Managing returns and refunds under VAT OSS: how to stay compliant across EU countries

Spis treści

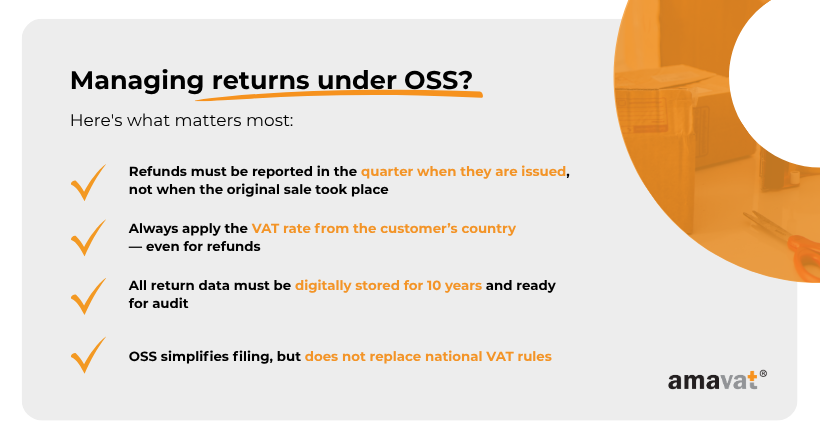

When it comes to returns and refunds, the process gets a bit more complicated. Even under OSS, businesses still need to follow the VAT rules of each individual member state where customers are based. That means knowing how and when to adjust VAT, what records to keep, and how to make sure everything lines up in your quarterly filings.

The real challenge? OSS simplifies where you report, but not the rules you have to follow. Handling refunds correctly isn’t just good accounting — it’s essential for staying compliant and avoiding issues during audits.

In this guide, we’ll break down how to manage returns and refunds under VAT OSS, so you can stay on the right side of the rules while keeping your business running smoothly across borders.

What is VAT OSS and why it matters for returns & refunds

The VAT One Stop Shop (OSS) is a system introduced by the EU to simplify VAT reporting for businesses selling goods and certain services to consumers in other member states. Instead of having to register for VAT in every country where a sale takes place, businesses can use OSS to file one quarterly VAT return and make a single payment through the tax authority in their own country.

It applies to things like:

- Distance sales of goods (e.g. online retail)

- Digital services (e.g. streaming, downloads)

- And a few other B2C services within the EU

Once a business opts into OSS, it must use it for all eligible cross-border B2C sales — partial participation isn’t allowed. This keeps the system uniform, but it also means you’re responsible for applying the correct VAT rate for every sale, depending on where your customer is based.

So why is this relevant when it comes to returns and refunds?

Because OSS doesn’t change the core VAT rules — it just centralizes the process. You’re still accountable for making accurate VAT adjustments when goods are returned or services are refunded. Those changes must be reflected in your OSS return for the quarter in which the refund takes place, and your records must be able to back that up — sometimes years down the line.

In short: OSS helps reduce paperwork, but not responsibility. When managing refunds, you still need to know the rules in every EU country you sell to — and follow them.

How returns and refunds work under OSS

When a customer returns a product or cancels a service, it’s not just a matter of sending the money back — you also need to adjust the VAT you’ve already reported and paid. Under the OSS scheme, these adjustments must be handled carefully to stay compliant across all the countries you sell to.

Here’s how it works:

Adjusting VAT in the OSS return

If you’ve already declared VAT on a sale through your OSS return and then issue a refund, you’ll need to reflect that refund in your next OSS return — specifically, in the quarter when the refund is processed. You can’t go back and change a previous return, but you are expected to reduce the VAT amount in the current one to account for the returned sale.

Timing matters

The key point is when the refund is issued, not when the original sale took place. Even if a sale happened last quarter and the return comes in this quarter, the VAT adjustment must be made now.

Keep records that tell the full story

You’re required to keep detailed records of all sales and refunds — including invoice numbers, customer locations, refund dates, VAT rates, and the exact adjustments made. These records must be stored electronically and be available for 10 years in case tax authorities request them.

Why it matters

Incorrect or incomplete adjustments can result in VAT being overpaid (or underpaid), which could raise flags during audits. Inconsistent records across different quarters or missing refund documentation could also trigger compliance issues.

Calculating VAT adjustments on returns across EU

When handling refunds under the OSS, one of the most important — and often overlooked — details is ensuring that VAT is adjusted using the correct rate from the customer’s country. This might sound simple, but it can get tricky when dealing with multiple tax rates across the EU.

Always use the original VAT rate

The refund must reflect the same VAT rate that was applied at the time of the original sale. So if a customer in Sweden paid 25% VAT on a purchase in Q1, and they return the product in Q2, your adjustment in the Q2 OSS return must use that same 25% rate.

There’s no flexibility here: the VAT rate is tied to the destination country and cannot be averaged or replaced with a standard rate.

How to report the adjustment

The reduction in VAT due should be included in your OSS return for the quarter in which the refund was issued. This ensures your VAT liability is accurate and up to date. You don’t revise the original quarter’s return — OSS works on a “moving forward” basis.

Important: input VAT refunds don’t go through OSS

If you’ve incurred VAT on business expenses (e.g. warehousing, logistics, tools) in other member states, you can’t reclaim it through OSS. Instead, you’ll need to use the EU VAT refund procedure via the local tax authorities in the country where the expense occurred.

This is a common source of confusion. OSS is strictly for collecting and remitting VAT on sales to consumers — not for managing VAT on your own operational costs.

💡 Quick tip: Keep an up-to-date table or use automated VAT software to track applicable rates per country — rates change, and using the wrong one can lead to costly errors.

Filing & payment compliance – the returns/refund impact

Managing returns under VAT OSS isn’t just about adjusting the numbers — it’s also about making sure those changes are filed correctly and on time. OSS returns follow a strict quarterly schedule, and any delays or errors can lead to penalties, interest, or compliance issues with multiple tax authorities.

Quarterly OSS deadlines

OSS VAT returns are filed once per quarter, and the deadline is the last day of the month following the end of the quarter. That means:

➜ Q1 (Jan–Mar): return due by April 30

➜ Q2 (Apr–Jun): return due by July 31

➜ Q3 (Jul–Sep): return due by October 31

➜ Q4 (Oct–Dec): return due by January 31

All refunds processed in a given quarter must be included in that quarter’s OSS return. Even if a refund relates to a sale from a previous period, the adjustment happens when the refund is actually issued.

Payment and reference numbers

Each OSS return comes with a unique reference number — this must be used when making payment to your local tax authority. Payments must match the declared VAT liability, after refunds and returns have been accounted for. Sending the wrong amount, or omitting the reference, can cause processing delays and penalties.

What if there were no sales?

Even if you haven’t made any qualifying sales during a quarter, you’re still required to file a nil return. If you issued refunds during that period (e.g. returns from previous sales), those need to be reflected — and in some cases, your return might even show a negative VAT amount.

Penalties for late filing or payment

Every member state can impose penalties if returns are filed late or payments are delayed — even though the OSS is centralised, the enforcement comes from the individual countries where the VAT is due. This makes timely and accurate reporting critical.

Record-keeping and audit preparedness

Under the VAT OSS scheme, the responsibility for accurate record-keeping sits firmly with the business. While the OSS simplifies filing, it doesn’t relax documentation standards — in fact, because you’re dealing with multiple tax jurisdictions, your records need to be watertight and consistently maintained.

What you need to keep

For each sale, return, or refund reported through OSS, you must retain detailed records that include:

- The customer’s location (to determine the correct VAT rate)

- The VAT rate applied

- The amount of VAT collected or adjusted

- The date and value of the transaction

- Any refunds issued, with dates and reasons

- Relevant invoice numbers or order IDs

These records must clearly link sales and refunds, showing how each transaction flows into your VAT reporting.

Storage requirements

All records must be:

- Stored electronically

- Easily accessible in case of tax authority audits

- Retained for a minimum of 10 years

Yes — 10 years. This long retention period allows tax authorities in any EU country where you’ve made sales to review your data if needed.

Audit readiness matters

Even if your local tax authority is your single point of contact under OSS, any member state can initiate a VAT audit for sales made to its consumers. That’s why your documentation must be consistent, organized, and exportable on request — across languages and tax systems.

Invoices and refund notes

While OSS itself doesn’t require formal invoicing, local rules may — especially for returns. Issuing proper credit notes or refund documentation can help avoid misunderstandings and demonstrate transparency during audits.

Common pitfalls and additional compliance notes

Even with the OSS simplifying cross-border VAT filing, there are still plenty of areas where businesses can stumble — especially when it comes to returns, registration rules, and handling refunds outside the OSS scope.

- Exceeding local thresholds or making non-OSS sales

While OSS covers most B2C sales within the EU, not everything is automatically included. For example:

- If you don’t opt in to OSS for certain services or products, you may still need to register for VAT locally in the customer’s country.

- Some countries apply thresholds or rules for specific goods (e.g. excise goods) — if you go over those, OSS may no longer be sufficient.

- If you sell both through OSS and outside of it (e.g. local B2B sales, warehousing with local fulfilment), you might need parallel VAT registrations.

💡 Key takeaway: OSS is not a universal cover-all. Make sure your sales model aligns with OSS eligibility, or you risk falling into non-compliance unintentionally.

- Forgetting that refunds don’t cancel the need to file

Even if your total sales net out to zero (or even a negative VAT amount due to refunds), you must still file your quarterly OSS return. Failing to do so could trigger enforcement actions, even if no VAT is owed.

- Reclaiming input VAT incorrectly

OSS only deals with VAT collected from customers — not the VAT you pay on your own costs, like shipping, storage, or software tools. If you incur VAT in other EU countries, you’ll need to use the EU VAT refund mechanism, not OSS.

Mixing the two systems can lead to confusion and rejected claims.

- Not keeping up with rate changes

VAT rates can change — sometimes mid-year, sometimes mid-quarter. If you’re not tracking rate updates for all 27 EU member states, it’s easy to apply the wrong rate on a sale or miscalculate a refund. That’s a red flag during audits.

💡 Pro tip: Subscribe to an official VAT rate database or use software that automatically updates your tax rules per country.

- Underestimating the impact of inconsistent records

Even small discrepancies — like missing refund dates or mismatched invoice numbers — can cause problems when national tax authorities review your OSS filings. Remember, while you file in one country, any member state can initiate an audit.

Best practices for managing returns under OSS

Managing returns and refunds under the VAT OSS isn’t just about tax—it’s about building operational systems that are accurate, transparent, and scalable across the EU. Here’s how to stay one step ahead.

- Standardize your refund workflow

Create a clear, repeatable process for handling refunds across all sales channels. This should include:

-

- Capturing the original transaction details (including VAT rate and customer location)

- Logging the refund date and value

- Issuing a credit note or refund confirmation

- Recording the VAT adjustment for OSS reporting

Automating this workflow through your accounting or e-commerce system can save time and reduce risk of human error.

- Sync your finance and compliance teams

Returns don’t just affect your finance department — they also impact your VAT obligations. Make sure your teams are aligned on:

-

- How refund data is captured

- When adjustments are reported

- Who is responsible for preparing OSS returns

Consider holding quarterly sync-ups to review any changes in VAT rules, product flows, or refund volumes.

- Let us handle the complexity for you

Managing VAT across 27 EU member states isn’t just about knowing the rules — it’s about having the right systems in place to apply them consistently. At amavat®, we provide expert-led, tech-supported solutions that make OSS compliance — including returns and refunds — easier, faster, and fully aligned with local requirements.

Here’s how we help:

-

- We apply the correct VAT rates automatically based on the customer’s location

- We ensure your OSS returns are filed accurately and on time

- We monitor VAT legislation across the EU, so you don’t have to

- We support you with clear, compliant documentation for refunds and adjustments

With our support, you can focus on running your business — while we take care of the regulatory side, from filings to audit-ready records.

- Keep audit-readiness in mind

Design your documentation process so that every refund has a clear paper trail — from the customer’s original order to the adjusted VAT amount. Assume that, at any point, a tax authority in any EU country could request documentation.

Checklist:

✔ Refunds tied to original sales

✔ Correct VAT rates used

✔ All data stored electronically and backed up

✔ 10-year retention policy in place

- Monitor VAT developments

Tax rules evolve. Subscribe to official updates from the European Commission and your national tax authority, or work with a VAT specialist to stay informed. Changes in VAT rates, OSS scope, or refund procedures can affect your compliance overnight.

Conclusion

The VAT One Stop Shop scheme has transformed how cross-border B2C sales are reported within the EU — but it hasn’t erased the complexity. When it comes to managing returns and refunds, businesses still need to navigate a patchwork of national VAT rules, apply the correct rates, and report adjustments precisely and on time.

Compliance under OSS isn’t just about meeting deadlines — it’s about maintaining transparency, accuracy, and control across all EU markets you sell to. And that requires more than good intentions — it requires expertise and systems that work together.

At amavat®, we specialize in helping businesses stay fully compliant under OSS, from initial setup to ongoing support. Whether you’re dealing with high return volumes, expanding into new countries, or just want peace of mind that your VAT obligations are covered — we’re here to help.

Let us take the complexity off your plate, so you can focus on what matters most: growing your business.