Revolution in VAT management: Amazon automation with the amavat® application

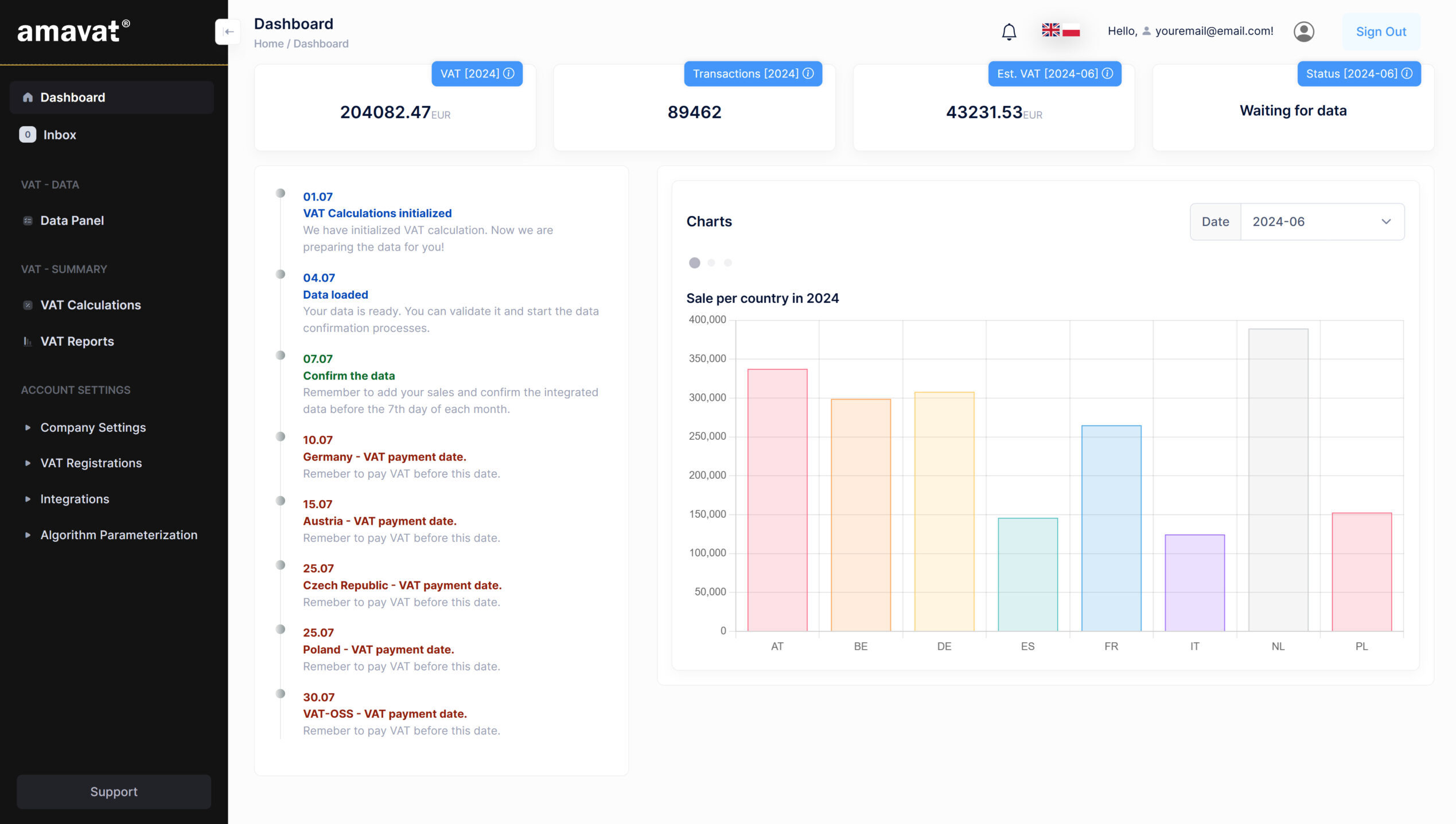

The amavat® application is a modern solution designed for efficient VAT management in e-commerce. With its advanced integration features, amavat® allows for seamless connection with various sales platforms, including Amazon. In this article, we will closely examine how the amavat® application works with Amazon, offering support in automatic transaction data management and VAT reporting.

Innovative features of the amavat® application

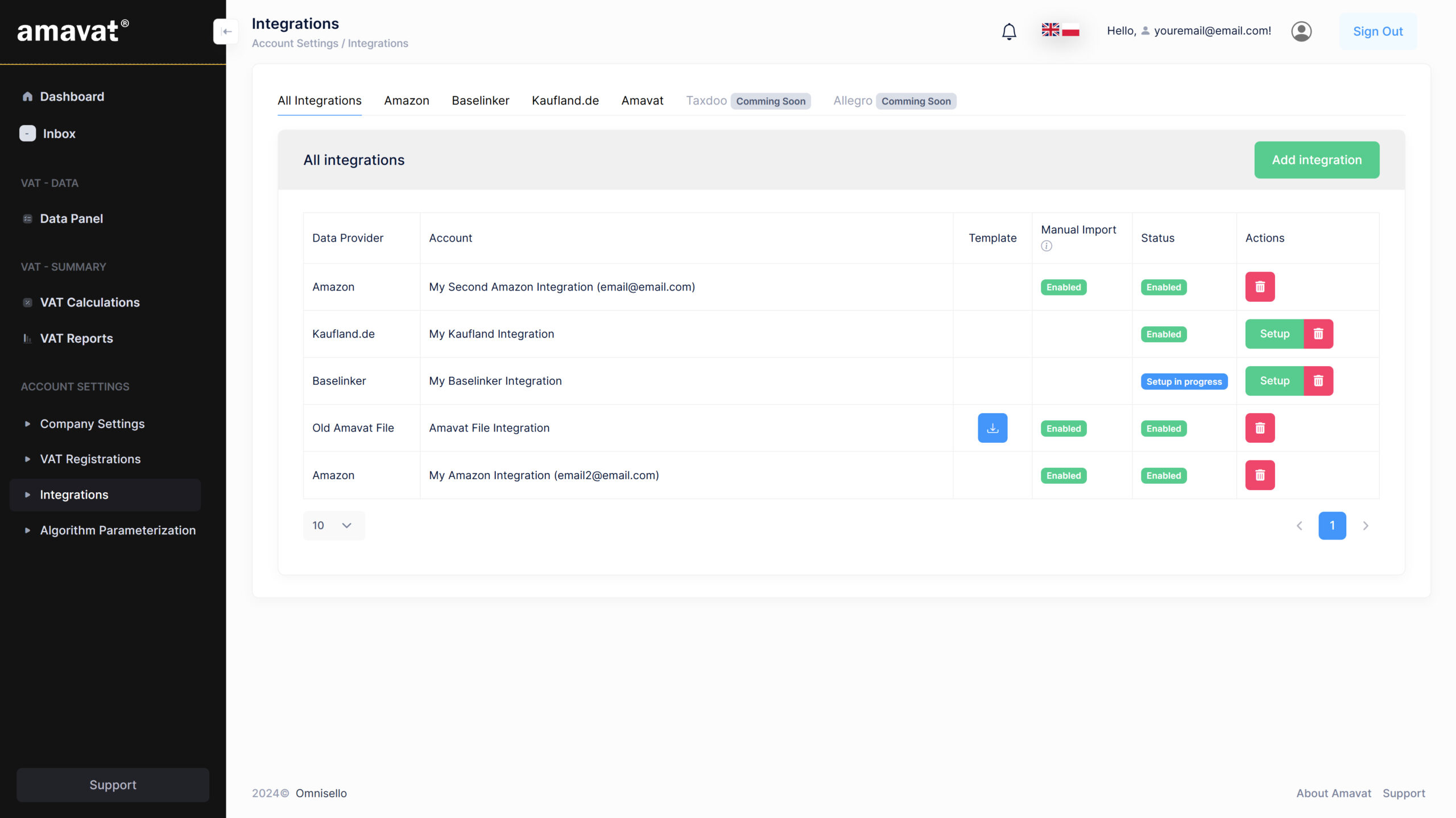

The amavat® application was designed with the goal of simplifying and automating key processes related to VAT management. One of its main advantages is the ability to directly upload transaction data from Amazon without the need to generate complex reports. This feature makes the process of gathering data for VAT settlements faster, less error-prone, and more intuitive. At the same time, amavat® offers direct integration with Kaufland.de and Baselinker. Thus, the amavat® application enables the automatic collection of data from multiple sales channels, standardizing and validating it. Automatic data synchronization with these platforms also enhances the efficiency of transaction management and reduces the workload associated with manual tasks, ultimately saving time for e-commerce businesses. The application’s intuitive interface further simplifies data import, making the entire process clearer and more convenient.

Transaction data from Amazon: Step by step

Automation with Amazon in the amavat® application is a key element for many entrepreneurs operating on this platform. The process is simple and intuitive, taking literally just a few minutes. Users need to download the Amazon VAT Transactions Report directly from Amazon Seller Central and upload it to the amavat® application in the designated section. Here’s how you can do it:

- Log in to Amazon Seller Central.

- In the left menu, go to Reports, then Fulfillment by Amazon.

- From the left panel, select the Tax category and click on Amazon VAT Transactions Report.

- Choose the settlement month.

- Download the file in .txt format by selecting the Request .txt Download option.

- Save the file to your computer.

- Next, in the amavat® application, go to the Data Panel and the Integration Data section.

- Under Amazon integration data, click “Upload Data.”

- Click “Choose File” and select the saved file from your computer.

- Click “Upload File” to load it into the amavat® application.

If you do not have transaction data for a given month, you can skip adding the file by clicking the “Skip” icon. If the uploaded file is incorrect, you can submit a new file using the “Upload Data” button before confirming the data.

Connecting your Amazon account with the amavat® application

Currently, the amavat® application offers full integration with two platforms: Kaufland and Baselinker. In the future, additional platforms are planned to be included. It is important to avoid duplicating integrations. If data is already being automatically transferred between Amazon and Baselinker, there is no need to add Amazon integration again in the “Integrations” section.

To connect your Amazon account with the amavat® application, follow these steps:

- Log in to the amavat® application.

- Go to account settings.

- Select the Integrations option.

- Click on the “Amazon” tab and then “Add Integration.”

- Enter a unique account name and click “Add.”

Why choose the amavat® application?

Our amavat® application provides comprehensive support for e-commerce businesses, combining accounting with advanced IT solutions. With our innovative integration tool, the way you conduct your business both domestically and internationally will undergo a radical transformation.

What do you gain?

- Modern user interface – intuitive and functional design for a better experience.

- Advanced integrations with Kaufland.de and Baselinker.

- Direct upload of transaction data from Amazon.

- Easier VAT reporting – easy-to-use reports that simplify your accounting and tax processes.

- Centralized document storage – all necessary documents available in one place.

The amavat® application is a practical investment for e-commerce companies, designed to deliver real value to our clients. Inquire about our service and revolutionize your business today.

If you want to learn more about the amavat® application and see how it works, we invite you to read our amavat® application service manual.

Summary

The amavat® application is a versatile tool that combines advanced technologies with accounting functions, offering effective solutions for VAT management and integration with e-commerce platforms. With features like automatic data transmission from Amazon and an intuitive interface, users can significantly simplify reporting and transaction management processes.