Automate your VAT processes: Integration of Baselinker with the amavat® application

The integration of the amavat® application with Baselinker is a key solution for e-commerce businesses looking to automate accounting and VAT processes. Baselinker, as a platform that enables managing multiple sales channels in one place, works with amavat® by automatically importing transaction data and supporting the optimization of tax settlements. In this article, we will guide you step by step on how to configure this integration to simplify VAT management and improve accounting in your e-commerce.

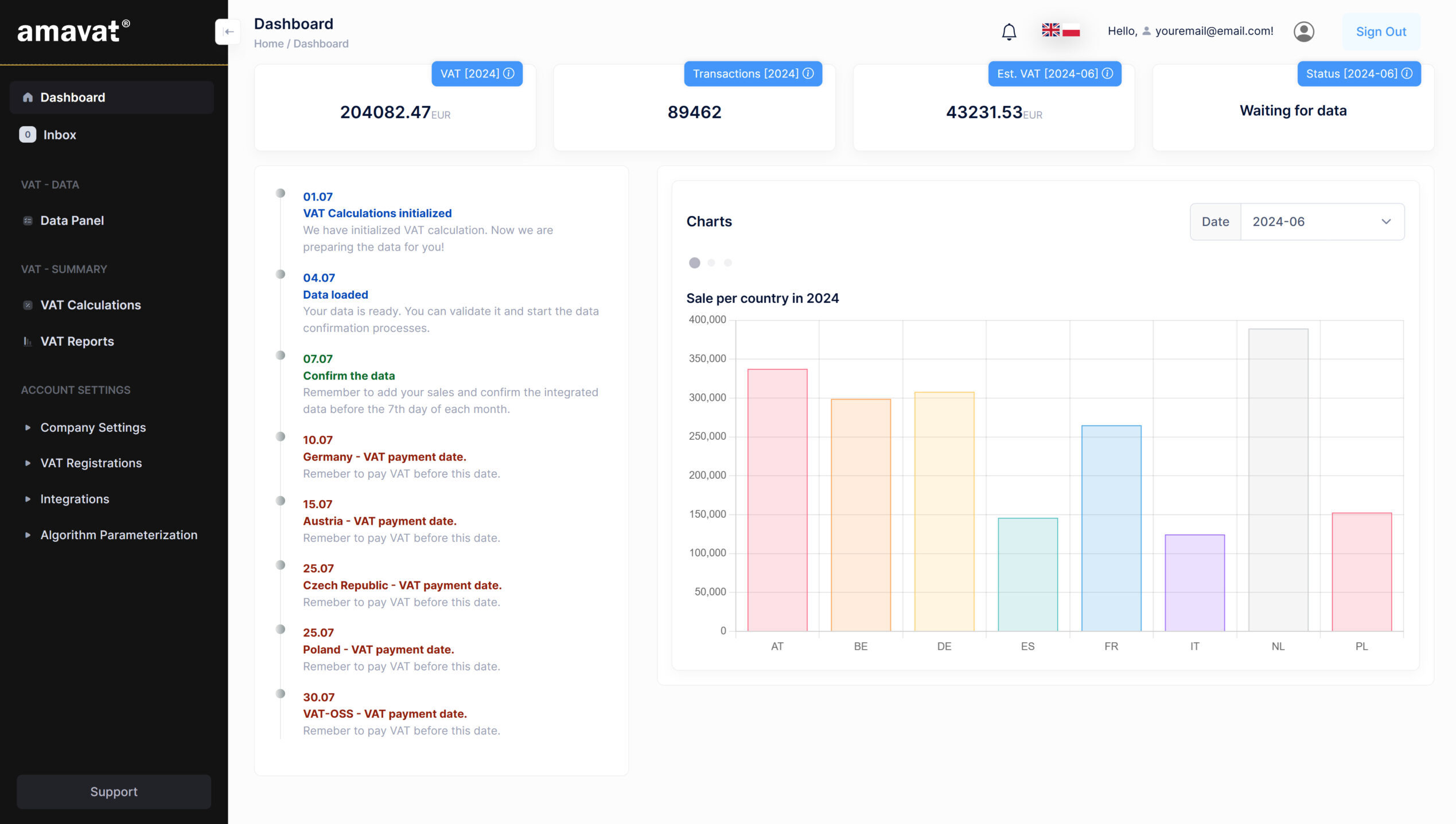

Key features of the amavat® application

The amavat® application is designed to simplify and automate VAT management for e-commerce businesses. With the ability to integrate with sales platforms such as Baselinker and Kaufland.de, amavat® automatically synchronizes transaction data, significantly easing VAT reporting. Automating these processes reduces the risk of errors and minimizes the need for manual data entry. Additionally, the intuitive user interface ensures ease of use, and document management becomes convenient and transparent.

Why is the integration of amavat® with Baselinker useful?

The integration with Baselinker allows for the automatic retrieval of transaction data without the need for manual file uploads or additional actions. This helps business owners save time, increase reporting accuracy, and focus on growing their business instead of dealing with cumbersome accounting processes. The amavat® application not only automates data retrieval but also integrates it with the VAT system, facilitating tax reporting and settlements.

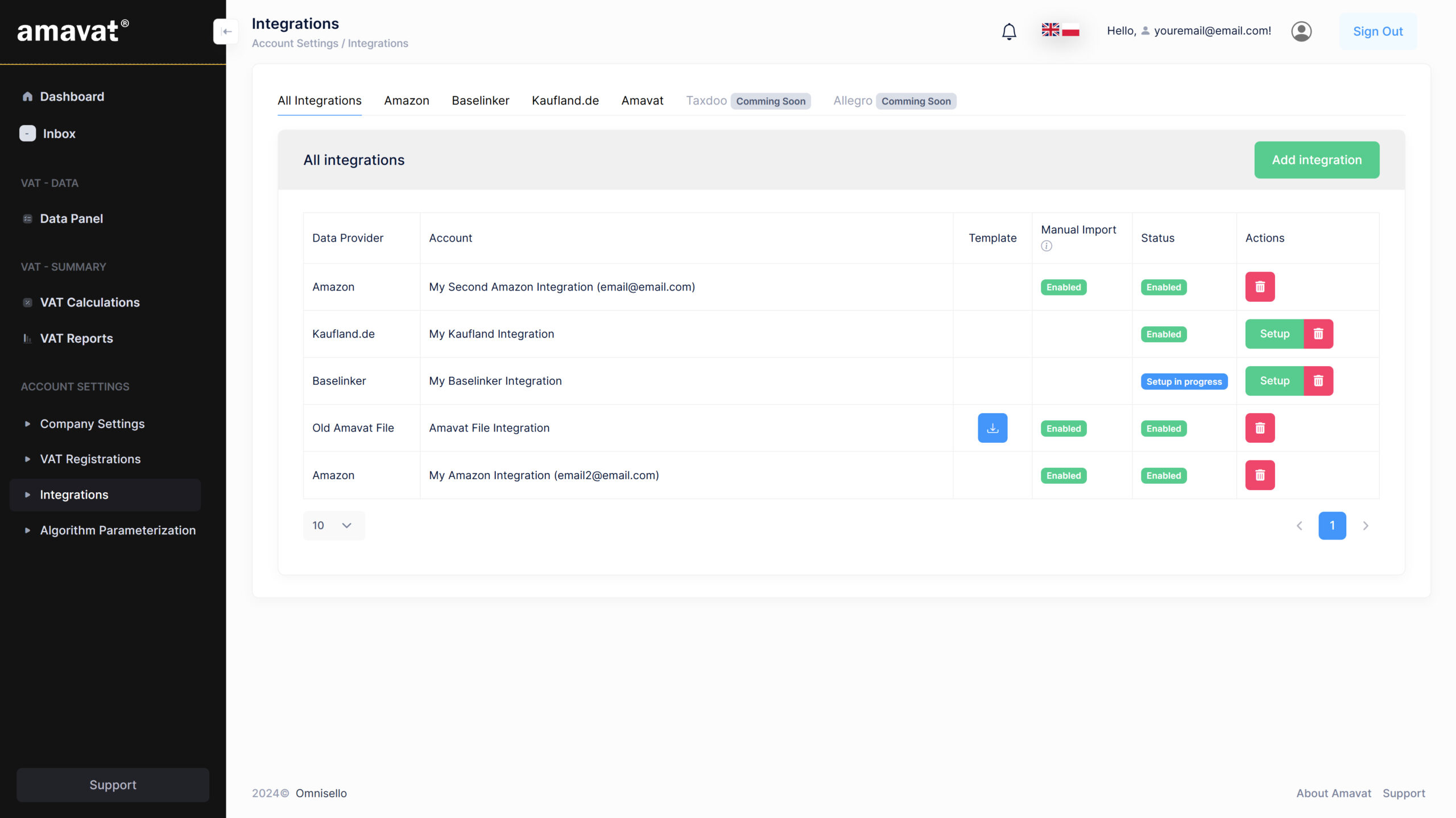

Step-by-step: Integrating Baselinker with the amavat® application

Integrating your Baselinker account with amavat® is a simple and intuitive process that only takes a few minutes. Below, you will find detailed instructions to quickly set up the connection between both platforms.

- Log in to the amavat® application.

- Go to the account settings category.

- Select the Integration option, which will redirect you to a page with all available integrations.

- On the top panel, you will see all available and future integrations. To access the Baselinker integration, click on the “Baselinker” tab.

- Use the green “Add Integration” button in the upper right corner. A window will appear, allowing you to enter your account name and API key.

- To successfully add the Baselinker integration, first enter the account name. This name will be used to identify the integration in future steps. Then, enter the API key.

- Log in to your Baselinker account.

- Click on the account button in the upper right corner.

- Expand the list and select “My Account.”

- Choose the API tab.

- A panel titled “Your API token” will appear, where you can copy the API key using the “Copy to Clipboard” button.

- In the amavat® application, enter the account name (which can be any name to identify the integration) and paste the copied API key.

- Click the “Add” button in the bottom right corner of the window. At this stage, the integration status will be “Initializing” – this process takes about 20 minutes. After initialization, the status will change to “Configuration in progress.”

- Once the status changes to “Configuration in progress,” click the “Baselinker Setup” button to adjust the integration settings.

- In the status configuration section, you will find all the statuses imported from Baselinker. Choose the appropriate settings for them.

- Sale

- Refund

- Not loaded

- Go to the next section, “Source systems,” where you will find integrations made with Baselinker. Select those that should be included in the data import as Enabled. Otherwise, use “Disabled.” Also, set the shipping country.

- After setting all the options, click “Confirm” at the top of the configuration window. The integration should change its status to “Active – Enabled,” meaning that data import from Baselinker to the amavat® application has started.

How to obtain an API key?

Options include:

Key benefits of the amavat® integration with Baselinker

The integration of amavat® with Baselinker offers many benefits that can significantly impact the optimization of accounting and tax processes in your e-commerce. Here are the most important ones:

- Automatic data retrieval: Without the need for manual data entry, all information is automatically synchronized, reducing the risk of errors.

- Easier VAT reporting: Transaction data is automatically processed, making VAT reports and tax settlements easier to generate.

- Centralized transaction management: amavat® allows integration with various sales platforms, enabling centralized management of all transactions and accounting documents in one place.

- Quick and intuitive setup: The integration process is simple and transparent, and the application provides a user-friendly interface.

If you want to learn more about the amavat® application and see how it works, we invite you to read our amavat® application user manual.

Summary

The integration of Baselinker with the amavat® application is the perfect solution for e-commerce businesses looking for ways to automate and simplify their VAT-related processes. Thanks to this integration, business owners can focus on growing their business while the amavat® application takes care of all accounting and tax-related aspects. Ask about our solutions and start a revolution in VAT management today!