometimes without any specific request from you.

Once Amazon’s system shows that your goods have been placed in a German warehouse, your VAT obligation in Germany is automatically activated. The legal threshold is crossed not when you sell to a German customer, but when the goods physically arrive at the warehouse. This is sometimes referred to as the “physical presence trigger.” It applies equally to small e-commerce businesses and large multinational brands.

The Role of Pan-European FBA and Automatic Transfers

The flexibility of Amazon’s logistics network is both its greatest advantage and its most common source of confusion for sellers. Under the Pan-European FBA model, Amazon decides how to distribute inventory to minimize delivery times across the continent. For example, if demand for your product suddenly rises in Germany, the system will automatically shift part of your stock there, even if your business is registered in Spain or Italy. From a commercial standpoint, this improves sales performance. From a tax standpoint, it creates new obligations overnight.

Because of this, sellers are strongly advised to monitor their FBA Inventory Ledger and FBA Storage Location reports regularly. These reports indicate exactly where each unit of stock is being held. If you notice that products have been moved to a German warehouse, that is your cue to start the registration process immediately. Waiting until the next financial quarter or until the first sale in Germany occurs is not acceptable from a legal standpoint. The German authorities consider the presence of goods in the country as sufficient to establish tax liability, and Amazon’s own compliance systems are now designed to detect this automatically.

Failing to act promptly can lead to an uncomfortable sequence of events. First, Amazon may request proof of your German VAT registration. If you are unable to provide it within a set timeframe, your selling privileges on Amazon.de can be suspended. Soon after, your details may be shared with the German tax authorities under the marketplace reporting obligations that apply to Amazon. Once the Finanzamt becomes aware that you are holding stock in Germany without registration, they have the legal right to assess your tax position retrospectively and demand payment of VAT for all sales made from that stock, even if they occurred months earlier.

Clarifying the Myth of Thresholds and OSS Coverage

Many sellers still operate under the misconception that VAT obligations arise only after reaching a certain annual turnover threshold. This may have been the case for distance selling under older EU rules, but it does not apply to inventory stored abroad. In the case of Amazon FBA, there are no thresholds, no exemptions, and no waiting periods. The obligation arises instantly when goods enter Germany.

Equally common is the belief that participation in the One Stop Shop (OSS) system removes the need for local VAT registration. While OSS greatly simplifies cross-border VAT reporting, it covers only distance sales—that is, sales where goods move directly from one EU country to customers in another. It does not apply to sales made from stock located in a foreign country. Once your inventory is stored in Germany, the OSS mechanism ceases to apply. Those transactions are classified as domestic German sales and must be reported to the German tax authorities through local VAT returns.

In short, OSS and local VAT registration are complementary, not interchangeable. The first covers shipments between countries, the second covers sales from within the country. Both may apply to your business simultaneously if you store goods in Germany and also ship from another EU country to customers elsewhere.

About the Small Business Exemption

German VAT law does contain a provision that allows very small businesses to operate without charging VAT, known as the Kleinunternehmerregelung, or small business rule. Under this regulation, a company with annual domestic turnover below twenty-five thousand euros may be exempt from VAT. However, this rule is intended primarily for German-based microbusinesses that sell within Germany itself. For foreign companies that store goods in German warehouses, the situation is different.

In theory, a foreign business could apply for this exemption, but in practice it rarely works. Amazon’s own compliance requirements demand that all FBA sellers provide a valid VAT registration number in each country where their inventory is held. The marketplace does not recognize the small business exemption as sufficient proof of compliance, and sellers who attempt to rely on it often find their accounts restricted until a proper VAT number is submitted. For that reason, the Kleinunternehmerregelung is not a viable option for most FBA sellers operating internationally.

What This Means in Practice

From a practical point of view, the key takeaway is that the location of your inventory determines your tax obligations. The country where your goods are stored dictates where VAT must be reported. This principle is consistent across the European Union but is enforced with particular rigor in Germany, where tax authorities actively cooperate with Amazon to identify non-compliant sellers.

If you are using Amazon FBA and your products are stored in Germany—whether permanently or temporarily—you are required to register for German VAT. The registration must be completed before you start selling, and certainly before any stock movements generate taxable transactions. Ignoring or delaying registration can lead not only to tax liabilities but also to administrative penalties and business interruptions.

It is therefore essential to treat VAT in Germany Amazon FBA as part of your operational checklist, not as an afterthought. Registering early ensures uninterrupted access to the German marketplace, keeps your Amazon account in good standing, and protects your business from the costly consequences of non-compliance. In the competitive environment of European e-commerce, where timing and reputation matter, being proactive about VAT registration is both a legal necessity and a strategic advantage.

The Registration Process – How to Get a German VAT Number

Where and How to Apply for German VAT Registration

Once you establish that your products are or will be stored in Germany, the next step is to register for VAT with the German tax authorities. This process is handled by the Finanzamt, Germany’s equivalent of a tax office. Unlike in some EU countries, the German administration has partially centralized this procedure for foreign sellers. Depending on where your company is established, your application will be directed to a specific Finanzamt that deals with foreign entities. For example, sellers from other EU member states are typically managed by the Finanzamt Hannover-Nord, while non-EU companies may be assigned to a different regional office.

The process itself begins with a formal application for a German VAT number, known as the Umsatzsteuer-Identifikationsnummer or USt-IdNr. This number is the German equivalent of the EU VAT ID and serves as your tax identification for all transactions conducted within Germany. The application can be made directly to the Finanzamt either in German or in English, although all official correspondence will typically be issued in German. This is one of the reasons many foreign sellers choose to work with a local tax consultant or accounting firm: having a professional intermediary can help ensure that your documents are submitted correctly and that communication with the tax office proceeds smoothly.

To complete the registration, the Finanzamt will require detailed information about your company. You will need to provide your business registration certificate, VAT number from your home country (if you are established in the EU), a short description of your commercial activities, and sometimes proof that you are actively trading. You will also need to disclose information about your planned sales in Germany, including the expected turnover and the types of products you intend to sell. While there is no fixed processing time, it is advisable to begin the registration well before sending your first shipment to a German warehouse. Delays can occur if documentation is incomplete, if translations are required, or if the tax office needs to clarify details about your business model.

Once the registration is complete, you will receive two identifiers. The first is the Steuernummer, a general tax number used for communication with the German tax office. The second is the Umsatzsteuer-Identifikationsnummer (VAT ID), which begins with the prefix “DE” and is recognized across the European Union. Both are necessary for proper reporting, but the VAT ID is the one you will use to identify yourself on Amazon and in transactions with customers or suppliers.

What Happens After Registration

After obtaining your VAT number, you officially become a VAT-registered entity in Germany. From that moment onward, you must comply with all German VAT reporting and filing obligations. These include submitting periodic VAT returns, maintaining accurate records of all sales and purchases, and ensuring that invoices issued to customers meet German legal requirements. The Finanzamt expects full accuracy and consistency in your filings, and any discrepancies can trigger audits or requests for clarification.

For Amazon FBA sellers, the VAT number must be entered in Seller Central under the Tax Information section. Amazon’s system automatically verifies the validity of your number using the European VIES database, which connects to national VAT registers. Once the verification succeeds, Amazon updates your compliance status and confirms that your account meets the requirements for operating in Germany. This process replaced the earlier system based on the so-called §22f certificate, which we will discuss in the next section.

It is worth noting that since July 2021, Amazon has adopted an even stricter approach to VAT compliance due to new EU-wide marketplace liability rules. The company now has a legal obligation to ensure that all sellers using its German fulfillment centers have valid VAT registrations. This means that your VAT number is not just a formal requirement but a prerequisite for accessing Amazon’s German logistics infrastructure. Without it, Amazon cannot legally allow you to sell or store goods in its German warehouses.

Documents and Practical Considerations

Although the registration process itself is straightforward in principle, in practice it requires careful preparation. The Finanzamt may request additional documents depending on your company’s legal form, location, or trading history. Typical supporting documents include a copy of your company registration, proof of address, identity documents of the company’s directors, and a brief overview of your sales channels. If your business is not based in the EU, you may also need to provide documentation regarding import procedures, such as EORI registration, to demonstrate how goods will enter Germany.

Because the German tax system places a strong emphasis on documentation and audit trails, it is advisable to maintain complete and well-organized records from the beginning. Keeping accurate logs of invoices, transport documents, and Amazon reports will make future VAT filings significantly easier. In the event that the Finanzamt requests clarification or initiates a compliance review, having a structured archive can save considerable time and prevent misunderstandings.

Many EU sellers are surprised by the level of precision required by German authorities. Even small inconsistencies, such as mismatched addresses on invoices or untranslated business names, can delay the registration process. German officials are meticulous about formality, and any deviation from standard procedure can trigger additional requests for clarification. To avoid delays, it is therefore best to submit your documents through a tax representative or accountant who regularly deals with German VAT registrations and is familiar with the Finanzamt’s expectations.

Timing and Practical Advice

In theory, registration should be initiated as soon as you know that your goods will be shipped to a German warehouse. Waiting until after arrival is risky because tax liability begins immediately upon entry of goods into Germany. If the registration process is still ongoing when your products arrive, you may still be required to declare transactions retrospectively once your VAT number is issued. The Finanzamt can assess VAT obligations back to the date the first product entered German territory, which means late registration does not exempt you from payment obligations—it only complicates them.

Processing times for VAT registrations vary depending on the workload of the tax office and the completeness of your documentation. In some cases, the process can take as little as four weeks; in others, especially during busy periods or when additional verification is needed, it may extend to several months. It is therefore prudent to plan ahead and begin the process as early as possible, ideally before your first shipment leaves your home country. This ensures that your VAT number is ready by the time your goods reach the warehouse, avoiding both administrative stress and potential sales interruptions.

Once registered, you will enter the regular VAT reporting cycle. Most new registrants are required to submit monthly VAT returns for the first year. After that period, the frequency may be adjusted to quarterly or annual filings depending on your turnover. This reporting structure will be discussed in greater detail in the section on ongoing VAT obligations, but it is worth keeping in mind from the outset. Registration is not a one-time task; it marks the beginning of a continuous relationship with the German tax authorities.

In essence, obtaining a VAT number in Germany is both a procedural step and a strategic milestone. It signals that your business is prepared to operate on a European scale and that you take compliance seriously. The process may appear bureaucratic, but it is ultimately straightforward when approached systematically. With proper preparation, clear documentation, and timely action, VAT registration in Germany becomes not a hurdle but an integral part of building a sustainable Amazon FBA business in the European marketplace.

The Former §22f Certificate Explained (and Why It’s Obsolete)

What the §22f Certificate Was and Why It Existed

Until mid-2021, any seller trading on online marketplaces in Germany—especially Amazon—was required to obtain and submit a special document known as the §22f-Bescheinigung, or §22f certificate. This certificate was not a mere formality; it was a legal prerequisite for being allowed to sell on German online platforms. Issued by the local tax office, the Finanzamt, it served as official proof that a business was correctly registered for VAT in Germany and that its tax affairs were in good standing.

The purpose of the §22f certificate was to combat tax evasion among foreign sellers. In the years leading up to its introduction, the German government had observed that a large number of non-resident companies were selling goods to German consumers through platforms like Amazon and eBay without properly registering for VAT or paying the corresponding tax. These practices caused significant losses to the German treasury, prompting legislators to adopt stricter measures to close the loopholes.

Under §22f of the German VAT Act (Umsatzsteuergesetz, abbreviated as UStG), marketplaces such as Amazon were made responsible for verifying that every seller using their platform was compliant with local VAT obligations. The §22f certificate was the formal mechanism to make this verification possible. Sellers were required to apply for the certificate at their local Finanzamt once they had registered for VAT in Germany. The certificate listed their company name, address, and VAT number, and confirmed that they were authorized to conduct taxable transactions in the country.

Without this certificate, sellers could not legally trade on Amazon.de. The platform itself faced potential liability for unpaid VAT if it allowed non-compliant sellers to operate. As a result, Amazon enforced the rule rigorously. Any seller who failed to upload a valid §22f certificate risked immediate suspension of their account, freezing of disbursements, and removal of their product listings. For thousands of foreign businesses, obtaining this certificate became a crucial step in the process of expanding into the German market.

The Legislative Reform of July 2021

Everything changed on 1 July 2021, when the European Union introduced its new VAT e-commerce package, a comprehensive set of reforms designed to modernize and harmonize VAT collection across the single market. As part of this reform, Germany overhauled its own system for marketplace oversight and tax enforcement. The new framework shifted responsibility away from paper certificates and toward automated verification of VAT numbers using digital databases.

The §22f certificate was officially abolished, replaced by a system of real-time VAT validation. Under the revised law—specifically §25e of the Umsatzsteuergesetz—marketplaces remain liable for ensuring that sellers are correctly registered for VAT, but they now fulfill this obligation by verifying VAT identification numbers electronically. When you enter your German VAT ID in Amazon’s Seller Central, the platform automatically checks its validity through official databases such as the EU’s VIES system and Germany’s own tax information registers.

This reform eliminated the need for sellers to obtain or submit additional paperwork. The rationale was simple: the digital age made manual certification redundant. The German authorities recognized that with the increasing integration of tax databases across Europe, it was both faster and more reliable to verify VAT numbers directly rather than rely on physical documents that could be outdated or falsified. From the seller’s perspective, this change simplified administrative procedures and removed one of the main barriers to cross-border participation in the German marketplace.

However, while the abolition of the §22f certificate reduced bureaucracy, it did not relax the underlying tax obligations. Sellers are still required to register for VAT in Germany if their goods are stored there, and they must still file periodic VAT returns. What has changed is only the method of verification: where once you had to present a certificate issued by a tax office, you now prove compliance through the presence of a valid VAT ID that can be automatically confirmed by the system.

How the New Verification System Works

In the current setup, the process of verification is largely invisible to the seller. Once you register for VAT and receive your Umsatzsteuer-Identifikationsnummer (USt-IdNr.), you simply enter it into your Amazon account. Amazon then checks the validity of the number through the VIES (VAT Information Exchange System), an EU-wide database maintained by the European Commission, and cross-references it with national tax registers. If the number is active and corresponds correctly to your company’s legal details, your account remains fully operational.

If, on the other hand, the number is inactive, misspelled, or associated with inconsistent data—for example, if the company name or address differs from what appears in the VIES record—Amazon will flag your account as non-compliant. In such cases, you receive an automated notification asking you to update your tax information. If the discrepancy is not corrected within a certain period, Amazon may suspend your selling privileges on its German marketplace and freeze your payouts until the issue is resolved.

This process ensures that the marketplace itself remains compliant with German tax law while also maintaining a transparent trading environment. The system is continuous and dynamic: Amazon’s compliance algorithms run automatic VAT checks periodically, meaning that sellers must keep their registration details up to date at all times. The Finanzamt no longer issues or renews certificates, but it remains fully capable of verifying the authenticity of VAT registrations through these digital channels.

The Role of §25e UStG and Marketplace Liability

The replacement of the §22f system with §25e UStG marked a fundamental shift in how VAT compliance is managed in e-commerce. The new law introduced the concept of “marketplace liability” (Marktplatzhaftung). Under this principle, marketplaces like Amazon, eBay, and Kaufland.de share responsibility with sellers for ensuring that VAT is properly declared and paid. If a seller operates without a valid VAT registration, the marketplace can be held jointly liable for any unpaid tax.

This legal framework gives Amazon a direct incentive to enforce compliance rigorously. The company has developed internal compliance tools and data-sharing mechanisms to ensure that every seller using its FBA warehouses in Germany is duly registered. In practice, this means that Amazon continuously monitors the tax status of all its sellers, cross-checks their VAT numbers against official databases, and cooperates with the German tax authorities when irregularities are detected.

For sellers, this creates a clear and predictable system: as long as your VAT registration is valid and your details match official records, your account remains unaffected. There is no longer a need to request or renew certificates, nor to submit additional documentation beyond what is required during initial registration. The administrative burden has been replaced by an automated compliance infrastructure that is both more efficient and less prone to human error.

What Sellers Should Do Today

While the §22f certificate has been officially retired, it still appears occasionally in older Amazon documentation or in communications from tax advisors referencing historical procedures. Sellers who obtained the certificate before July 2021 do not need to renew or resubmit it; the document remains a relic of a previous regulatory era. What matters today is that your Umsatzsteuer-Identifikationsnummer is active, valid, and correctly linked to your Amazon account.

It is also essential to ensure that the details associated with your VAT registration—company name, address, and legal form—are identical across all systems. Discrepancies between your Finanzamt registration, your Amazon account, and the VIES database can cause unnecessary complications, even if your number is technically valid. Consistency is key to uninterrupted operations.

The abolition of the §22f certificate has undoubtedly made life easier for sellers, but it has also raised the stakes for accuracy. With automatic verification, there is no longer a human intermediary who might overlook small errors or grant flexibility. The system operates purely on data consistency. Any mismatch, however minor, can lead to immediate account restrictions. This reflects the broader trend in European tax administration toward digital integration and real-time compliance monitoring.

In Summary

The story of the §22f certificate is a perfect example of how tax regulation evolves alongside technology. What began as a paper-based safeguard against VAT fraud has been transformed into a fully digital compliance ecosystem. For Amazon FBA sellers, this evolution has brought both simplification and accountability. The process of proving compliance is faster and easier than ever, but it demands precision and attention to detail.

Today, the phrase “VAT in Germany Amazon FBA” no longer conjures images of long queues at tax offices or piles of paperwork. Instead, it represents a seamless interaction between online sellers, marketplaces, and tax authorities—a system designed to ensure that everyone trading within the German market contributes fairly while maintaining a frictionless digital experience. Sellers who understand this system and keep their VAT information accurate can operate confidently, knowing that their business meets all legal standards without unnecessary bureaucracy.

Your Ongoing VAT Obligations: Returns, Reports, and Invoicing

Regular VAT Returns and the Finanzamt’s Expectations

Once you are registered for VAT in Germany, the real work begins. Registration is merely the formal entry point into the German tax system; what follows is a continuous cycle of declarations, reports, and accounting obligations that must be fulfilled with precision and regularity. From the perspective of the German Finanzamt, registration makes you a fully fledged taxpayer, subject to the same standards and expectations as any domestic business operating within the country.

Your first and most important responsibility is to file periodic VAT returns, known in German as Umsatzsteuervoranmeldungen. These returns are submitted electronically through Germany’s official online tax system, ELSTER (Elektronische Steuererklärung), which is the digital gateway for all VAT reporting. For most newly registered sellers, the reporting frequency will be monthly during the first year of operation, regardless of turnover. This allows the Finanzamt to monitor your compliance closely and ensure that payments are being made correctly.

After this initial period, the frequency of returns depends on the size of your tax liability. If your total VAT due in the previous calendar year exceeded €7,500, you will continue filing monthly. If it fell between €1,000 and €7,500, you may switch to quarterly filings. Only when your annual VAT due is below €1,000 can the Finanzamt allow annual reporting, but this is rare for active Amazon FBA sellers.

Each VAT return must include a detailed breakdown of all taxable transactions carried out in Germany during the reporting period. This includes sales made through Amazon, any direct B2C sales from your own website, intra-EU acquisitions, and self-supplies, such as stock transfers from another EU country into Germany. You must also report your input VAT—the tax you have paid on business expenses and imports—which can be deducted from your total liability. The result of this calculation determines whether you owe tax to the Finanzamt or are entitled to a refund.

Punctuality is critical. The German tax system is strict about deadlines, and even short delays can result in penalties or interest charges. Returns are typically due by the 10th day of the month following the reporting period. For example, a VAT return for January must be submitted by February 10th. Sellers can apply for a one-month filing extension, known as a Dauerfristverlängerung, but this must be formally approved by the tax office. Failure to file on time can lead to automatic fines, known as Verspätungszuschläge, and in repeated cases, may trigger an audit.

At the end of each calendar year, you are also required to file an annual VAT return, the Umsatzsteuererklärung. This document summarizes all taxable transactions from the previous year and reconciles them against the periodic returns already submitted. It serves as the Finanzamt’s final verification of your VAT position for the year, ensuring that all amounts have been declared accurately and consistently.

Additional Reports: EC Sales List and Intrastat

In addition to VAT returns, sellers who participate in cross-border trade within the EU must also submit other reports that complement the VAT system and allow the authorities to monitor the movement of goods across the single market.

The first of these is the EC Sales List, known in Germany as the Zusammenfassende Meldung (abbreviated as ZM). This report captures all intra-EU supplies of goods and services made to VAT-registered businesses in other EU countries. While the VAT return records the tax liability within Germany, the EC Sales List ensures that corresponding transactions are recognized by the tax authorities in the other member state. Even though most Amazon FBA sellers primarily deal in B2C transactions, this report can still apply in cases where you transfer stock between your own warehouses in different EU countries—a situation that Amazon’s Pan-European FBA model often creates automatically. The Zusammenfassende Meldung is typically filed monthly, even if your VAT returns are quarterly, and it must list the VAT numbers of all counterparties along with the total value of transactions conducted with each.

The second reporting requirement concerns Intrastat, a statistical system managed by Germany’s Federal Statistical Office (Statistisches Bundesamt, or Destatis). Intrastat is not a tax report but a statistical one, used by the EU to track the flow of goods between member states. However, compliance is mandatory once certain thresholds are exceeded. As of 2025, businesses that send goods worth more than €1,000,000 from Germany to other EU countries (dispatches) or receive goods worth more than €800,000 (arrivals) in a year must file Intrastat declarations. For Amazon FBA sellers operating at scale, these thresholds can be reached more easily than expected, particularly when stock is frequently redistributed across borders by Amazon’s logistics system.

Both EC Sales Lists and Intrastat reports are designed to improve transparency in cross-border trade. They allow European authorities to reconcile transactions between countries and ensure that VAT is properly accounted for throughout the supply chain. For sellers, they are part of the routine compliance ecosystem and should be integrated into the accounting process from the beginning rather than treated as an afterthought.

Invoicing and VAT Rates in Germany

Equally important to compliance is the correct issuance of invoices. Under §14 of the Umsatzsteuergesetz, every business registered for VAT in Germany must issue invoices that meet specific legal requirements. These invoices must contain detailed information: the seller’s full name and address, the buyer’s details, a unique invoice number, the date of issue, a clear description of the goods or services supplied, the quantity, the net price, the applicable VAT rate, the VAT amount, and the total price including VAT. The seller’s German VAT identification number (USt-IdNr.) must also appear on each invoice.

The invoice must be issued no later than six months after the delivery of goods or completion of the service. Electronic invoices are fully accepted under German law, provided that their authenticity and integrity are ensured. Most Amazon sellers rely on automated invoicing systems for this purpose. Amazon itself offers a tool called the VAT Calculation Service (VCS), which automatically generates invoices that comply with German VAT regulations. This service applies the correct VAT rate to each transaction, issues invoices in the buyer’s language, and stores them electronically for audit purposes. The Finanzamt recognizes these invoices as valid, as long as the seller’s VAT number and transaction data are accurate.

Germany applies two main VAT rates: a standard rate of 19% and a reduced rate of 7%. The reduced rate applies to certain categories of goods such as printed books, newspapers, essential food products, public transport tickets, and some medical supplies. All other goods and services are taxed at the standard rate. Determining the correct rate for your products is an important step in setting up your VAT configuration on Amazon. Applying the wrong rate may result in overcharging customers or underpaying VAT—both of which can create complications later.

The importance of proper invoicing extends beyond taxation. In Germany’s highly regulated commercial environment, accurate invoices also serve as proof of legitimacy in business relationships. Customers, auditors, and banks expect to see invoices that conform to legal standards, and discrepancies can raise red flags. For this reason, maintaining consistent and professional invoicing practices is as much about reputation as it is about compliance.

Record-Keeping and Audit Readiness

German tax authorities are known for their thoroughness and precision. They expect VAT-registered businesses to maintain detailed and transparent records for all transactions, including invoices, bank statements, shipping documents, and Amazon reports. These records must be kept for at least ten years and made available to the Finanzamt upon request.

Audits can be triggered randomly or as a result of inconsistencies detected in filings or data shared by marketplaces. Amazon’s own reporting system automatically provides transaction data to the tax authorities, allowing them to cross-check declared sales against actual marketplace performance. For compliant sellers, this digital transparency works as a form of protection—it reduces the likelihood of misunderstandings and ensures that data speaks for itself. However, for sellers who fail to maintain accurate records or misreport their figures, the same transparency makes it easy for discrepancies to be identified and penalties imposed.

Proper bookkeeping is therefore not merely an administrative task but an essential safeguard. Using professional accounting software or partnering with a VAT compliance specialist can make the process significantly smoother. It also provides peace of mind in the event of an audit, allowing you to demonstrate that every euro of VAT has been properly accounted for.

Compliance as a Continuous Process

For Amazon FBA sellers operating in Germany, VAT compliance is not something that can be handled once and forgotten. It is an ongoing process that requires regular attention, timely submissions, and accurate data management. German tax law leaves little room for flexibility, but it rewards diligence and transparency. Sellers who build robust compliance systems from the start rarely face problems later; those who take shortcuts often find themselves dealing with account suspensions, backdated tax demands, or costly disputes with the Finanzamt.

Ultimately, fulfilling your VAT obligations in Germany is about more than satisfying a legal requirement—it is about creating a stable foundation for your business to grow within Europe’s largest economy. In the next section, we will explore how the One Stop Shop (OSS) mechanism interacts with these obligations and why, even with its convenience, it does not replace local VAT registration for sellers using Amazon FBA warehouses in Germany.

The Role of OSS (One Stop Shop) and What It Doesn’t Cover

Understanding the Union OSS Mechanism

In 2021, the European Union introduced one of the most significant VAT reforms in decades: the Union One Stop Shop, more commonly referred to as OSS. The system was designed to simplify VAT compliance for businesses engaged in cross-border sales within the EU by allowing them to declare and pay VAT in one member state rather than register in multiple countries. For many online sellers, OSS has been a welcome relief from the complexity of dealing with numerous tax authorities across Europe. However, as helpful as it is, OSS does not replace local VAT registration when it comes to Amazon FBA operations in Germany.

To understand why, it helps to revisit the basic purpose of the OSS scheme. The system applies to what EU law calls intra-Community distance sales of goods, meaning sales of goods dispatched from one EU member state to private consumers in another. Before OSS, sellers were required to register for VAT in every country where their sales exceeded that country’s distance selling threshold, which created a patchwork of obligations and a bureaucratic burden. The OSS reform abolished national thresholds and replaced them with a single EU-wide limit of €10,000 per year, after which all B2C sales across borders must be taxed in the customer’s country. With OSS, these taxes can be reported and paid in the seller’s home country, using a quarterly return that covers all eligible cross-border sales.

This framework works perfectly for businesses that ship directly from one country to customers in another. A seller based in Spain who sends an order to a customer in France can declare the French VAT through their OSS registration in Spain, without needing to register in France. The system achieves its goal of simplification: one registration, one declaration, one payment.

However, for sellers using Amazon FBA, the situation becomes more complicated, because the OSS mechanism is tied to the place of dispatch, not the place of storage. Once goods are stored in a warehouse in Germany, any sale to a German customer is considered a domestic German sale, not a cross-border one. Domestic sales are outside the scope of the OSS system and must be reported directly to the German tax authorities through local VAT returns. The same rule applies to sales from Germany to customers in other EU countries if the goods are first moved between warehouses within the Amazon logistics network before being sold. These stock transfers—called intra-Community movements of own goods—are also not covered by OSS and must be declared separately in both countries involved.

Why OSS Doesn’t Eliminate the Need for Local Registration

The core limitation of OSS lies in its design: it simplifies the taxation of cross-border distance sales but does not cover transactions that originate within another member state where the seller already stores goods. In the case of VAT in Germany Amazon FBA, this means that as soon as your products enter a German warehouse, you are considered to be making local supplies within Germany. Those supplies are subject to German VAT and must be declared through the German VAT system, not through OSS in your home country.

This distinction is not merely theoretical. It has direct and practical consequences for compliance. Many Amazon sellers register for OSS in their home country and assume that this single registration allows them to sell freely across Europe without additional local obligations. The reality is that OSS and national registrations are complementary systems, not interchangeable ones. OSS covers cross-border B2C sales of goods dispatched from your home country to another EU country, while local VAT registration covers domestic sales of goods that are already located in the customer’s country.

Imagine, for example, that your company is based in Italy and participates in Amazon’s Pan-European FBA program. You ship a batch of products from your Italian warehouse to Amazon’s fulfillment center in Germany. Once those products arrive there, they are no longer considered Italian stock. If a customer from Berlin orders one of these items, the sale is a domestic German transaction subject to German VAT, even though your company is legally established in Italy. To comply with this obligation, you must have a German VAT number and file periodic returns with the Finanzamt. OSS cannot be used to report this sale.

Even if you sell to customers outside Germany, OSS only covers those transactions if the goods are shipped from Germany to another EU country and the sale is to a private individual. In such cases, the sale may be reported under OSS—but the initial transfer of goods from Italy to Germany (your own stock movement) must still be declared as an intra-Community supply in Italy and an intra-Community acquisition in Germany, which again requires local registration. In other words, OSS can simplify part of the process, but it cannot eliminate the local VAT registration entirely.

Combining OSS with Local VAT Compliance

For many Amazon FBA sellers, the optimal approach is to combine both systems strategically. OSS is used to manage distance sales from your home country, while local VAT registrations handle compliance in the countries where your stock is stored. This dual setup might appear complex at first, but it provides full coverage of your tax obligations across the EU and prevents the risk of unreported transactions.

In practice, this means that if your goods are stored in Germany, you file local VAT returns with the Finanzamt to report domestic German sales and movements of goods between warehouses. Meanwhile, if you also ship directly from Germany to customers in France, Spain, or any other EU country, you may report those cross-border B2C transactions through your OSS registration in your home country. Each system serves its specific function, and together they create a comprehensive compliance framework that satisfies both German and EU-level requirements.

Sellers who operate multiple FBA accounts or use Amazon’s Pan-European FBA service often find it helpful to map their inventory flows carefully. Understanding where your stock is located and where your customers are based allows you to determine which sales fall under OSS and which must be reported locally. This mapping exercise is essential for maintaining accurate VAT records and avoiding double taxation or omissions.

It is also important to remember that OSS declarations are filed quarterly, while German VAT returns are typically monthly or quarterly depending on turnover. These reporting cycles are separate, and each has its own submission deadlines and payment requirements. Coordinating both schedules is a crucial aspect of good compliance management.

Common Mistakes Sellers Make with OSS and Amazon FBA

The most frequent mistake among Amazon FBA sellers is assuming that registration for OSS covers all EU countries automatically. This misunderstanding leads many businesses to skip local registrations in Germany or other key markets, only to discover later that they have accumulated unpaid VAT liabilities and are exposed to penalties. Another common error is failing to record intra-Community transfers of own goods, which occur when Amazon moves inventory between its warehouses in different countries. Each of these movements is treated as both a supply and an acquisition for VAT purposes, even though no sale to a customer has occurred. Ignoring them creates inconsistencies in tax records that can be easily detected by the Finanzamt or during an audit.

A subtler but equally problematic issue arises when sellers declare sales through OSS that should have been reported locally. For example, if a French seller declares sales from German stock to German customers under OSS, those transactions will be misclassified. The Finanzamt can identify these discrepancies through the marketplace transaction data shared by Amazon, which includes warehouse locations. Once the mismatch is found, the seller may face backdated VAT assessments, interest, and administrative penalties.

These mistakes are rarely intentional. They usually result from a lack of understanding of how OSS interacts with the logistical realities of Amazon FBA. The best way to prevent them is to develop a clear internal policy that distinguishes between OSS-covered sales and local ones. Regularly reviewing Amazon’s inventory reports, sales reports, and tax transaction reports can help maintain accuracy and ensure that every transaction is reported in the correct system.

The Practical Rule for FBA Sellers

If there is one principle that every Amazon seller should internalize, it is this: OSS simplifies cross-border VAT, but it does not replace national VAT registrations where goods are stored. Once your products are located in Germany, they fall under German VAT law, and compliance with that system is mandatory. OSS is a valuable complement—it can reduce the need for multiple registrations and centralize your cross-border reporting—but it cannot shield you from the obligations arising from local physical presence.

In essence, the two systems coexist rather than compete. They are two halves of a single European compliance puzzle: OSS covering the virtual flow of goods across borders, and local VAT registration covering the physical reality of goods resting in foreign warehouses. Sellers who understand this distinction and structure their VAT strategy accordingly find that compliance becomes predictable, manageable, and far less stressful.

In the next section, we will examine what happens when sellers fail to meet these obligations—how the German authorities and Amazon itself respond to non-compliance, what penalties can be imposed, and why prevention is always more cost-effective than remediation.

Conclusion – VAT in Germany Amazon FBA as the Foundation of Sustainable Growth

Operating under the Amazon FBA model within Europe offers tremendous advantages: automation, scalability, and access to one of the largest customer bases in the world. Yet this convenience comes with a structural reality that every seller must confront. The physical movement of goods defines your tax obligations. Once your products enter Germany’s fulfillment network, they become subject to the country’s VAT laws. This principle is absolute, unaffected by turnover, nationality, or participation in other EU schemes such as OSS. In the German system, the rule is simple: if your goods are stored in Germany, you are required to register for VAT there.

The central misunderstanding among new sellers lies in confusing the freedom to trade within the European Union with the freedom from tax compliance. The EU’s single market makes it easy to sell across borders, but it does not harmonize every aspect of VAT administration. Each member state still retains its own procedures, and Germany’s approach—precise, structured, and data-driven—reflects its broader administrative culture. Compliance here is not optional or symbolic. It is the legal foundation that allows you to participate in one of the most lucrative e-commerce ecosystems in Europe.

The introduction of the OSS mechanism in 2021 simplified cross-border VAT obligations, but it did not erase the need for local registration in countries where goods are physically stored. OSS handles distance sales; local registration handles domestic ones. Amazon’s Pan-European FBA model blurs the lines between these categories, as goods move freely between countries for logistical efficiency. But from a tax perspective, each of these movements creates specific obligations. Recognizing this distinction early protects sellers from costly mistakes later.

German tax enforcement has evolved significantly in recent years. The abolition of the §22f certificate and the introduction of automated VAT validation have made compliance both easier and more immediate. Instead of relying on paper forms and manual verification, the system now operates through continuous digital oversight. Marketplaces like Amazon are legally required to monitor their sellers’ VAT status and to suspend accounts that fail to comply. This automation leaves little room for neglect or delay, but it also creates a level playing field. Every seller, regardless of size or nationality, must meet the same standard of transparency.

The practical consequences of non-compliance are serious. A seller who fails to register for VAT in Germany risks more than an administrative penalty. Amazon may suspend the account, freeze disbursements, and provide sales data to the Finanzamt. The tax authority, in turn, has the power to assess unpaid VAT retroactively, with interest and potential fines. In the most severe cases, repeated non-compliance can be classified as tax evasion under German law, with all the legal consequences that entails. But compliance, once understood and integrated into the business model, is not burdensome. It is a predictable process built on clear rules and well-defined procedures.

At the same time, VAT registration brings tangible advantages. It legitimizes your operations in the eyes of both Amazon and your customers, allows you to reclaim import VAT on goods entering Germany, and signals to partners that your business operates according to European legal standards. It transforms you from an informal online trader into a recognized participant in the EU’s internal market. Sellers who treat VAT registration not as an obstacle but as part of their expansion strategy tend to grow more sustainably, because they can scale their operations across multiple markets without fearing sudden compliance interruptions.

In the end, VAT in Germany Amazon FBA is not simply a matter of taxation—it is a matter of trust and continuity. It ensures that your business remains stable, your cash flow predictable, and your Amazon account fully operational. Compliance in this area is not just about avoiding problems; it is about enabling opportunity. Germany, as the largest economy in Europe, offers a vast customer base, an efficient logistics infrastructure, and one of the most mature online marketplaces in the world. To operate here is to enter a market that rewards diligence, professionalism, and consistency.

The lesson for every Amazon FBA seller is straightforward but essential. Understand where your stock is stored, register where the law requires you to register, and maintain accurate, timely reporting. Do this, and you will not only avoid penalties—you will position your business for steady, legitimate, and scalable growth across the European Union. Compliance is not the end of entrepreneurship; in the context of Amazon FBA, it is what makes long-term success possible.