EU VAT OSS vs IOSS: which scheme fits your e‑commerce business?

Spis treści

That changed on 1 July 2021, when the EU introduced a major VAT reform for e-commerce. The reform was designed to simplify cross-border sales within the EU and also to level the playing field between EU and non-EU sellers. Instead of being forced into separate national registrations, many businesses can now use one central VAT registration to declare and pay tax on sales across the Union. For the first time, the rules were harmonised under two special schemes: the One Stop Shop (OSS) and the Import One Stop Shop (IOSS).

This reform didn’t remove VAT obligations — but it made them much easier to manage, especially for smaller sellers who don’t have the resources of a multinational retailer.

The challenge for modern e-commerce sellers

While the reform stripped away much of the old red tape, it also created a new decision point: which VAT scheme fits my business best?

This question goes beyond compliance. VAT has a direct effect on your cash flow, your administrative workload, and even the checkout experience your customers see when they click “buy.” For many founders, especially those running lean online shops that are growing quickly, every saved hour of admin and every avoided hidden cost matters.

That’s why taking the time to understand how OSS and IOSS differ — and which one matches your situation — is not just smart, it’s essential for sustainable growth.

A clear recommendation upfront

Although we’ll explore the details in depth later, here’s the simplified guidance that applies in most cases:

- Choose the Union OSS if you’re an EU-based seller making cross-border B2C sales of goods or services within the EU. If your combined annual sales across all EU countries exceed €10,000 (net), you must apply the VAT rules of your customer’s country and register for Union OSS. If you stay below the €10,000 threshold, you may continue to apply your domestic VAT rate — but you can still opt into OSS voluntarily for smoother compliance.

- Choose the IOSS if you sell low-value goods — meaning consignments worth up to €150 — that are shipped from outside the EU directly to consumers. With IOSS, VAT is charged at the point of sale and declared through a single monthly return, which avoids surprise import charges and speeds up delivery with simplified customs clearance.

Choosing the right scheme helps you avoid unnecessary registrations, ensures a smoother buying experience for your customers, and strengthens your reputation as a trustworthy seller.

In the next sections, we’ll unpack how both systems work, where they overlap, and what practical factors you should weigh before deciding which one best fits your e-commerce business model.

Understanding the schemes

What is OSS?

The One Stop Shop (OSS) is a special VAT scheme introduced on 1 July 2021 to simplify compliance for cross-border B2C sales within the EU. Its purpose is to let sellers report and pay VAT in just one EU Member State — known as the Member State of identification. From there, the tax authorities automatically send the VAT to each customer’s country of consumption.

This means that instead of registering separately in every country where you sell, you can manage it all through a single quarterly OSS return. For small and medium-sized online shops, this cuts out hours of admin work and removes the need to juggle multiple VAT numbers across Europe.

The scheme mainly covers intra-EU distance sales of goods (where goods are shipped between EU countries to private consumers) and certain cross-border services. In other words, if you’re an EU-based seller sending products to customers across borders, OSS is designed with you in mind.

OSS is divided into three distinct variants:

- Union OSS: For businesses established in the EU making cross-border B2C distance sales of goods or providing services to consumers in other EU Member States. This is the version most small EU-based e-commerce shops will use.

- Non-Union OSS: For businesses not established in the EU but supplying certain services to EU consumers, such as digital platforms or software providers.

- Import OSS (IOSS): A related but separate scheme for goods imported from outside the EU up to €150 per consignment. Because it has its own specific rules, we’ll explain it separately in the next section.

👉 The key takeaway: OSS simplifies VAT for intra-EU B2C sales, allowing sellers to treat their cross-border activity almost like domestic sales when it comes to administration.

What is IOSS?

The Import One Stop Shop (IOSS) is designed for distance sales of goods imported from outside the EU, where the consignment value does not exceed €150.

Before the 2021 reform, customers often faced a frustrating process: their parcel would arrive at customs, VAT would be added on top of what they had already paid, and in many cases handling fees were charged too. This led to delays, surprise costs, and disappointed customers — hardly ideal for any growing online shop.

With IOSS, the process looks completely different. Sellers (or in many cases, online marketplaces) charge VAT directly at checkout, so the buyer sees the final price upfront. That VAT is then reported through a monthly IOSS return, and when the goods enter the EU, they benefit from a faster customs process via the so-called “green lane.”

For online shops importing low-value items like gadgets, fashion accessories, or home décor, this makes a huge difference. Customers know exactly what they’re paying, parcels arrive more quickly, and there are no unpleasant surprises at delivery.

👉 In short: IOSS is the scheme that removes customs headaches for low-value imports, giving both sellers and buyers a smoother cross-border shopping experience.

OSS vs IOSS: Side-by-Side Comparison

When you first look at OSS and IOSS, it’s easy to confuse them. Both were introduced under the same reform, both simplify VAT reporting, and both allow you to avoid juggling multiple national registrations. But in practice, they apply to very different situations. Understanding those differences is key to choosing the right path.

Eligibility and Scope

The Union OSS is designed for EU-based sellers who make cross-border B2C sales within the EU. If you’re an online shop in Spain sending clothes to customers in France, or a German seller shipping books to Austria, OSS is your scheme. It also covers EU businesses supplying services to consumers across borders.

By contrast, the IOSS only applies when goods are imported from outside the EU and the value of each consignment is €150 or less. This makes it the go-to option for sellers in non-EU countries, or for EU sellers sourcing stock abroad and sending it directly to EU customers.

Registration and Thresholds

With Union OSS, you register in your home Member State, and from there you can declare VAT due in all other EU countries. The threshold that triggers OSS is €10,000 net per year in total cross-border B2C sales across the EU. Below this amount, sellers may continue applying their domestic VAT, though many choose OSS anyway for simplicity.

IOSS is different: there’s no threshold to meet. If you sell consignments under €150 from outside the EU, you can choose to register. EU businesses can register in their home state, while non-EU sellers usually need an EU-established intermediary to handle the process.

VAT Rules and Filing

In both schemes, VAT must be charged at the rate of the customer’s country, not the seller’s. This ensures fair competition across the single market.

The filing frequency is one of the practical differences:

- OSS returns are filed quarterly.

- IOSS returns must be filed monthly.

That means IOSS requires more regular reporting but keeps cash flow and VAT settlements aligned with shorter cycles.

Customer Experience

This is where IOSS really shines. Under OSS, the customer simply pays the VAT-inclusive price when shopping within the EU, much as they would at home. There are no surprises, but there are also no special perks: delivery and customs treatment are the same as in domestic transactions.

With IOSS, customers avoid the dreaded doorstep shock. VAT is included in the checkout price, so there are no extra import fees when the parcel arrives. This creates a transparent and predictable shopping experience, which often leads to fewer abandoned carts and better reviews.

Customs Treatment

For OSS, customs is business as usual: goods already circulating within the EU don’t need special handling. VAT obligations are settled through the quarterly return.

For IOSS, however, customs treatment is streamlined. Parcels sent under IOSS benefit from a “green lane” clearance, meaning goods pass through border controls without VAT being charged again. This speeds up delivery and reduces the risk of goods being held until VAT is paid.

Who benefits from each scheme?

- OSS is the natural fit for EU-based businesses selling to customers in other EU countries. It cuts down paperwork, removes the need for multiple registrations, and makes cross-border VAT compliance far less daunting.

- IOSS is the right choice for businesses shipping low-value consignments from outside the EU. It improves transparency, prevents surprise charges for customers, and speeds up customs — all of which build trust in your shop.

In short: OSS is about making EU-to-EU sales easier; IOSS is about removing barriers for low-value imports.

Which scheme fits your business?

Even with the rules laid out, many small business owners still ask the same question: which scheme actually applies to me? The answer depends mainly on where your business is established and what kind of sales you make.

EU-Based Sellers

If your business is established in the EU, the scheme most relevant to you is the Union OSS.

The practical rule is simple: once your total cross-border B2C sales of goods and eligible digital services within the EU exceed €10,000 (net) per calendar year across all EU countries combined, you must apply the customer’s country VAT rate rather than your own. At that point, Union OSS becomes the smart move because it lets you declare and pay all this VAT in your home Member State via a single quarterly return.

If your sales remain below the €10,000 threshold, you may continue to apply your domestic VAT rate to those cross-border sales. Many sellers still opt into Union OSS voluntarily because it avoids a sudden switch once sales grow, keeps pricing and tax handling consistent across markets, and makes expanding into new EU countries simpler.

Example: a Polish seller shipping handmade jewellery to customers in Germany, France, and Italy. Once combined sales to those countries exceed €10,000 in a year, the seller must charge VAT at each customer’s local rate. By using Union OSS, they file everything through the Polish tax authority, which then distributes VAT to the correct countries.

Non-EU sellers

If your business is established outside the EU, you cannot use Union OSS, but you may benefit from the Non-Union OSS — provided you sell services to EU consumers. This variant is for non-EU businesses supplying things like digital products, e-learning, or online subscriptions where VAT is due in the customer’s Member State. Under Non-Union OSS, you can choose your Member State of identification and declare EU VAT centrally. An intermediary is not required for Non-Union OSS.

Important scope note: Non-Union OSS covers services only, not goods.

For non-EU businesses selling goods into the EU, look instead to IOSS (covered below).

Importers of low-value goods

If your business imports goods from outside the EU, the scheme to look at is the Import One Stop Shop (IOSS). This applies when the consignment value is €150 or less.

IOSS allows you to charge VAT at checkout and declare it centrally through a monthly return. This prevents VAT from being collected at the border and gives your parcels access to a faster customs “green lane”.

The main advantage here is the customer experience: no unexpected fees, no delays at customs, and more trust in your shop. For sellers who rely on global suppliers — whether that’s fashion accessories, gadgets, or home décor items — IOSS can be the difference between happy repeat buyers and angry reviews.

If a consignment exceeds €150, IOSS cannot be used. In that case, the standard import VAT process applies, and VAT is typically collected at the border by the courier or directly from the customer.

Benefits and Considerations

Administrative simplification

One of the most noticeable advantages of both OSS and IOSS is the streamlining of reporting. Before July 2021, many sellers had to register for VAT separately in every EU country where they sold to consumers. That often meant keeping track of several VAT numbers, filing different returns, and sometimes hiring local accountants in each country just to stay compliant. With Union OSS, this complexity is replaced by a single quarterly return filed in your home Member State, covering all cross-border B2C sales of goods and certain digital services. With IOSS, the process works on a monthly basis but follows the same principle: one central filing for all eligible low-value imports into the EU. For small shops without dedicated finance staff, this kind of simplification can make the difference between manageable admin and an overwhelming workload.

Cash flow management

VAT doesn’t just affect compliance, it also shapes the way cash flows through your business. With IOSS, VAT is collected directly at checkout, meaning sellers know from day one how much tax they need to declare in their next monthly return. This upfront collection prevents the surprise of import VAT at the border and gives businesses more predictable cash flow. Union OSS works on a different rhythm. Because VAT is declared quarterly, sellers have fewer reporting deadlines but must plan ahead carefully, setting aside funds as sales come in to avoid a financial squeeze at the end of the quarter. Both systems provide clarity, but they require slightly different approaches to managing money.

Customer satisfaction

From the customer’s perspective, the benefits of these schemes are just as significant. Before IOSS, parcels from outside the EU often arrived with unexpected VAT bills and courier handling fees, creating delays and frustration at delivery. By charging VAT-inclusive prices at checkout, IOSS eliminates those surprises and allows goods to clear customs more quickly, which makes shopping smoother and builds trust in your brand. Union OSS brings a similar kind of transparency for intra-EU sales. Customers are charged VAT at their own country’s rate, so the experience feels familiar and predictable no matter where in the EU they are based. For small e-commerce businesses trying to grow, this level of trust can make the difference between a one-time sale and a loyal returning customer.

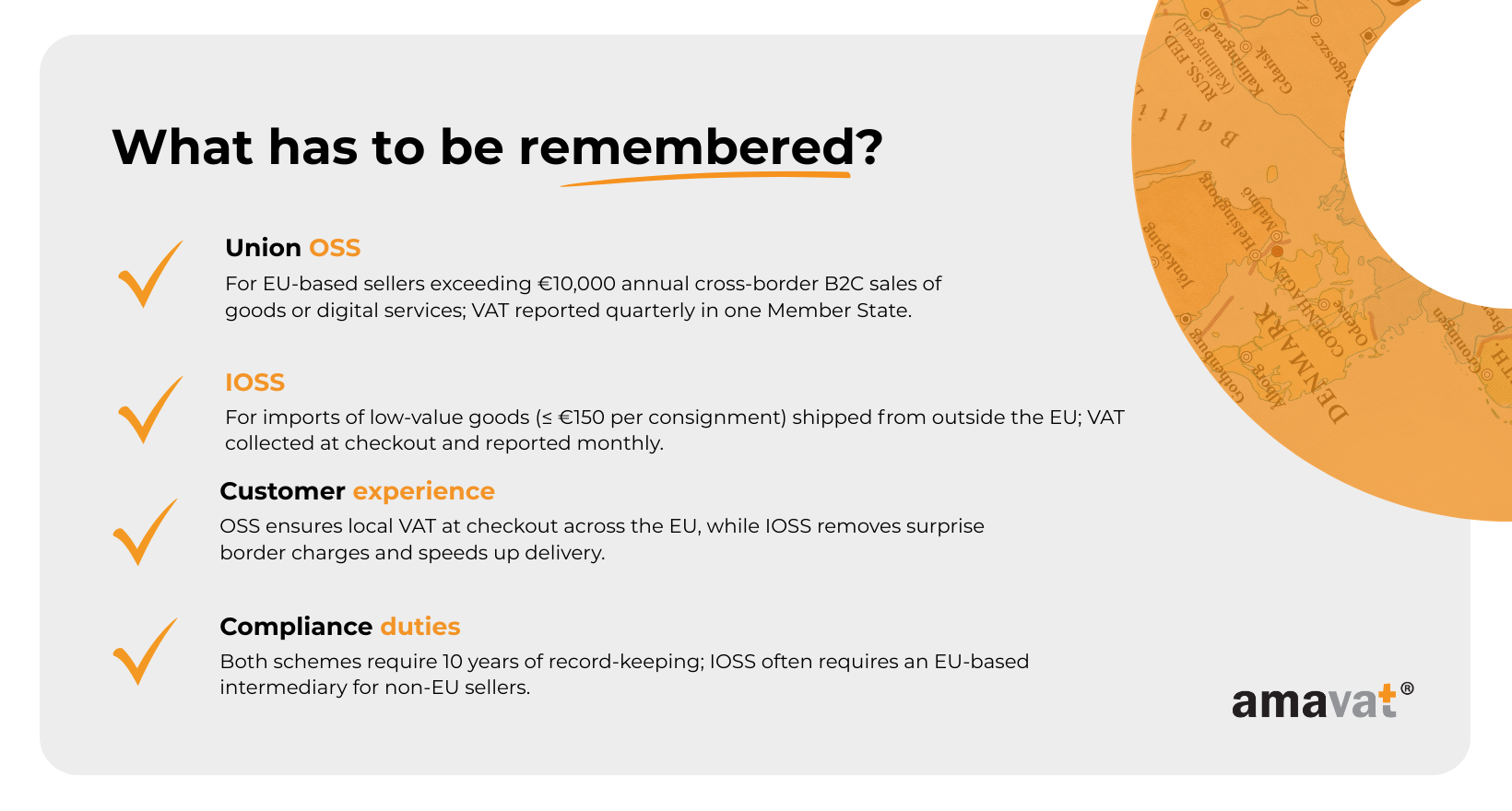

Compliance obligations

While the schemes make VAT simpler, they also come with strict compliance duties. Both OSS and IOSS require sellers to keep detailed records of all relevant transactions for ten years, ready to be presented to tax authorities on request. This makes reliable accounting systems or proper integrations with e-commerce platforms essential. For non-EU sellers using IOSS, there is an additional requirement: most must appoint an EU-based intermediary to handle registration and filings. The only exception is for businesses based in countries that have a VAT cooperation agreement with the EU, such as Norway. This extra step adds cost, but it is the price of accessing the simplification that IOSS offers.

Technology support

The rise of digital commerce has made compliance less daunting than it once was. Most major e-commerce platforms — including Shopify, WooCommerce, and Magento — now support OSS and IOSS through dedicated plugins or integrations. With the right setup, VAT rates are applied automatically at checkout, errors are reduced, and reporting becomes more reliable. For lean teams, this kind of technology is not just convenient but essential, particularly given the long record-keeping obligations imposed by EU VAT law. By relying on smart tools, small businesses can stay compliant without sacrificing the time and focus they need to grow.

Practical guidance for sellers

For many entrepreneurs, the theory behind OSS and IOSS is clear enough, but the real challenge is applying the rules in everyday business. Both schemes were designed to simplify VAT, yet they serve very different contexts. Thinking through a few practical questions about your business setup, your customers, and your products can help you determine which option is the right fit.

Where is your business established?

The starting point is always your place of establishment. If you are based inside the EU, your natural route is the Union OSS. This scheme allows you to centralise all VAT reporting on cross-border B2C sales of goods and certain digital services into a single quarterly return submitted in your home Member State.

If you are established outside the EU, the options shift. You cannot use Union OSS, but you may qualify for the Non-Union OSS if you supply services such as digital products, e-learning, or online subscriptions to EU consumers. When it comes to goods, the relevant scheme is usually IOSS, which applies to consignments of up to €150. Anything above that threshold falls under the standard import VAT process, where VAT is normally collected at the border.

Where are your customers?

The location of your customers is just as decisive as where you are established. If most of your buyers are consumers within the EU, Union OSS is likely to be the scheme you rely on most, since it removes the need for multiple national VAT registrations and allows you to manage all your cross-border obligations in one place.

If, on the other hand, your goods are shipped from outside the EU directly to EU customers, then IOSS becomes more relevant — provided the consignments are worth no more than €150. In both cases, it is important to remember that VAT rates always depend on the customer’s country of residence. The schemes do not change this fundamental rule, but they make it far easier to comply with it.

What is the value of goods?

The value of your goods determines which thresholds apply. For Union OSS, the critical line is €10,000 per calendar year (net). This threshold covers the combined value of all cross-border B2C sales of goods and certain digital services across EU Member States. Once your sales exceed this figure, Union OSS is not just helpful, it becomes the most efficient choice.

For IOSS, the key threshold is €150 per consignment, not per product. If you import consignments below this limit from outside the EU, IOSS allows you to charge VAT upfront at checkout and avoid customs charges for your buyers. Once the consignment value rises above €150, IOSS can no longer be used, and standard import VAT rules apply.

Do you want smoother customs clearance or simplified VAT returns?

Your priorities as a seller also influence which scheme makes more sense. If your main concern is reducing administrative work and avoiding multiple VAT registrations within the EU, then Union OSS is the right fit. It consolidates your VAT reporting into one quarterly return, even as you expand across borders.

If, however, your bigger challenge is customs delays or customers frustrated by surprise import charges, then IOSS delivers more value. By collecting VAT at checkout and using the “green lane” for customs clearance, it ensures faster deliveries and transparent pricing.

Combining the schemes

For some businesses, the best solution is to use both schemes together. Union OSS can handle intra-EU B2C sales of goods and services, while IOSS is used for direct imports of low-value consignments from outside the EU. This combination allows sellers to keep VAT reporting streamlined across Europe and at the same time eliminate customs headaches for imported goods.

In the end, the decision comes down to the shape of your business: where you are established, where your customers are, what you sell, and how much you value either administrative efficiency or a seamless buying experience. The good news is that whichever scheme applies, both OSS and IOSS are designed to reduce your compliance burden while protecting customer trust.

Conclusion

The 2021 EU VAT reform reshaped how e-commerce businesses operate across Europe, and the choice between OSS and IOSS is at the heart of that change.

The Union OSS is the right route for EU-based sellers whose cross-border B2C sales of goods or digital services exceed €10,000 per calendar year (net, across all Member States combined). It centralises VAT reporting into a single quarterly return filed in the seller’s home Member State and removes the need to register separately in multiple EU countries.

The IOSS, by contrast, is tailored for imports of low-value goods worth up to €150 per consignment when shipped from outside the EU directly to consumers. By collecting VAT upfront at checkout and declaring it through a monthly return, IOSS eliminates surprise charges for customers and ensures parcels move more smoothly through customs.

Choosing the right scheme is more than a compliance decision — it directly shapes the customer experience. It determines whether deliveries are simple and transparent or whether buyers face delays and unexpected costs. For young, fast-growing e-commerce brands, that difference can define whether a shopper becomes a loyal repeat customer or a frustrated one-time buyer.

Because VAT rules come with strict compliance obligations, including the requirement to keep detailed records for ten years, it is always wise to confirm the details using official EU guidance or by consulting a qualified VAT advisor before registering. Making the right choice early helps secure smoother growth, happier customers, and fewer hours lost to administration.