Amazon FBA and VAT in Poland

Spis treści

For e-commerce entrepreneurs, Poland represents a market with extraordinary potential. The country boasts a high level of digitalization, a steadily growing online shopping culture, and comparatively low business costs. All this makes Poland a compelling choice for ambitious sellers eager to establish or expand their European presence. Yet, behind this potential lies a layer of complexity that every seller must face – and one of the most crucial elements is VAT compliance.

Selling through Amazon FBA within the EU can be a challenge, particularly when your products are stored in multiple countries. Poland’s VAT system – known locally as podatek od towarów i usług – comes with its own nuances: a relatively high standard rate, a web of exceptions, and rigid reporting deadlines. To make matters even more dynamic, new regulations and digital initiatives, such as the National e-Invoicing System (Krajowy System e-Faktur, or KSeF), continue to reshape how businesses must manage their tax obligations. Understanding the rules once isn’t enough; staying compliant in Poland means staying constantly informed and adaptable.

The importance of getting VAT right cannot be overstated. Mistakes in tax reporting can cost far more than the profit from sales. Amazon enforces strict compliance standards – sellers who fail to meet their tax obligations risk suspended accounts, frozen payouts, and invisible listings. Such disruptions can devastate a thriving business in a matter of days. Conversely, managing VAT properly provides stability, predictability, and credibility – both with Amazon and with the Polish tax authorities.

This article was written to save you the trouble of piecing information together from countless forums, Facebook groups, and scattered English-language resources. Here you’ll find everything you need to understand how VAT works for Amazon FBA sellers in Poland – from the moment your inventory enters a Polish fulfillment center to the point you file your VAT declaration. You’ll learn when registration is required, what the process involves, which documents are needed, and how the JPK_VAT reporting system functions. It will also explain what KSeF is, when a tax representative is necessary, and how Amazon itself plays a role in VAT settlements through the so-called “marketplace facilitator” model.

But more than just explaining the rules, this guide aims to show them in practice – through the lens of a modern e-commerce entrepreneur operating across borders. After reading it, you should have a clear understanding of what needs to be done, when to do it, and how to avoid costly missteps that could jeopardize your operations.

If you’re preparing to enter the Polish market with Amazon FBA, or if you’re already selling in Poland but aren’t fully confident about your compliance, this guide is for you. The following sections will take you through the essentials of VAT management in Poland – giving you the clarity to navigate the system with confidence and the freedom to focus on what matters most: building your business sustainably, without unnecessary stress.

The VAT System in Poland: What Every Amazon FBA Seller Should Know

VAT – or Value Added Tax – is an indirect tax on goods and services, ultimately paid by the end consumer. In the Amazon FBA model, the seller acts as an intermediary: charging VAT on sales, deducting VAT on purchases, and settling the difference with the tax authorities. While the European Union provides a shared legal framework, each member state sets its own VAT rates, thresholds, and reporting deadlines.

For sellers storing goods in Poland or selling directly to Polish consumers, Polish regulations take precedence. This is where key decisions are made — from determining which VAT rate applies to identifying where the tax obligation arises. In the context of Amazon FBA, correctly establishing the place of taxation for cross-border sales and assigning the right VAT rates to your assortment are crucial for staying compliant and protecting your business.

VAT Across the EU – Where and How You Pay

Within the European Union, VAT obligations depend on where the transaction is considered to occur. For standard domestic sales, VAT applies in the country where the goods are delivered to the consumer. For intra-EU distance sales to consumers (B2C transactions across borders), once your total EU sales exceed €10,000 in a year, the place of taxation shifts to the buyer’s country.

At that point, compliance becomes much simpler if you register for the One Stop Shop (OSS) system, which lets you report and pay VAT for all your EU sales through one centralized return. Below that threshold, VAT continues to be applied in the country from which the goods are dispatched — although you may choose to opt into OSS voluntarily if it’s more convenient.

For B2B transactions within the EU, the rules differ: if certain conditions are met, these can qualify as intra-Community supplies, taxed at a 0% rate by the seller, with the buyer applying the reverse charge mechanism in their own country.

VAT Rates in Poland – What They Mean for Amazon Sellers

Poland’s standard VAT rate is 23%, covering most goods sold online — from electronics and home accessories to clothing, cosmetics, toys, bottled water, and energy drinks. The 8% rate applies to a narrower group of goods and services of social or everyday importance. However, most Amazon FBA sellers are unlikely to use it frequently, except for specific service-related cases such as the supply of water via public networks.

The 5% rate applies to items like e-books and publications, as long as the content is not primarily audiovisual. For example, an e-book qualifies for 5%, but a video-based online course would generally be taxed at 23%. Finally, the 0% rate applies in specific, well-documented cases such as exports outside the EU or B2B sales classified as intra-Community supplies. Sales to EU consumers, however, are not eligible for this — they’re taxed at the rate applicable in the customer’s country and reported via OSS.

For most FBA sellers operating from Poland, the 23% rate will dominate, since the majority of popular product categories do not qualify for reduced rates. Lower rates demand careful verification to ensure your products genuinely fit the relevant classification. For goods, the proper rate is determined using CN codes under Poland’s VAT matrix, while services are classified according to the PKWiU system. The difference between the two is more than just technical: it can determine whether you owe hundreds or thousands more in VAT each year.

Amazon’s VAT Calculation Service (VCS) can automate VAT calculations and invoice generation, but only when properly configured in Seller Central with valid VAT numbers and accurate tax settings. Automation aside, the responsibility for accuracy remains entirely with the seller. Regular classification checks, rate validation, and order reviews should be standard practice — a small effort that can prevent large compliance issues.

If you’re shipping from Poland to consumers in other EU countries and your annual cross-border sales exceed €10,000, the VAT is due in the customer’s country, and OSS is your best route for simplification. For B2B sales within the EU, a 0% VAT rate may apply if you have proof of dispatch and your buyer’s valid EU VAT number.

At first glance, VAT in Poland can seem like a bureaucratic labyrinth. But once you’ve mapped your product range to the right CN codes, tested rates on representative SKUs, and correctly configured VCS in Seller Central, the process becomes predictable and transparent. That predictability is the hidden currency of successful e-commerce — allowing you to expand across borders with confidence, consistency, and the peace of mind that comes with full compliance.

When You Need to Register for VAT in Poland

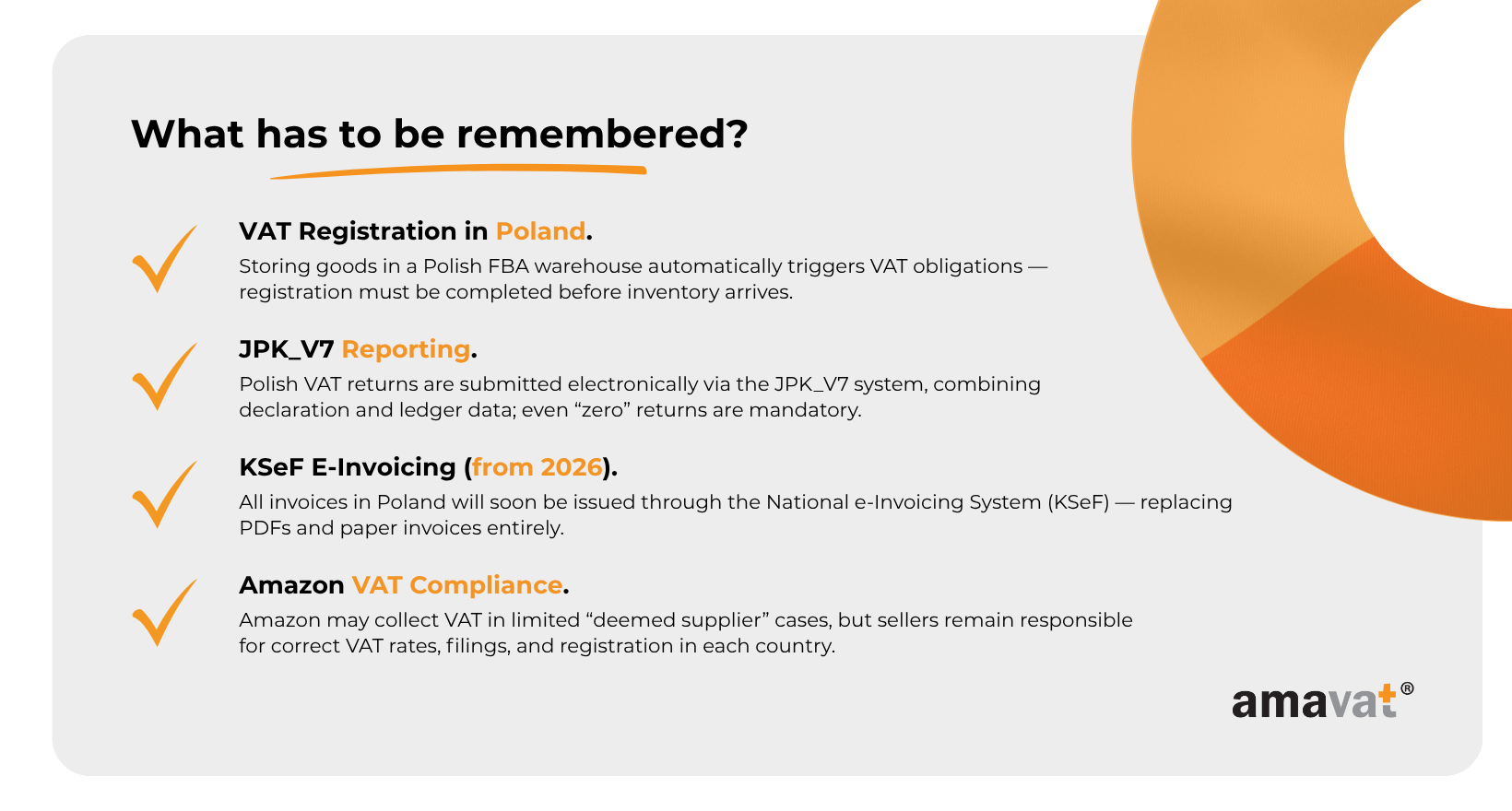

For Amazon FBA sellers, the moment you register for VAT in Poland is a turning point. It marks the line between casual cross-border selling and fully participating in the EU’s tax system. From that point on, all obligations apply — filing VAT returns, submitting JPK_VAT reports, and soon, issuing e-invoices through the KSeF (National e-Invoicing System).

The exact rules depend on where your business is based — in Poland, in another EU member state, or outside the European Union entirely. However, one principle applies universally: if your goods are physically stored in Poland, VAT registration becomes mandatory, regardless of where your company is established. Simply storing your products in a Polish Amazon fulfillment center is enough to trigger the obligation to register.

Polish Businesses

If your company is registered in Poland, you may benefit from a VAT exemption until your annual revenue from sales exceeds PLN 200,000. This is known as the small business exemption, defined in Article 113(1) of the Polish VAT Act. While you remain under this threshold, you don’t charge VAT on sales, you’re not required to file returns, and you cannot deduct input tax.

There are, however, important exceptions. Certain activities require VAT registration regardless of turnover — for example, trading in electronics, excise goods, new means of transport, or selling through online platforms that use foreign warehouses. If your goods are stored in an Amazon warehouse outside Poland, you are already operating in a context that demands full VAT registration.

In practice, many Polish Amazon FBA sellers choose to register for VAT early, even before reaching the threshold. Amazon often requires an active VAT number in Seller Central, especially for participation in programs such as FBA, Pan-EU, or CEE. This is not a legal obligation but a platform rule: without a VAT number, some account functions may be limited, invoicing may become difficult, and your sales could even be suspended.

Businesses Based in the European Union

If your company is established in another EU country and you sell goods to Polish consumers, you fall under the rules for intra-EU distance sales (WSTO). Since 1 July 2021, a common EU-wide threshold of €10,000 (around PLN 42,000) applies annually.

Below this limit, you can report VAT in your home country. Once you exceed it, the place of taxation shifts to the buyer’s country — in this case, Poland. At that stage, you have two options: register for VAT in Poland or use the One Stop Shop (OSS) system, which allows you to report and pay VAT for all your EU sales in one country.

It’s essential to note, however, that OSS applies only to B2C transactions — sales to private consumers. It does not cover situations where you store goods in another EU country. If your products are physically located in a Polish Amazon fulfillment center, VAT registration in Poland is required, even if you already use the OSS system.

This is a common misunderstanding among sellers from Germany, France, and the Netherlands, many of whom assume that using OSS eliminates the need for Polish VAT registration. In reality, storing goods in Poland automatically creates a taxable presence there. Failure to register can lead to significant tax arrears and penalties.

Businesses from Outside the European Union

For non-EU businesses, VAT rules are the strictest. If your company is based in a third country — for example, the UK, the US, Canada, or China — you must register for VAT in Poland from the very first transaction if you sell to Polish consumers or store goods in Poland.

There is one limited exception. If you sell goods shipped directly from a third country to consumers in Poland, and the value of each parcel does not exceed €150, you may use the Import One Stop Shop (IOSS) scheme. This system allows VAT to be collected at the point of sale, eliminating the need for Polish VAT registration.

In all other cases — especially when goods are stored in Poland or another EU member state — VAT registration in Poland is mandatory from the start.

Additionally, non-EU businesses must appoint a tax representative — an entity established in Poland that acts on their behalf. This representative is jointly and severally liable for VAT obligations, which is why the role is tightly regulated. There are exceptions, however: companies from countries that have mutual tax assistance agreements with Poland, such as the United Kingdom and Norway, are exempt from appointing a representative.

Storing Goods in Poland: When Fulfillment Creates a Tax Obligation

For many Amazon FBA sellers, storing goods in Poland is the single most common reason VAT registration becomes mandatory — even if the business itself is located abroad. Amazon operates several large fulfillment centers in Poland, including WRO1 (Wrocław), POZ1 (Poznań), and SZZ1 (Szczecin).

If your inventory is sent to one of these facilities — whether you sell directly to Polish customers or simply use Poland as a logistics base under Amazon’s European fulfillment programs — you must register for VAT in Poland. There is no sales threshold, grace period, or exception.

In fact, the obligation arises before the first shipment reaches the warehouse, meaning your registration must be completed before Amazon receives your goods. In practical terms, you should have an active Polish VAT number (a NIP beginning with “PL”) before sending your first pallet to WRO1 or SZZ1.

It’s also important to know that Amazon frequently relocates inventory between its European warehouses under the Pan-European FBA, CEE Program, or Central Europe FBA. This can happen automatically — without your explicit approval — and result in your goods being stored in Poland. To stay on top of this, regularly check the Inventory Event Detail Report in Seller Central to track where your stock is physically located.

Every movement of goods between EU countries is considered a separate taxable event, known as the transfer of own goods. Each transfer triggers a VAT registration obligation in the destination country. For many Amazon FBA sellers, especially those based outside the EU, this is the most common — and most overlooked — cause of accidental non-compliance in Poland.

The VAT Registration Process in Poland

Registering for VAT in Poland is a mandatory step for every Amazon FBA seller whose business involves either storing goods in Poland or selling to Polish consumers. While it’s a formal procedure, it also serves as a form of verification — the Polish tax authorities use it to confirm that a business genuinely operates within the EU and intends to comply with local tax regulations.

In the Amazon FBA model, VAT registration must be completed before your goods are moved into a Polish warehouse. This is because the very act of storing inventory on Polish territory constitutes a taxable event.

Required Documents and Practical Requirements

The VAT registration process begins with submitting the VAT-R form to the tax office. For businesses that do not have their registered seat in Poland — including those from the EU and outside the EU — the competent authority is the Second Tax Office Warsaw–Śródmieście, located at Jagiellońska 15 in Warsaw. This office specializes in handling foreign taxpayers.

Your application must include documents proving the legal existence and legitimacy of your business operations. The most essential are: a recent extract from your commercial register or equivalent business registration document, the company’s articles of association, ownership details, and the identity documents of persons authorized to represent the business.

The authorities may also request evidence of genuine commercial activity — for example, an agreement with Amazon, proof of an active Seller Central account, sales reports, or invoices demonstrating trade within the European Union.

For EU-based businesses, the tax office often requires confirmation of an active VAT number in your home country. For non-EU companies, a tax representative agreement is mandatory, unless your country has a bilateral tax assistance treaty with Poland — as is the case for the United Kingdom and Norway.

One of the most critical yet often overlooked elements is the translation requirement. All documents must be translated into Polish by a sworn translator registered with the Polish Ministry of Justice. Translations done independently or by uncertified agencies will not be accepted. Missing or incorrect translations are among the most common reasons for delays or rejections.

The office may also ask you to provide details such as a Polish or EU bank account to be used for tax payments. If a tax advisor or accounting firm submits the application on your behalf, a power of attorney (UPL-1 form) must be included. In practice, the tax office often requests additional clarifications, such as the type of goods you sell, the location of your inventory, and the expected scale of your business activity.

Timeline and Verification

For EU-based businesses, VAT registration in Poland usually takes between two and six weeks, with most applications finalized in around three to four. For companies outside the EU, the process takes longer — typically six to eight weeks, and sometimes up to twelve if the documents are incomplete or require further verification.

The process unfolds in several stages. Once the VAT-R form and supporting documents are submitted, the tax office first performs a formal review, checking that the application is complete and internally consistent. Then, it proceeds with a substantive review, verifying whether the business genuinely conducts commercial activities and whether its plans are credible.

If anything raises doubts — such as missing translations, inconsistencies between documents and the VAT-R form, or vague descriptions of planned activity — the tax office will request explanations or supplementary materials. For non-EU businesses, the office may also ask for confirmation of contact with the appointed tax representative.

Once verified, the office issues a NIP (tax identification number) or, if one already exists, activates it as an EU VAT number with the prefix PL. No new number is created — the same NIP becomes your active VAT number. From that point, your business appears in both the VIES system and the Polish register of active VAT taxpayers.

After receiving your VAT number, it should be promptly added to your Amazon Seller Central account under the Tax Information section. Amazon requires that this be done within 60 days of starting sales in Poland. Failure to provide an active VAT number may lead to account limitations or payment holds.

Timing and Common Mistakes

VAT registration must be completed before moving goods into Poland. According to Article 15 of the Polish VAT Act, storing goods in a Polish warehouse without prior registration is considered conducting taxable business activity on Polish territory without fulfilling legal obligations. Polish tax authorities have repeatedly confirmed this in official rulings (for example, 0114-KDIP1-2.4012.88.2021.2.RM), clarifying that the obligation arises when goods are moved, not when they are sold.

Moreover, under Article 96(4b) of the VAT Act, the tax office can refuse registration if it believes the business will not actually operate in Poland or if the registration appears to be fictitious. This most often affects companies unable to demonstrate a genuine link between their declared activity and a tangible economic presence in Poland.

In practice, well-prepared documentation and cooperation with an experienced tax advisor or accounting firm can dramatically reduce waiting times and eliminate the risk of rejection. The most frequent causes of delay include missing translations, outdated company extracts, and inconsistencies in identifying data. Starting the process well in advance — ideally several weeks before shipping your first goods to an Amazon fulfillment center in Poland — is the best way to ensure a smooth and timely registration.

Why Proper Registration Matters

A correctly completed VAT registration not only allows you to trade legally within the EU but also gives you access to the full benefits of being an active VAT taxpayer — including the ability to deduct input tax on purchases and enjoy greater credibility with business partners, tax authorities, and Amazon itself.

In the fast-moving ecosystem of European e-commerce, compliance isn’t just a box to tick. It’s a foundation for sustainable growth and operational security — the difference between expansion with confidence and expansion with risk.

VAT Reporting in Poland – The JPK_VAT System

Once you’re registered as an active VAT taxpayer in Poland, you enter a steady reporting cycle that connects your Amazon FBA sales directly with the requirements of the Polish tax authorities. Since October 2020, VAT declarations and sales records have been merged into a single document known as JPK_V7, which has replaced all previous VAT return formats.

Although many still refer to it as JPK_VAT, the official name is JPK_V7, available in two versions: V7M (monthly) and V7K (quarterly). Each combines the declarative and ledger components, allowing the tax administration to automatically cross-check your sales data against your business partners’ records — a system designed to detect discrepancies faster and more efficiently.

Even if you have no transactions during a given reporting period, you must still submit a “zero file” — because being an active VAT taxpayer automatically carries a reporting obligation.

Reporting Frequency and Filing Obligations

By default, sellers report monthly, preparing and submitting a JPK_V7M file for each month within the statutory deadline. The quarterly version, JPK_V7K, is available to so-called small taxpayers — those whose annual turnover does not exceed the equivalent of €2 million and who meet the other VAT Act criteria for quarterly settlements.

In practice, this means that for the first two months of each quarter, you submit the ledger portion monthly, while the declarative section is filed once per quarter. Choosing between the two is not merely a matter of convenience — the law restricts which taxpayers and transaction types can use the quarterly model. Before switching, make sure you meet the relevant eligibility requirements.

Regardless of the filing mode, you must maintain accurate and consistent VAT records, as these serve as the foundation for your JPK_V7 file. Every invoice, sale, return, or correction must be properly reflected in your records, since any inconsistency can trigger an inquiry or audit.

Format, Deadlines, and Best Practices

The report itself is an XML file that follows the official JPK_V7 structure published by the Ministry of Finance. It must be submitted electronically, signed with a qualified digital signature or an official ePUAP trusted profile. The filing deadline is fixed — the 25th day of the month following the reporting period.

For monthly filers, this means a straightforward month-to-month rhythm. For quarterly filers, the ledger portion must still be sent every month, while the declarative part is submitted once the quarter ends.

The Ministry of Finance provides free tools for filing, including e-Mikrofirma, JPK WEB Client, and the e-Tax Office (e-Urząd Skarbowy) portal. However, many Amazon FBA sellers prefer integrated accounting systems connected to Seller Central, which automatically generate, validate, and transmit JPK_V7 files. These commercial solutions help ensure accuracy and save time by synchronizing transaction data directly with tax filings.

If an error is detected, Polish tax authorities currently apply a relatively lenient correction mechanism. You’ll first receive a request to amend the file and have 14 days to correct the issue. Only if you fail to respond may a fine of up to PLN 500 per error be imposed. It’s a helpful safeguard, but not one to rely on regularly — preventing mistakes at the source remains the best strategy.

For Amazon FBA sellers, discrepancies often arise from date mismatches and rate classifications. The VAT recognition date may differ from the shipping date or the transaction date shown in Amazon reports, while small mistakes in VAT rate mapping can cascade into your records.

A good habit is to reconcile your Seller Central reports with your VAT ledger each month before finalizing and submitting the JPK_V7 file. This extra step saves you from stressful corrections later — and helps you stay in sync with both Amazon and the tax office.

KSeF – The New E-Invoicing Obligation from 2026

Starting in 2026, Poland’s tax system will enter a new digital era. Every business — including those operating under the Amazon FBA VAT Poland model — will be required to use the National e-Invoicing System (KSeF). This is a centralized platform developed by the Ministry of Finance that will replace traditional paper and PDF invoices with a standardized electronic format.

The change is part of Poland’s broader tax digitalization strategy, designed to simplify compliance, automate accounting workflows, and strengthen fraud prevention. Although KSeF is already available on a voluntary basis, it will become mandatory within two years, meaning that Amazon FBA sellers should begin preparing now. Implementation will involve not only adapting your accounting software but also ensuring that your invoicing system — including the tools used in Amazon Seller Central — can communicate directly with KSeF.

Implementation Timeline

The rollout of KSeF will take place in several stages to help businesses adjust smoothly to the new technical requirements. According to the 2025 KSeF Act, from 1 February 2026, the system will become mandatory for large enterprises, defined as those with annual revenues exceeding PLN 200 million in 2024.

Two months later, on 1 April 2026, the obligation will extend to all other VAT-registered taxpayers, including small and medium-sized businesses and foreign sellers registered for VAT in Poland.

The final stage will come into effect on 1 January 2027, covering micro-entrepreneurs and VAT-exempt entities — such as very small traders with monthly sales below PLN 10,000. From that point onward, every invoice issued in Poland, regardless of business size, must be processed through KSeF and assigned a unique identification number.

Importantly, the obligation applies not only to active VAT payers but also to VAT-exempt entities (“non-VAT taxpayers”) who issue invoices. In other words, anyone who issues invoices in Poland — even occasionally — will be required to use the KSeF system.

The Benefits of KSeF

While KSeF introduces new technical requirements, it also brings tangible benefits for both tax authorities and businesses. One of the most significant advantages will be a shortened VAT refund period, reduced from 60 to 40 days. To qualify for this faster refund, all invoices must be issued through KSeF, and payments must be made cashlessly in compliance with the “white list” of VAT taxpayers. For Amazon FBA sellers, this faster refund cycle means improved cash flow — a crucial factor in e-commerce, where liquidity often determines scalability.

Another key benefit is the automation of invoice management. Every invoice uploaded to KSeF undergoes automatic validation, eliminating formal errors, duplicates, and inconsistencies. Each document is stored centrally by the Ministry of Finance for ten years, so businesses no longer need to maintain separate electronic archives.

KSeF will also eliminate the need to send JPK_FA files (invoice reports on request). Because all invoice data will be transmitted to the authorities in real time, audits and reconciliations will become simpler and more transparent.

For Amazon FBA sellers who operate across multiple EU jurisdictions, KSeF also adds a layer of security and standardization. Invoices issued through the Polish system will be considered authentic under EU law and stored in a secure, centralized database, ensuring consistency and legal certainty across borders.

Technical Requirements and Integration

Invoices under KSeF will follow a unified XML format based on the FA_VAT logical structure — currently version FA(3). The Ministry of Finance plans to release version FA(4) before the 2026 rollout, aligning the system with updated EU standards and expanding optional data fields.

To issue an invoice in KSeF, the business or its authorized representative must go through a digital authentication process. This can be done in three ways: using a qualified electronic signature, a trusted ePUAP profile, or a KSeF authorization token. The token is system-generated and linked to a specific user or software, allowing seamless integration between KSeF and external accounting platforms, bookkeeping firms, and e-commerce systems — including Amazon Seller Central.

Once received by the system, each invoice is assigned a unique KSeF number, which becomes its sole identifier. After validation, the invoice is stored in the Ministry’s central repository for ten years, eliminating the need for separate archiving (though businesses may still keep copies in their own systems).

From 2026 onward, paper and PDF invoices will generally lose their legal validity. A transitional “offline-24” mode will exist for exceptional technical circumstances — such as temporary system outages — allowing invoices to be issued outside KSeF but requiring them to be uploaded within 24 hours once the system is restored.

For Amazon FBA sellers, this means ensuring that all invoicing and accounting tools are KSeF-ready well before 2026. Most leading accounting and e-commerce integration providers — such as Taxdoo, LinkMyBooks, and Amavat — are already developing KSeF API modules to automate invoice issuance, transmission, and retrieval without logging directly into the government portal.

KSeF should not be viewed merely as an obligation but as an opportunity. For Amazon FBA sellers, it represents a step toward greater control, faster VAT refunds, and fewer accounting errors. With its introduction, Poland will become one of the first EU countries to implement a fully digital invoicing system across both B2B and B2C transactions.

The years leading up to 2026 should be treated as a preparation phase — a time to review invoicing processes, test KSeF integrations, and automate VAT workflows. When the system becomes mandatory, businesses that are ready will already be operating more efficiently, with fewer errors, faster cash flow, and complete digital compliance.

Amazon as a Marketplace Facilitator – How VAT Really Works

When selling through Amazon FBA in Poland, it’s important to remember that Amazon is not just a sales platform. In some cases, it acts as a tax intermediary, known in EU law as a Marketplace Facilitator or deemed supplier. Under specific circumstances, Amazon formally becomes a party to the transaction and takes responsibility for collecting and remitting VAT.

This mechanism, introduced as part of the EU VAT e-Commerce Package in July 2021, was designed to simplify VAT compliance and reduce tax evasion in cross-border online trade.

The “Deemed Supplier” Mechanism

Amazon becomes a deemed supplier only in specific cases defined under EU law. The rule applies exclusively to B2C transactions (sales to consumers) and only in the following situations:

- When goods are sold by a non-EU seller to a consumer located within the EU, and Amazon “facilitates” the transaction — for example, by providing the platform, processing payment, or handling delivery.

- When goods are already located within the EU, but the seller is based outside the EU — in this case, Amazon collects and remits VAT on behalf of the seller.

For businesses registered within the EU — including Polish FBA sellers — Amazon does not become a deemed supplier. In these cases, the seller must calculate and remit VAT independently: either directly in Poland for domestic sales or through the OSS (One Stop Shop) scheme for cross-border EU transactions.

Under the deemed supplier model, each transaction is effectively split into two separate supplies. The first occurs between the seller and Amazon and is treated as a B2B transaction subject to the reverse charge mechanism — meaning Amazon accounts for the VAT as the purchaser. The second occurs between Amazon and the final consumer and is a B2C sale, where Amazon charges and remits VAT in the consumer’s country.

As a result, if you operate as a non-EU seller, Amazon effectively handles the VAT for you — but only for the second transaction (the sale to the end customer). You are still responsible for recording the first sale (to Amazon) in your VAT books and reporting it in your JPK_V7 file.

In Poland, this transaction is typically reported as a supply at a 0% rate or as outside the scope of VAT (EE), depending on the exact circumstances. The final B2C sale to the customer is not included in your Polish VAT records, since Amazon has already handled the VAT on your behalf.

It’s essential to note that the deemed supplier mechanism does not apply to B2B transactions or intra-EU sales between VAT-registered entities. In those cases, full VAT responsibility remains with the seller, who must continue to manage VAT either domestically or via OSS registration.

Amazon’s VAT Calculation Service (VCS)

To help sellers comply with VAT rules, Amazon offers the VAT Calculation Service (VCS) — an automated tool that calculates VAT according to local tax rates and legislation. Once activated, Amazon can issue invoices on your behalf — but only after you explicitly agree to self-billing terms. This agreement authorizes Amazon to generate VAT invoices in your name.

The VAT rate applied depends on both the product’s origin and destination countries, as well as the Product Tax Code (PTC) you assign in Seller Central. The PTC determines whether a product is subject to the standard, reduced, or zero rate. If you assign an incorrect tax code, any resulting miscalculation or non-compliance remains your responsibility, not Amazon’s.

VCS automatically generates invoices with your correct VAT number (NIP with the “PL” prefix for Polish sales) and makes them available in Seller Central to both you and the buyer. Legally, these invoices are considered issued by you, even though Amazon’s system creates them.

To use VCS, you must enter your active VAT number in your Seller Central settings (under Settings → Tax Information → VAT Information) within 60 days of starting sales in the relevant country. Failure to do so can limit account functionality or even block disbursements.

While VCS greatly simplifies compliance, it does not exempt you from keeping proper VAT records or submitting JPK_V7 reports. The Amazon VAT Transactions Report can serve as a helpful data source for accounting, but it does not replace formal recordkeeping obligations or document archiving.

Regularly reconciling VCS data with your own accounting records is highly recommended — especially regarding invoice dates and VAT recognition dates, which can sometimes differ. These small inconsistencies are among the most common triggers for queries from Polish tax authorities.

Why Understanding the Marketplace Facilitator Model Matters

The Marketplace Facilitator VAT framework reflects the EU’s broader push toward automation and simplification in digital commerce taxation. For Amazon FBA sellers operating in Poland, it means fewer formalities in certain cross-border B2C scenarios, but also a greater responsibility to ensure data accuracy — particularly in assigning correct tax codes and keeping precise records.

Understanding where Amazon’s responsibilities end and yours begin is critical. Amazon may handle VAT in some situations, but the legal accountability for compliance, documentation, and correct classification ultimately remains with you.

Mastering this balance — automation on Amazon’s side, accuracy on yours — is what ensures smooth, lawful operations within the EU VAT system and protects your business from costly compliance issues.

Uploading Your VAT Number to Amazon Seller Central

For every seller operating under the Amazon FBA VAT Poland model, adding your VAT number to your Amazon Seller Central account is not just a formality — it’s a legal and practical requirement.

Amazon requires that all sellers who either sell within the European Union or store goods in EU-based FBA warehouses hold an active VAT number in every country where a tax obligation arises. Failing to provide this number violates Amazon’s Terms of Service and can lead to severe consequences — including restricted account functionality, payment holds, or even suspension of your selling privileges.

Where and How to Add Your VAT Number

Once you obtain your Polish VAT number — that is, your NIP number activated for VAT purposes with the prefix PL — you need to add it to your Seller Central account. Following Amazon’s 2025 interface update, the current path is:

Settings → Account Info → VAT Information → Add a new VAT number.

Select Poland (PL) from the list, enter your VAT number in the format PL1234567890, and confirm. After submission, Amazon automatically verifies the number via the VIES system (VAT Information Exchange System), the EU-wide database of VAT-registered businesses.

Be aware that your number may not appear in VIES immediately — it typically takes two to five days after activation by the Polish tax office. Amazon will reject any VAT number not yet visible in VIES, so it’s wise to verify its status beforehand at ec.europa.eu/taxation_customs/vies.

After registration, your Polish NIP becomes an EU VAT number — the same identifier, but now active for intra-EU transactions and visible in VIES with the “PL” prefix. This distinction matters: the NIP identifies you domestically, while the VAT-EU version authorizes you to trade and declare VAT within the European Union.

If you participate in programs such as Pan-European FBA, CEE Program, or Central Europe FBA, each country where your goods are stored requires a separate VAT registration. This means adding multiple VAT numbers in Seller Central — for Poland (PL), Germany (DE), Czech Republic (CZ), France (FR), Italy (IT), and so on. Missing a number for any of these countries may cause Amazon to restrict storage, shipping, or sales from that region.

Deadlines and Compliance Consequences

Amazon requires that a valid VAT number be added within 60 days of your first sale in a given country. For instance, if you make your first sale in Poland on 1 January, your VAT number must be entered by 1 March. This deadline is strict — failure to comply can result in withheld payments, listing removal, or account suspension.

It’s also important to note that the countdown begins from the date of your first actual sale, not from when you created your Seller Central account. If your VAT registration is still in progress, you should notify Amazon via Seller Support and attach confirmation from the Polish tax office showing that your VAT application has been submitted. Doing so can prevent an automatic compliance block.

For non-EU sellers registering for VAT in Poland through a tax representative, Amazon may request additional documents — such as a copy of the representation agreement or a VAT power of attorney (UPL-1 form). Without these, your VAT number may not be validated in the system.

If your VAT details are missing or outdated, Amazon may immediately restrict your account. First, it will suspend payouts and mark your profile as non-compliant within its internal tax compliance system — meaning your funds are frozen until a valid VAT number is provided.

The next step is the loss of listing visibility and access to FBA programs. Amazon can halt fulfillment operations from Polish warehouses, remove your offers from the Polish marketplace, and restrict EU-wide sales until the issue is resolved.

Another critical consequence involves the Buy Box algorithm. Since 2022, Amazon’s ranking system factors in tax compliance status. An inactive, invalid, or mismatched VAT number (for instance, one not found in VIES or inconsistent with your business address) reduces your chance of winning the Buy Box — which, in practice, means a sharp drop in sales.

Beyond Amazon’s internal rules, Polish tax law also imposes serious penalties. Storing goods in a Polish FBA warehouse without an active VAT number is treated as conducting business in Poland without proper registration. In such cases, the tax authorities may demand payment of retroactive VAT on all past sales, along with interest and administrative penalties of up to 30% of the assessed tax liability.

Why It Matters

Uploading your VAT number to Seller Central may seem like a small administrative step, but in reality, it’s the cornerstone of tax compliance and account stability. For Amazon FBA sellers in Poland, it determines whether Amazon recognizes your operations as fully compliant with EU law.

A correctly entered and validated VAT number ensures seamless payouts, uninterrupted sales, and eligibility for key programs — while also signaling to both Amazon and tax authorities that your business operates transparently and lawfully.

In short, your VAT number is not just an identifier — it’s a passport to smooth operations across Amazon’s European marketplaces. Handle it with care, verify it regularly, and treat it as a critical component of your compliance infrastructure.

Risks and Penalties for Non-Compliance

In the world of online sales — and especially within the Amazon FBA VAT Poland environment — tax compliance isn’t just a bureaucratic checkbox. It’s the foundation of your business’s security. Failure to register properly, filing errors, or outdated VAT data can lead not only to serious issues with Polish tax authorities but also to direct consequences on the Amazon platform itself. Understanding these risks allows you to prevent them before they disrupt your sales and reputation.

Financial Penalties

Poland’s VAT regulations are among the strictest in Europe, and the tax authorities place significant emphasis on verifying that businesses comply with their registration and reporting obligations.

If a seller fails to register for VAT on time or does not remit VAT on sales, the tax office can impose substantial financial penalties. Unpaid VAT is subject to statutory interest — currently around 14.5% annually (as of 2025) — calculated for each day of delay. In addition, under the Polish Fiscal Penal Code, the authorities may impose a fine of 5% of the unpaid tax, and in serious cases, a penalty reaching tens of thousands of złotys.

The most severe sanctions apply when a business operates without VAT registration despite being legally required to do so. In such cases, the tax office may demand full payment of VAT arrears for the entire period of activity, along with interest and an administrative penalty of up to 30% of the total liability. In practice, this means that if you sell for six months without an active VAT number, you could be required to pay back the entire VAT amount for that period — even if you charged VAT to customers but never remitted it.

Penalties can also increase if the tax office determines that the omission was deliberate. Intentional failure to register or report VAT may trigger fiscal-criminal proceedings, which in extreme situations can lead to personal liability of the business owner.

Platform Risks on Amazon

Separate from Polish legal requirements, non-compliance also carries platform-level risks. Amazon increasingly collaborates with EU tax administrations and cross-verifies seller information in real time.

The first step Amazon typically takes when detecting VAT non-compliance is to suspend payments. Funds from your sales are held in escrow until a valid VAT number is provided or discrepancies are resolved. If the issue remains unresolved, Amazon may temporarily suspend your account, blocking login access, removing listings, and halting all FBA fulfillment processes.

Losing an active or verified VAT number in the VIES system can also affect your performance metrics. Amazon’s Buy Box algorithm factors tax compliance into its ranking logic. If your VAT number is missing, inactive, or inconsistent with VIES data, your offers are less likely to win the Buy Box — which, in practice, can cause sales to plummet, since most customers purchase through that single-click feature.

Another risk is losing Prime eligibility. Amazon can temporarily remove Prime badges or restrict access to key fulfillment programs such as Pan-EU, Central Europe FBA, and CEE. For many sellers, this effectively eliminates their main conversion channel and visibility advantage.

In certain cases, Amazon also shares transaction and sales data with national tax authorities upon request. If discrepancies arise between VAT returns and the data stored in Seller Central, it can trigger a cross-audit or an official request for correction from the Polish tax office.

Tax Audits and the Cost of Non-Compliance

When irregularities are detected, Polish tax authorities may initiate a tax audit, reviewing all transactions, invoices, JPK_V7 files, and sales records from Amazon. Increasingly, such audits are powered by data provided directly by Amazon through its cooperation agreements with EU tax bodies.

Most commonly, these audits focus on periods when a business was active without VAT registration or maintained incorrect records. The authorities can demand copies of all invoices, sales reports, payment confirmations, and contractual agreements with Amazon. If it turns out VAT has not been properly remitted, the company must pay all outstanding tax, interest, and administrative penalties.

A particularly risky situation is known as a VAT backlog — when unpaid VAT accumulates over several months or years. In these cases, authorities can require retroactive settlement, forcing the seller to amend past JPK files, recalculate VAT, and pay the entire balance with accrued interest.

For non-EU companies, the situation is even more complex. When non-compliance is confirmed, financial liability can extend to the tax representative registered in Poland, who may be held jointly responsible for unpaid VAT. This makes cooperation with a knowledgeable representative and meticulous documentation critical for safeguarding your business.

The Real Cost of Neglect

In cross-border e-commerce, tax mistakes are rarely small — and always unnecessary. Delayed registration, incomplete reporting, or misaligned data between Seller Central and your accounting system can quickly evolve from a technical error into a business crisis.

Timely VAT registration, accurate returns, and full data consistency with Amazon’s reports are the simplest and most effective ways to protect yourself. Proper VAT management in Poland safeguards not just your finances, but also your reputation, operational stability, and customer trust — assets that, in e-commerce, are worth far more than any margin percentage.

The Most Common Mistakes Made by Amazon FBA Sellers

Selling through Amazon FBA in Poland presents an enormous opportunity — but also a field full of potential pitfalls. Many sellers, especially those new to international operations, underestimate how strict VAT regulations are in Poland and across the European Union. Below are the most frequent mistakes Amazon FBA sellers make, and why avoiding them is essential to protect your business.

1. Delayed VAT Registration

This is the most common — and most expensive — error among Amazon FBA sellers. Many EU-based entrepreneurs mistakenly believe that they only need to register for VAT in Poland once their sales exceed a certain threshold. In reality, for FBA sellers, the obligation arises not from revenue, but from the physical movement of goods into Poland.

For EU businesses, VAT registration becomes mandatory the moment your goods are transferred to an Amazon warehouse in Poland. This constitutes an intra-community transfer of own goods, which is legally treated as a taxable supply.

For non-EU companies, the obligation arises even earlier — upon the first sale to a Polish consumer or the mere storage of goods in Poland. Any B2C sale to Polish customers without active VAT registration violates Polish tax law and may trigger fines, backdated VAT assessments, and interest charges.

To avoid this, start the registration process early — ideally before shipping goods to an Amazon FBA fulfillment center. Polish tax authorities increasingly verify that VAT registration occurred before the first stock transfer, not after sales have begun.

2. Missing VAT Number in Seller Central

This is one of the most underestimated — yet operationally critical — mistakes. Having a VAT number is one thing; entering it correctly into Amazon Seller Central is another. Without it, Amazon’s system flags your account as non-compliant.

As of the 2025 interface update, the path to add a VAT number is: Settings → Account Info → VAT Information → Add a new VAT number. For Poland, select “Poland (PL)” and enter your NIP with the prefix PL (e.g. PL1234567890).

Registration with the Polish tax office alone is not enough. Amazon verifies VAT numbers through VIES (the EU VAT Information Exchange System), so your number must be active and visible in VIES, not just locally registered. It can take a few days for it to appear in the system — usually between two and five. Checking its status on the European Commission website is the safest step before updating Seller Central.

Failure to list your VAT number results in frozen disbursements, hidden listings, and limited access to FBA programs such as Pan-EU and CEE. It’s a simple technical detail that can completely stall your business. Periodically confirm that all VAT numbers in Seller Central are active, accurate, and consistent with registration data.

3. Incorrect VAT Rates

Misapplying VAT rates is another frequent source of problems, often caused by unfamiliarity with product classifications or overreliance on Amazon’s default settings. Poland applies four main VAT rates — 23%, 8%, 5%, and 0% — depending on the exact product type.

For goods, classification is based on CN (Combined Nomenclature) codes; for services, on PKWiU 2015. These codes determine the proper rate, and in case of doubt, sellers can request a Binding Rate Information (WIS) ruling from the Polish tax authorities — a formal confirmation that protects the seller during audits.

Common misclassifications include:

- Bottled water – 23%

- Tap water (via water supply network) – 8%

- E-books – 5%

- Online video courses – 23%

Under the VAT Calculation Service (VCS), Amazon automatically applies VAT based on the Product Tax Code (PTC) you assign to each listing. If your code is incorrect, you — not Amazon — are liable for any errors in VAT calculation. Double-checking product classifications before uploading listings is a non-negotiable best practice.

4. Missing Reverse Charge for B2B Sales

When selling to other EU-registered businesses (B2B), many sellers mistakenly charge VAT or fail to mark the transaction as an intra-community supply. Such transactions should generally be processed under the reverse charge mechanism — meaning no VAT is charged, and the buyer accounts for VAT in their own country.

To apply this correctly, your business partner must hold a valid EU VAT number, and you must retain proof of delivery to another EU Member State. In Poland’s JPK_V7 report, these transactions are marked with the code EE for intra-community supplies (WDT).

If you sell outside the EU, a 0% VAT rate applies, provided you have export confirmation documents (e.g. customs declaration EX or IE-599). Failing to use the correct mechanism leads to reporting discrepancies and possible tax audits.

5. Lack of a Tax Representative

Non-EU sellers often overlook that Polish VAT law requires them to appoint a tax representative if they do not have a registered office or permanent establishment within the EU. The representative is responsible for ensuring compliance — handling registration, filing VAT returns, communicating with the tax office — and, most importantly, shares joint liability for VAT debts.

This obligation applies to all businesses from countries outside the EU’s VAT cooperation framework under Directive 2010/24/EU. Sellers from the US, China, Canada, or Switzerland must appoint a tax representative, whereas businesses from the UK and Norway are exempt due to bilateral administrative cooperation agreements.

It’s important to distinguish between a tax representative and a VAT proxy (UPL-1 form). A proxy can submit returns and communicate with the authorities but does not bear financial responsibility. A representative, however, is legally and financially accountable for the accuracy of the taxpayer’s filings.

Staying Compliant Is Your Competitive Edge

Understanding these five common mistakes helps you avoid most of the issues that trip up Amazon FBA sellers in Poland. Proper registration, correct VAT rate classification, accurate reporting, and close cooperation with your tax representative form the foundation of a compliant and sustainable e-commerce operation.

As Polish tax offices increasingly cross-check Amazon’s sales data with VAT filings, compliance is no longer just an obligation — it’s a competitive advantage. The sellers who take VAT seriously will be the ones who build lasting, scalable businesses in the European marketplace.

Conclusion

VAT compliance in the context of Amazon FBA in Poland is far more than a bureaucratic requirement. For many sellers, it’s the fine line between running a stable, growing business and one constantly exposed to audits, suspensions, and penalties. In today’s e-commerce environment — where Amazon actively collaborates with EU tax authorities — transparency and accurate VAT reporting are not just legal obligations; they’re a strategic competitive advantage.

A seller who maintains full VAT registration in every relevant country, files returns on time, applies the correct rates, and reports data consistent with both VIES and JPK_V7 is seen by Amazon as a reliable partner. Such accounts are less likely to be flagged by Amazon’s automated compliance checks, rarely face payout holds, and have a stronger chance of winning the Buy Box. Beyond that, tax transparency builds trust with customers — something that’s becoming increasingly important as cross-border shoppers grow more conscious of where and how they buy.

Proper VAT management also shields you from cumulative financial risks. Unpaid VAT, interest charges, administrative fines, and legal fees can erase months of profit in a matter of weeks. Regular monitoring, early error detection, and proactive verification of your VAT status in the VIES system can prevent such setbacks before they escalate.

The most effective strategy is to work with a tax advisor familiar with Amazon’s operations, someone who can align your VAT approach with your business model. A knowledgeable advisor not only assists with registration and filings but also helps optimize your structure — advising when to register in new countries, how to use OSS or IOSS procedures, and how to avoid unintended tax triggers when moving stock across borders.

Equally important is automation. Integrating your sales and VAT data — whether through Amazon’s VAT Calculation Service (VCS) or external accounting software — saves time and eliminates the inevitable errors that occur with manual reporting. With the upcoming implementation of KSeF and further digitalization of tax processes, automation will soon move from a convenience to a necessity.

In short, VAT compliance should never be viewed as an obstacle to growth, but rather as an integral part of it. It’s an investment in the stability and credibility of your brand within the European market. In the world of Amazon FBA, success doesn’t belong solely to those who sell the most — but to those who sell responsibly, transparently, and predictably.

VAT isn’t your enemy. Treated correctly, it’s your strongest ally — a safeguard for your operations, a mark of professionalism, and a tool that can set you apart in one of the world’s most competitive e-commerce landscapes.