CONTACT OUR SPECIALISTS

Need support with VAT Compliance services:

Dominika - International Sales Manager

If you operate a company selling products to international customers and need comprehensive VAT settlement services, we invite you for a free consultation with our expert who will answer all your questions.

WHAT WE DO

VAT Compliance services for e-commerce

VAT Registration in the EU

The service covers the entire process related to assigning a local tax identification number for VAT settlement purposes or for deregistering it.

VAT in the EU for non-European Union companies

We handle all formalities related to settlement and registration for EU VAT for companies outside the European Union. If you do not have fiscal representation, we offer a service for establishing a company in Poland.

VAT OSS registration for those declaring VAT in Poland and Germany

We provide comprehensive service for matters related to VAT OSS obligations, tailored to your needs.

VAT settlement and submission of VAT returns

Is your company registered for VAT in different European

countries?

We

will settle your VAT and prepare declarations for you in each of the countries

where you are

registered.

INTRASTAT reporting

We offer a comprehensive service related to INTRASTAT reporting and provide support in monitoring thresholds within the EU.

EORI

registration for

e-commerce sellers

We offer a professional EORI registration service tailored specifically for e-commerce. With amavat®, you will quickly and efficiently obtain your unique EORI number.

VAT Tax advisory

amavat® offers support in VAT tax advisory and compliance. We collaborate with a network of tax firms across Europe.

Late EU VAT registration and retroactive VAT settlements

We will register you for VAT retroactively in all countries where such registration was required. We will submit all outstanding settlement declarations.

Support for e-commerce businesses

Comprehensive VAT settlement services for e-commerce

Take advantage of our services and forget about the stress of VAT tax filing forever.

Contact usExpand your business in Europe

Countries where we register for VAT:

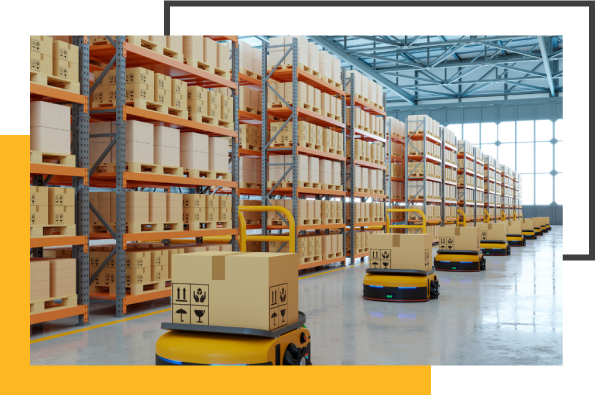

Amazon FBA (Fulfillment by Amazon)

Amazon FBA and VAT Registration and Declaration

Amazon FBA (Fulfillment by Amazon) is an innovative service that allows e-commerce sellers to outsource the logistics and warehousing processes. However, with the dynamic growth of e-commerce and globalization, issues related to VAT registration and tax declarations have emerged. The proper approach to these aspects is crucial to ensure compliance with tax regulations.

VAT Registration:

VAT registration in the country where you operate business is essential when using the Amazon FBA service. Depending on the location of your Amazon market place, you may be required to register for VAT. The registration process varies from country to country, so it is advisable to consult a tax expert or use professional services to ensure compliance with local requirements.

VAT Declaration:

Running a business using Amazon FBA introduces additional challenges related to VAT declaration. Valuable products moving between different countries require precise documentation and reporting of the appropriate tax amounts. We offer comprehensive support in the VAT registration process, filing tax returns and adapting to the evolving e-commerce environment.

Choose Convenience

Let amavat® handle your VAT obligations

With our services, you can focus on growing your business, confident that tax matters are properly managed.

Contact usEFN, CE, or PAN-EU?

Solutions for Amazon sellers

EUROPEAN FULFILLMENT NETWORK

Warehouse in ONE country and sell on ALL Amazon market places

FOR BEGINNER SELLERS

CENTRAL EUROPE PROGRAM

Warehouse in GERMANY, CZECH REPUBLIC, and POLAND, and sell on ALL Amazon markets

TAKING SALES TO THE NEXT LEVEL

PAN-EUROPEAN PROGRAM

Warehouse in ALL fulfillment centers and sell in on ALL Amazon marketplaces

FOR LARGE SELLERS

(1200+ items/month)

CONTACT OUR SPECIALISTS

Interested in a partnership?

Dominika - Interntational Sales Manager

Does your company offer services for online sellers? Do Would

you like to

additionally offer them VAT Compliance and other related services in

Europe?

We invite

you to partner with us:

Empowering your business growth

Why choose us

Dedicated customer care

Every client has the opportunity to collaborate with a dedicated customer care representative proficient in multiple foreign languages. Additionally, they are supported by a team of experts available for assistance.Our qualified tax advisors are at your disposal for all matters related to VAT, as well as in the event of tax audits across Europe.

Automation of accounting processes

By automating data retrieval for tax settlements and the integration with marketplaces or ERP systems, you can save time for your e-commerce team, which leads to cost savings. Simultaneously, our IT solutions allow the preparation of customized reports for accounting and e-commerce departments.

Comprehensive offering

You can rely on comprehensive support for accounting, payroll, as well as registration and VAT settlements for international sales, mail-order sales abroad under the VAT-OSS or Intrastat procedure. At the same time, you can count on our support in all European countries, ensuring centralized accounting and VAT services for your expanding e-commerce business. All essential services are consolidated on the Client Portal, facilitating efficient financial management of your business.

Premium service

Our Premium Service includes dedicated customer care support with direct telephone contact, 24/7 access to the Client Portal and round-the-clock access to tax information. Additionally, clients receive Customer Information, providing real-time updates on the latest legal and tax changes. We prioritize swift and accurate responses to your inquiries and concerns.

Transparent pricing system

We present an attractive pricing policy that is not dependent on the volume of transactions. We offer diverse packages tailored to the size of businesses. You can rely on consistent, transparent, and stable prices.

Highest security standards

We provide the support of an expert team during tax audits, as well as an analysis of complex VAT declarations and corrections if necessary. We ensure the timeliness of your settlements with tax authorities and oversee that no financial consequences threaten you. Simultaneously, we guarantee the security of your data, even within our automation and integration processes. You have the opportunity to benefit from over a decade of our team's experience in both Polish and international accounting.

With us, you don't have to look for intermediaries

About us in numbers

the e-commerce market

European network

filed with us

customers

marketplaces on the market

Our locations

Our VAT Compliance offices in Europe:

REVIEWS

What our clients say

The individual approach, process automation, and comprehensive service in the registration and settlement of VAT make us highly satisfied with our cooperation with amavat®.

Paulina Dziewulska

Head of Accounting

KAZAR

amavat® represents a professional approach to VAT settlement. Services are comprehensively handled, with attention to all aspects of VAT settlement (e.g., movement of goods between Amazon warehouses). Assigned individual advisors and prompt communication are distinct positive features in collaboration with amavat®.

CANPOL

We turned to amavat® after being disappointed with services of another provider. The transition of work to amavat® went smoothly in all the countries where we operate. All our needs were taken care of.

Timo Nicklas

Managing directors

Fashion2need GmbH

amavat® took care of our required registrations immediately and within a short time. Subsequent filings in various countries were executed promptly.

Andreas Kremer

Owner

Kremers-Schatzkiste

Our VAT registrations are handled professionally and on time. Backdated reports were professionally submitted to the relevant financial authorities.

Jukka Bruhn

Manager

FDS GmbH

The staff at amavat® responds to our inquiries with great competence. Even complex issues are resolved satisfactorily.

Mike Meiser

Head of Accounting Department

itenga GmbH

Knowledge Base

Tax and accounting news for e-commerce

Stay informed about updates in tax regulations and the latest trends in e-commerce accounting, VAT, as well as procedures related to VAT Compliance.

FAQ

Frequently asked questions about

VAT Compliance for e-commerce

When is it mandatory to register as a VAT taxpayer in another EU country?

An online seller is obligated to register for VAT in a European country other than the one where their company is based when meeting one of the following conditions:

- Exceeding a limit, that is, if the online seller makes sales above a certain sales limit and is not registered for the VAT-OSS procedure, they must register for VAT in the countries where to which distance sales occurred after exceeding the said limit. Effective as of July 2021, the limit for mail order sales to individuals is €10,000 per year.

- Warehousing goods in a country outside the company's country of residence: When a seller begins storing their goods abroad, they should already have an active VAT number in the country where they use the warehouse. This applies even if it is a rented warehouse or a warehouse provided by a platform such as Amazon under the FBA Amazon model.

It is worth noting that VAT regulations in Europe may vary from country to country, both within and outside the European Union. Therefore, it is always advisable to consult with a tax advisor or tax authority in the respective country to get accurate information and understand all tax obligations.

Do I have to register for VAT-OSS?

The VAT OSS or "One Stop Shop" procedure is a voluntary VAT settlement in distance sales for EU businesses selling to B2C customers. It came into effect on July 1, 2021.

The main principle of this system is that declarations and the corresponding tax are submitted to the tax office in one EU country, and that tax office is responsible for transferring the amount to local tax offices in other EU countries. Settlement for transactions is possible in a single quarterly declaration in EUR.

Registration is not mandatory. Entrepreneurs have the option, but are not obligated, to register for VAT-OSS immediately after commencing online sales in EU countries or after exceeding the 10,000 EUR (net) threshold. Importantly, the limit is calculated cumulatively for all EU countries and on an annual basis.

For additional information, please visit: https://amavat.eu/information-about-one-stop-shop-oss/

If I have local VAT abroad, can I be registered for VAT-OSS?

Of course. Registration for the VAT-OSS procedure does not preclude you from having an active local VAT number in European countries and vice versa.

An e-commerce company based in Poland may find itself in a situation where it ships goods from both its domestic warehouse and Germany. The scale of cross-border sales is significant, and it anticipates that it will quickly exceed the 10,000 EUR net limit or does not want to risk exceeding it without an active VAT-OSS registration. In such a situation, the company is obliged to register for VAT locally in Germany and at the same time, due to cross-border distance sales to individuals, it can register for the VAT-OSS procedure.

Does the VAT settlement fee depend on the number of transactions?

No. At amavat®, we have a transparent pricing system that does not depend on the number of online sellers' sales transactions.

While we encourage each of our clients to see their sales grow and businesses thrive, the scale of these sales does not affect the subscription fee.

What is VAT EU?

It stands for the European VAT number, which is required for every commercial transaction within the European Union. To obtain it, one must register as a VAT payer with the tax authorities office. In Poland, a document called VAT-R must be completed for this purpose.

Once the VEU VAT number is obtained, it allows to verify if a particular foreign company is an active taxpayer.

This number also helps to avoid taxation of a transaction according to the tariff from the counterparty's country.

It should also be remembered that companies that were exempt from VAT are obliged to update the previously mentioned VAT-R form.

If you want to check whether a counterparty is an EU VAT payer, you can use the European Commission's search engine in the form of the VIES online tool.

What is Intrastat, and do I have to submit it?

Intrastat is essentially a list of all intra-community transactions involving the exchange of goods between a company and other businesses. Entrepreneurs are obligated to provide information on the imports and exports of goods to European Union countries. It can be said that this is the main purpose for which Intrastat was created.

If your company operates in the European Union markets, one of your obligations is to submit the Intrastat declaration, but only if the value of goods turnover with EU countries exceeds specific thresholds established in individual states during the calendar year (reporting year) or, importantly, in the year preceding the reporting year.

If you need support in this area, we will be happy to help. Feel free to contact us.

What is EORI, and do you need it?

EORI (Economic Operator’s Registration and Identification) is the Community System for Registration and Identification of economic entities. This number must be possessed by all EU-registered entities sending goods to third countries, as well as entities registered outside the Union planning to import goods into the EU. All entities registered in the EU sending goods to third countries, and entities registered outside the EU planning to import goods into the EU, must have this number.

It is crucial to apply for an EORI number before you start exporting sales or importing goods between the European Union and non-Union countries. Why? Because the EORI number will be required at the very first customs operation.

The EORI number is unique, assigned only once, and valid throughout the EU. All assigned EORI numbers can be verified on the website https://ec.europa.eu/taxation_customs/dds2/eos/eori_validation.jsp?Lang=en.

It is worth noting that due to Brexit, trading between the European Union and the UK also requires businesses to have an EORI number. In fact, two EORI numbers are needed:

- European – for goods to leave the EU

- British - for goods to enter the UK.

For more information on this matter, feel free to reach out to one of our experts during a non-binding consultation.

How long does the process of registering for VAT locally in Europe take?

The VAT registration process in European countries can vary from a few weeks to several months, depending on the country of registration and the timing of the process.

In Poland, the VAT registration process is relatively efficient. However, in other European countries, one should expect at least a few weeks of waiting for the VAT number after submitting the registration application. In countries such as Spain and Italy, to you should expect up to several months of waiting.

It is essential to note that during holiday seasons, this process is often slowed down due to vacation periods in government offices. It may be similar in the fourth quarter of the year, when e-commerce experiences its highest turnovers and there is an increased interest in international expansion, the demand for foreign VAT registration is higher.

How long does the VAT-OSS registration process take?

The VAT-OSS registration process takes a few business days from the time the application is submitted.

Unlike domestic VAT, VAT-OSS does not involve the issuance of an additional identification number. The taxpayer receives a confirmation of registration for the VAT-OSS procedure.

What is the difference between Amazon FBA and FBM?

Amazon FBA (Fulfillment by Amazon) is a service offered by Amazon to its sellers, allowing them to sell products worldwide with from Amazon’s logistics support.

In the FBA model, Amazon takes care of both packaging and shipping, as well as the subsequent handling of shipments. The advantage of this solution is access to the world's largest markets, thereby resulting in increased sales. Sellers do not need to worry about organizing their warehouse space or the timeliness of delivering goods.

However, the most significant advantage of Amazon FBA seems to be the transfer of responsibility for shipping and product preparation from the seller to Amazon. This not only changes the way online stores operate but also impacts financial aspects. It is important to consider that the nature of accounting practices may also undergo changes.

On the other hand, Amazon FBM, or Fulfillment by Merchants, is a collaboration model offered by Amazon for sellers who prefer to ship goods from their own warehouses. In essence, by choosing Amazon FBM, the seller is responsible for storing, packaging, shipping, and delivering products to customers.

What is a "reverse charge"?

This is the so-called "reverse charge mechanism". It may take place at the time of sale.

Reverse charge on purchase:

If a Polish business receives an

invoice

marked as "reverse charge," it is obliged to pay and settle the VAT. Therefore,

this

obligation rests with the purchaser of the service or goods. on the basis of the

so-called

"self-calculation".

Reverse charge on sales:

It is important to note that the

reverse

charge mechanism applies only to sales made to companies registered as active

VAT taxpayers.

In Poland, the obligation for "reverse charge" is referred to in Article 106e,

paragraph 1,

point 18 of the VAT Act. This occurs when a company invoices the supply of goods

or the

provision of services, for which the purchaser of the goods or services is

obliged to settle

VAT.

To apply the reverse charge mechanism, the following conditions must be met:

- A. The supply of goods or provision of services is subject to VAT taxation in a country other than Poland.

- B. The regulations of that latter country state that the obligation to settle VAT for the supply of goods or services documented with a given invoice should be imposed on the purchaser of the goods or services.

It is also crucial to remember that if a Polish business provides services to a taxpayer subject to VAT from another EU country or engages in intra-Community acquisitions of goods, it is obliged to submit a monthly summary VAT-UE information to the tax office where the tax obligation arises.