2024 in Polish e-commerce: Growth in sales and seasonal challenges

The Polish e-commerce market is currently undergoing dynamic changes, driven by both an increase in the number of orders and a rising average shopping cart value. Despite a general slowdown in consumption seen in the economy, data from April 2024 indicates a significant growth in the online retail sector. Let’s analyze in detail how this market is developing this year and what challenges and opportunities online sellers face.

Dynamic sales growth

An analysis of sales performance from 3,000 leading e-commerce vendors in Poland shows that in April 2024, online sales were 17.2% higher compared to the same period last year. This growth consists of an increase in the number of orders by 15% and an increase in the average order value by 1.9%, reaching PLN 202.6. Domestic sales grew by 15.7%, while international sales saw an even higher increase of 24.6%.

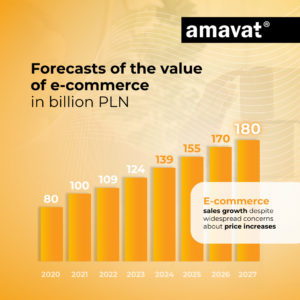

Forecasts for the value of online commerce in Poland are optimistic, indicating a year-on-year upward trend. Data from Statista.com shows that e-commerce in the country is experiencing dynamic growth, achieving higher values each year.

The impact of calendar layout on sales performance

Sales increase in April

The calendar plays a crucial role in e-commerce sales performance. In previous years, the period from March to April saw sales declines due to fewer favorable shopping days in April. For instance, in 2023, the drop was 6%, and in 2022, it was 7%. However, in 2024, a more favorable calendar structure led to an increase in April sales, positively impacting both year-over-year and month-over-month growth dynamics.

Slowdown in shopping activity in May

May 2024 brought the typical seasonal slowdown in shopping activity. The long weekends in May encouraged Poles to spend time with family, resulting in reduced shopping activity both online and offline.

According to data from the Central Statistical Office (GUS), retail sales in May grew by 5% compared to the previous year, while online sales increased by 6.8%. The share of e-commerce in total retail sales was 8.6% in May, up from 8.5% in the same period last year, though it declined from 8.8% in April.

Experts note that seasonal fluctuations in May are a normal phenomenon, influenced by the calendar, which during this month favors spending time with family over shopping.

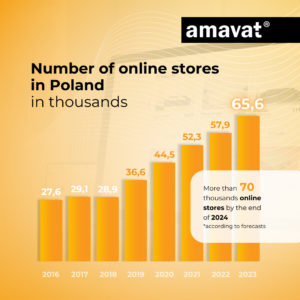

Steady growth and increasing number of online stores

The latest research from UCE Research and the Offerista Group shows that despite widespread concerns about rising prices, the e-commerce sector continues to grow. Over 60% of Poles fear further price increases, driving a more cautious approach to spending. Nevertheless, the number of online stores in Poland keeps growing. By the end of 2023, the number of e-shops exceeded 65,000, and projections suggest that this number could surpass 70,000 in 2024. This indicates that Polish online retailers are well-prepared to compete in both domestic and international markets.

Seasonal challenges and average shopping cart value

Despite positive trends, in May there was a decline in the average shopping basket value. Experts highlight that such seasonal fluctuations are typical and should not be a reason for concern. Similar drops were observed in 2022 and 2023, usually leading to a rebound in the following months, typically in August. The key here is a flexible approach to sales strategies and readiness to adjust offers in response to changing consumer needs and preferences.

Preparing for key sales periods

The approaching summer means increased preparations for key sales periods in e-commerce. Summer shopping, such as warm-weather clothing, camping gear, or recreational items, always boosts demand. Experts note that the Polish online retail market is already intensively preparing for the fourth quarter, the most important period of the year in terms of sales, due to holiday shopping and the back-to-school season.

Household income growth

The growth in household income in Poland is one of the key factors supporting the development of e-commerce. In the first quarter of 2024, thanks to a decline in inflation, the average wage in the national economy increased by 11% year-over-year in real terms. This increase fully compensated for previous losses related to high inflation at the turn of 2022 and 2023, enhancing the purchasing power of Polish consumers and supporting their spending.

If you want to learn more about the current state of the e-commerce market in Poland, the share of different product categories, key trends, and future forecasts, we invite you to read our comprehensive article here.

Summary

In 2024, the Polish e-commerce market demonstrates its resilience to challenges and its capacity for dynamic growth. Rising sales, an increasing number of online stores, and stable household incomes provide a solid foundation for the sector’s continued development. Despite seasonal fluctuations and competition, Polish online retailers are well-equipped to seize upcoming opportunities and face challenges. The key will be to adapt flexibly to changing market conditions and consumer preferences, ensuring stable growth in the coming months.